Partner content in association with Cento

Doing deals in a downturn: A rare success story of a team from SEA in LATAM

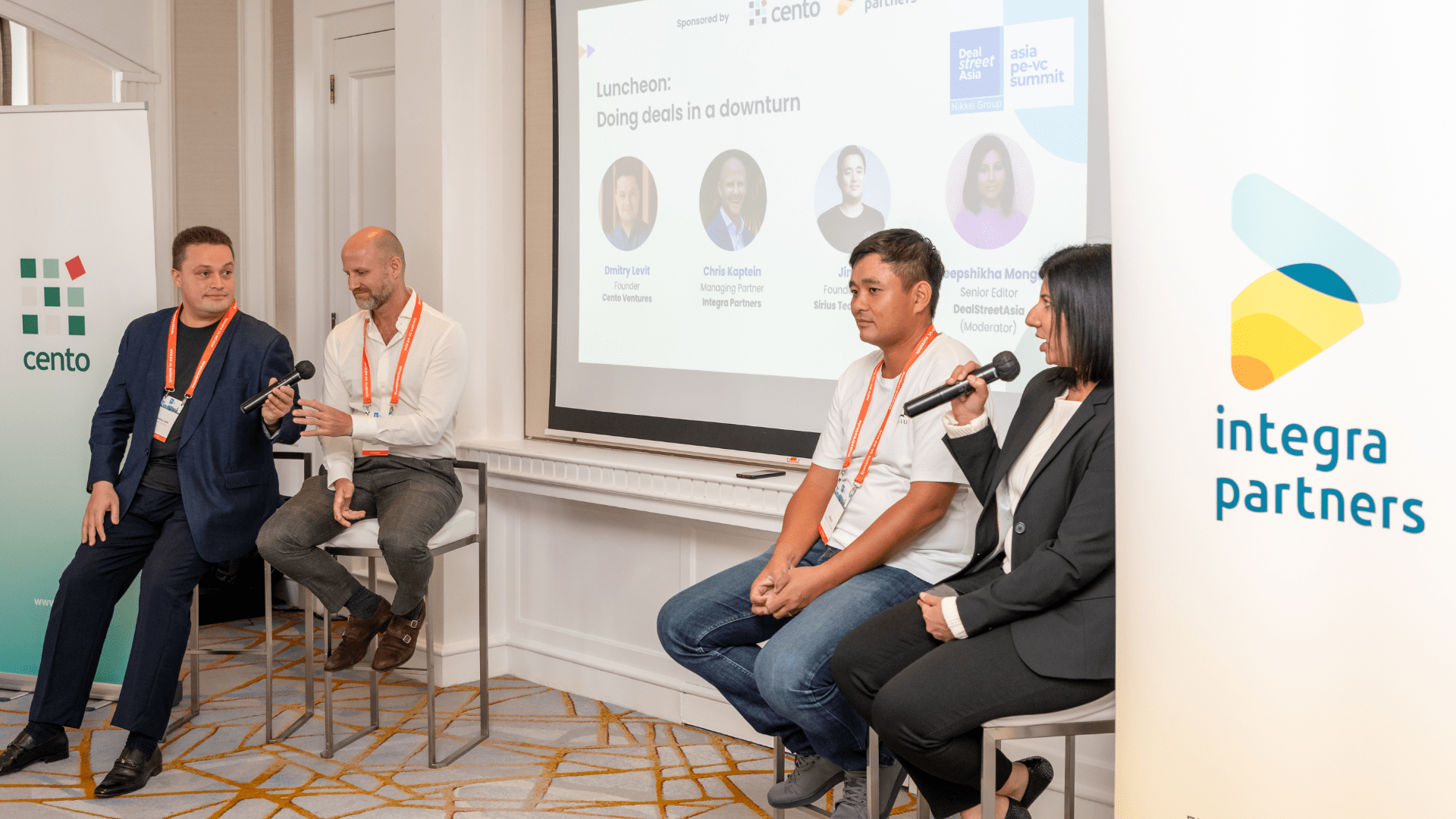

(L to R) Dmitry Levit, Founder, Cento Ventures; Chris Kaptein, Managing Partner, Integra Partners; Jing Li, Founder and CEO, Sirius Technologies; Deepshikha Monga, Senior Editor, DealStreetAsia

In times of an economic downturn, businesses face numerous challenges and uncertainties that can significantly impact their ability to engage in successful deals and transactions. Deal activity often declines as businesses become more risk-averse and conservative in their investment decisions. But even in a downturn, a bright spark or a partnership emerges, setting an example for the entire landscape to follow suit.

Certain businesses achieve favourable results by adopting strategies and considerations for doing deals in a downturn, drawing on various aspects such as mergers and acquisitions (M&A), partnerships, and financing arrangements. They place emphasis on the importance of adaptability, risk management, and strategic planning to maximise opportunities and mitigate potential pitfalls.

In this uncertain period, one deal, in particular, which stands out is that struck by Sirius Technologies, a Singapore-based enterprise architecture tech startup. Dealstreet Asia has written about Sirius’s recently announced $18-million Series A round of funding, attracting not only three regional VC investors but also strategic corporate capital from Korea and family office investors from Southeast Asia. The round was anchored by venture capital investors Integra Partners and Cento Ventures. According to regulatory filings, Integra invested $3.12 million through its $90-million second VC fund Integra Partners Fund II, while Cento contributed $2 million to the round.

To delve deeper into the factors that led up to this successful deal during a downturn, DealStreetAsia, in association with Cento Ventures and Integra Partners, hosted an exclusive discussion at the Asia PE-VC Summit 2023 in Singapore.

The esteemed panellists — Dmitry Levit, Founder, Cento Ventures; Chris Kaptein, Managing Partner, Integra Partners; and Jing Li, Founder and CEO, Sirius Technologies — engaged in a riveting conversation with Deepshikha Monga, Senior Editor, DealStreetAsia, and moderator for the session, to share their unique perspectives on how Southeast Asia has become home to experienced founding teams ready to take the region to the next level.

This is the story of the partnerships that made the deal happen during a downturn — partnerships between the lead investors, the founder and his stakeholders, and the company and the ecosystem that embraced it. This is also the story of how cross-country partnerships can benefit emerging markets globally and of the rare success of a team from Southeast Asia in Latin America.

Read on for a transcript of the discussion, edited for brevity and clarity.

Jing could we start with your backstory? You were the lead architect at WeBank, which was the first digital bank in China. What led you to start Sirius?

Jing: Starting in 2014, I led a team of engineers to build the whole network. Scaled the brand from 0 to more than 300 million users or monthly active users. We believe that this kind of know-how and technology deserves a bigger stage. We wanted to pursue the dream and bring this technology to the global stage, and naturally, for a Chinese team, Southeast Asia is by default a go to place. So, we were looking for a landing pad in Southeast Asia and we happened to know that there was some large commercial bank in Thailand which was looking for technology to accelerate their digital transformation. So, we went to Thailand and managed to lock in our first and second clients in Bangkok. And that’s how we set up our organisational operations headquarters in Bangkok. Our research centre is in Shenzen.

Apart from the fact that you landed these customers, what made you think that Thailand was the right market for it, considering Singapore is the place to be, especially when you talk about digital and banking?

Jing: It’s mostly because the first batch of opportunities came from Thailand. That’s why we needed to set up an operation base there to serve the clients. Thailand was our first step. We are not stopping just in the Thai market, we are actively looking to grow into a regional and global company. We already have clients in Latin America. Of course, expanding our presence in Southeast Asia will be a very important next initiative.

In non-technical terms, could you explain what Sirius does? What’s the gap that it is addressing?

Jing: Sirius offers alternative options for enterprises to bootstrap or speed up their digital journey. Instead of going for a big bang spending millions in investments to replace your existing setup in which millions have already been invested, we can help you prolong your current setup and evolve into the new ways of bridging your current capabilities with your digital expectation. We have the platform, we have the solution, we are basically the one-stop-shop for everything that you need to accelerate digital transformation in a more practical way.

Based on our offerings, we currently already have a few success stories in Thailand and Latin America. We built the whole digital channel for the biggest credit card company in Thailand, without them having to invest anything in the existing back end. We basically digitised someone without changing their legacy systems, whether it’s in a credit card company, a bank, or in a security trading company. In Latin America, we’ve become the new generation of the whole enterprise platform for the top banks in Colombia. This proves that what we believe and what we’ve built are good for the whole BFSI landscape, across industries and geographies.

As VCs, what made you identify Sirius as the company to invest in? Especially during the funding winter this is a big round. Why Sirius and why at this time?

Chris: Sirius is a single platform that can power any fintech or any enterprise digital journey. Technology is a very core part that can power an entire industry, which makes the opportunity for Sirius so big and not just specific to one country, but the scope of expansion is huge. It’s really a global opportunity. I think approximately $650 billion is spent on enterprise IT in financial services alone. Therefore, the opportunities for us as a VC fund are unbounded. The second, of course, is Jing’s track record with his team of building a great platform. What they build is very impressive and to further develop that as a service and bring it across the globe, is a huge opportunity.

Dmitry: I see quite a few actual operators and builders in this room and you’d know that building digital companies in Southeast Asia, despite all the excitement of this event, is tedious. Every country is special and different, and regulations are tough to manoeuvre. So, we always seek out these opportunities, especially in the b2b space, where a certain kind of customer (in this particular case a large bank), is deeply unhappy in exactly the same way across the globe. And thanks to the IBMs and the Oracles of the world it is exactly the case in the area Jing pitches (my apologies to the present and past members of IBM and Oracle). For example, once Jing’s pitch is in front of the head of IT of a large bank, this head of IT realises that there are the following choices in front of them when their CEO tells them to digitise. One choice is to go and ask the CEO and the Board for $3 billion– always a career winner! Or, launch a cheap challenger bank on a ready to go suite of software, like Mambu or Thought Machine, which is why we have so many interesting challenger banks out there. And with Sirius in front of them, they see the third choice – they can postpone that $3 billion investment for about 10 years, and ride on the solution that Sirius has built for them. And that seems to work not just in Bangkok, KL, and Philippines, it’s all the way to Colombia and Argentina from what we hear. That’s a very good sign because we can then skip that tedious phase of adjusting the solution for every single country in Southeast Asia and global emerging markets.

Jing, could you talk about your strategy to cater to Latin American markets before expanding within SE Asia?

Jing: Like Dmitry said, the pain points that most of the enterprises, especially the large BFSIs, are facing are the same. Itaú Unibanco, the largest bank in Brazil, pays five times more to IBM than the largest bank in China, The Industrial & Commercial Bank of China (ICBC). They are facing the same issue by getting locked into a rather legacy kind of setup. The OPEX is getting higher and higher, and the result is the same. Our solutions, however, can easily help considering the experience we have gained so far, especially because nowadays remote delivery mode is more acceptable among large enterprises. So, doing a business as a Thai company, in a region that’s 12 time zones away, becomes totally possible. With these two factors, we managed to successfully land the projects and also expanded them to Colombia and soon in Brazil and Argentina.

As VCs, why do you think the Thai market is sort of overlooked in the broader Southeast Asian context. What is your view on the opportunities there?

Dmitry: We started investing in Thailand in 2011, but my partner here, Ali Fancy, had been there for 25 years. It is a topic of much debate between us, over many a whiskey and cigar, as to why Thailand is considered a “flyover” state as far as digital Southeast Asia is concerned, even though it is the second largest economy in this region. I still do not know the answer.

There seems to be a narrative of all these large, well-run corporations, that have pretty much overtaken every market opportunity. There seems to be a narrative that the Thai market is full of all those corporate VCs, and there is no way one could invest. There’s also an internal narrative in Thailand, that the local entrepreneurs are not up to scratch; but that is unfair and an internal narrative.

But if you look at the reality of the last ten years for example, starting with AsiaSoft, and all the way to the modern day’s LineMan and others, from 2C2P to Pomelo, you’ll see there’s a league of companies here that were built by a blend of Thai professionals and foreigners of every stripe that happened to be based out of Bangkok. There’s a massive Japanese community, a massive Korean community, a massive German community, a whole bunch of other communities – a Burmese community for a start! When they come together, they form teams that are not afraid to take on the entire Southeast Asia. At their own speed, not always very quickly. And why is this not being reported by the major technology media outlets? I wouldn’t know. But it is the fact that it was Thailand-originated companies that generated most of the exit liquidity in the past couple of years in Southeast Asia if you look at the actual dollars and cents, not IPO reports. While I don’t know why this is so, this is the reason why Thailand is the market we prioritize heavily – because the world seems not to.

Chris: From a fintech perspective, whether it’s banking or asset management, the higher the GDP per capita, the more money there is for financial institutions and the more money customers have to invest in long-term pension investments or to borrow for mortgages on their houses. So in a way, that relates I guess, to Sirius. There are many customers to serve in a more mature market from a financial services perspective. As an enterprise vendor, it makes Thailand a very interesting market for a company like Sirius and hence for us as investors as well.

Can we talk about your customers as well? How do you position yourself in a market where challenger banks are applying? Are you working with just traditional banks? What is your view on challenger banks?

Jing: Sirius’s technology is suitable for any type of enterprise that is pursuing a digital journey; it doesn’t limit itself to a newly set up challenger bank or a well-established financial organisation. Our technology can seamlessly blend into all the setups and bridges whatever you already have as long-term investment and then bring you to the digital endpoints that you want to get. We also make sure the journey is flexible and progressive. So we don’t really have that limitation. We can work anyway.

Where do you see Sirius in the next few years, you’ve talked about expansion in Latin America? What about Southeast Asia? Are you looking at other geographies? Because the pain points that you said are the same across the world?

Jing: Yes, at the moment after two years of hard work, with Sirius, with Sirius partners (channel partners and systems integrators), we managed to enable roughly around 50 million people across different markets to benefit from better services through better technology. They get better services in the greater digital sector through our technology. Our vision is to always bring this seamlessly to a bigger size of the population. We want to add another zero to this number, i.e. expand coverage from 50 million to 500 million. We want to increase our ability to build technical systems so that we can bring this great technology into more markets with faster speed, more efficiency, and less costs.

I want to come back to the deal contour. How interesting was it to invest alongside Thai conglomerates and family offices?

Dmitry: This particular cap table was interesting. About half the number that was mentioned in the press, 9 million out of 18 million, was raised through convertible notes from a variety of operators in Thailand. And they are interlinked with a number of local conglomerates and some of these conglomerates are also Sirius’ customers. So, this would be a little bit of a different deal from what you’d see in the faster moving parts of Southeast Asia back in 2021 – significant amount of transaction cost and time had to be expended during the deal preparation to understand who is who, how are they all connected, why are they asking for things they’re asking for – someone is asking for discounts, someone is asking for delays. Are they just being, returns-oriented, or are they lobbying on behalf of one of their affiliates that is also a customer? It was a little painful to gauge.

But, the way we think about a well done deal at Cento is this – it’s not done when the cheque clears, it’s not done when the share certificates arrive, it is done when the first board meeting goes well. It’s when you can listen to the board purr like a finely tuned engine and you know that everyone is aligned and everyone is on the same page and everyone is pulling in the same direction. And how would you achieve this alignment if you don’t spend time getting to know everyone’s exact business interests – and spending a couple of months on this during due diligence, especially during a downturn, is absolutely critical to building that alignment. That effort takes a village – and it takes good collaboration between participating VC firms.

My partner Ali has been working with Integra on figuring out how everyone here is connected to each other, we had McKinsey’s network working with us through MVP, we had Korean networks working with us through Shinhan Bank, and that’s what it took to map out everyone who is on the cap table and how to make them into happy customers. We are very proud of this deal — high complexity, high return, fantastic alignment between all stakeholders – who are all sending Jing new orders as we speak.

Chris: I think the way that Dmitry described it, it’s an exceptional group together, where I think everybody really has a lot of value to add, whether it is on the operational side of what customers want or for market entry to different markets or ecosystems. So I’d say that it’s really a nice group. Everybody brings something that the other does not, which is how you want it to be.

Could you tell us more about regulations, because you’re coming into very different markets. Once you go to Latin America, and Brazil is a whole different thing in itself. The regulatory landscape is different. How do you tackle those issues?

Jing: The good news is that the Sirius team came from a banking background. We built the bank, we worked in the bank, we’ve been in financial services. I’ve been in the financial services industry my whole career. So, we do understand how very important compliance is. It’s never a question of why are we doing all these silly things just to satisfy regulations? It’s a must and we totally understand that. Hence, when we are building our solutions and platforms, we take compliance with industrial standards very seriously. For example, we are probably among the handful of companies in this region that have been certified under OpenID FAPI-CIBA standard which is the de-facto industry standard for Open Banking as many countries’ open banking standards are derived from OpenID. So these are very important things. For instance, even PCIDSS (PCI Data Security Standard), all these certificates are very important to us. So, number one, we as an early-stage company, we are very serious about it. From a product perspective, we build this kind of DNA into our solutions. Number two, we try not to build comprehensive sets. Because the moment you do a very comprehensive solution and you go to different jurisdictions, you need to start customising it. This means we might have to strip off all the unique characteristics for different regulators in different countries.

We believe in and maintain a very generic layer of business logic. We build up to that layer without finalising, and then we leave the localising part to our local partners. They know the local regulations way better than us. They know how to generate all the reports or the compliance issues. So we enable them with the generic layer and they add the cream on top of that to make sure it is localised. That’s how we plan and advise going into different markets while complying with all the local regulations.

For clients that don’t exactly need your sweet spot, which is looking for something that can help their legacy, what is a typical sales cycle? And what are the most difficult parts within the sales cycle that you need to overcome to get clients onboard and to offboard? And once you’re onboard, are there opportunities for upsells within the bank itself?

Jing: The first hurdle we have to overcome is very typical for a startup. You’re two years old, and you just finished your Series A, but still who are you? You are nobody in the market. So typically, they want to compare you with Mambo and TomoChain. It is very important for the alignment. That’s why the sales cycle can vary a lot. Some of the leads, we finish within the first one or two meetings, because we realise that what they want is a big bang. And a big-bang project has two challenges on Sirius – number one, a big-bang migration happens in a big bang. It is going to consume a lot of resources from us that will hinder us from growing broader with more opportunities. It’s very resource consuming and risky. It’s not just how good you are, because it takes a lot of effort from the clients as well. It is too complex for a startup to handle. So that’s why we try to avoid that. If they are so sure that they will go down that path, we will keep in touch with them but we move on to the next next opportunities.

Once we have the alignment, especially for those who learned some lessons in the previous attempts, it’s a lot easier to create a common understanding for them to appreciate our value proposition and our solutions. Our next step is to build trust. Because these companies come back to us with the same question — “how can I trust my enterprise level strategy for digital transformation to you?” So, that leads to your last question about upsells. Upsells is very significant in our approach, because in order to build trust, the easiest way is to find a sweet spot to do a small ending project, which we call “expand”. A small project to prove that you are as good as what you will be paid for and then build the trust. And then they will keep giving us more. Once you have proven that your value proposition is valid and your technology and your capabilities can support that, they will give you more and more. Who doesn’t want to have a 10% cost? So that’s typically the journey that we have with our clients.

Are you underpricing your solutions?

Jing: That’s a very good question. We’ve got to start a bit lower. Otherwise, you don’t have any competitive advantage compared to those we have established vendors. But are we underpricing to a point of losing money on purpose? No, we are not. Because, for a lot of software that you currently buy in the market, the margin is low. Basically the vendors, they take a lot of money from clients. We try not to do that. We try to be a bit more friendly, less greedy vendors who help you grow. So that’s why we have more flexible commercial models. Like Chris mentioned, we can gradually bring the price up by doing less discounts. We have to do something to win the first few deals, but we will work on that.