Partner content in association with

A guide to tapping into the wealth management boom in Asia

DealStreetAsia has dived deeper into the reasons driving Asia’s growing relevance as a destination for investors looking to generate outsized returns in its recently launched whitepaper ‘Investment Offices Flourish as Wealth Finds Green Shoots’. The paper — created in partnership with CSC, a leading provider of specialized administration services — seeks to answer fundamental questions to investors seeking a safe and productive haven for their funds, including:

- How have the private capital markets fared recently in Greater China and Southeast Asia?

- Which sectors are seeing funding momentum in the above regions?

- What are the risks to look out for amid a blistering pace of funding and exits?

- What are the recommendations of investment structure advisors when it comes to fund structures trending for high-net-worth investment family offices?

The wealth management boom across East and Southeast Asia

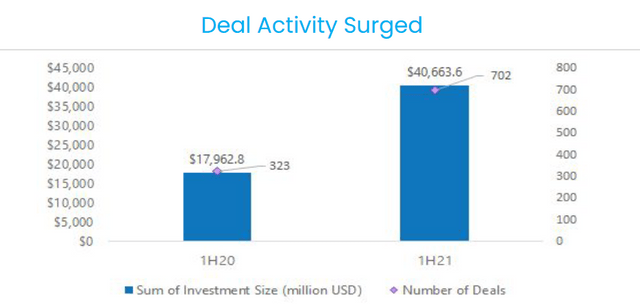

In Greater China, the deal count across H1 2021 has more than doubled* reaching $40.7 billion a YOY increase of 126%.

Southeast Asia has seen 21 unicorns (companies whose valuation surpass the $1 billion mark) so far this year, exceeding the total number minted in the preceding five years. Deal activity has surged on the back of rapid digitalisation and high expectations for a post-pandemic economic recovery.

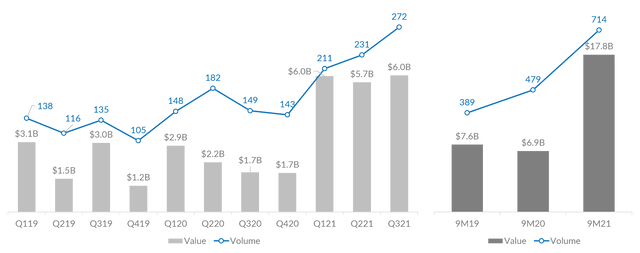

Private capital investors have funneled at least $17.8 billion into homegrown venture-backed startups in Southeast Asia as of September 2021 — a figure that is twice the $8.6 billion that was raised through all of 2020. Funding is on track to surpass $20 billion in total proceeds this year.

The factors driving the boom

The categories driving the boom in China are e-commerce, followed by AI and SaaS. While retail and e-commerce occupy the first two spots on the list in Southeast Asia, there is a huge opportunity for decentralised finance (DeFi), given a large underbanked population who have so far not received significant attention from traditional financial services.

The benefits

The boom — particularly in IPOs as can be seen in Hong Kong and Indonesia — has created more millionaires. Having materially benefited from the region’s technology ecosystem, they are often eager to reinvest, particularly in areas like e-commerce, fintech and healthtech.

There is also industry-wide acknowledgement of the positive government steps across Asia to forge a responsible, equitable path to prosperity.

For example, stock exchanges like Indonesia’s IDX and Singapore’s SGX are making themselves more IPO friendly, government bodies are showing a greater degree of flexibility when it comes to drawing in high-net-worth investors and family offices.

The aforementioned, taken in tandem with the economic substance legislation to make offshore jurisdictions a little more complicated from an investment perspective, has resulted in Asian economies becoming a more attractive base for investors.

The VCC regime of Singapore, introduced in January 2020 to leverage growing interest in the country’s investment offices, has gained significant momentum. Hong Kong’s OFC and LPF structures are also growing in popularity as funds look for opportunities in the Greater Bay Area.

In addition, wealth management advisors recommend looking beyond the fiscal factors to the non-fiscal aspects of an investment destination. These include the ability to diversify jurisdictional risk, strong and transparent rule of law, proximity and connectivity to attractive investment opportunities, and an established financial centre with a large pool of professionals.

Finally, sustainability has grown in importance in the region. Advisors see that ESG-investments, whether these are in renewable energy, urban sustainability, or areas involving social development goals are attracting a lot more attention and interest.

The risks

With a boom comes challenges as well. Most notably, unsuccessful SPAC mergers at the onset may negatively thwart momentum, increased competition is inflating investment values which may not see lucrative pay offs, and as always the threat of regulations can all have negative repercussions.

About the report

For a more in-depth perspective on unleashing the wealth management boom, including details on demographics by country, preferred asset classes, risk factors, and recommended structures for family office investments by experts from DBS, Dentons, KPMG, ShookLin & Bok and Walkers, please access a copy of the full report, free of charge.

The methodology

Information for the report was sourced from DealStreetAsia’s research and analytics product Data Vantage, insights from CSC, industry leading investment advisors, and relevant industry reports and macroeconomic or industry data sets such as Worldbank, HKMA, World Economic Outlook among others.

CSC is a global, independent service provider that has been a stable partner supporting successes of its clients for more than 120 years, with experience in the APAC region for over four decades, offering a full suite of corporate and fund administration services — including prelaunch support, NAV preparation, SPV management, investor services, tax assistance, and more. Whether you are launching a new fund, considering outsourcing or contemplating an alternative to your current third party provider, CSC is a reliable business partner. To learn more, visit cscgfm.com or contact agnes.chen@cscgfm.com.

Investment Offices Flourish as Wealth Finds Green Shoots‘ was created by DealStreetAsia in partnership with CSC Global.