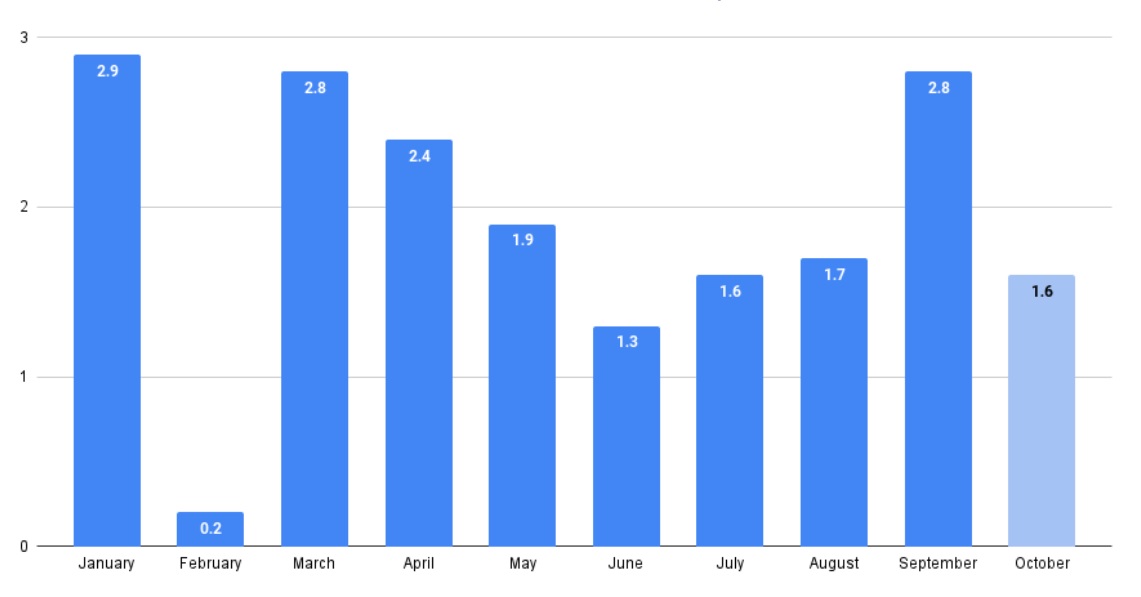

SE Asia Deals Barometer Report: Startup funding falls to $1.6b in Oct on fewer megadeals

Fundraising by Southeast Asia’s privately-held companies cooled in October, after four consecutive months of growth in dealmaking activity. Deal value dropped to levels last seen in July on fewer megadeals in the month, compared with September.

Proprietary data compiled by DealStreetAsia showed that Southeast Asian firms raised about $1.6 billion in October — a 43% decline from about $2.8 billion in September. The number of deals, too, dropped to 89 in October from 98 in the previous month.

The data covers venture capital and private equity investments, grants, corporate funding rounds, initial coin offerings, debt financing, and convertible note offerings.

The number of megadeals, or transactions worth at least $100 million, dropped to just four, compared with seven in September. The four megadeals in October raised $945 million, or just about half of the $1.8 billion that megadeals gathered in September.

Together, October’s megadeals accounted for nearly 60% of the capital raised, compared with 64% in September.

Deal value by month ($ billion)

October’s biggest deal was GoTo Group’s $400-million, pre-IPO round led by a wholly-owned unit of Abu Dhabi Investment Authority (ADIA).

ADIA, which is the sovereign wealth fund of the emirate of Abu Dhabi in the UAE, now joins global investors such as Alibaba, Facebook, Google, KKR, PayPal, Sequoia India, SoftBank Vision Fund 1, Temasek, Tencent, and Warburg Pincus on GoTo’s cap table.

Vietnamese e-commerce company Tiki Corporation also announced in October that it has raised $240 million in total for its Series E funding, making it a near unicorn. The funding round was Southeast Asia’s second-biggest deal last month.

Indonesian fintech startup Ajaib also raised $153 million in a Series B financing led by DST Global in a deal that minted the company as a unicorn.

The megadeals ($100m and above) of Oct 2021

| Startup | Headquarters | Investment Size (USD) | Investment Stage | Lead Investors | Industry / Sector |

|---|---|---|---|---|---|

| GoTo Group | Indonesia | $400,000,000 | Funding Round | Abu Dhabi Investment Authority | Superapp |

| Tiki Corporation | Vietnam | $240,000,000 | Series E | AIA Group | E-commerce |

| Ajaib | Indonesia | $153,000,000 | Series B | DST Global | Fintech |

| Sky Mavis | Vietnam | $152,000,000 | Series B | Andreessen Horowitz | Gaming |

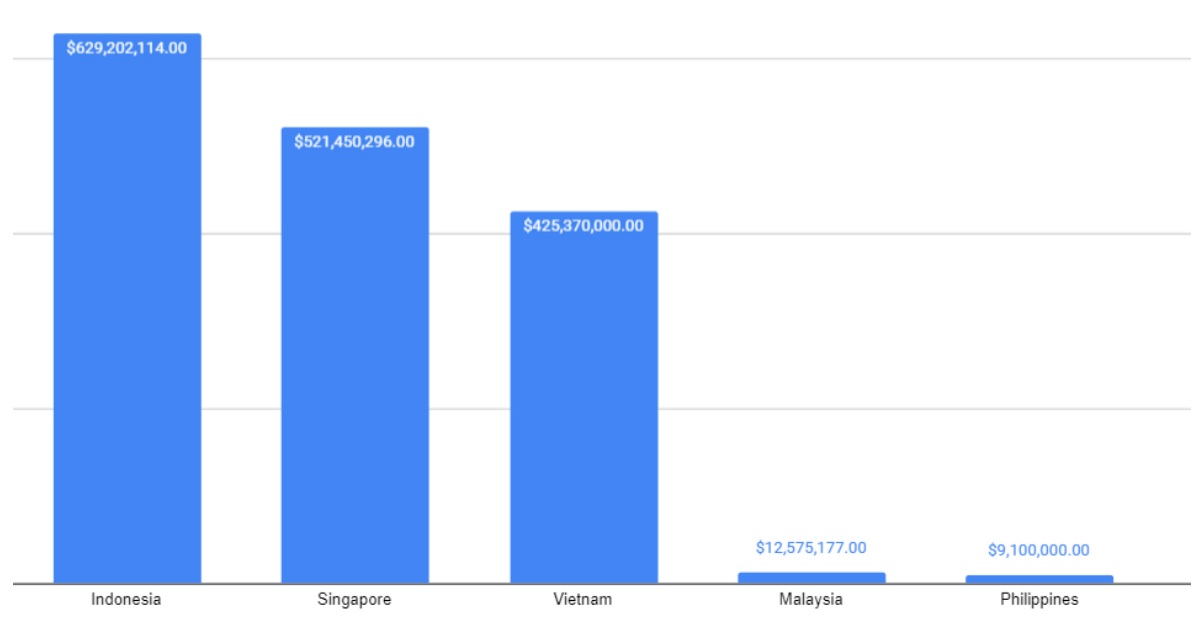

Singapore, Indonesia lead in volume, value

Singapore startups continued to lead the region with the most number of deals at 43, with an overall value of at least $521 million.

However, even with just 18 deals, Indonesian firms cornered the most funding at $629 million in October, thanks to two megadeals — GoTo Group’s $400-million funding and Ajaib’s $153-million Series B.

Vietnam scored $425 million from 12 deals while Malaysia’s seven deals raised $12.6 million. The Philippines had nine deals valued at $9.1 million.

At least 18 transactions did not disclose the amount that was raised.

Fundraising by country in Oct.

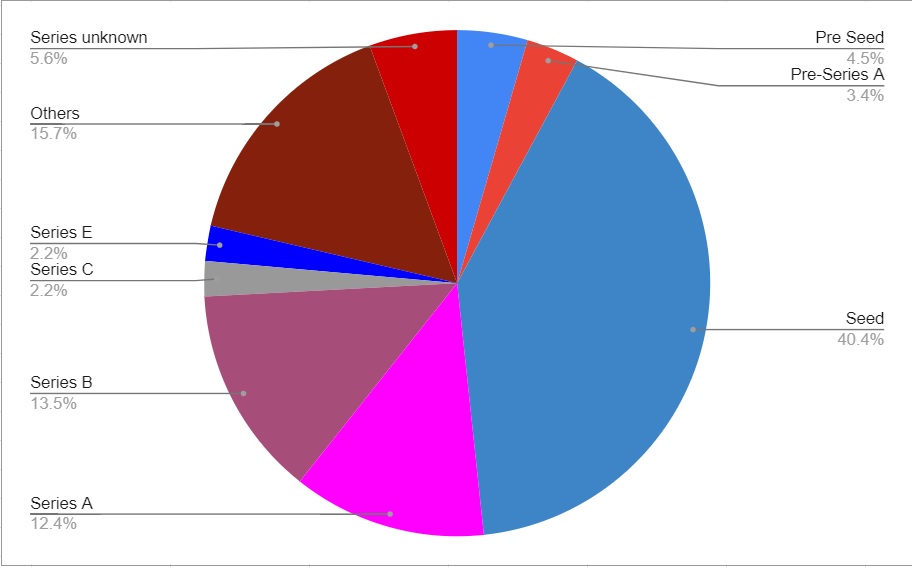

Early-stage deals in favour

The October data showed that startups in their earlier funding stages were more popular than their growth- and later-stage peers in terms of deal count.

Investors’ appetite for emerging businesses in Southeast Asia was evident in the 54 deals being sealed in the Series A stage and earlier. This was followed by deals in the Series B stage (12), while a total of four deals were recorded in the Series C and E stages.

Deals by stage in Oct 2021

Tech investments in Southeast Asia have been on the rise since the onset of the pandemic, particularly in the e-commerce and financial services space. In October, startups in the e-commerce space scored the most funding at $350.3 million from just eight deals.

Those in the financial technology and financial services sector topped in terms of deal volume at 15 but only raised $235.3 million. Startups in the gaming space secured $174.5 million from eight deals, while those in the biotech sector raised $82.7 million from four transactions.

Most active investors

Singapore-based venture capital firm Wavemaker Partners was the most active investor last month, taking the lead in at least four deals. The firm’s lead investments included data analytics startup QoreNext (Singapore), drone maker Poladrone (Malaysia), energy storage and batteries firm VFlow Tech (Singapore), and SaaS startup Komunidad (Philippines).

Cocoon Capital and Monk’s Hill, both Singapore-based venture investors, and Southeast Asia-based East Ventures were also among the most active investors in the month.

Share this story with your friends and colleagues.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: PE-VC investments further retreat to $6.8b in Oct

Dealmaking activity in Greater China further retreated in October 2021, continuing the decline witnessed in September...

Venture Capital

India Deals Barometer Report: Big-ticket deals push startup funding to $4.6b in October

Riding high on several big-ticket deals, Indian startups raised $4.65 billion across 162...