SE Asia Deals Barometer Report: Startup funding touches new record at $5.2b in November

The startup fraternity in Southeast Asia has reasons to cheer.

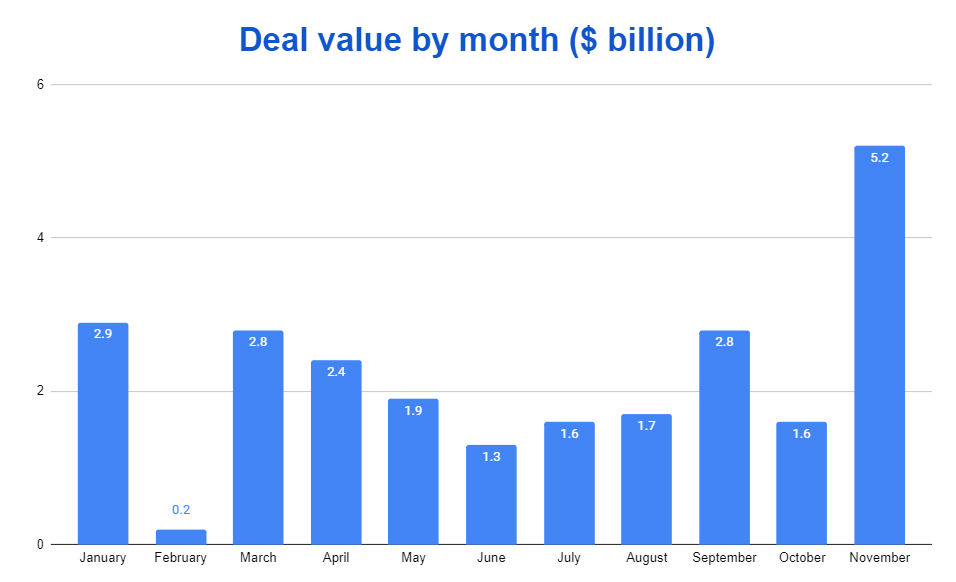

Even as the adverse impacts of the COVID-19 pandemic are still looming large on the region, privately-held companies raised $5.2 billion in November, the highest so far this year, recording a whopping 225% jump from the month of October.

According to proprietary data compiled by DealStreetAsia, the increase in value can be attributed to two large-ticket transactions that accounted for more than half of the total corpus raised by entrepreneurs.

In terms of volume, as many as 119 funding deals (primarily venture capital) were clocked last month, up from 98 in October, the data further showed.

In the months of August and September, startups in Southeast Asia raised $2.8 billion and $1.7 billion, respectively.

In the biggest transaction in November, Indonesian courier startup J&T Express raised $2.5 billion in a funding round that valued the company at $20 billion, ahead of its plan to list in Hong Kong as early as the first quarter of 2022.

According to a Reuters report, Boyu Capital, Hillhouse Capital Group, and Sequoia Capital China, besides Chinese gaming and internet giant Tencent Holdings invested in the maga funding round.

Meanwhile, the biggest tech group in the archipelago, GoTo, formed through the merger of e-commerce leader Tokopedia and ride-hailing giant Gojek, raised over $1.3 billion in the first close of its pre-IPO round led by a wholly-owned unit of Abu Dhabi Investment Authority (ADIA).

Other megadeals in November include Philippines-based payments app Mynt’s over $300 million funding; Indonesian over-the-top platform Vidio Dot Com’s $150 million investment from Affinity Equity Partners; and Singapore-based used car marketplace Carro’s $100 million funding.

The megadeals ($100m and above) of November 2021

| Startup | Headquarters | Investment Size (US$) | Investment Stage | Lead Investor/s | Industry / Sector |

|---|---|---|---|---|---|

| J&T Express | Indonesia | $2,500,000,000 | Private Equity | Boyu Capital, Hillhouse Capital Group, Sequoia Capital China, SIG China (SIG Asia Investments), Susquehanna International Group (SIG), Tencent | Logistics and distribution |

| GoTo | Indonesia | $1,300,000,000 | Pre-IPO | Abu Dhabi Investment Authority (ADIA), Avanda Investment Management, Fidelity International, Google, Permodalan Nasional Berhad (PNB), Primavera Capital Group, SeaTown Master Fund, Temasek, Tencent, and Ward Ferry | SuperApp |

| Mynt | Philippines | $300,000,000 | Private Equity | Bow Wave Capital Management, Insight Partners, Warburg Pincus | Fintech |

| Vidio | Indonesia | $150,000,000 | Private Equity | Affinity Equity Partners | Media & Entertainment |

| Carro | Singapore | $100,000,000 | Series C | Anderson Investment (Temasek), Permodalan Nasional Berhad | E-commerce |

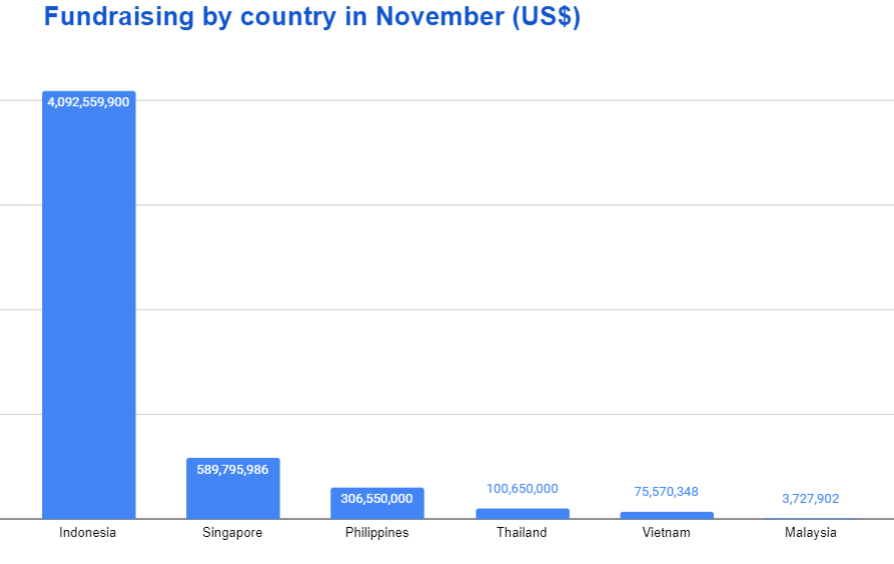

Indonesia leads value, Singapore tops volume

Indonesia saw 26 funding deals last month valued at over $4 billion, thanks to the combined multi-billion-dollar deals of J&T Express and GoTo. Meanwhile, in Singapore, investors pumped in $590 million across 54 transactions.

The Philippines came in at third in terms of deal value, with local firms securing $306.5 million over nine deals. Thailand’s eight funding deals netted $100.6 million, while Vietnamese firms raised $75.5 million in 10 transactions.

In Malaysia, the number of deals stood at 11 worth $3.7 million. Myanmar, however, witnessed only one transaction wherein the amount of funding was undisclosed.

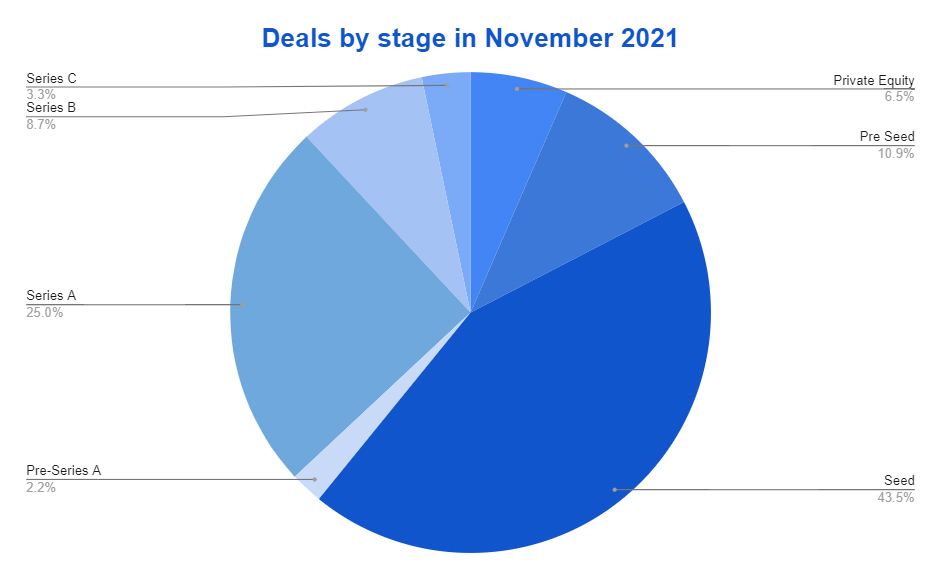

Early-stage deals remain favourite

Data compiled by DealStreetAsia showed that startups in their earlier funding stages continued to be more popular than their growth- and later-stage peers in terms of deal count.

In November, investor appetite for emerging businesses in Southeast Asia was evident in the 75 deals sealed in Series A-stages and earlier. Of that, seed rounds accounted for 40 transactions.

There were only eight Series B deals and three Series C deals sealed during the month. Private equity funding saw six transactions, while the remaining 27 deals did not specify the funding amount.

Tech investments in the region continue to evince significant investor interest as startups gear up to grab a slice of the internet economy in Southeast Asia, which is poised to touch $1 trillion by 2030, according to the e-Conomy SEA 2021 report.

In November, startups in new-age digital sectors such as e-commerce, financial services, and software spaces continued to bag funding, a trend that started gaining steam when the COVID-19 virus hit the shores of Southeast Asia.

Fintech and financial services witnessed as many as 31 transactions, raising $575.5 million in funding last month. E-commerce followed with 17 deals valued at $253 million, while SaaS firms raised $9.3 million from 15 deals.

Logistics only had four deals but raised the largest amount at $2.511 billion on the back of J&T Express’s mammoth funding.

Meanwhile, media and entertainment scored $160.5 million with just three deals, while three deals in renewable energy raised a combined $100.5 million in funding.

Most active investors

F10, a Swiss-based startup incubator and accelerator, provided non-equity assistance to five startups in November to become one of the most active investors in Southeast Asia.

Accelerating Asia, another accelerator programme based in Singapore, invested seed funding in four startups. Animoca Brands, Global Founders Capital, Heliconia Capital Management, MassMutual Ventures, and Sequoia Capital India were among the most active lead investors in the month.

Share this story with your friends and colleagues.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Nov dealmaking falls short of last year despite uptick from Oct

Startups in the Greater China region raised nearly $7.3 billion across 140 private equity (PE) and venture capital (VC)...

Venture Capital

India Deals Barometer Report: Indian startups raise $4.55b across 154 PE, VC transactions in November

The startup ecosystem in India is bustling with activity. Private equity (PE) and venture capital (VC) firms pumped...