SE Asia Deals Barometer Report: Startup funding up 36% sequentially in July as megadeals recover

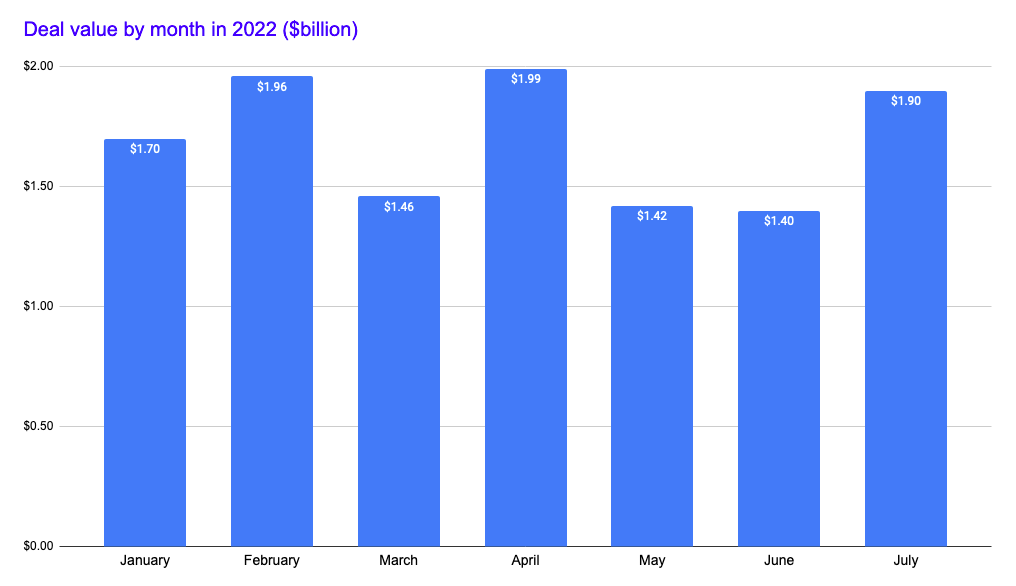

Startups in Southeast Asia raised at least $1.9 billion in funding in July, recording a 36% jump from June, when dealmaking in the region had fallen to $1.4 billion — the lowest so far in 2022.

Proprietary data compiled by DealStreetAsia showed that six megadeals — defined as transactions worth at least $100 million — raised a combined $1.4 billion in July, accounting for 74% of the total fundraising.

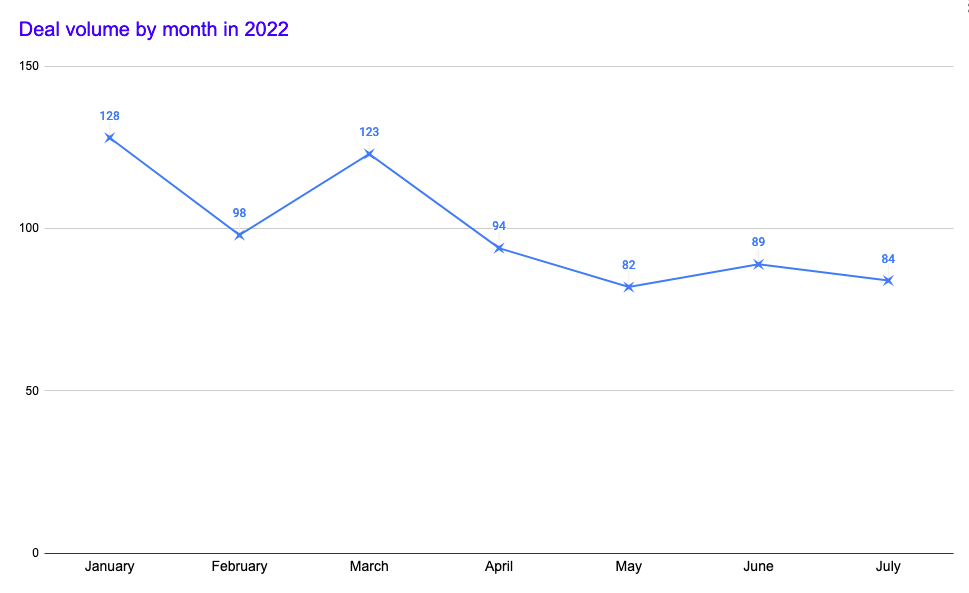

In terms of deal volume, though, July’s 84 deals were lower than the 89 transactions recorded in the region in June. The deals included private equity (PE), venture capital (VC), debt financing, initial coin offerings (ICO), and equity crowdfunding.

The July deals brought the total startup funding in Southeast Asia so far this year to about $11.8 billion from at least 698 transactions.

Megadeals shore up fundraising

The fall in fundraising witnessed in May and June was due to a dearth of megadeals in the region.

In June, a mere three mega deals had raised $447 million, while there were only two mega deals in May that raised $400 million. In April, while there were only three mega deals, they raised a combined $1.05 billion. Consequently, the month witnessed the highest fundraising so far in 2022 at about $1.99 billion.

In July, too, the six megadeals helped shore up fundraising.

Singapore-based Jubilant Pharma raised the largest funding at $400 million in the form of a five-year debt financing from Standard Chartered Bank. Continuum Wind Energy, a Singapore-based renewable energy firm, also raised $350 million from international investors in July.

The six megadeals of July 2022

| Company Name | Headquarters | Funding Stage | Amount Raised | Lead Investor/s | Sector |

|---|---|---|---|---|---|

| Jubilant Pharma | Singapore | Debt financing | $400,000,000 | Standard Chartered Bank | Pharma |

| Continuum Wind Energy | Singapore | Debt financing | $349,089,739 | SaaS | |

| Bank Jasa Jakarta | Indonesia | Corporate Round | $258,428,129 | PT. Astra International Tbk | Banking |

| TNG Digital (Touch N’ Go) | Malaysia | Series Unknown | $168,300,000 | Lazada Group | Fintech |

| Ambassador Education | Thailand | Private Equity | $110,000,000 | Navis Capital Partners | Edtech |

| RubiX Networks | Singapore | Private Equity | $100,000,000 | LDA Capital | Software & IT |

Two PE deals worth a combined $210 million also ramped up fundraising value in July.

RubiX Networks, a Layer 1 blockchain protocol for P2P data transfer with operations in Singapore, raised $100 million from LDA Capital while Thailand-based edtech startup Ambassador Education scored $110 million from Southeast Asian PE firm Navis Capital Partners.

Other top grossers of the month included Malaysia’s TNG Digital, the owner and operator of Touch ‘n Go eWallet, which raised about $168.3 million in equity funding led by Lazada Group.

Indonesia’s WeLab-backed Bank Jasa Jakarta also raised around $259 million from Indonesian conglomerate Astra International.

Singapore continues to lead in value, volume

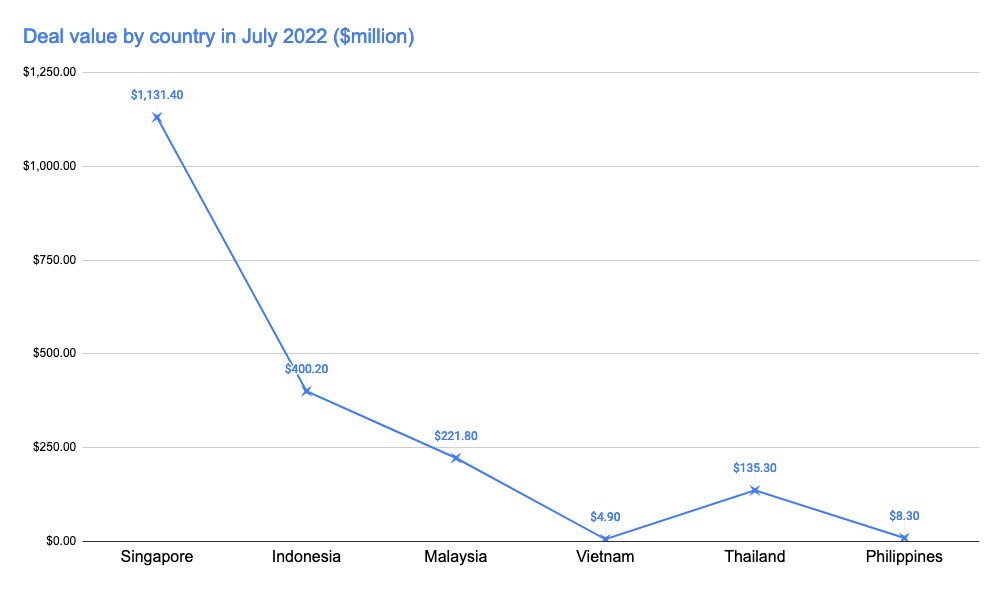

Private companies in Singapore continued to dominate Southeast Asia’s funding scene in July, both in the number of deals and total amount raised.

DealStreetAsia’s data showed that 39 startups based in the city-state amassed about $1.1 billion in total or about 58% of the region’s combined investments. In June, 41 Singapore startups had amassed about $704 million.

Three of the six megadeals in July were by Singapore startups — Jubilant Pharma’s $400-million debt financing, Continuum Wind Energy’s $350-million funding, and RubiX Networks’s $100-million PE raise.

Indonesia trailed Singapore in terms of deal volume and value, with 25 transactions that raked in $400 million. In June, Indonesian startups had raised $579 million from over 24 transactions.

The largest deal that Indonesia saw last month was Bank Jasa Jakarta’s $259-million corporate round from Indonesian conglomerate Astra International.

Malaysia climbed to the third spot in July, from the fourth a month earlier, with five deals that raised $221.8 million, much higher than the $9.5 million that Malaysian startups saw in June. Thailand-based startups raised $135 million from seven deals.

The Philippines saw four deals that raised a cumulative $8.3 million while Vietnam saw four deals that secured $4.9 million in total.

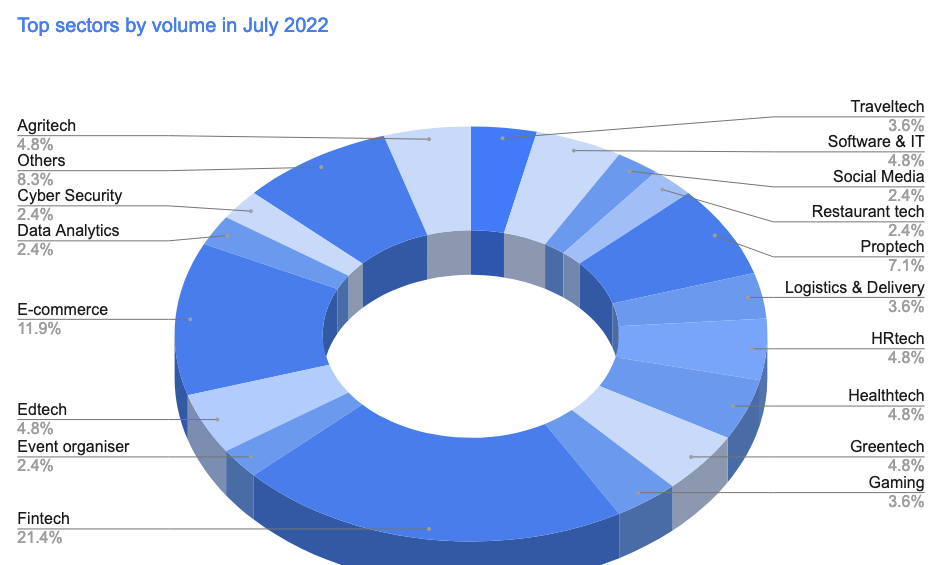

Fintech remains top sector in July by volume

Startups in the financial technology sector were involved in 18 transactions that raised $315 million in total funding, making it the top industry by volume.

In July, TNG Digital’s $168.3 million equity funding was the largest in the fintech space, followed by Singapore-based buy now, pay later firm Atome, which raised $45 million from its parent company Advance Intelligence Group.

By volume, e-commerce came in second place with 10 deals that raised a total of $65.2 million. Singapore-founded end-to-end commerce enablement company AnyMind Group’s $29 million Series D funding was the highest in the sector.

Greentech saw only four deals but the transactions raised a combined $354 million. Edtech and Software & IT also posted four deals each that raised $124 million and $114.7 million, respectively.

Seed rounds dominate

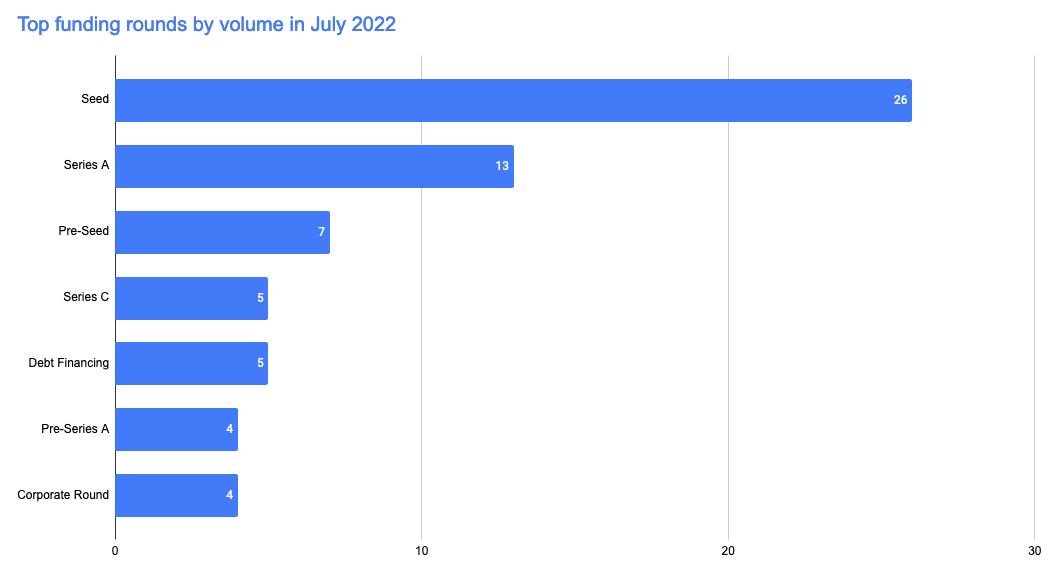

DealStreetAsia’s compilation showed that early-stage fundings continued to dominate Southeast Asia in July in terms of deal volume, with seed taking the lead.

During the month, there were 26 Seed rounds, 13 Series A, 7 pre-Seed, 5 Series C, 4 pre-Series A, 5 debt financing, 4 corporate rounds, 2 Series B and private equity fundings, and 1 pre-Series B, among deals with disclosed stages.

July also saw one Series D funding — AnyMind Group’s $29.4 million round.

Related Stories

Venture Capital

China Deals Barometer Report: At 236 PE-VC transactions, dealmaking volume dips a tad in July

Dealmaking in Greater China slackened in July but still managed to remain at elevated levels as startups...

Venture Capital

India Deals Barometer Report: Indian startup funding hits 21-month low in July at $885m, less than half of June

With macro headwinds in the backdrop, fundraising by Indian startups through private equity and venture capital...