SE Asia Deals Barometer Report: Startup funding at four-month high of $2b in April

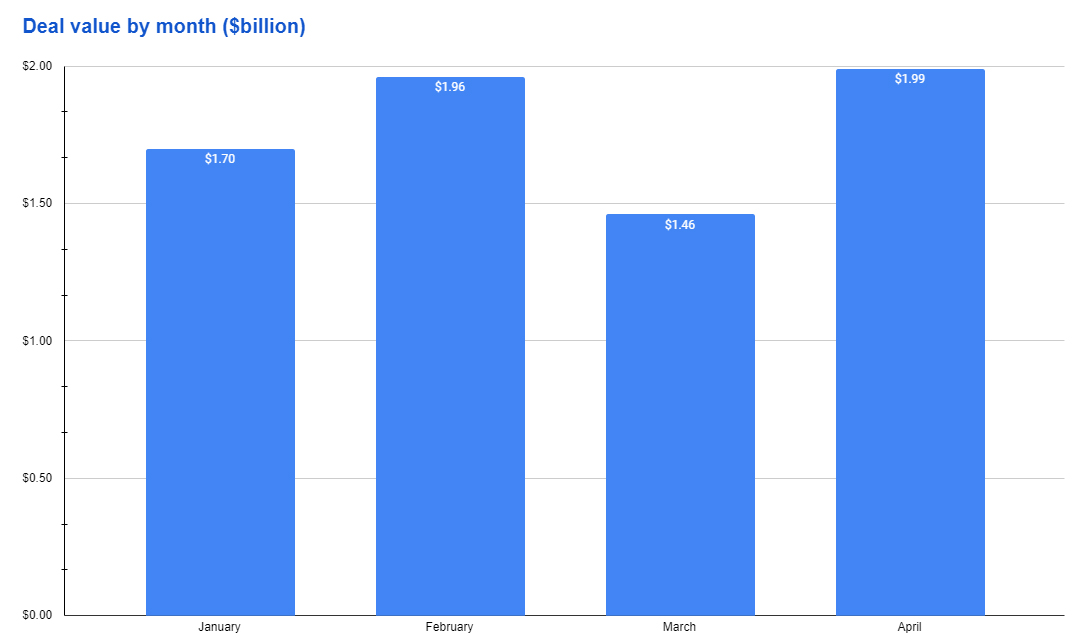

Venture capital (VC) and private equity (PE) funding in Southeast Asia rebounded in April, with startups raising nearly $2 billion during the month, the highest so far this year, proprietary data compiled by DealStreetAsia show.

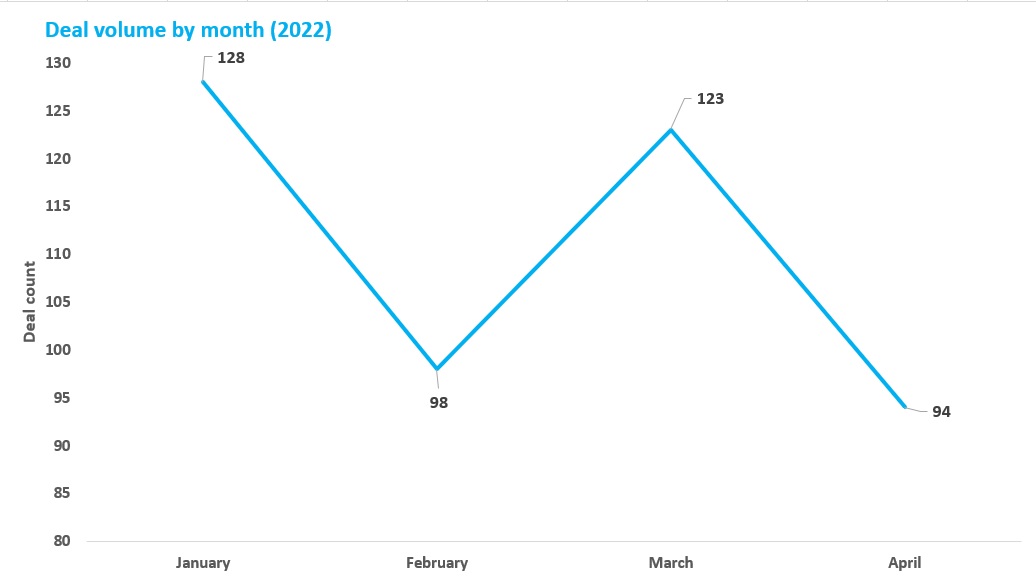

While there were only 94 deals registered in April, compared with 123 in March, the total amount raised stood at $1.99 billion. This does not include the 17 deals where fundraising value was undisclosed. The deals also involved corporate rounds, convertible notes, and debt financing, the data showed.

Funding value was up 36% from $1.46 billion in March. Startups in the region had raised $1.96 billion from 98 transactions in February and $1.7 billion from 128 deals in January.

The increase in deal value in April can be attributed to three megadeals — those worth atleast $100 million — that raised a combined $1.05 billion.

Notably, there were 27 deals in the $10-100 million bracket that raised a combined $800 million in funding, up from 19 in March.

The April deals bring the total startup funding in Southeast Asia to $7.11 billion in the first four months of the year from at least 443 transactions.

Big-ticket transactions

Coda Payments, a Singapore-based independent platform for digital content monetisation, raised $690 million from VC firm Insight Partners, New York-based Smash Capital, and Singapore sovereign wealth fund GIC Pte. The deal, which was a mix of primary and secondary transactions, was the largest among private companies in April.

The month also saw the minting of a new tech unicorn — Voyager Innovations in the Philippines. The firm, which operates money platform PayMaya and neobank Maya Bank, raised $210 million in a funding round that valued the company at nearly $1.4 billion.

Voyager’s funding round was led by SIG Ventuer Capital, the Asian VC arm of SIG, and backed by new investors, including Singapore-based EDBI and investment holding company First Pacific.

Also joining the megadeals club in April was Sky Mavis, the Vietnamese blockchain-based gaming unicorn behind Axie Infinity. The startup raised a fresh $150 million in a funding round led by crypto exchange Binance. Existing investors Animoca Brands, a16z, Dialectic, Accel, and Paradigm also participated in the round.

The three megadeals ($100m and above) of April 2022

| Startup | Headquarters | Investment Size | Stage | Lead Investor/s | Vertical |

|---|---|---|---|---|---|

| Coda Payments | Singapore | $690,000,000 | Series C | GIC, Insight Partners, Smash Ventures | Fintech |

| Voyager Innovations | Philippines | $210,000,000 | Convertible Notes | Susquehanna International Group (SIG) | Fintech |

| Sky Mavis | Vietnam | $150,000,000 | Series C | Binance | Fintech |

Singapore continues its perch on top

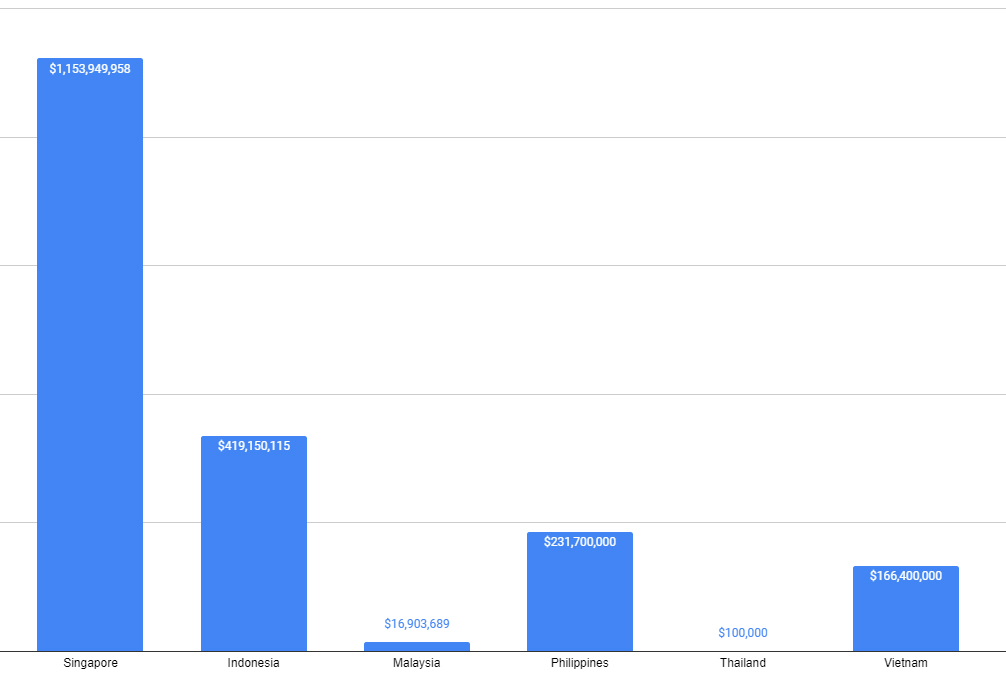

Private companies in Singapore continued to dominate Southeast Asia’s funding scene in April, with 55 startups in the city-state amassing about $1.2 billion in total investments — over 60% of the region’s total.

The largest deal that the city-state saw last month was the $690-million funding in Coda Payments.

Indonesia came in second in terms of deal volume and value, with 21 transactions that raised $419 million. In March, 27 startups in Indonesia had raised $414 million.

The country did not see megadeals in April. Moladin, a local marketplace of used cars and motorbikes, raised $95 million in Series B funding to become the largest deal in the month in Indonesia.

Indonesia had witnessed a strong 2021, minting seven unicorns and the domestic IPO of homegrown e-commerce firm Bukalapak — a sign that exits are visible and feasible in this market. For 2022, Indonesia-focused VCs say they remain bullish.

The Philippines saw only four deals in April but these transactions raised a total of $231.7 million, thanks to the $210 million that tech firm Voyager Innovations raised from SIG Venture Capital and existing investors.

Vietnam saw eight deals that raked in $166.4 million while Malaysia raised $16.9 million from five deals.

April 2022 deal value by country

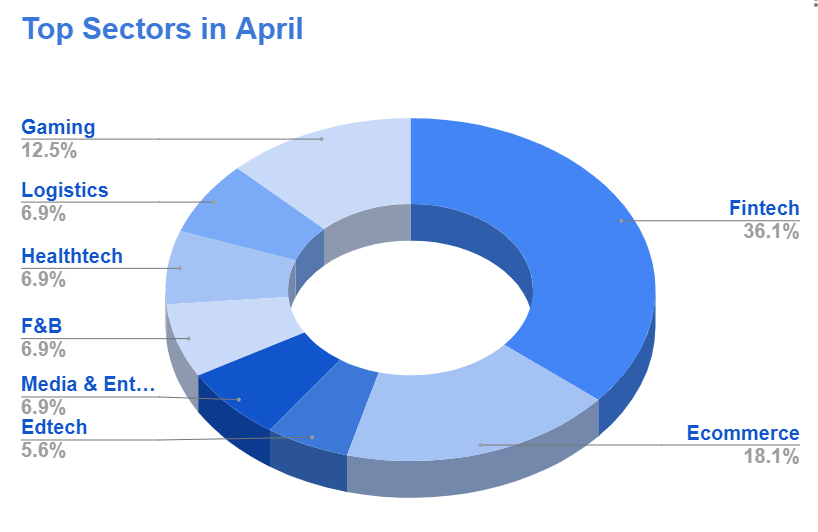

Fintech dominates deal volume, value

Startups in the financial technology (fintech) sector were involved in 26 deals that raised at least $1.3 billion in total funding, up from just $294.3 million in 23 transactions in March.

The $690 million raised by Coda Payments was the largest in the fintech space during the month. Vietnamese unicorn Sky Mavis’ $150 million fresh funding also helped push fintech on top of the leaderboard.

According to DealStreetAsia DATA VANTAGE’s SE Asia Deal Review: Q1 2022, one in four dollars of equity funding went to fintech in the first three months of this year.

E-commerce startups, meanwhile, raised $176 million from 13 deals, led by Moladin’s $95-million Series B funding. Logistics and Distribution raised $105.7 million over five deals, while startups in the Gaming and Edtech spaces raised a combined $158 million.

Seed rounds lead deal volume

DealStreetAsia’s compilation showed that early-stage fundings continued to dominate in Southeast Asia in April in terms of deal volume, with Seed taking the lead.

There were 37 Seed deals, 18 Series A deals, and 7 pre-Seed transactions. Series B, C, and D accounted for a combined 10 deals during the month while four startups closed angel rounds.

A recent report released by Asia Partners showed that there is a $1.1 billion funding gap in Series C and Series D stages in Southeast Asia when compared to China. This shortfall of growth equity series capital in the region has widened from 2019 when it was about $930 million.

Alwyn Rusli of Trihill Capital earlier told DealStreetAsia that the general trend is that more local and regional VCs are raising growth-stage funds as the ecosystem matures.

“Combining this with the increasing deployment by global funds into the region, it seems that gap may very soon be filled,” Rusli was quoted in DealStreetAsia’s SE Asia Deal Review: Q1 2022.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startup funding value drops 42% to $2.7b in April

Greater China clocked a busy month of dealmaking in April with the completion of 170 venture deals...

Venture Capital

India Deals Barometer Report: At $2.9b in April, startup funding lowest so far this year

Fundraising by Indian startups stood at $2.9 billion across 129 transactions in April...