India Deals Barometer Report: Startup funding dips a tad to $1.6b in Sept

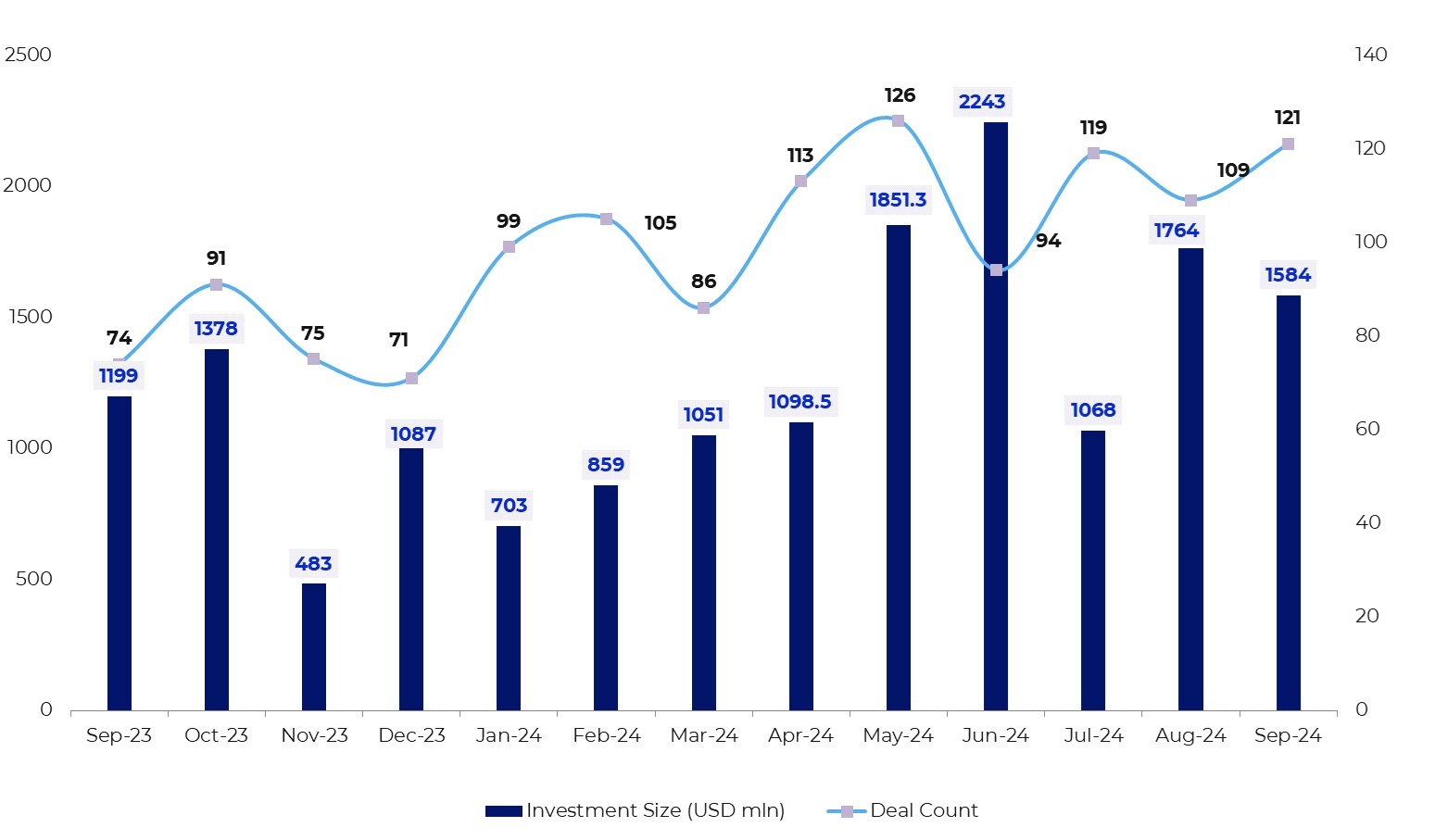

After a robust month for dealmaking in August, Indian startups witnessed a marginal dip in funding in September as they collectively raked in about $1.6 billion from 121 private equity and venture capital transactions, according to proprietary data compiled by DealStreetAsia.

In August, Indian startups had collectively scooped up $1.76 billion across 109 transactions. At 121, the deal volume was, however, up 11% month-on-month, the data showed.

On a year-on-year basis, the funding grew nearly 33% from $1.19 billion in September 2023. Deal volume also surged 63.5% from 74 in the comparable period last year.

Startup fundraising in the country has mostly been moving northwards since March this year, touching its peak in June. Megadeals have also seen an uptick in the past few months, reflecting a surge in investor confidence which was otherwise subdued due to a prolonged funding winter and uncertain market conditions.

Five megadeals, or investments worth at least $100 million, raised a total of $648 million in September, accounting for 41% of the total capital raised. In comparison, four megadeals worth $1.08 billion were closed in August.

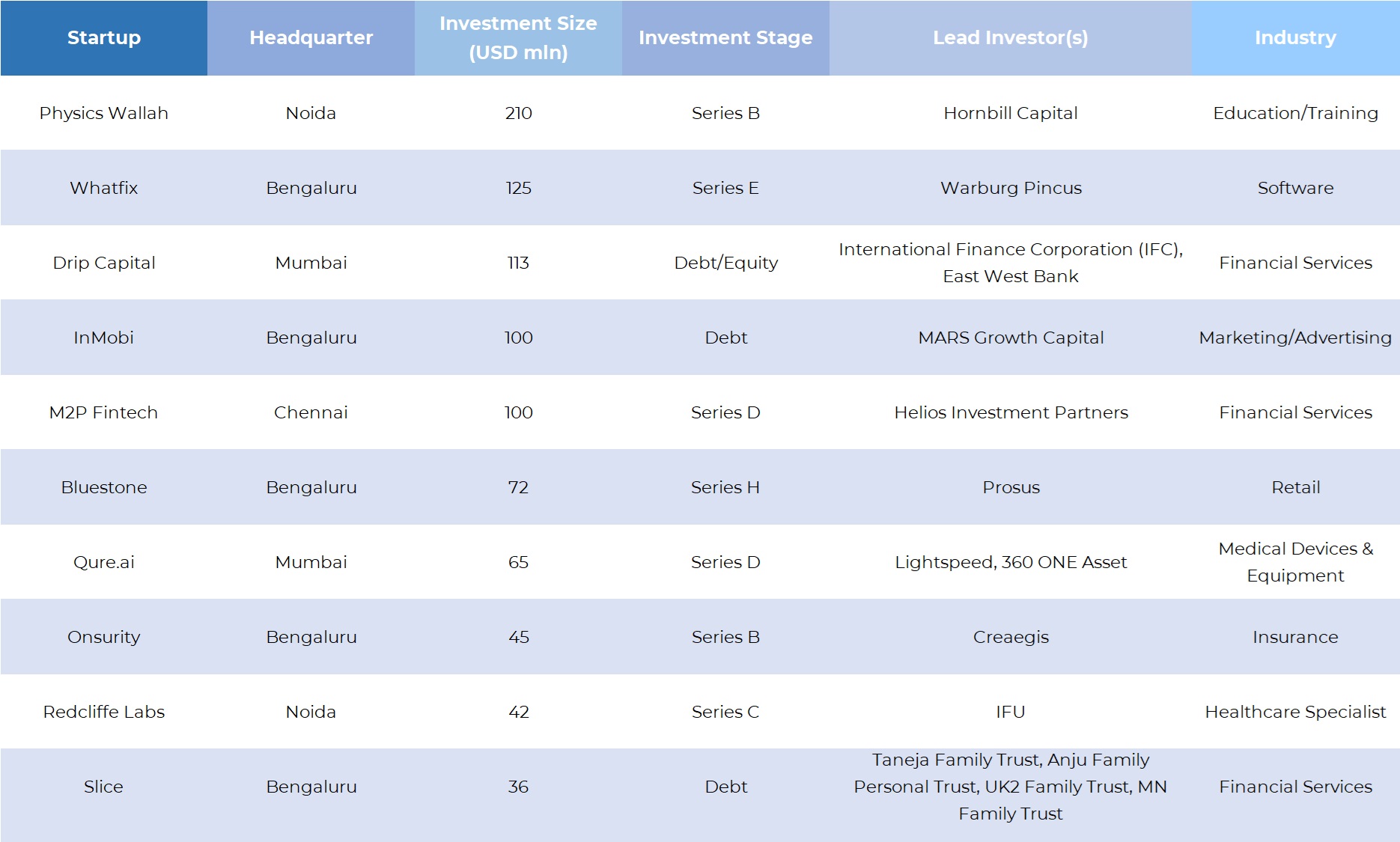

PhysicsWallah, which offers coaching for engineering entrance exams, raised the largest round of $210 million in its Series B funding round in September at a $2.8-billion valuation, defying the funding slowdown that has heavily impacted the edtech sector. The round came two years after the firm raised its Series A round of $100 million from Westbridge and GSV Ventures, catapulting the test-prep edtech startup into India’s coveted unicorn club.

Top 10 funding deals in Sept 2024

SaaS-based digital adoption solution provider Whatfix followed with a $125-million funding led by private equity major Warburg Pincus. The software startup last raised $90 million in its Series D funding round in June 2021 led by SoftBank Vision Fund 2. Other megadeals in the month were announced by cross-border trade finance platform Drip Capital ($113 million), advertising technology tech firm InMobi ($100 million), and application programming interface (API) infrastructure company M2P Fintech ($100 million).

Consumer lending platform Moneyview was the only startup to enter the unicorn club in September following a new funding round from its existing investors, Accel India and Nexus Venture Partners. Unicorn is a moniker used to describe a privately held startup company with a valuation of over $1 billion.

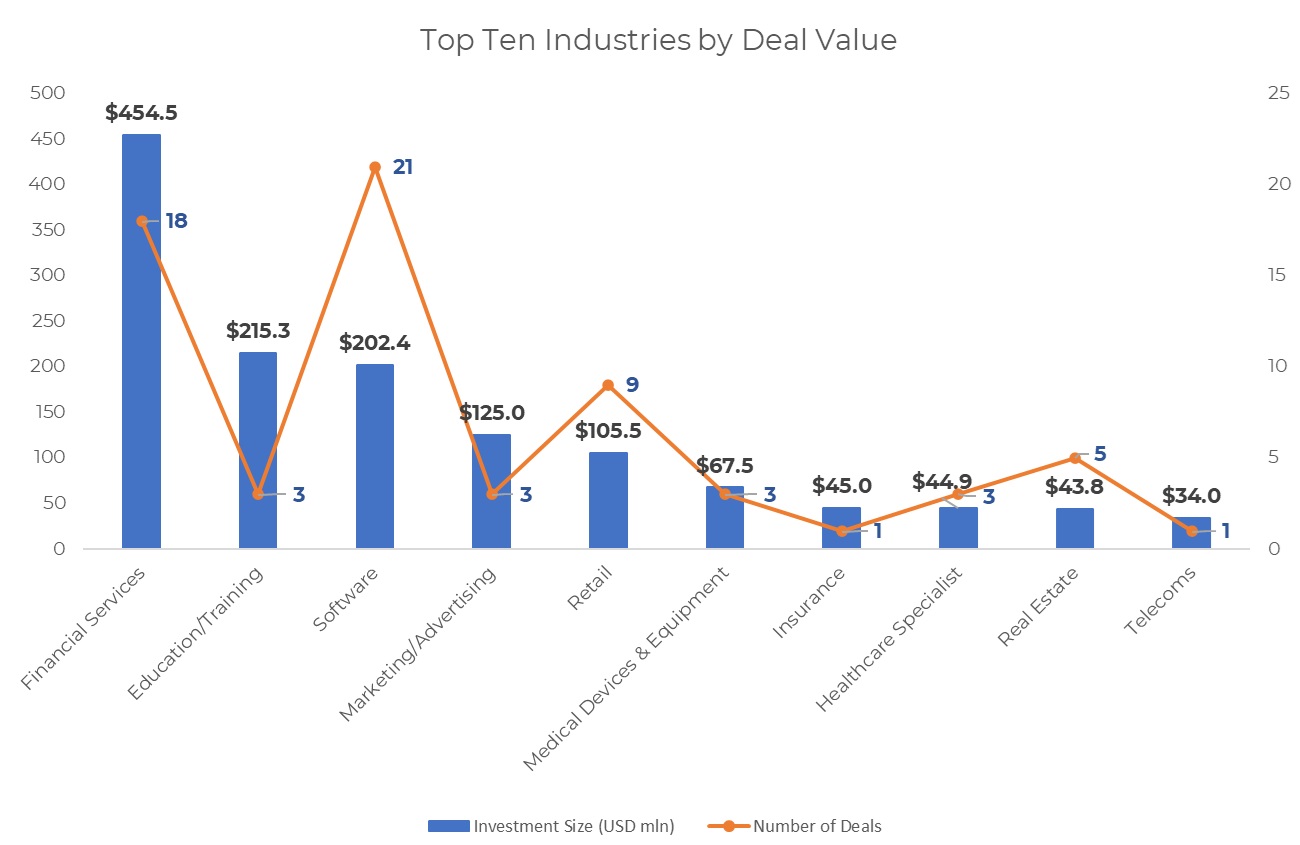

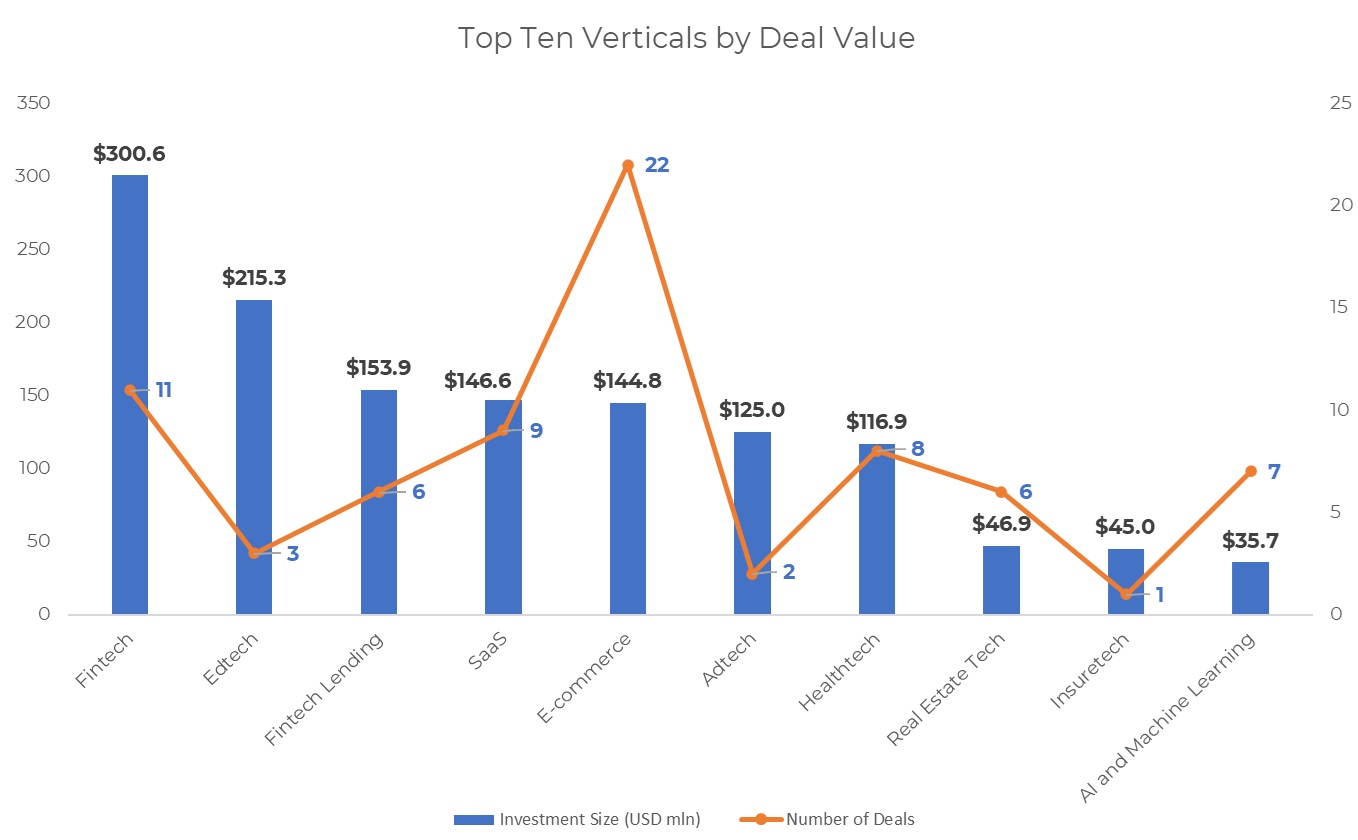

Financial Services continues to rule

Financial services continued to lead funding in September with total proceeds worth $454.5 million from 18 deals. This was slightly lower than the $561 million raised across 21 deals in August.

Within financial services, Drip Capital scored the highest funding worth $113 million. While $23 million in equity came from Japanese institutional investors GMO Payment Gateway and Sumitomo Mitsui Banking Corporation (SMBC), International Finance Corporation (IFC) and East West Bank led the debt investment of $90 million.

M2P Fintech followed with $100 million in its Series D funding round led by Africa-focused private equity firm Helios Investment Partners. The funding round, which involved a mix of primary and secondary capital raise, also saw participation from existing investors, including Flourish Ventures, as well as several Asia-based bankers.

Other prominent deals within the industry were Slice ($36 million), FlexiLoans ($35 million), Moneyview ($30 million), Aye Finance ($30 million), Northern Arc Capital ($27.4 million), Moneyboxx Finance ($20.9 million), and Centricity ($20 million).

Buoyed by the PhysicsWallah deal, the education and training industry was pushed to the second spot with a total of $215.3 million in funding from three deals. The other two deals within the industry were Invest4Edu ($3 million) and Vedantu ($2.3 million).

The edtech industry is facing a severe funding crunch as investors adopt a cautious stance towards the sector. As a result, edtech startups in India are tightening their purse strings and even resorting to drastic steps like layoffs to keep their bottom lines intact.

The software industry was the third most-funded industry in the month with total funding worth $202.4 million across 21 deals. Whatfix led funding within software, followed by Nurix AI ($27.5 million), e6data ($10 million), Aarna.ml ($6.7 million), and NowPurchase ($6 million). In comparison, software startups secured $89.3 million across 17 deals in August.

Together, the top three industries — financial services, education/training and software — scooped up a total of $872 million or 55% of the total deal value.

Uptick in early-stage deals

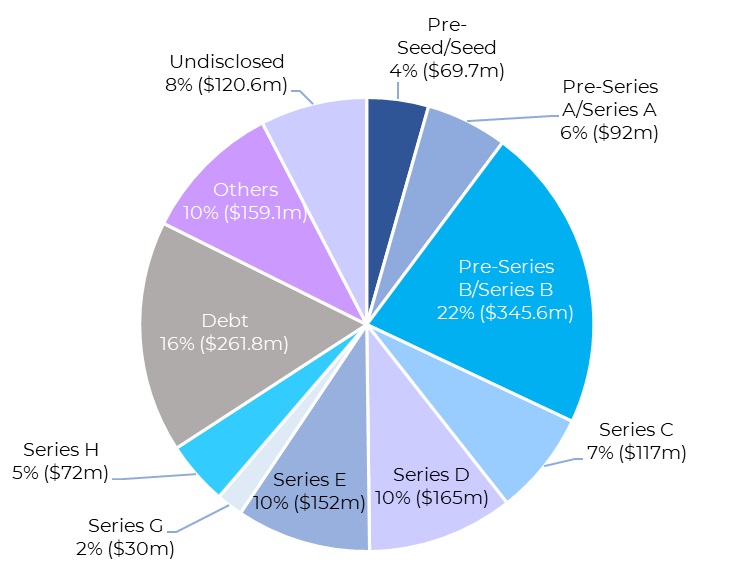

The value of pre-seed and seed stage deals increased to $69.7 million in September from $33 million in August. Their volume also increased to 35 from 24 in the previous month. The largest seed deal in the month was closed by wealth management platform Centricity, which raised $20 million led by venture capital firm Lightspeed.

Meanwhile, the capital raised by startups in the pre-Series A and Series A stages dropped to $92 million from $161.5 million in August. The number of such deals was also down to 20 from 32 in the previous month.

Nurix AI, a startup founded by Myntra and Cultfit founder Mukesh Bansal, announced raising $27.5 million in seed-Series A funding co-led by General Catalyst and Accel, with participation from Meraki Labs, in the month. Other Series A deals included e6data ($10 million), Aarna.ml ($6.7 million), Clean Electric ($6 million), Nutrabay ($5 million), Ahammune Biosciences ($5 million), and ELIVAAS ($5 million).

Growth-stage deals, or companies in the Series B or post-Series B rounds (including pre-IPO), collectively raised $917 million, accounting for nearly 58% of the total capital raised in the month. In comparison, the share of growth-stage deals worth $1.27 billion stood at 72% in August.

Startups that raised growth rounds in September included PhysicsWallah ($210-million Series B), Whatfix ($125-million Series E), M2P Fintech ($100-million Series D), Bluestone ($72-million Series H), Qure.ai ($65-million Series D), Onsurity ($45-million Series B), Redcliffe Labs ($42-million Series C), and FlexiLoans ($35-million Series C), among others.

Debt funding escalated to $261.8 million across seven transactions in September. Meanwhile, there were only two debt deals worth $34.3 million in August.

Top investors

Venture Catalysts, along with its accelerator fund 9Unicorns (now 100Unicorns), emerged as the top investor in September with a total of six investments. These included SaaS-enabled marketplace for metal manufacturers NowPurchase; BASIC Home Loan, a platform for automating home loans for middle- and low-income households in India; conversational AI startup CoRover; finance operations automation platform Bluecopa; Nautical Wings Aerospace; and cleantech startup ReCircle.

Peak XV Partners (formerly Sequoia Capital India & SEA), along with its accelerator platform Surge, was the second most-active investor with a total of five investments. Their investments included social networking platform for the crypto community 0xPPL; visa-processing platform Atlys; bread brand The Health Factory; AppsForBharat, the parent company of the devotional app Sri Mandir; and tech-driven villa and luxury apartment management company ELIVAAS.

Other venture capital firms, including Accel, Blume Ventures, Elevation Capital, Inflection Point Ventures, and Lightspeed, made three investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

Greater China Deals Barometer Report: PE/VC deal volume sinks to two-and-a-half-year low in Sept

Greater China’s dealmaking activity saw its coldest winter in September as investors sealed a meagre 144 deals, the lowest since March 2022. The deal count was down 12.7% from the previous month.

Venture Capital

SE Asia Deals Barometer Report: Startups raise a modest $230m in Sept as deal volume plunges

Startup fundraising in Southeast Asia remained subdued in September, as large-ticket investments remained scarce and the number of equity deals dropped to a 12-month low.