India Deals Barometer Report: Fundraising by startups bounces back to touch $1.2b in Sept

Fundraising in India bounced back in September after a lull of almost three months, with startups amassing nearly $1.2 billion across 74 private equity and venture capital transactions, according to proprietary data compiled by DealStreetAsia.

The investment was significantly higher than in August, when startups raked in $473 million across 59 transactions, a month that saw the lowest investment received by Indian startups since the pandemic-hit June 2020.

On a year-on-year basis, the deal value in September was up 20%. Meanwhile, the aggregate deal volume in the month was 35% lower compared with the corresponding period last year. The deal value of at least 15 startups was not disclosed during the month, the data showed.

Fundraising by Indian startups has been on a downward trajectory since May this year as an extended funding winter coupled with global market volatility and geopolitical conditions have adversely affected economic activity in the country. The sequential rise in fundraising, however, provided some respite to the startup fraternity.

The number of megadeals, or deals worth at least $100 million, also rose to three in September from just one in August. The share of these deals in the overall investment stood at almost 40% in the month.

Top 10 venture deals in India (Sept 2023)

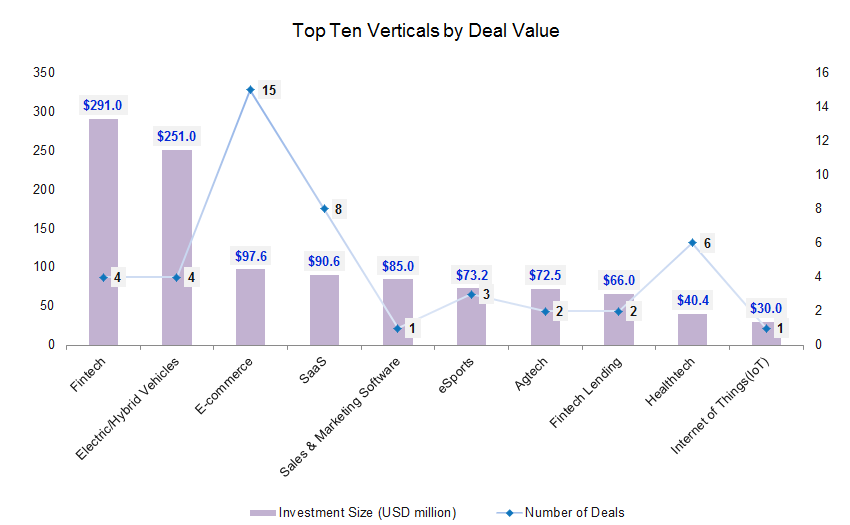

The biggest transaction in the month was closed by Bengaluru-based fintech startup Perfios, which raised $229 million in its Series D round from private equity firm Kedaara Capital. The deal also marked one of the largest investments in an Indian B2B SaaS company this year.

Among other top deals were electric vehicle makers Ola Electric’s $140-million round and Ather Energy’s $108-million funding round. No startup made it to the unicorn club (startups valued at $1 billion and above) in the month. Instant grocery delivery startup Zepto was the first and only startup to turn unicorn this year.

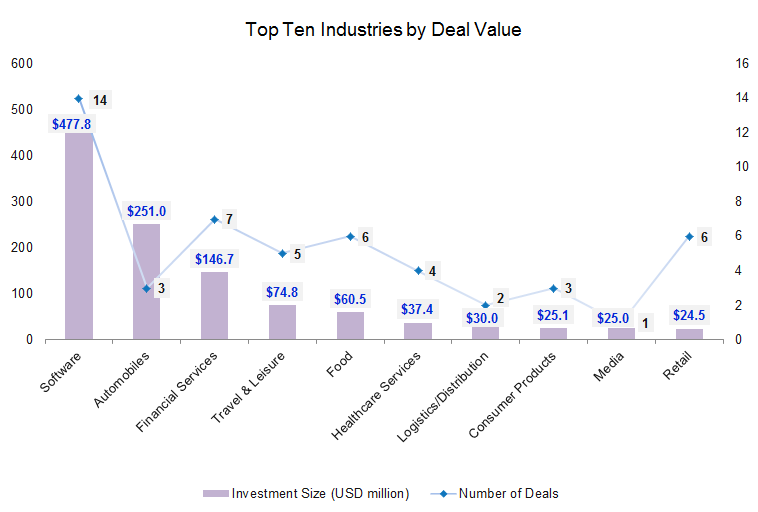

Software tops the chart

Buoyed by Perfios, software emerged as the most funded industry in September with total investments worth $477.8 million across 14 transactions. In comparison, 13 software startups raised a total of $86.9 million in August. The other prominent deal within software was Pixis’s $85-million Series C1 round led by Touring Capital. The round also saw the participation of new and existing investors, including Grupo Carso, General Atlantic, Celesta Capital, and Chiratae Ventures.

Other key transactions in the industry included Leads Connect ($62.5 million), Certa ($35 million), VVDN Technologies ($30 million), Atlys ($12 million), and Atomicwork ($11 million).

The automobile industry managed to secure a position in the top 10 after raking in a total of $251 million across three transactions. The top deal within the industry was Ola Electric, which garnered $140 million in a funding round led by Singapore’s investment firm Temasek at a reported valuation of $5.4 billion.

This is the second funding for the EV startup in three months. Earlier in May, the startup had raised $300 million from unnamed investors. Among other prominent deals within automobiles were Ather Energy ($108 million) and Raptee ($3 million).

Meanwhile, there were seven deals worth a combined $146.7 million in the financial services industry. Within financial services, Bright Money closed the largest round of $62-million, of which $50 million was in the form of debt financing from Encina Lender Finance and $12 million in equity led by Alpha Wave, Hummingbird, and PeakXV.

Microfinance startup SATYA MicroCapital’s $60-million debt deal led by Japan’s Sumitomo Mitsui Financial Group marked the second-biggest transaction within financial services.

Together the top three industries – software, automobile and financial services – raised a total of $875.5 million, accounting for about 73% of the total deal value in the month.

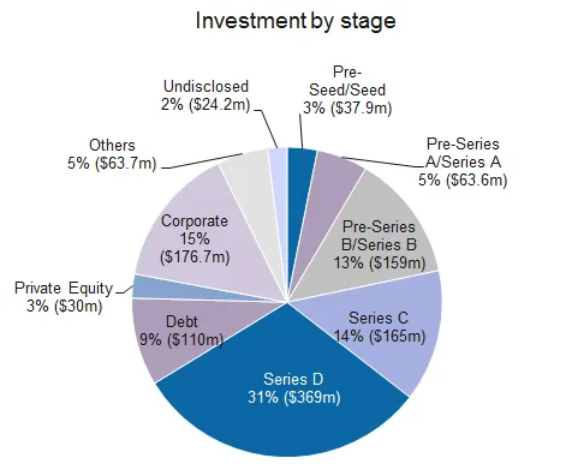

Growth-stage deals dominate

Growth-stage deals (including private equity rounds) led funding with a share of about 58% of the total deal value in September. Companies in the Series B or post-Series B rounds collected an aggregate of $697 million through 18 investments in the month compared with an aggregate of $280 million raised last month across three transactions.

Growth rounds in September were raised by Perfios ($229 million), Ola Electric ($140 million), Pixis ($85 million), Doceree ($35 million), Certa ($35 million), Kale Logistics ($30 million), Third Wave Coffee ($35 million), Kuku FM ($25 million), and Captain fresh ($20 million), among others.

Startups in the pre-Series A and Series A stages raked in about $63.6 million across 12 transactions as against $38 million across 11 transactions in August. Brine Fi, a crypto trading execution platform, raised the largest Series A round of $16.5 million led by Pantera Capital at a $100-million valuation. Atlys ($12 million), Seeds Fincap ($6 million), SigNoz ($5.4 million), Legistify ($4 million), The Good Bug ($3.5 million), and Data Sutram ($3 million) were among the other disclosed Series A deals in the month.

The value of pre-seed and seed-stage deals dropped marginally to $37.9 million in September from $41.9 million in August. The deal volume was also down to 29 from 32 in the previous month.

B2B SaaS startup Atomicwork raised the largest seed round of $11 million led by Blume Ventures and Matrix Partners India, with participation from Storm Ventures, Neon Fund, and angel investors from Silicon Valley and India. altM ($3.5 million), Clinikally ($2.6 million), EquityList ($2.2 million), QuriousBit ($2 million), and abCofee ($2 million) were among those who raised seed rounds in the month.

Corporate deals too picked up significantly in September worth a combined $176.7 million. The value of debt deals too more than doubled in the month to $110 million.

Top investors

Angel investing platform Inflection Point Ventures emerged as the top investor in September with a total of four investments, including healthcare payments startup QubeHealth, mental health platform LISSUN, drone manufacturer InsideFPV, and artificial intelligence and automation as a service startup EaseMyAI.

In June, the venture firm announced that it made 12 exits from its portfolio companies in 2022, giving an internal return rate of 160% to its investors. Some of the key exits included high-performing startups like BluSmart, Otipy, Stage, and Buyofuel.

Elevation Capital, Creaegis, EvolveX, Matrix Partners India, and Vertex Ventures made at least three investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startup fundraising dips a tad in Sept as deal volume falls Edit

Startup fundraising in the Greater China region slowed a tad in September as fewer deals were sealed in the month.

Venture Capital

SE Asia Deals Barometer Report: Megadeals lift startup funding to $1.1b in Sept—up 126% from Aug

Startups based in Southeast Asia raised $1.1 billion in September, up 126% from August, and marking the third time this year that fundraising has crossed the $1-billion mark...