India Deals Barometer Report: Startup fundraising plunges 29% to $1.1b in October

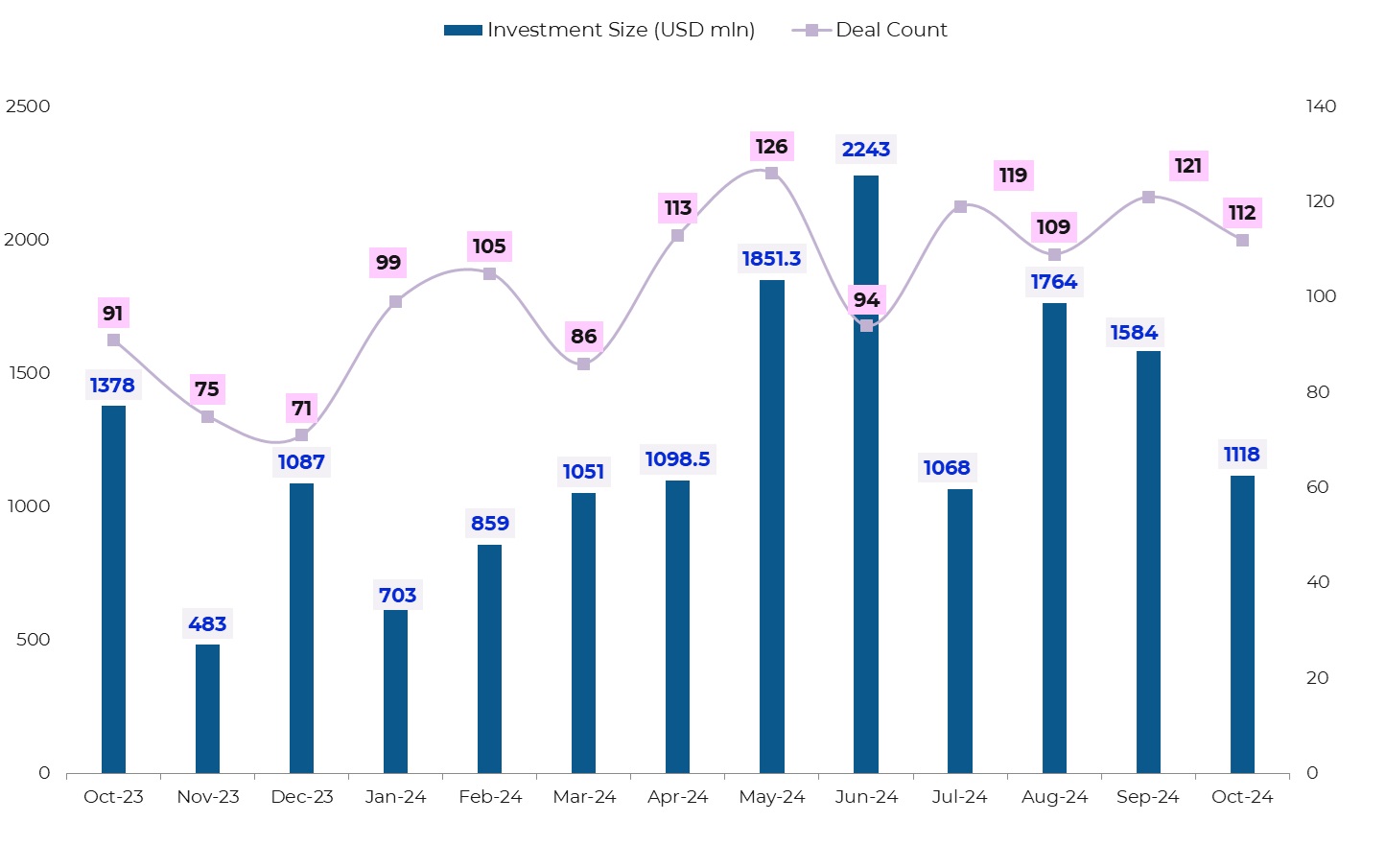

Risk capital investors further tightened their purse strings in October, investing a mere $1.12 billion into Indian startups compared with $1.58 billion in September, according to proprietary data compiled by DealStreetAsia.

The volume of venture capital and private equity transactions, too, dropped to 112 in October from 121 in the previous month. Deal volume in the month was dominated by early-stage deals.

There were at least 26 transactions in October whose deal value was not disclosed.

On a year-on-year basis, the deal value at $1.1 billion was down 19% from October 2023 when $1.38 billion worth of investments were secured by Indian startups. The volume was, however, up 23% from 91 in the comparable period last year.

Fundraising has been a challenge for most startups since the latter part of 2022 driven by multiple factors such as the rate hikes in developed markets, the geopolitical situation in Eastern Europe, and COVID-related supply-chain shocks. While fundraising remained subdued for the most part of 2023, the situation improved this year as the total funding raised by local startups increased 37% to $12.1 billion in the first nine months of 2024. Deal count, too, went up by 37% on a year-on-year basis to 966.

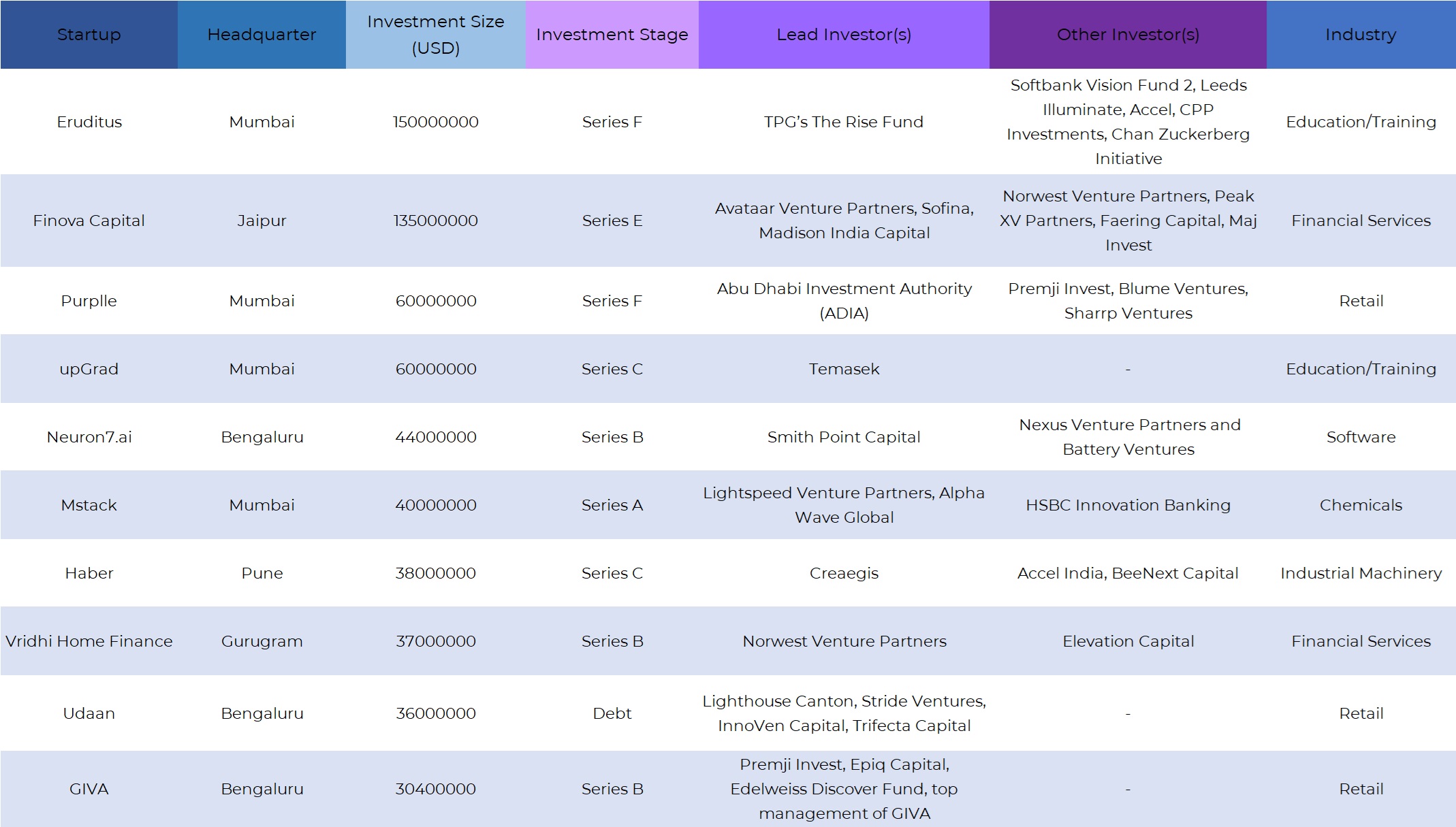

The number of megadeals, or transactions worth $100 million and above, dropped to two in October from five in September. The largest funding round in the month was closed by executive education-focused startup Eruditus, which amassed $150 million in its Series F funding round led by private equity firm TPG’s The Rise Fund. The financing for the edtech unicorn came after a gap of nearly two-and-a-half years.

Top 10 funding deals in Oct 2024

The other megadeal during the month was announced by Finova Capital, a Jaipur-based non-banking financial company (NBFC). The company raised $135 million in a Series E round of funding from Avataar Venture Partners, Sofina, and Madison India Capital.

No startup made it to the unicorn club in October. Unicorn is a moniker used to describe a privately held startup company with a valuation of over $1 billion.

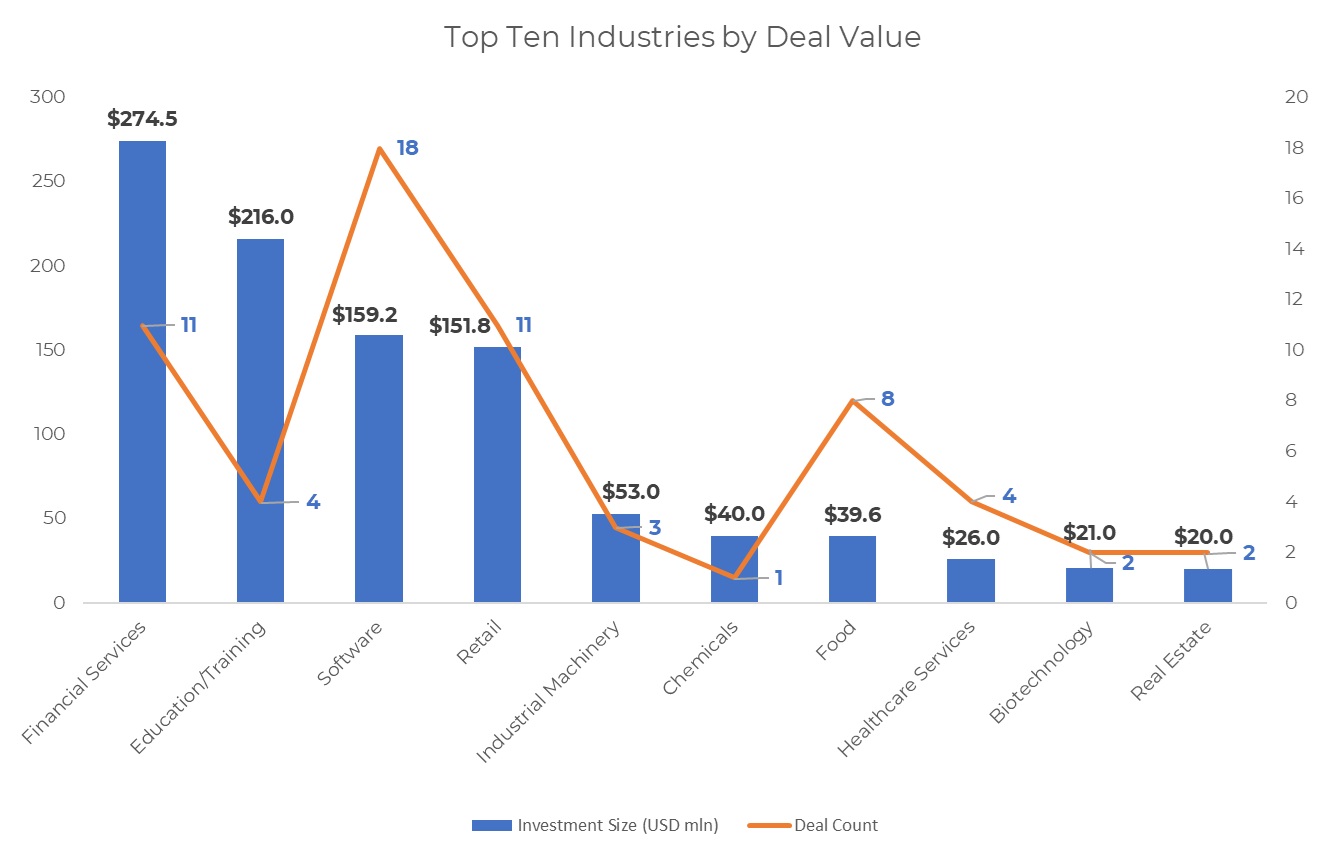

Financial services industry tops the charts

The financial services industry, comprising banking, mortgages, credit cards, and digital payment startups, led PE-VC funding in October with total investments worth $274.5 million, or 24.5% of the total funding value in the month. The capital was raised through 11 deals. In comparison, financial services raked in $454.5 million from 18 deals in September.

Within financial services, Finova Capital led the pack with $135-million funding, followed by Vridhi Home Finance ($37 million), Lendingkart ($30 million), Zinc ($25.5 million), and Navi Finserv ($24.5 million).

Buoyed by Eruditus’s $150-million funding round, the education and training industry made it to the second spot with total proceeds worth $216 million from four deals. The other big deal within the industry was closed by upGrad, which was founded by media mogul and serial entrepreneur Ronnie Screwvala. The edtech unicorn raised $60 million in the month from existing backer and Singapore state investor Temasek.

Software startups occupied the third place with a total of $159.2 million across 18 transactions. Within software, Neuron7.ai raised the largest round of $44 million in Series B funding led by Smith Point Capital, a firm founded by former Salesforce co-CEO Keith Block.

Together the top three industries — financial services, education, and software — garnered $649.7 million, accounting for 58% of the total deal value in the month.

Early-stage deals drive volumes

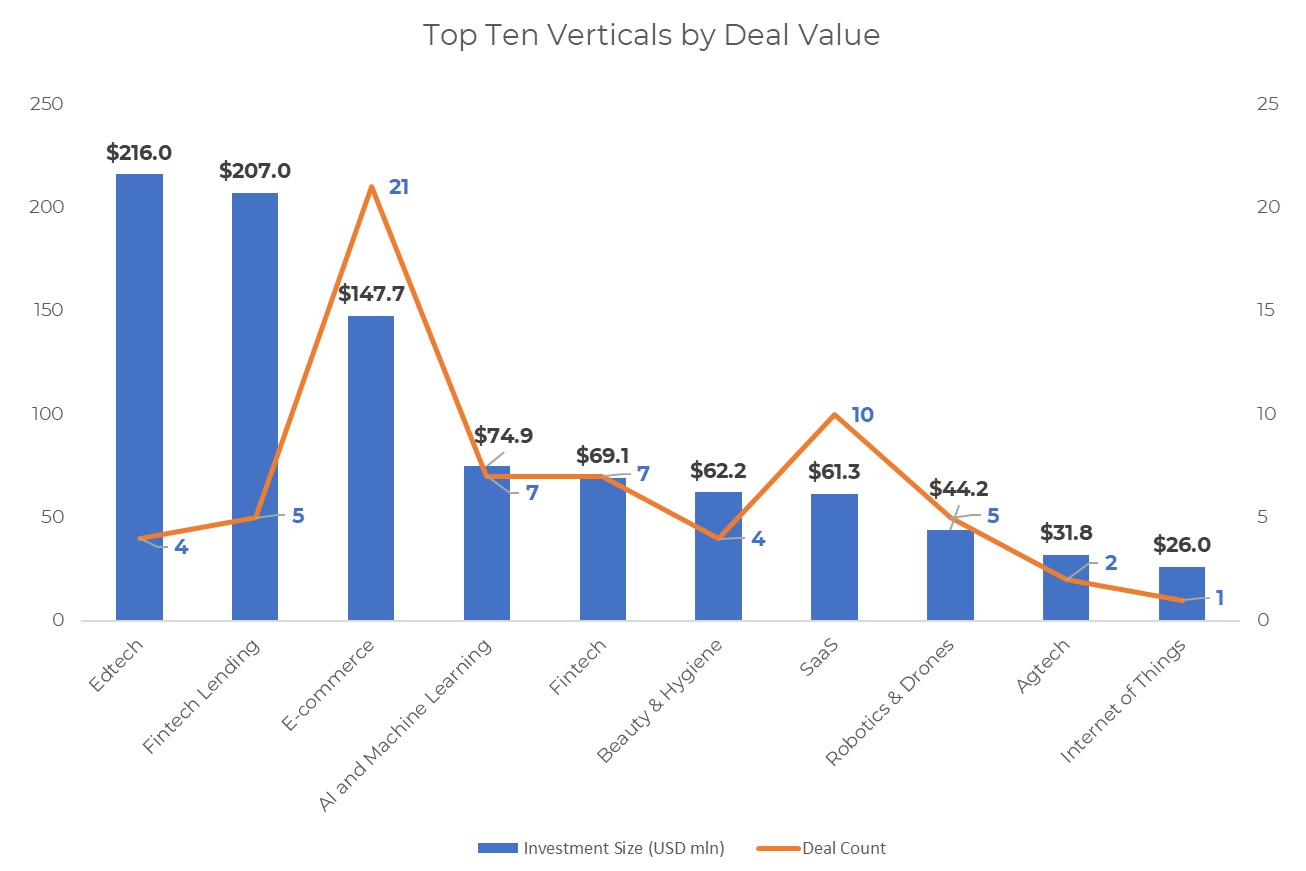

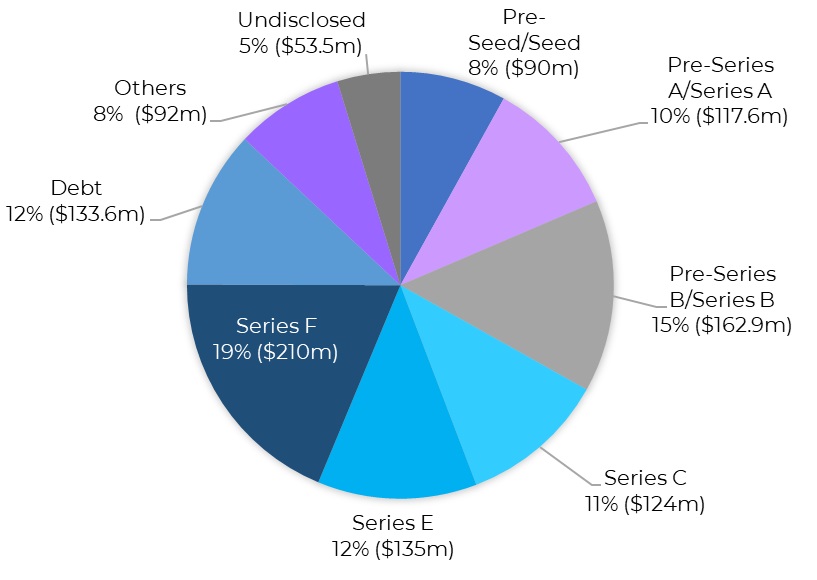

Early-stage startups, comprising companies in their pre-seed to Series A stages, had a share of 48% in the total deal volume in October. There were a total of 54 such deals in the month as against 55 in September. The value of early-stage deals increased to touch $207.6 million in October as against $161.7 million in the previous month.

Pre-seed and seed stage deals alone raised $90 million from 35 deals in the month as against $69.7 million from the same number of deals in September. Zinc Services India, a startup that helps parents save for and finance their children’s overseas education, raised $25.5 million in one of the largest seed rounds in 2024.

Other startups that raised seed rounds during the month include Primus Senior Living ($20 million), XDLINX Space Labs ($7 million), Humm Care ($5 million), Auquan ($4.5 million), Budy.bot ($4.2 million), AGNIT Semiconductors ($3.5 million), and Perceptyne ($3 million).

Breaking it up further, startups in pre-Series A and Series A stages scooped up about $117.6 million from 19 transactions as against $92 million across 20 transactions in September. In the largest Series A funding, speciality chemical manufacturing platform Mstack raised $40 million co-led by Lightspeed and Alphawave along with a debt from HSBC Innovation Banking.

Spry Therapeutics ($15 million), Economy Process Solutions ($12 million), Simplismart ($7 million), BioPrime Agrisolutions ($6 million), and str8bat ($3.5 million) were among the other startups that raised Series A rounds in the month.

Growth-stage deals, or companies in the Series B or post-Series B rounds (including pre-IPO), collected an aggregate of $629.7 million in October, down 31% from $917 million in September. Their share was also marginally down to 56% in the month from 58% in the previous month.

The growth transactions during the month were closed by startups including Eruditus ($150 million Series F), Finova Capital ($135 million Series E), Purplle ($60 million Series F), upGrad ($60 million Series C), Neuron7.ai ($44 million Series B), Haber ($38 million Series C), Vridhi Home Finance ($37 million Series B), and GIVA ($30.4 million Series B).

Nine debt deals worth $133.6 million were closed in October as against seven deals worth $261.8 million in September.

Top investors

Venture Catalysts, along with its accelerator fund 9Unicorns (now 100Unicorns), and Inflection Point Ventures were the top investors in October with five investments each.

Venture Catalysts, along with its fund invested in artificial intelligence (AI) startup NAYAN TECH; AI-based healthtech platform Aikenist; SuperUs, a technology original equipment manufacturer (OEM) and original design manufacturer (ODM); SaaS startup Alchemyst AI; and sports technology startup str8bat.

Meanwhile, Inflection Point Ventures invested in wellness brand Secret Alchemist, assistive technology startup Social Hardware, Gen AI SaaS startup Alchemyst AI, premium open-ear headphone brand NG EarSafe, and food services platform COOX.

Venture capital firm Accel, 3One4 Capital, Peak XV Partners (formerly Sequoia Capital India & SEA), FAAD Capital, and Blume Ventures occupied the second spot with three investments each.

Other prominent investors in the month were Alphawave, BEENEXT, Anicut Capital, JITO Angel Network, Lumikai, Nexus Venture Partners, Norwest Venture Partners, Omnivore, Elevation Capital, Titan Capital, Sharrp Ventures, and Premji Invest.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

Greater China Deals Barometer Report: Startup funding in Oct lowest since Feb 2020

Startup funding activity Greater China suffered a steep 36% month-on-month decline in transaction value in October, a month that recorded transactions worth only $1.9 billion.

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising up 18% in October

Equity fundraising by startups in Southeast Asia rose 18% month-on-month in October but it remained below the psychologically important $1 billion threshold, as the absence of megadeals continued to suppress total capital raised.