India Deals Barometer Report: Indian startups raise $4.55b across 154 PE, VC transactions in November

The startup ecosystem in India is bustling with activity.

Private equity (PE) and venture capital (VC) firms pumped in a whopping $4.55 billion across 154 transactions in November, according to proprietary data compiled by DealStreetAsia.

While this is a tad lower when compared to the preceding month of October, the total funding amount last month goes on to signal how investors are betting big on the country’s burgeoning sector as entrepreneurs continue to adopt an innovative approach to cater to the new-age consumer.

In October, startups had collectively mopped up $4.65 billion across 162 transactions. Meanwhile, of the total transactions in November, the value of 27 deals was not disclosed.

At least seven Indian startups made it to the unicorn club (startups valued at $1 billion and above) in November that include content-to-commerce platform Good Glamm, fitness startup Curefit, e-commerce rollup firm Mensa Brands, real estate platform NoBroker, used car buying platform Spinny, online brokerage startup Upstox, and fintech startup Slice.

In comparison, October saw six startups enter the unicorn club. India has produced a total of 41 unicorns in 2021 so far. In its annual report on startups at the beginning of the year, Nasscom had stated that the country can expect to have at least 50 new unicorns emerge in the whole of 2021 – the biggest in India’s history so far.

In terms of mega deals (that were worth $100 million or more), November lagged behind October and witnessed only nine such deals. Their share in the month’s total deal value was about 73%. In comparison, October saw 16 mega deals, which accounted for about 70% of the total deal value.

Edtech decacorn Byju’s’ $1.2 billion debt deal marked the biggest transaction of the month. The Bengaluru-based firm earlier planned to raise $500 million through a term loan B (TLB) in the US. The company was last valued at around $18 billion during a funding round in October 2021, when it raised Rs 2,200 crore led by New York-based Oxshott Venture Fund.

| Startup | Headquarter | Investment Size (USD) | Investment Stage | Lead Investor(s) | Industry | Verticals |

|---|---|---|---|---|---|---|

| Byju’s | Bengaluru | $1.2 billion | Debt | Undisclosed | Education/Training | EdTech |

| Dream Sports (Dream11) | Mumbai | $840 million | Undisclosed | Falcon Edge, DST Global, D1 Capital, Redbird Capital, Tiger Global | Travel & Leisure | eSports |

| Spinny | Gurugram | $283 million | Series E | Tiger Global, Abu Dhabi Growth Fund | Automobiles Other Vehicles & Parts | E-commerce |

| Slice | Bengaluru | $220 million | Series B | Tiger Global, Insight Partners | Financial Services | Fintech |

| NoBroker | Bengaluru | $210 million | Series E | General Atlantic, Tiger Global Management, Moore Strategic Ventures | Real Estate Development & Operating Company | Real Estate Tech |

| Zenwork | Hyderabad | $161 million | Private Equity | Spectrum Equity | Software | SaaS |

| Good Glamm (formerly MyGlamm) | Mumbai | $150 million | Series D | Prosus Ventures (Naspers), Warburg Pincus | Consumer Products | Beauty & Hygiene |

| CureFit | Bengaluru | $145 million | Corporate | Zomato | Healthcare Services | Fitness & Wellness |

| Mensa Brands | Bengaluru | $135 million | Series B | Alpha Wave Ventures | Retail | E-commerce |

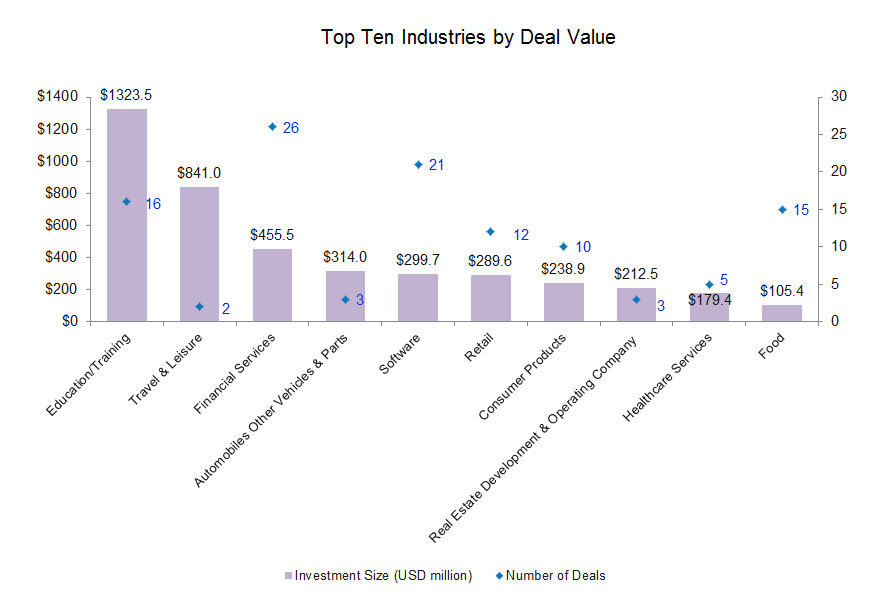

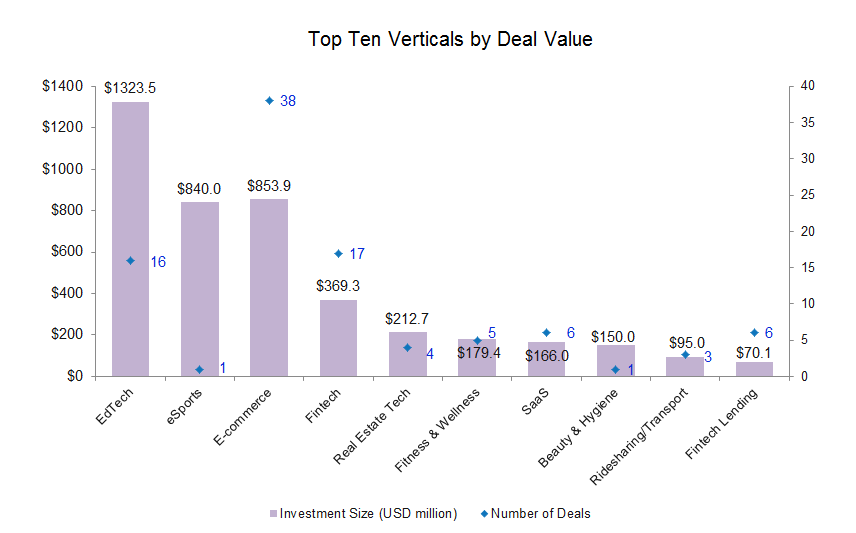

Byju’s deal drives education to top

Byju’s $1.2 billion debt deal pushed the education and training industry to the top, which garnered a total of $1.32 billion in funding across 16 deals. Byju’s has been aggressively splurging on acquisitions to take on competitors like Vedantu and Unacademy. In 2021 alone, the edtech decacorn has spent over $2 billion to expand its operations through the inorganic route. India has produced a total of five unicorns in the edtech space so far.

Other edtech startups to have raised funding during the month include BrightChamps, GENLEAP, Disprz, GetSetUp, Toppersnotes, Early Steps Academy, and Edvizo.

Travel/leisure was the second most funded industry in November as startups within the industry raised a total of $841 million across just two deals.

Among those that secured funding, Dream Sports, the parent company of online fantasy gaming startup Dream11, alone raised $840 million in a single round from Falcon Edge, DST Global, D1 Capital, Redbird Capital and Tiger Global at a valuation of $8 billion.

This goes on to show how online gaming gathered pace in India after the first phase of the COVID-19-induced lockdown in March last year. The Indian online gaming industry is expected to grow at a compound annual growth rate of 22% to touch $2 billion by 2023, up from $906 million in 2019, according to a report by All India Gaming Federation (AIGF) and EY India. The sector reached $1.027 billion in 2020. Online gamers in India are forecasted to grow from 360 million in 2020 to 510 million in 2022.

Meanwhile, startups within the financial services industry collectively raised about $455.5 million across 26 transactions. Within financial services, fintech startup Slice raised the largest round of $220 million at a valuation of over $1 billion. The Series B round was led by New York-based investment firms Tiger Global and Insight Partners.

Together, the top three industries – education and training, travel and leisure, and financial services – raised a total of $2.6 billion, accounting for about 57% of the total deal value in the month.

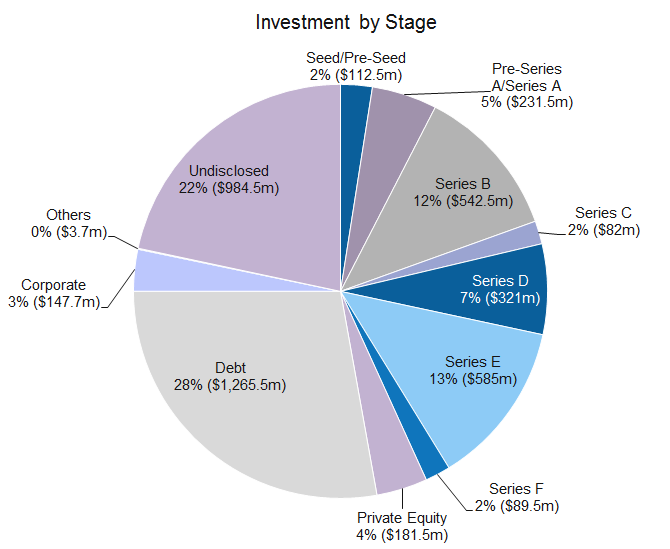

Early-stage deals push up volume

Companies in Series B or post-Series B rounds collected an aggregate of $1.62 billion across 25 transactions in November as against $3.4 billion through 34 investments in October. Startups that raised big growth rounds in the month include Zoomcar, Good Glamm, Magicpin, Mensa Brands, Slice, and Shiprocket, among others.

There were about seven debt deals worth $1.26 billion, while PE deals worth $550 million were closed in November. There were only two corporate deals during the month. Food delivery major Zomato led the largest corporate round of $145 million in fitness startup Curefit.

Deal volumes were led by early-stage transactions in November. There were a total of 56 pre-seed and seed deals worth $112.5 million in the month as against 48 deals worth $81.4 million in October. Startups in pre-Series A and Series A stages mopped up about $231.5 million across 32 transactions as against $228.6 million across 40 transactions in the previous month.

Most active investors

Sequoia Capital India, along with its startup accelerator programme Surge, invested in a total of eight startups, making it the highest investment by a single investor in the month.

The investor-led funding rounds for five startups including Mutlplier Brand Solutions, a professional employment organisation (PEO) platform for international hiring, health and wellness startup Mosaic Wellness, ecommerce enablement platform GoKwik, saas startup Toplyne, and parking solutions provder Park+.

Tiger Global emerged as the second most active investor with seven investments to its kitty in November. These include startups such as Faze Technologies, Mensa Brands, NoBroker, Spinny, Dream Sports, Slice, and Upstox. The firm had made eight investments in October.

Venture capital firm Better Capital and Titan Capital occupied the third spot with six investments each.

Share this story with your friends and colleagues.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Nov dealmaking falls short of last year despite uptick from Oct

Startups in the Greater China region raised nearly $7.3 billion across 140 private equity (PE) and venture capital (VC)...

Venture Capital

SE Asia Deals Barometer Report: Startup funding touches new record at $5.2b in November

The startup fraternity in Southeast Asia has reasons to cheer. Even as the adverse impacts of the COVID-19 pandemic are still...