India Deals Barometer Report: At $1.9b, startup fundraising in May hits nearly two-year high

After encountering periods of uncertainty and slowdown, startup fundraising in India hit its highest in nearly two years at $1.9 billion in May as a result of a spurt in megadeals, according to proprietary data compiled by DealStreetAsia. The big-ticket deals had dried up over the last seven quarters owing to a prolonged funding winter.

Fundraising in May marked a growth of about 73% over April when startups had collectively garnered $1.1 billion across 115 private equity and venture capital transactions. At 128, the deal volume in May was also the highest since November 2022.

Even as the deal value stood at a mere $2.61 billion in the Jan-March quarter, marking a drop of 11% from $2.94 billion in the previous quarter, fundraising has been on an upward trajectory since January this year, signalling a thawing funding winter.

On a year-on-year basis, the investments rose about 23% in May, while the volume jumped 42%, the data revealed.

Big-ticket deals made a comeback in May with at least six startups securing $100 million plus in funding during the month, including e-commerce companies Flipkart and Meesho, insurtech startup Go Digit General Insurance, data collaboration software startup Atlan, dialysis chain NephroPlus, and deep tech enterprise startup SEDEMAC. These startups together raked in $1 billion or 53% of the total deal value in the month.

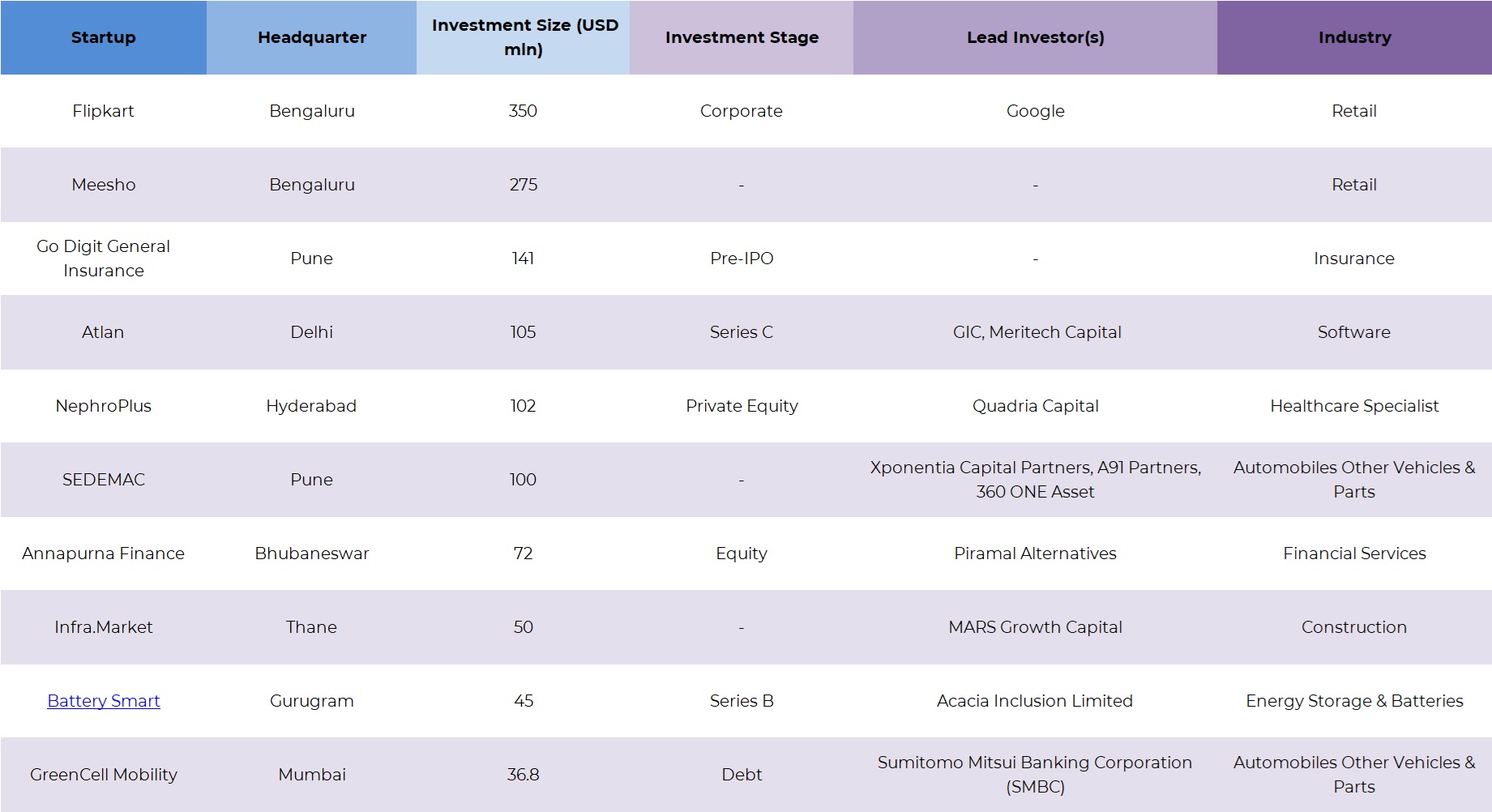

Top 10 deals in May 2024

Walmart-backed Flipkart raised $350 million from Google, making it the top deal of the month. The Google investment is part of a nearly $1-billion funding round that Flipkart kicked off in 2023. Walmart led the round with a $600 million investment late last year.

No startup earned the unicorn tag in May.

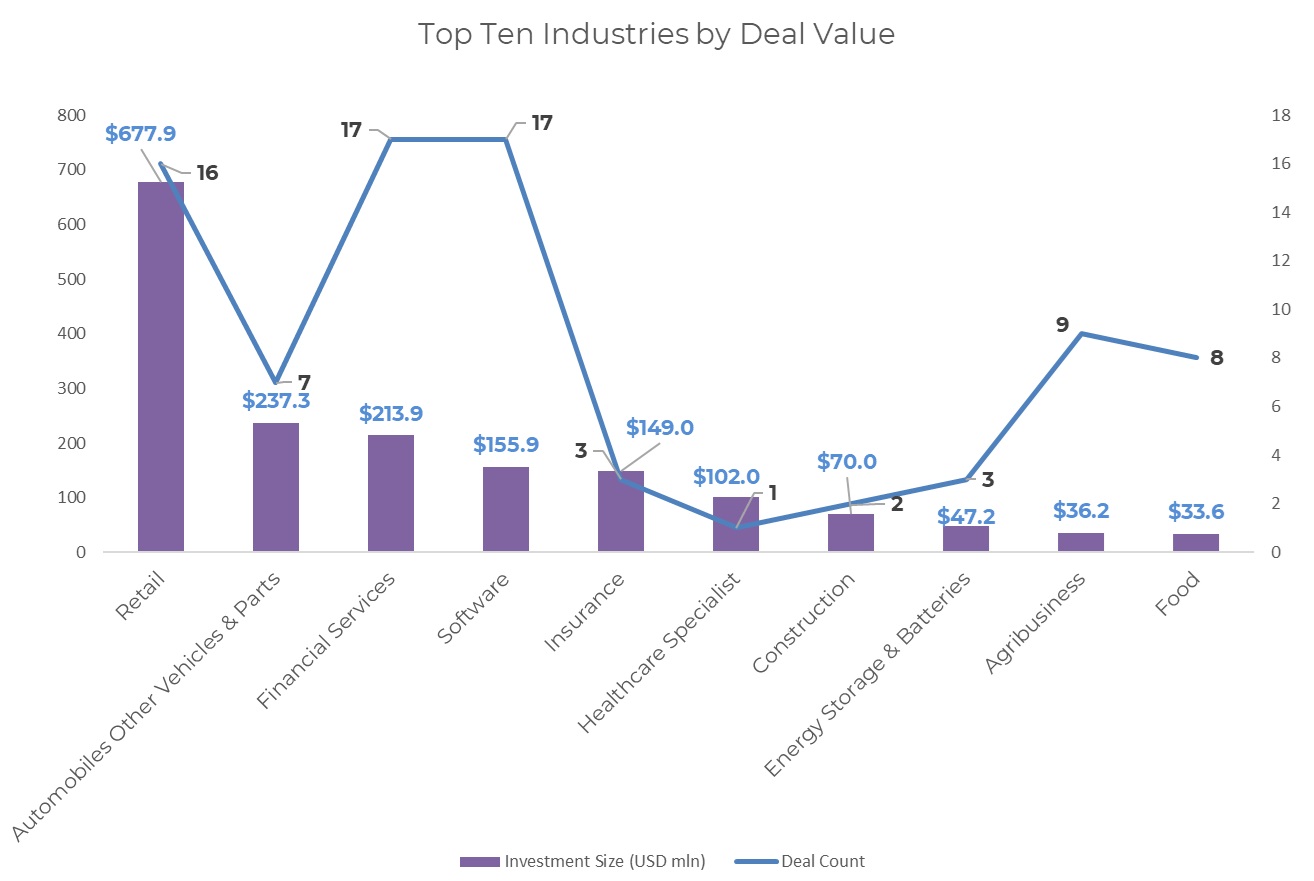

Retail makes it to the top

Retail, which includes both offline and online commerce, pipped financial services to emerge as the most funded industry in the month, with a total of $678 million funding across 16 transactions as against $66 million in the previous month.

Flipkart led the industry with $350 million in funding from Google, followed by Meesho, which secured $275 million in a new funding round. The latest funding for Meesho is part of a larger financing round that is likely to include secondary transactions and reach over $500 million, TechCrunch reported. The startup is being valued at about $3.9 billion in the latest round.

Other notable deals within retail include TechnoSport ($21 million), Libas Fashions ($18 million), and High Street Essentials ($6 million).

Automobiles and parts industry, too, moved up to occupy the second spot with $237 million in funding across seven deals, marking a more than four-fold increase in funding over April. Auto components and powertrain controls manufacturer SEDEMAC secured the highest funding by raising $100 million led by Xponentia Capital Partners, A91 Partners and 360 ONE Asset. The deal marked a full exit for the company’s first institutional investor Nexus Venture Partners. Sedemac’s other backers TR Capital and Montane Ventures also scored a complete exit with the latest round.

Meanwhile, financial services slipped to the third spot with $214 million in funding across 17 transactions in May from $312.6 million across 20 transactions in April. Micro-finance lender Annapurna Finance led the pack with $72 million in funding from Piramal Alternatives, a unit of the Ajay Piramal-controlled Piramal Group.

Education-focused fintech firm Propelld followed with $25 million debt funding for its licensed non-banking financial company (NBFC) unit Edgro. Edgro raised the amount from nine lenders including Credit Saison India Private Limited, AU Small Finance Bank, InCred Financial Services Limited and Northern Arc Capital Limited.

Other prominent deals within financial services include Kinara Capital ($24.4 million), Navi Finserv ($18 million), Save Group ($13 million), Lendingkart ($10 million), Dvara KGFS ($10 million) and Infinity Fincorp ($8 million).

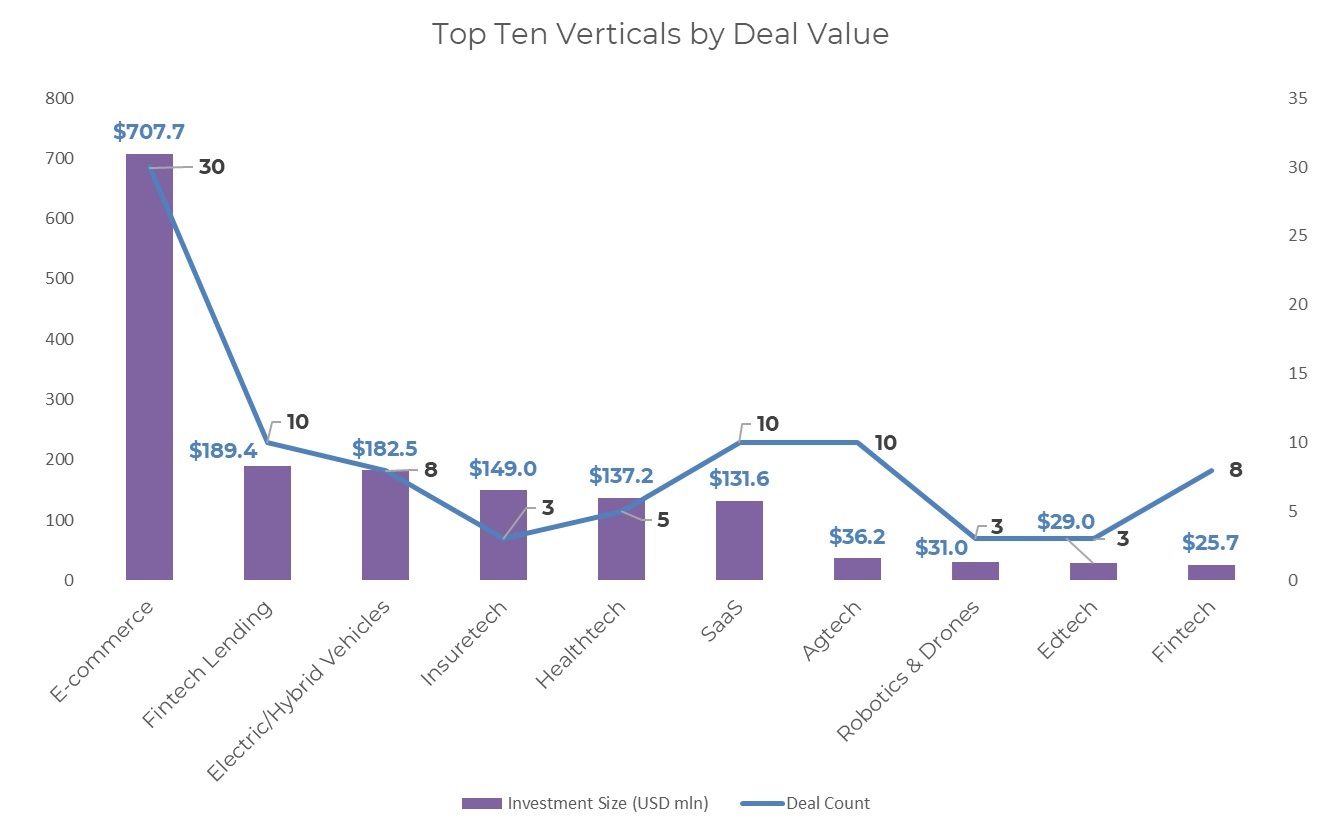

Uptick in growth-stage deals

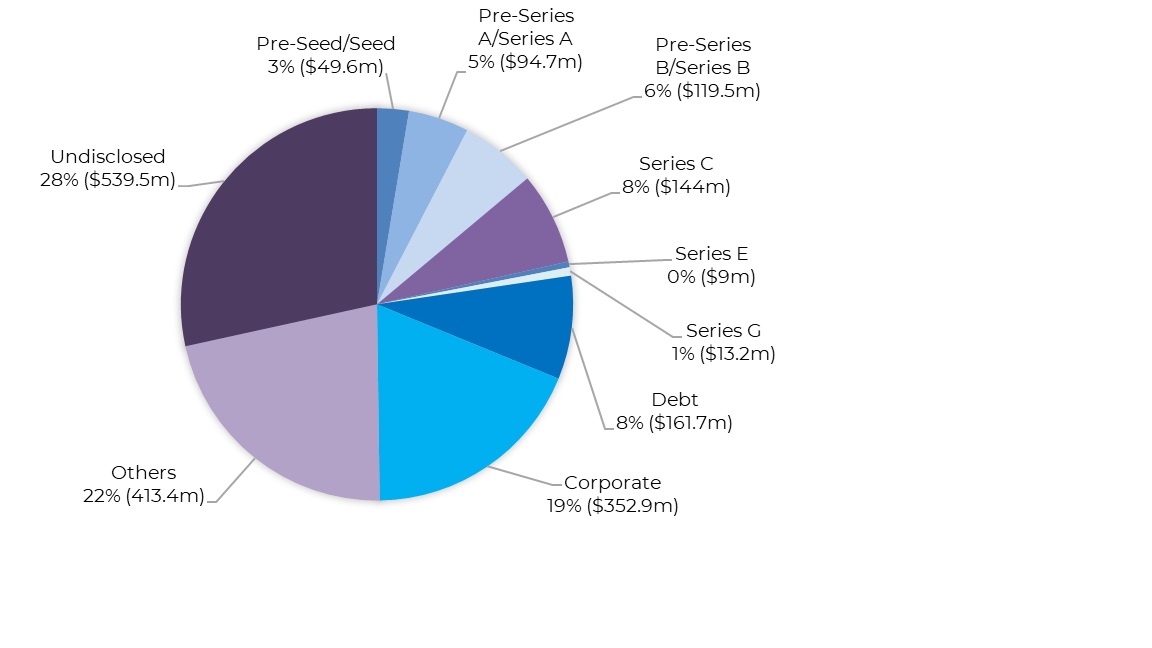

A spurt in megadeals signalled a potential revival in funding sentiments during the month. Companies in Series B or post-Series B rounds (including Flipkart, Go Digit General Insurance, and Meesho) collected an aggregate of $1.02 billion across 14 transactions in May as against $464 million through 15 investments in April.

Among other startups that closed growth-stage deals in the month include Atlan ($105 million), Battery Smart ($45 million), Euler Motors ($24 million), Zypp Electric ($15 million), Rebel Foods ($13.2 million), and Niqo Robotics ($13 million).

The deal value of pre-Series A and Series A transactions remained unaltered at $94.7 million. Their volume, however, increased to 26 in May from 24 in April. In the largest Series A deal, oncology-focused artificial intelligence company Triomics raised $15 million from Lightspeed, Nexus Venture Partners, General Catalyst and Y Combinator.

Other prominent Series A deals include Superplum ($15 million), Turno ($6 million), DiFACTO ($4.8 million), and Matel ($4 million).

Breaking it up further, pre-seed and seed rounds scooped up $49.6 million across 26 transactions in the month, down about 50% from $99 million in the previous month. In the largest seed round, UnifyApps raised $11 million led by Elevation Capital, with additional support from business angels and the company’s founders.

Debt deals were also down in May to $161.7 million across eight transactions as against $187.2 million across 13 transactions in April.

Top investors

Venture Catalysts, along with its accelerator fund 9Unicorns (now 100Unicorns), emerged as the top investor in May with at least seven investments, including deep-tech robotics and AI company Perceptyne, online paan company The Betel Leaf Co, ice popsicle maker Skippi, healthtech startup Humors Tech, on-demand drone delivery and logistics firm TechEagle, credit underwriting company AbleCredit, and AI-driven mixed reality (MR) publishing platform Flam.

Startup investing platform Inflection Point Ventures occupied the second spot with six investments, including drone technology startup TechEagle, agritech startup Fresh From Farm, reengineered tyre startup Regrip, online paan company The Betel Leaf Co, cybersecurity startup Treacle, and tea brand Freshleaf Teas.

Alteria Capital, British International Investment (BII), DeVC, Elevation Capital, SIDBI Ventures, and Venture Highway recorded at least three deals each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startup funding slumps 32% to a record low in May

Venture capital funding for privately-held firms across mainland China, Hong Kong, Macau, and Taiwan plunged 32% to $2.5 billion in May over the previous month, as China’s uneven economic growth and ongoing geopolitical tensions weighed on investor sentiment. This was the lowest amount raised by Chinese startups since DealStreetAsia started tracking deals of all sizes in April 2020.

Venture Capital

SE Asia Deals Barometer Report: Startup funding rebounds to five-month high of $878m in May

Southeast Asian startups continued to see a subdued funding environment in April, as the total private capital raised during the month plunged to $227 million, the lowest this year and down 54% month on month, according to proprietary data collated by DealStreetAsia.