India Deals Barometer Report: PE/VC investments in startups breach billion-dollar mark in March

Private equity and venture capital investments in Indian startups surpassed the billion-dollar mark for the first time this year in March, touching $1.06 billion, according to proprietary data compiled by DealStreetAsia.

This is a jump of about 17% from February, when startups collectively garnered $876 million, and an increase of 24% from January when venture funding in companies stood at $853 million.

The deal volume, however, slipped to 87 in the month from 100 in February on account of fewer early-stage transactions. Of the total deals, the value of nine transactions was not disclosed, the data showed.

While the recovery in funding reflects improved investor confidence, 2024 is yet to catch up with last year’s deal flow. On a year-on-year basis, the funding value was down 24% from $1.38 billion in March 2023. The deal volume, however, was up 24% from the comparable period last year.

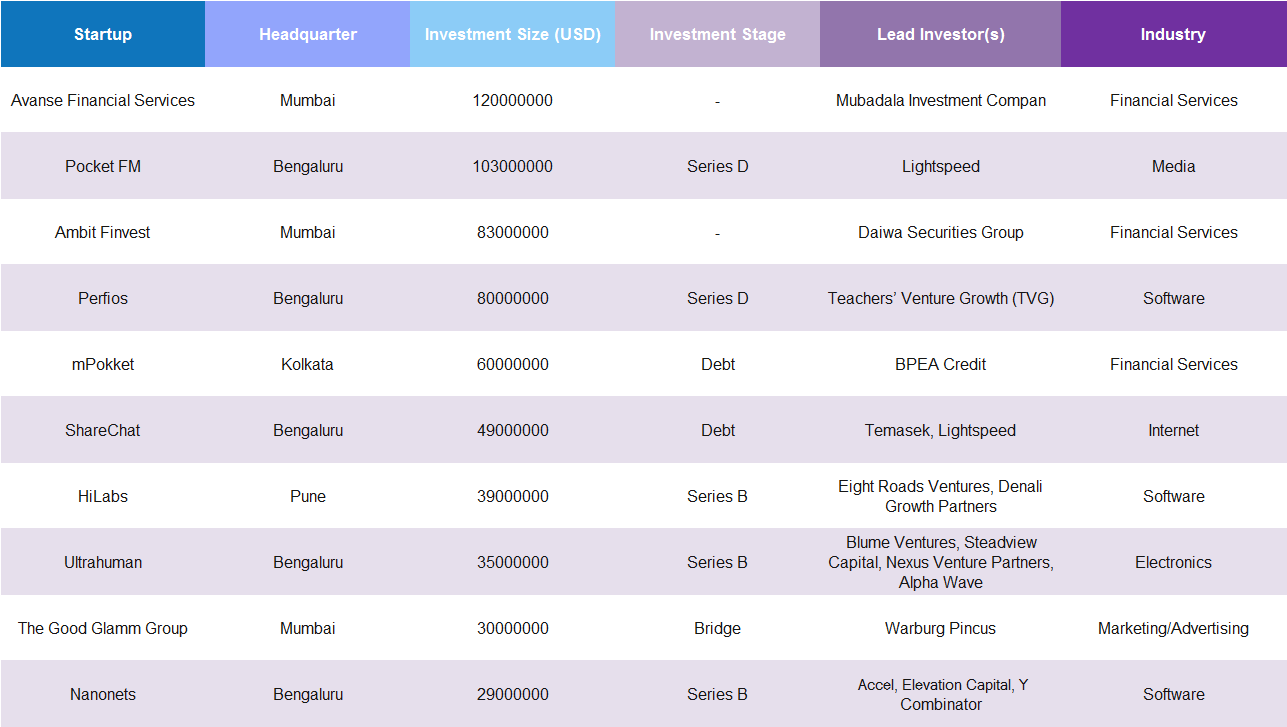

Only two mega-deals, or deals worth at least $100 million, were announced in the month as against one in February. These include Avanse Financial Services and Pocket FM. Avaanse raised the largest round of $120 million led by Abu Dhabi-based Mubadala Investment Company. Avendus PE Investment Advisors Private Limited, via its fund Avendus Future Leaders Fund II, also participated in the financing.

Top 10 deals in March 2024

Meanwhile, Pocket FM raked in $103 million in its Series D round led by Lightspeed with participation from Stepstone Group. With the latest infusion, the company saw its valuation jump to $750 million from $390 million when it previously raised $65 million in its Series C round in March 2022

Among other prominent deals in the month were Ambit Finvest ($83 million), Perfios ($80 million), mPokket ($60 million), ShareChat ($49 million), HiLabs ($39 million), and Ultrahuman ($35 million)

Amidst an extended funding winter, geopolitical uncertainties and tight credit markets, private equity and venture capital investments in India were largely subdued throughout 2023. Venture funding continues to be slow this year, and many are struggling to raise fresh funding at previous valuations.

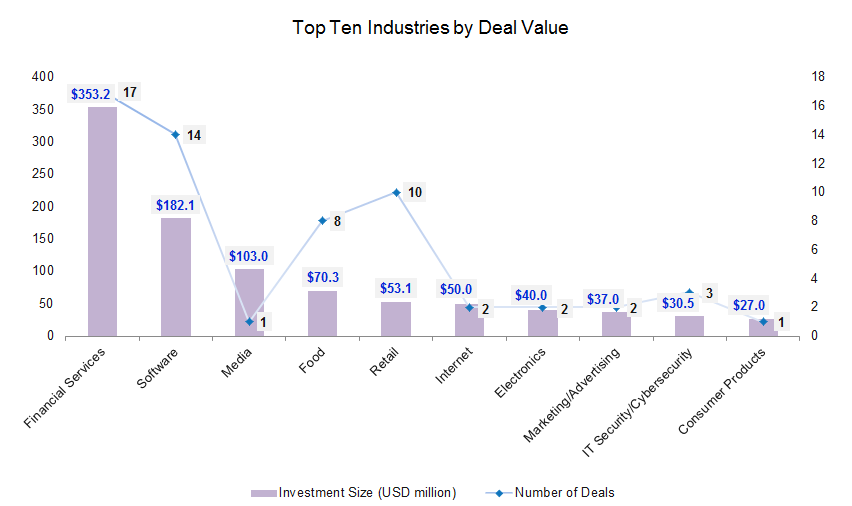

Financial services tops the charts

Financial services pipped software to emerge as the most funded industry with a total funding of $353.2 million across 17 deals. In comparison, 14 deals worth $125.7 million were closed by financial service startups in February. Prominent deals within the industry in March were Avanse Financial Services ($120 million), Ambit Finvest ($83 million), mPokket ($60 million), Aye Finance ($16.2 million), Sindhuja Microcredit ($14.5 million), and Dvara KGFS ($14.4 million).

Funding secured by software startups, too, increased 35% to $182 million across 14 transactions in March from $135 million across 15 deals in February. Fintech-focused software startup Perfios raised the largest round of $80 million from Teachers’ Venture Growth (TVG), the late-stage venture and growth investment arm of Ontario Teachers’ Pension Plan.

Among other deals within software were healthcare-based data intelligence platform HiLabs ($39 million), AI-based document workflow automation platform Nanonets ($29 million), AI platform for business RapidCanvas ($7.5 million), and data collaboration software provider Atlan ($6.5 million).

Pocket FM, the only deal within media, pushed the industry to the third spot. The audio series platform had secured $103 million in its Series D round led by Lightspeed, with participation from Stepstone Group.

Together the top three industries—financial services, software, and media—raised a total of $638.3 million, accounting for about 60% of the total value in March.

Growth-stage deals make a comeback

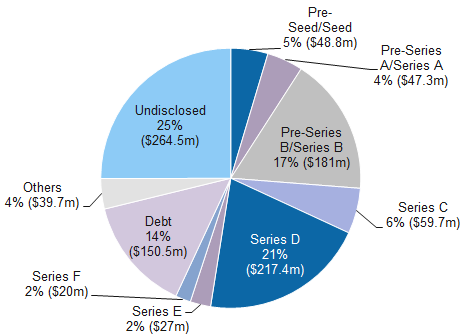

Despite the recent funding slowdown, investor enthusiasm seems to be rebounding, especially for growth-stage startups. Companies in Series B or post-Series B rounds collected an aggregate of $502 million across 19 transactions in March as against $473 million through 16 investments in February. This comes to a share of about 48% in the total deal volume in March.

Startups that raised growth rounds in March included Zetwerk ($20-million Series F), IDfy ($27-million Series E), KreditBee ($9.4-million Series D), Curefoods ($25-million Series D), Jumbotail ($18.2-million Series C), The Ayurveda Experience ($27-million Series C), Adonmo ($7-million Series B1), Cureskin ($20-million Series B), and PlanetSpark ($17-million Series B), among others.

Meanwhile, startups in pre-Series A and Series A stages mopped up a mere $47.3 million across 16 transactions in March as against $136.6 million across 27 deals in February. The largest Series A round of about $7.5 million was raised by sustainable packaging startup Bambrew, led by Blume Ventures.

Funding for early- and seed-stage startups, too, dropped 34% to $48.8 million from $73.5 million in February. The deal volume was also down to 16 from 30 in the previous month. In the largest seed fundraise, small business-focused lending startup Optimo Loan secured $10 million from Blume Ventures and Omnivore, along with additional infusion from Prashant Pitti, the founder.

The share of debt deals to total deal volume also rose in the month. March saw a total of six debt deals worth $150.5 million compared with eight debt deals worth $49.5 million in February.

Most active investors

Venture investing platform Venture Catalysts, along with its accelerator fund 9Unicorns, emerged as the most active investor with seven investments in total. These include furniture cloud factory Relso; diamond jewellery brand Fiona Diamonds; Attron Automotive, a provider of motor and controller solutions for electric vehicles (EVs); dubbing solutions startup dubpro.ai; and B2B marketing platform FreeStand.

Venture capital firm Blume Venture, along with its founders fund, occupied the second spot with a total of six deals, including health monitoring device maker Ultrahuman, Optimo Loan, Bambrew, tech-enabled grocery retail aggregator SuperK, Speciality coffee and cocoa startup Subko, and kids audio content platform Vobble.

Other firms including Accel, Anicut Capital, Inflection Point Ventures, and Nexus Venture Partners made at least three investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Three billion-dollar deals in March shore up Q1 venture funding

March was a record-breaking month for startup fundraising in Greater China after a cautious start to the year in January and muted dealmaking amid the Lunar New Year holidays in February.

Venture Capital

SE Asia Deals Barometer Report: Startup funding hits three-month high of $498m in March

Startups in Southeast Asia garnered approximately $498 million in funding in March—a 28% increase from the previous month and the highest amount raised so far this year, according to proprietary data compiled by DealStreetAsia.