India Deals Barometer Report: Startups raise $4b in March, record 10% jump from Feb

Indian startups raised about $4 billion in funding across 163 private equity (PE) and venture capital (VC) transactions in March, recording a jump of about 10% over February when companies had collectively scooped up $3.64 billion, according to proprietary data compiled by DealStreetAsia.

In terms of volume, however, there has been an 18% dip from February that saw 199 transactions.

The deal value in March was 68% higher over the corresponding period last year when the total funding raised by startups stood at $2.38 billion. Of the total transactions last month, the value of 27 deals was not disclosed.

There were at least nine mega deals or transactions worth at least $100 million in the month that accounted for about 51% of the total value, the data showed. In comparison, there were 11 mega transactions in February, accounting for about 70% of the total deal value.

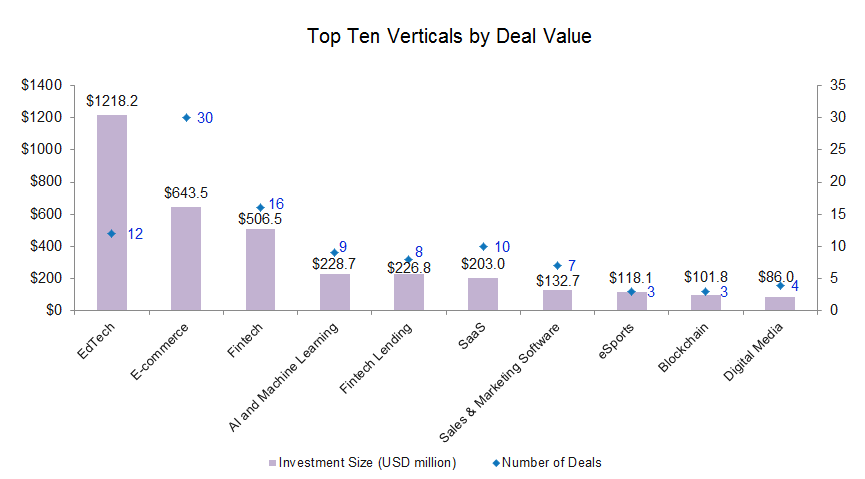

Edtech decacorn Byju’s raised the largest round of $800 million led by its founder and CEO Byju Raveendran, who invested 50% of the amount. Sumeru Ventures, Vitruvian Partners and BlackRock also took part in the financing. While the valuation was not disclosed in the latest round, in October last year, the company was valued at $18 billion when it raised $300 million led by Oxshott Capital Partners.

Other top grossers of the month include edtech startup Eruditus, fintech platforms Oxyzo Financial Services and CredAvenue, online meat retailer Licious, retail e-commerce management platform CommerceIQ, online grocer Blinkit, software development platform Builder.ai, and FanCraze, the developer of a non-fungible token (NFT) marketplace trading official cricket collectibles.

March also minted four new unicorns, a term commonly used to describe startups valued at $1 billion and above. These include online gaming platform Games24x7, Oxyzo Financial Services, cloud-based SaaS startup Amagi Media Labs, and CredAvenue. In comparison, February saw five startups enter the unicorn club.

Deals worth over $100m in Jan

| Startup | Headquarter | Investment Size (USD) | Investment Stage | Lead Investor(s) | Industry | Verticals |

|---|---|---|---|---|---|---|

| Byju’s | Bengaluru | 800,000,000 | Series F | Byju Raveendran | Education/Training | EdTech |

| Eruditus (Emeritus) | Mumbai | 350,000,000 | Debt | CPPIB Credit Investments Inc | Education/Training | EdTech |

| Oxyzo Financial Services | Delhi | 200,000,000 | Series A | Alpha Wave, Tiger Global, Norwest Venture Partners, Matrix Partners, Creation Investments | Financial Services | Fintech |

| Licious | Bengaluru | 150,000,000 | Series F | Amansa Capital, Kotak PE, Axis Growth Avenues AIF – I | Food | E-commerce |

| CredAvenue | Chennai | 137,000,000 | Series B | Insight Partners, B Capital Group, Dragoneer | Financial Services | Fintech |

| CommerceIQ | Bengaluru | 115,000,000 | Series D | SoftBank Vision Fund 2 | Software | Sales & Marketing Software |

| Blinkit (Grofers) | Gurugram | 100,000,000 | Series G | Zomato | Retail | E-commerce |

| Builder.ai | Gurugram | 100,000,000 | Series C | Insight Partners | Software | AI and Machine Learning |

| FanCraze (formerly Faze Technologies) | Mumbai | 100,000,000 | Series A | Insight Partners | Software | Blockchain |

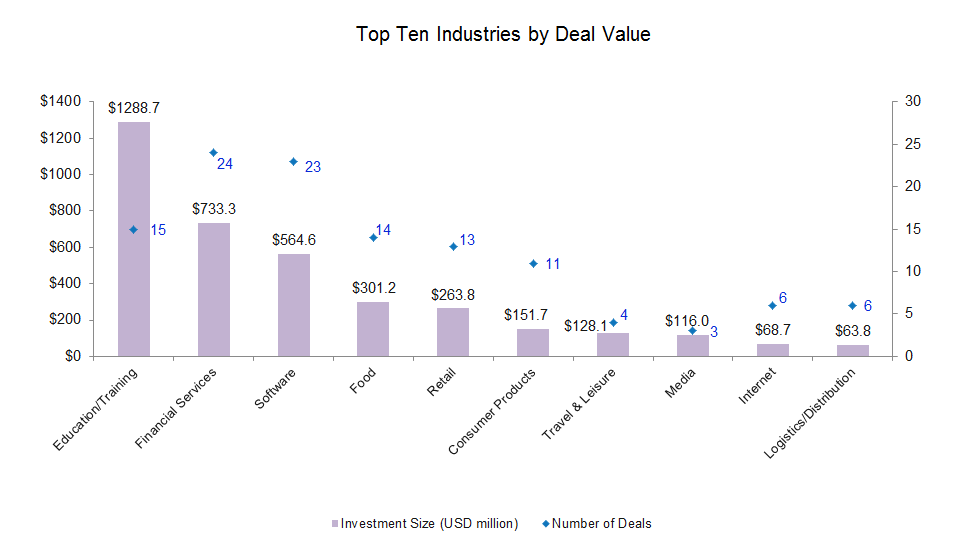

Education tops funding list

Byju’s $800-million funding deal helped push the education/training industry to the top with a total of $1.29 billion funding in its kitty through 15 transactions. Amongst other prominent deals clocked in the country’s education sector last month, Emeritus raised a whopping $350 million in a debt financing round from Canada Pension Plan Investment Board (CPP Investments). Other edtech startups to have secured funding in March include Classplus ($70 million), Filo ($23 million), Leverage Edu ($22 million), and InterviewBit ($10 million).

The edtech sector has been growing exponentially over the last few years, and even more so after the outbreak of the COVID-19 pandemic.

According to DealStreetAsia’s findings, the education industry raised a total of $5.43 billion across 155 transactions in 2021. India’s online education market is expected to be worth more than $3.5 billion by 2022 from $735 million in 2019, according to a new report by edtech-focused VC firm BLinC Invest.

Financial services, led by technology-enabled startups, was the second most funded industry in March with startups raking in a total corpus of $733 million across 24 transactions. Oxyzo Financial Services, the lending arm of industrial goods and services procurement platform OfBusiness, raised the largest round of $200 million. The Series A round was co-led by Alpha Wave and Tiger Global, and backed by Norwest Venture Partners, Matrix Partners, and Creation Investments.

Other transactions within the financial services sector in the month included CredAvenue ($137 million), Money View ($75 million), Viviriti Capuital ($55 million), Zeta ($30 million), Volopay ($29 million), and Kuhoo ($20 million).

Software startups occupied the third spot by mopping up a total of $564 million across 23 venture capital transactions.

Together, the top three industries – education/training, financial services, and software – raised a total of $2.6 billion, accounting for about 65% of the deal value in March.

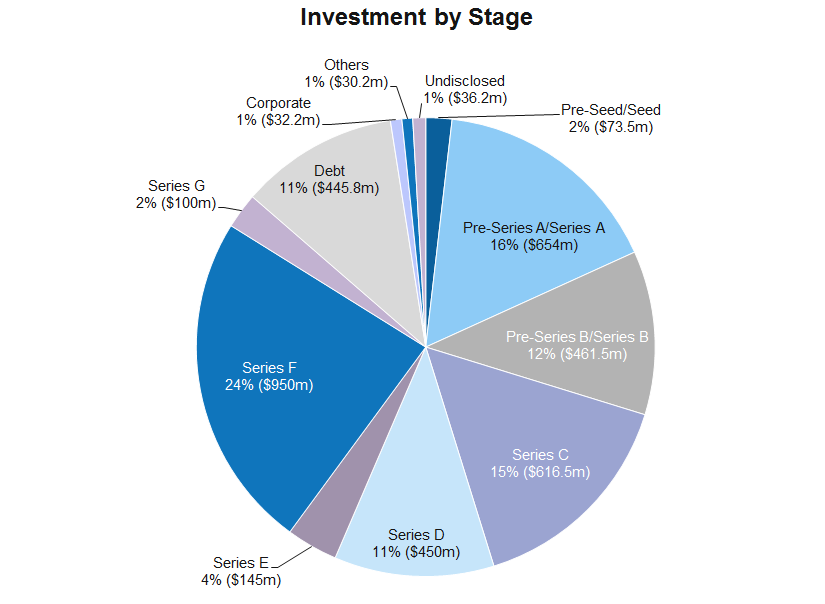

Growth stage deals dominate deal-making

Growth-stage deals continued to lead funding value in March. From Series B to Series G round, companies raked in an aggregate of about $2.7 billion through 35 transactions. The big deals included Byju’s, Blinkit, Money View, Licious, Amagi, Country Delight, Games24x7, CityMall, among others. Almost an equal amount was raised by growth-stage startups in February.

Startups in the pre-Series A and Series A stages collectively garnered $654 million through 43 transactions as against $234.1 million through 42 transactions in February.

The value of pre-seed and seed funding deals saw a marginal improvement at $73.5 million in March as against $59.5 million in February. The month also registered a marginal increase in the number of pre-seed and seed deals at 52 from 47 in February. Meanwhile, there were about 10 debt deals worth $446 million in March.

Most active investors

Sequoia India, along with its startup accelerator programme Surge, continued to be the most active investor in March with a total of nine investments. The VC firm led investments for four startups including AI-enabled upskilling and career development platform Seekho.ai, deep tech startup Praan, data collaboration software provider Atlan, and web3 platform Metasky.

Tiger Global, too, continued its investment spree in India. The New York-based investment firm funded a total of eight startups in March, and led funding in Wiz Freight, Captain Fresh, Money View, Oxyzo Financial Services, and Classplus. According to our proprietary data, Tiger Global made at least 67 investments in India in 2021 out of which it led funding for about 42 startups.

Accel occupied the third spot with six investments while Blume Ventures, along with its founders fund, Norwest Venture Partners, and Insight Partners made five investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: PE-VC fundraising remains muted in Q1 despite uptick in March

Startup financing in Greater China showed some signs of recovery in March...

Venture Capital

SE Asia Deals Barometer Report: PE-VC funding dips 25% to $1.46b in March

Venture capital (VC) and private equity (PE) funding in Southeast Asia slowed by 25% in March...