India Deals Barometer Report: Startup funding tanks 52% to $1b in July

After witnessing a sharp uptick in June this year, private equity and venture capital funding for Indian startups plummeted almost 52% to $1 billion in July, according to data compiled by DealStreetAsia. Startup funding crossed the $2-billion mark for the first time in two years in June.

The sharp jump in VC funding in June was largely due to the $665-million round raised by grocery delivery startup Zepto co-led by existing investors Glade Brook, Nexus, and StepStone, with Goodwater and Lachy Groom doubling down as well.

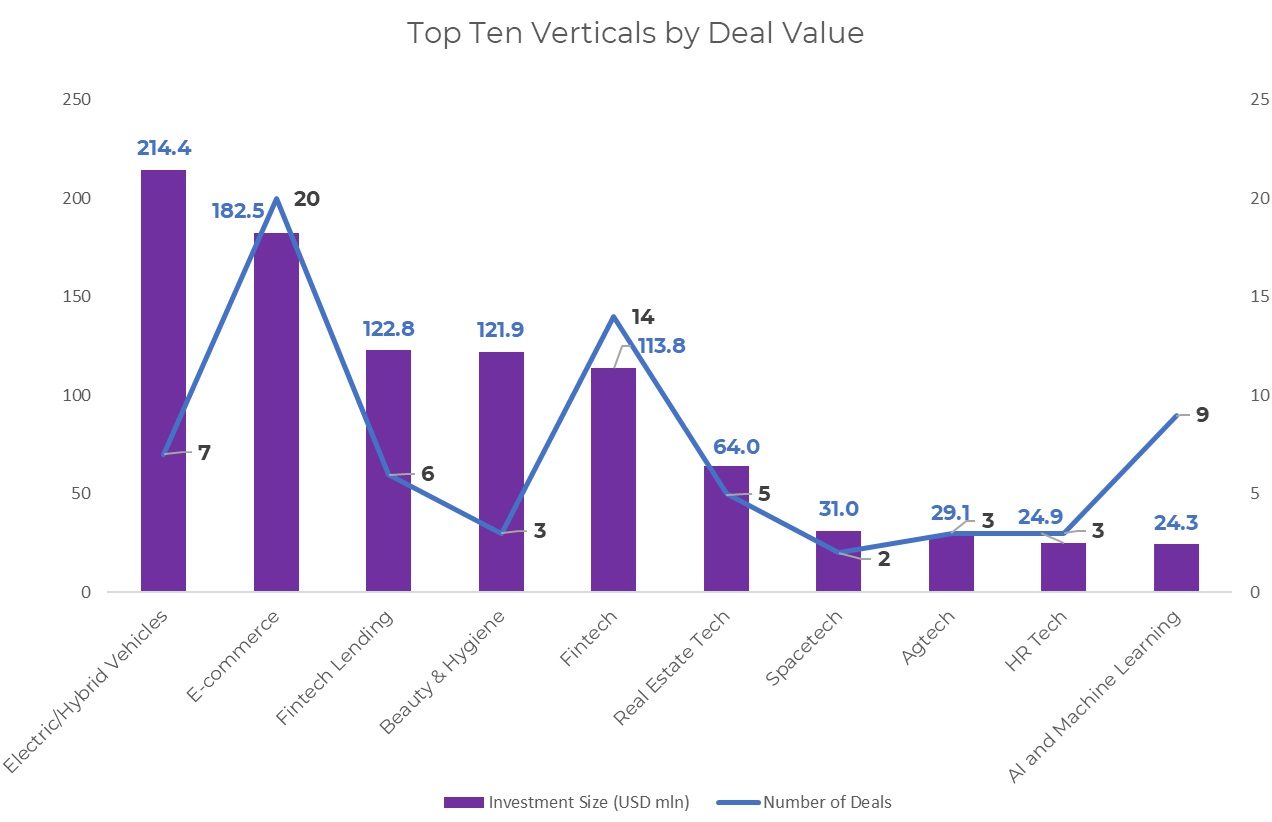

Deal volume, however, increased to 119 in July from 94 in June as a result of an increase in early-stage deal activity, especially across sectors including artificial intelligence (AI), fintech, and electric and hybrid vehicles, the data showed.

Overall, 2024 has shown a positive trend with a resurgence in capital investments. On a year-on-year basis, the funding value nearly doubled from $564 million in July 2023. Deal volume was also up 56% from the comparable period last year.

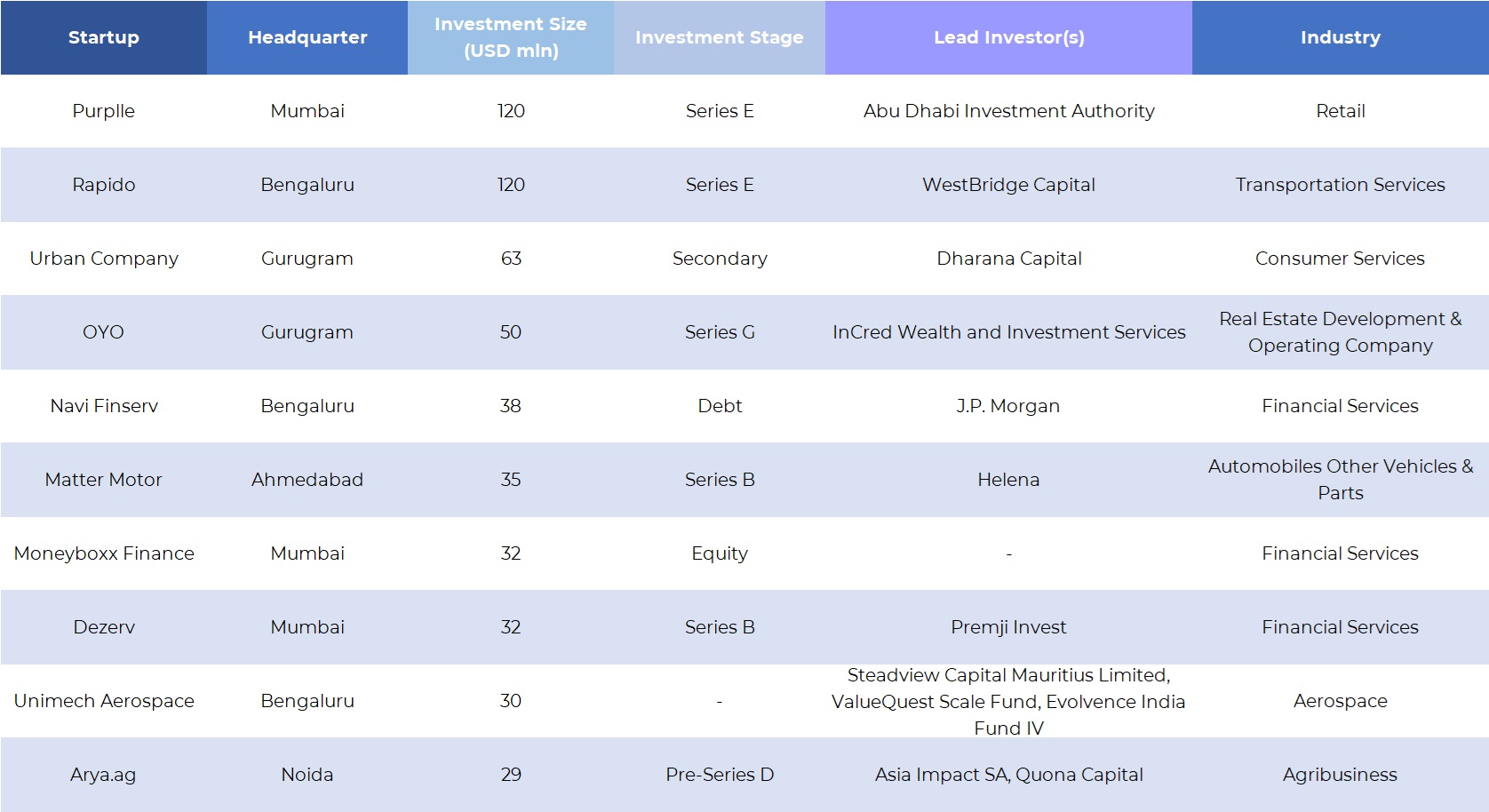

Big-ticket deals, however, continue to remain scarce. Only two megadeals or rounds of over $100 million in size were recorded during the month, including beauty and personal care products platform Purplle and ride-hailing startup Rapido. While Purplle raised about $120 million led by a wholly owned subsidiary of the Abu Dhabi Investment Authority (ADIA), Rapido secured $120 million in its Series E funding round led by its existing investor WestBridge.

Top ten funding deals in July 2024

With the latest round, Rapido also became the fourth company to have breached the $1-billion valuation mark in India this year, after logistics platform Porter, fintech startup Perfios, and AI startup Krutrim.

In comparison, four megadeals were closed in June and six in May. Meanwhile, the Jan-Mar 2024 quarter witnessed only three megadeals. 2023 was a tepid year for megadeals as investors pulled back amid an extended funding winter and uncertain market conditions.

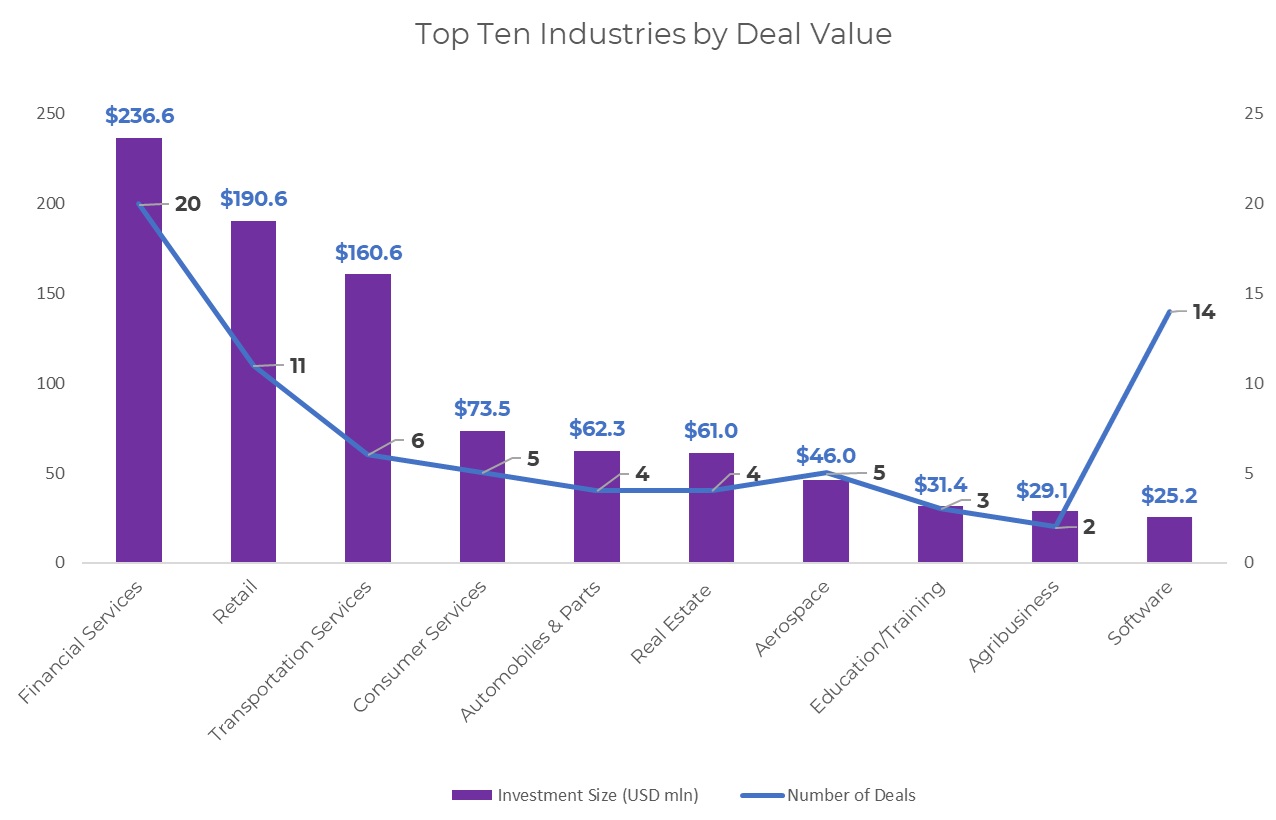

Financial services top the charts

Financial services emerged as the most funded industry in July with total proceeds worth $236.6 million from 20 deals, down 34% in value over June.

Navi Finserv led the pack with $38 million in funding from multinational financial services firm JP Morgan in a securitisation deal. Moneyboxx Finance followed with a $32-million funding through the issuance of equities to support its growth plans. Other notable deals within financial services include Dezerv ($32 million), BlackSoil NBFC ($24.8 million), Vayana Network ($20.5 million), Satin Creditcare ($16.2 million), and Stable Money ($15 million).

Buoyed by Purplle’s $120-million deal, the retail sector, which includes both offline and online commerce, moved to second place with total funding worth $190.6 million across 11 deals. In comparison, retail startups scooped up $289.4 million through 10 deals in June.

Other retail startups that raised funding during the month include D2C brand aggregator G.O.A.T Brand Labs ($21 million), eyewear retailer Lenskart ($20 million), fast fashion brand Newme ($18 million), sneaker brand Comet ($5 million), and luggage brand Nasher Miles ($4 million).

Led by Rapido, transportation services were pushed to the third spot with total funding proceeds worth $160.6 million from six deals. The other prominent deal within the industry was BluSmart, which raised $24 million in a funding round led by its existing investors Zurich-based climate finance firm ResponsAbility Investments, cricketer MS Dhoni’s Family Office, and ReNew founder Sumant Sinha.

Early-stage deals drive volumes

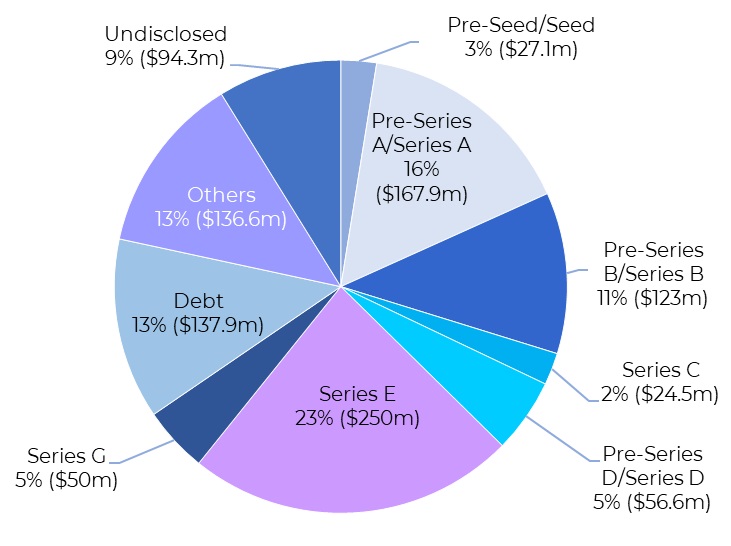

Increased investor interest in good business ideas is evident from the rise in the number of early-stage deals. While the value of pre-seed and seed deals fell to $27.1 million in July from $42.2 million in June, their number rose to 37 in the month from 19 in June.

Rabbitt AI, a generative AI solutions firm, raised the largest seed round of $2.1 million led by TechCurators and various angel investors. Other seed rounds during the month were closed by Moxie Beauty, DiscoveryAI, Ninecamp Ventures, Fibr, Icanheal, Fabriclore, Nected, nhance, and SkinInspired.

Meanwhile, about 27 pre-Series A and Series A transactions worth $167.9 million were closed in the month, marginally up from $161.5 million across 26 transactions in June. The largest Series A round of $20 million was raised by electric scooter maker Simple Energy, led by Balamurugan Arumugam, the chief growth officer at cashflow management software maker Klarity.

In terms of value, growth-stage startups led July’s fundraising. Companies in the Series B or post-Series B rounds collected an aggregate of $480 million — about 45% of the total deal value — through 13 investments.

Budget hotel chain OYO, payments app BharatPe, ride-hailing platform Rapido, beauty platform Purplle, electric scooter maker Ather Energy, trade financing platform Vayana Network, gig platform Awign, EV bike maker Matter Motor, wealthtech platform Dezerv, drone startup Aereo, education services provider CollegeDekho, consumer lighting company Corvi LED were among the startups that raised growth rounds in July.

Meanwhile, there were 11 debt deals worth $137.9 million in July as against $181.4 million in June across an equal number of deals.

Top investors

Early-stage investors FAAD Capital and Inflection Point Ventures were the top investors in July with a total of five investments each. FAAD invested $1,21,000 in four agritech startups — Godaam Innovations, VedaFit Foods, Aqin Biotech, and Mkelly Biotech — in the month to support their growth plans.

Meanwhile, Inflection Point Ventures-backed startups include Devnagri, MyPickup, Bloq Quantum, Medront Datalabs, and Telkes Technologies.

Venture capital firm Blume Ventures, along with its Founders Fund, occupied second place with a total of four investments, including ride-booking app Namma Yatri, fintech platform Multipl, EV charging platform ElectricPe, and home furnishing installation startup Wify.

Accel followed with three investments while Antler, AUM Ventures, Emergent Ventures, Fireside Ventures, InnoVen Capital, IvyCap Ventures, and Matrix Partners India made at least two investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

Greater China Deals Barometer Report: Startup funding shows signs of recovery in July as deal count grows Edit

Investors ramped up transactions in July as the Greater China market closed 184 deals, up 17.2% from June. The deal count, which hit a three-month high, shows signs of revival after the 9.2% month-over-month decline in deal volume in June.

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising falls 17% MoM in July

Startup fundraising remained subdued in Southeast Asia in July due to the absence of large-ticket deals.