India Deals Barometer Report: Indian startup funding hits 21-month low in July at $885m, less than half of June

With macro headwinds in the backdrop, fundraising by Indian startups through private equity and venture capital transactions plunged to a 21-month low of $885 million in July this year, showed proprietary data compiled by DealStreetAsia. This is also the first time in many months that fundraising in the country fell below the $1-billion mark.

The deal value in July was less than half of the $2 billion raised by startups in June as investors turned cautious towards bigger bets amid the heightened economic volatility. They are now looking at only promising and sustainable business models and those businesses that have clearly defined their route to profitability.

Deal volume, too, saw a marginal drop of 6.3% to 119 in July from 127 in the previous month even as early-stage deals, from Seed to Series A, continued to see traction. Of the total transactions in July, the value of as many as 26 deals was undisclosed, the data showed.

Owing to the economic slowdown, investors shied away from putting big money into startups, resulting in only two mega-deals, or where the funding size crossed $100 million, in July. These include OneCard, a mobile-first credit card firm, and 5ire, a Layer-1 blockchain network. In contrast, there were four mega-deals in June.

Top 10 deals in July

| Startup | Headquarter | Investment Size (USD) | Investment Stage | Lead Investor(s) | Industry | Verticals |

|---|---|---|---|---|---|---|

| OneCard (FPL Technologies) | Pune | 100,000,000 | Series D | Temasek | Financial Services | Fintech |

| 5ire Technologies | Bengaluru | 100,000,000 | Series C | Blackstone | Software | Blockchain |

| LifeWell (Mfine-LifeCell merged entity) | Chennai | 80,000,000 | Series C | OrbiMed | Biotechnology | Biotech |

| Spotnana | Mumbai | 75,000,000 | Series B | Durable Capital Partners LP | Travel & Leisure | Travel Tech |

| Jai Kisan | Mumbai | 50,000,000 | Series B | GMO Venture Partners, Yara Growth Ventures and DG Daiwa Ventures, Blume, Arkam Ventures, Mirae Asset, Snow Leopard Ventures, Northern Arc, Alteria, MAS Financial | Financial Services | Fintech |

| Fi (formerly epiFi) | Bengaluru | 45,000,000 | Series C | Alpha Wave Ventures | Financial Services | Fintech |

| PriceLabs | Pune | 30,000,000 | Series A | Summit Partners | Software | SaaS |

| NiYO | Bengaluru | 30,000,000 | Private Equity | Multiples Alternate Asset Management | Financial Services | Digibank |

| Detect Technologies | Chennai | 28,000,000 | Series B | Prosus Ventures | Industrial Machinery | AI and Machine Learning |

| Vegrow | Bengaluru | 25,000,000 | Series B | Prosus Ventures | Agribusiness | Agtech |

OneCard and 5ire were also the only startups to make it to the unicorn club in July. OneCard turned unicorn after it raised $100 million in its Series D financing round led by Singapore state investment firm Temasek, at a valuation of $1.4 billion. Unicorn is a term used to describe privately held companies valued at $1 billion or more. 5ire, too, raised $100 million at a valuation of $1.5 billion from UK-based SRAM and MRAM Group.

Edtech in the doldrums

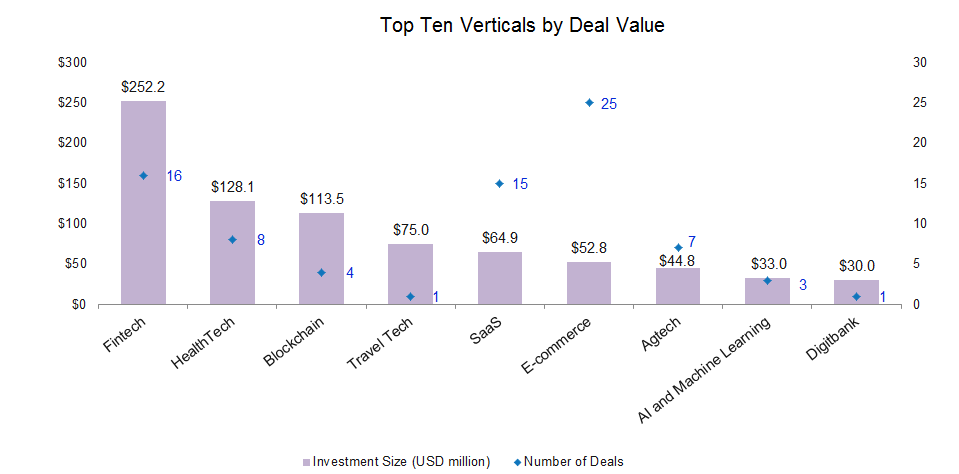

Financial services remained the most funded industry with a total of $306 million in its kitty across 20 transactions. Within financial services, the other prominent deals, apart from OneCard, were Jai Kisan and Fi (formerly epiFi) which raised $50 million and $45 million, respectively. Other fintech startups that raised funding in July include NiYO ($30 million), Sitara ($20 million), Innoviti Payment Solutions ($15 million), MarketWolf ($10 million) and Hyperface ($9 million).

The software industry moved up to the second spot with a total of $158 million across 19 transactions. This is a drop of about 23% from the funding amount ($204 million) raised by software startups in the previous month. Top deals within software include 5ire Technologies, PriceLabs, Zbytes, Attentive and Threado, among others.

Healthtech startup LifeWell’s $80-million funding round from OrbiMed helped push the healthtech industry into the top three, with a total fundraise of $95 million across mere two transactions. LifeWell was formed out of a merger between MFine and the diagnostics arm of genetic testing services provider Lifecell International last month.

Meanwhile, the education and training industry slipped from the second spot to the seventh, with mere $22-million financing across eight transactions in July compared with nine deals worth $245 million in June.

The top three industries — financial services, software and healthtech — together raised $559 million, accounting for about 63% of the total deal value in July.

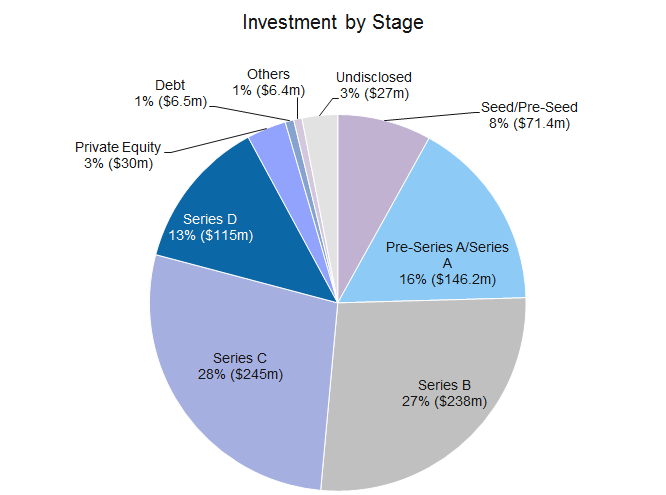

Early-stage deals push volume

Early-stage deals once again took the lion’s share in terms of volumes. Pre-seed and seed-stage deals accounted for about 46% of the deal volume at 55. These startups together racked up about $71.4 million funding in July, a tad lower than $89 million in the preceding month. Hyperface, SaveIN, ChattyBao Technologies, Homexchange, Kindly and Threado were among those who raised seed rounds in July.

The pre-Series A and Series A deals mopped up $146.2 million across 30 deals, registering a drop of about 73% over June, when these deals raised $533 million across 42 transactions. Revenue management solutions provider PriceLabs’ $30-million funding marked the largest Series A round in the month. Other deals include Eka Care, Fitterfly, Wheelocity, MarketWolf, AntWalk, Mokobara and Burger Singh.

Growth-stage deals — companies in the Series B or post-Series B stages — together scooped up about $598 million across just 13 transactions, accounting for about 68% of the total deal value in July. The growth rounds were raised by OneCard, 5ire Technologies, LifeWell, Spotnana, Jai Kidan, Fi, Detech Technologies, Vegrow and String Bio, among others.

Meanwhile, there was just one debt deal worth $6.5 million as against six worth $90 million in the previous month.

Most active investors

Inflection Point Ventures, an early-stage angel investing platform, ranked as the most active venture investor with a total of eight investments to its credit. The firm led or co-led funding for startups including The Healthy Company, ConsCent, WonderLend Hubs, Geekster, Hudle, The Nestery and Urvann.

Venture Catalysts, along with its early-stage fund 9Unicorns, was the second most-active investor with a total of six transactions as against eight in June. It backed startups including Degpeg, Fitterfly, Ensuredit and Lightbulb.ai.

While Y Combinator made a total of five investments, Ankur Capital, Better Capital and Blume Ventures, along with its Founders Fund, made four investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: At 236 PE-VC transactions, dealmaking volume dips a tad in July

Dealmaking in Greater China slackened in July but still managed to remain at elevated levels as startups...

Venture Capital

SE Asia Deals Barometer Report: Startup funding up 36% sequentially in July as megadeals recover

Startups in Southeast Asia raised at least $1.9 billion in funding in July, recording a 36% jump from June...