India Deal Review: Startup fundraising dips 23% to $853m in Jan but transaction volume rises

The prolonged funding winter continued to cast its shadow over startups in India as they raised a mere $853 million across 100 private equity and venture capital transactions in January, registering a drop of about 23% in value over the previous month, according to proprietary data compiled by DealStreetAsia.

At 100, however, the deal volume was up 32% over December when startups scooped up $1.1 billion through 76 transactions. Of the total deals, the value of seventeen transactions was not disclosed in January, the data showed.

On a year-on-year basis, the funding value was down 26% from $1.15 billion in January 2023. The deal volume, however, remained unchanged on a year-on-year comparison.

VC investments in India remained significantly subdued in 2023 amid an extended funding winter and macroeconomic uncertainties. For the whole of 2023, fundraising by startups shrunk by more than half to $11.8 billion from the previous year’s $26.6 billion. Deal volume was also down 40% from 1,562 transactions in 2022.

2024, too, started on a tepid note with investors continuing to take a guarded approach. Only one mega deal (worth at least $100 million) was closed in the month against two in December.

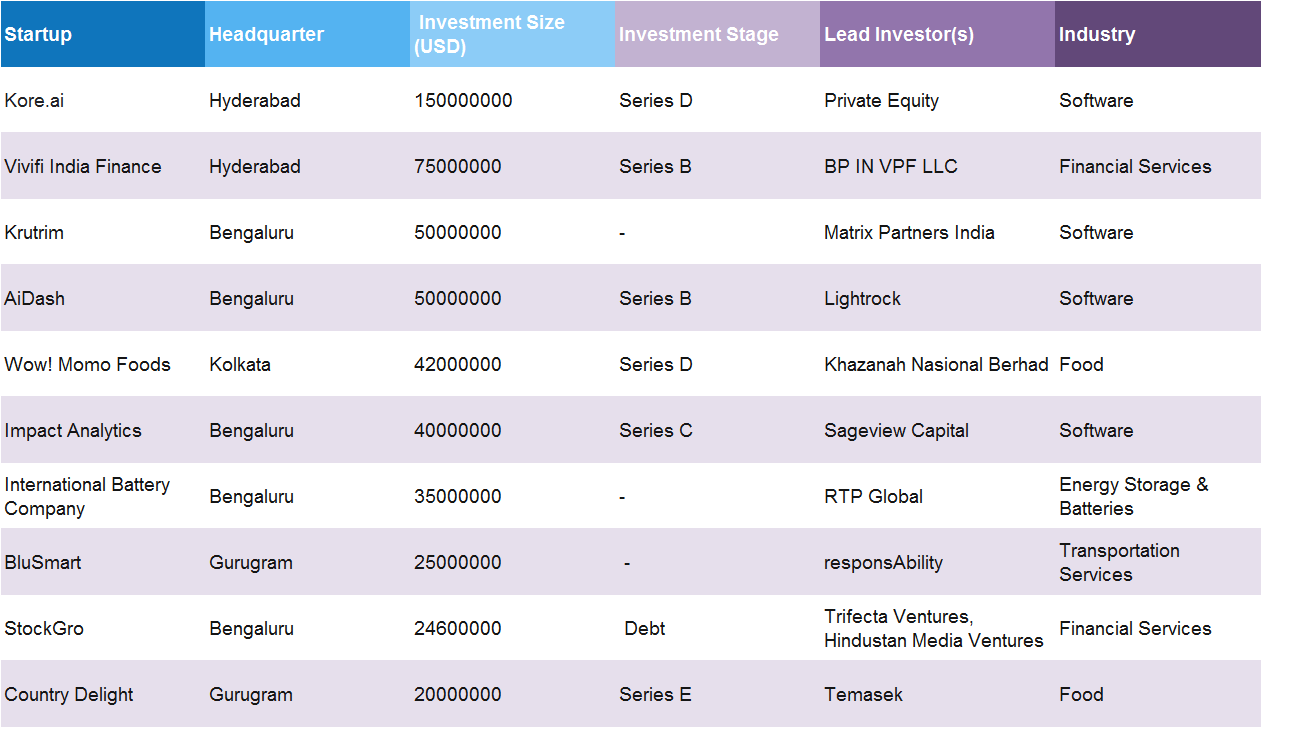

The mega deal was scored by enterprise conversational and generative AI platform Kore.ai, which raised $150 million led by FTV Capital along with participation from Nvidia and existing investors such as Vistara Growth, Sweetwater PE, NextEquity, Nicola and Beedie. Headquartered in Orlando, Kore.ai has a network of offices to support customers including in India, the UK, the Middle East, Japan, South Korea, and Europe. Its India unit, Koreai Software India Private Limited, is registered in Hyderabad.

Top 10 deals in January 2024

Other prominent deals sealed during the month include non-banking finance company Vivifi India Finance ($75 million), artificial intelligence startup Krutrim ($50 million), and enterprise SaaS company AiDash ($50 million).

Ola founder Bhavish Aggarwal’s artificial intelligence startup Krutrim SI Designs was the only startup to enter the unicorn club in January this year. Overall, only two startups – Zepto and InCred – bagged the unicorn tag in 2023.

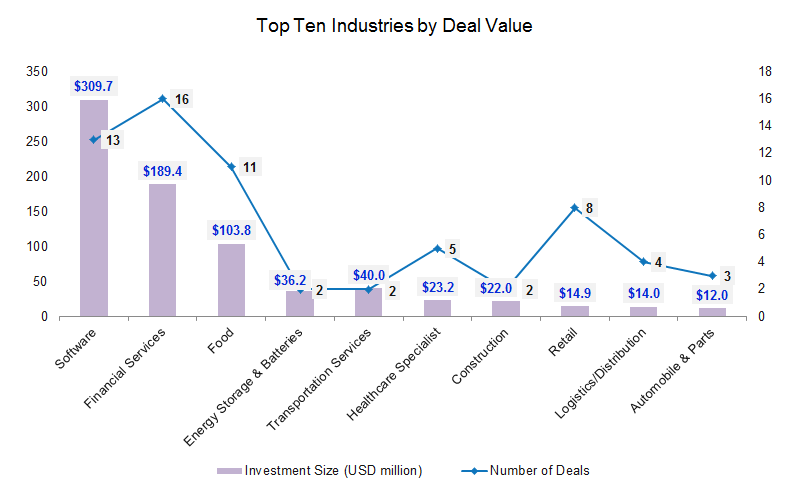

Software steals the show

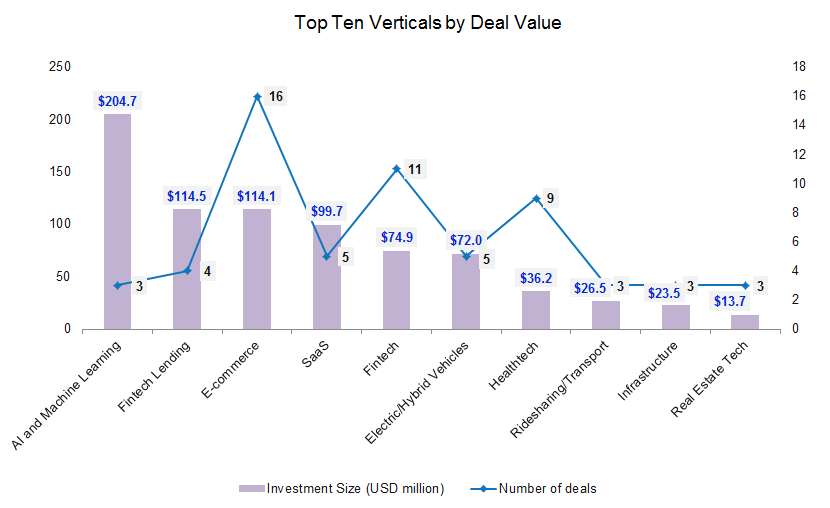

Led by Kore.ai, software emerged as the most-funded industry in January with a total of $310 million in investment across 13 transactions compared to $224 million across six deals in December. Krutrim ($50 million), AiDash ($50 million), and Impact Analytics ($40 million) were the other players in the sector to raise significant funding.

The financial services industry followed with $189.4 million in funding across 16 transactions. This is 75% higher than the $108 million garnered by financial services startups in December through 10 deals.

Within financial services, Vivifi India Finance closed the largest round of $75 million. Though the NBFC declined to name the investors, according to Registrar of Companies filings, the investing entity was BP IN VPF LLC. In the second biggest deal, social investment platform StockGro raised about $24.6 million in a debt round from Trifecta Ventures and Hindustan Media Ventures in two separate tranches.

Other deals within financial services include Namdev Finvest ($15 million), Varthana ($13.7 million), OneCard ($11.4 million), FinAGG ($11 million), Ecofy ($10.8 million) and Grip Invest ($10 million).

Food startups secured $103.8 million through 11 transactions. Wow! Momo Foods scored the largest round of $42 million from Khazanah Nasional Berhad, the sovereign wealth fund of Malaysia.

The top three industries –software, financial services and food – raised a total of $602 million, accounting for about 71% of the total funding raised in January.

Early-stage deals draw investors

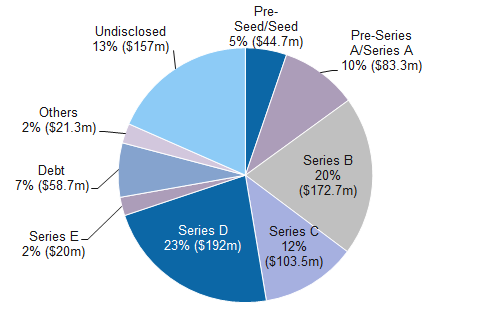

Fundraising by startups at pre-seed and seed stages increased to $44.7 million in January from $27.5 million in December. The volume also rose to 32 from 29 in the previous month.

P0 Security (6.5 million), PierSight ($6 million), Newme ($5.4 million), SalarySe ($5.2 million), RagaAI ($4.7 million), Electrifi Mobility ($3 million), Jeh Aerospace ($2.75 million), and Fixerra ($1.7 million) were among startups that raised seed rounds in the month.

Twenty-three startups raked in a total of $83.3 million in pre-Series A and Series A funding, which is way below the $141.4 million raised through 17 transactions in December. FinAGG Technologies, a fintech startup that provides working capital solutions to micro, small and medium enterprises, raised the largest Series A round of $11 million led by BlueOrchard and Tata Capital.

The share of growth-stage deals, defined as Series B or post-Series B rounds, dropped to 57% in total deal value in January from 75% in December. Growth-stage deals accumulated $488 million through 16 transactions in the month, down 41% from $829.6 million across 14 deals in December.

Startups that raised growth rounds in the month include Kore.ai (Series D), Vivifi India Finance (Series B), AiDash (Series B), Namdev Finvest (Series B), Impact Analytics (Series C), MakeO (Series C), Captain Fresh (Series C), Wow! Momo Foods (Series D), and Country Delight (Series E).

Most active investors

Early-stage angel investing platform Inflection Point Ventures emerged as the most active investor in January with a total of seven investments including social edutainment platform Maidaan, SaaS platform for hotels Bookingjini, engineering, procurement, and construction (EPC) company Vikran Engineering, SaaS-enabled marketplace startup GlamPlus, aerial logistics drone startup BonV Aero, co-living startup Settl, and insurtech startup Bharatsure.

Early-stage investor We Founder Circle (WFC), along with its accelerator platform EvolveX, and Fireside Ventures made four investments each. While EvolveX made just one investment in Maidaan, We Founder Circle invested in Maidaan, Settl and Bharatsure. Meanwhile, Fireside’s investments include Wholsum Foods (Slurrp Farm), Amaha, Newme, and The Baker’s Dozen. Matrix Partners India, Anicut Capital, and Trifecta Capital occupied the third spot with three investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startup funding plunges almost 40% YoY in Jan as investors brace for tough 2024

Startup financing in Greater China marked a 38.8% year-over-year (YoY) decline in January as geopolitical risks and macro risks continue to stifle the venture capital market.

Venture Capital

SE Asia Deals Barometer Report: In ominous start to the year, startup funding plunges 78% in Jan Edit

Southeast Asian startup funding plummeted to a 12-month low in January, marking a cautious start to the new year.