India Deal Review: Startup fundraising increases a tad to touch $876m in Feb

Fundraising by Indian startups rose marginally to touch $876 million across 106 private equity and venture capital transactions in February from $853 million in January, according to proprietary data compiled by DealStreetAsia.

At 106, the deal volume was up almost 6% from 100 in the previous month. Of the total deals in February, the value of nine transactions was not disclosed, the data showed.

Both the deal value and volume were also up compared to the same period a year ago when startups had scooped up $866 million across 76 transactions.

Fundraising has mostly been on a downward trajectory since the second half of 2022. As funding remained tepid in 2023, startups shifted their focus from aggressive growth strategies to strengthening unit economics, cash conservation, sustainable growth, and corporate governance. A revival in funding is expected later this year, with Series B onward developments stimulating increased engagement at earlier stages.

Only one megadeal, or deal worth at least $100 million, was announced in the month as investors continue to refrain from making big bets. In comparison, three megadeals were announced in the comparable period last year.

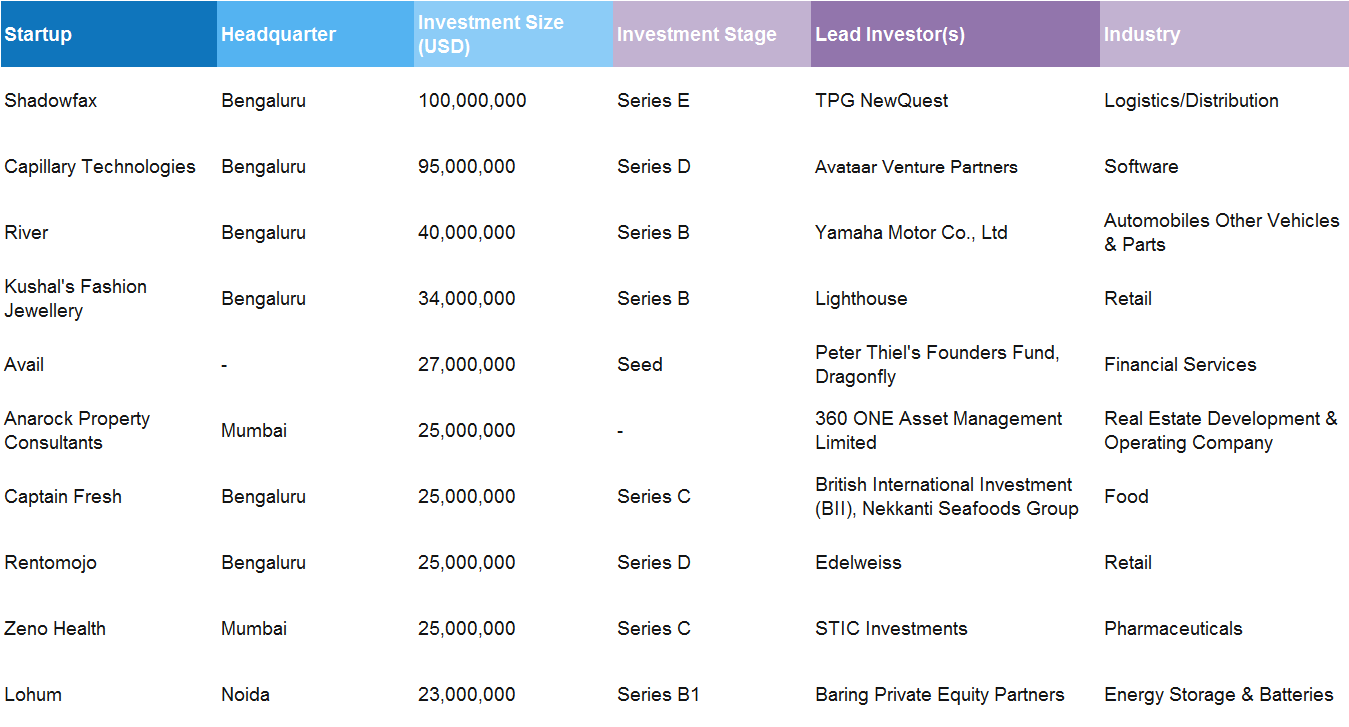

Top 10 deals in February 2024

The largest round of $100 million was raised by new-age logistics service provider Shawdowfax towards its Series E round, led by TPG NewQuest. Existing investors Mirae Asset Venture Investments (India), Flipkart, International Finance Corporation, Nokia Growth Partners, Qualcomm, and Trifecta Capital also participated.

Among other prominent deals in the month were customer engagement software provider Capillary Technologies ($95 million), electric vehicle startup River ($40 million), Kushal’s Fashion Jewellery ($34 million), and blockchain startup Avail ($27 million).

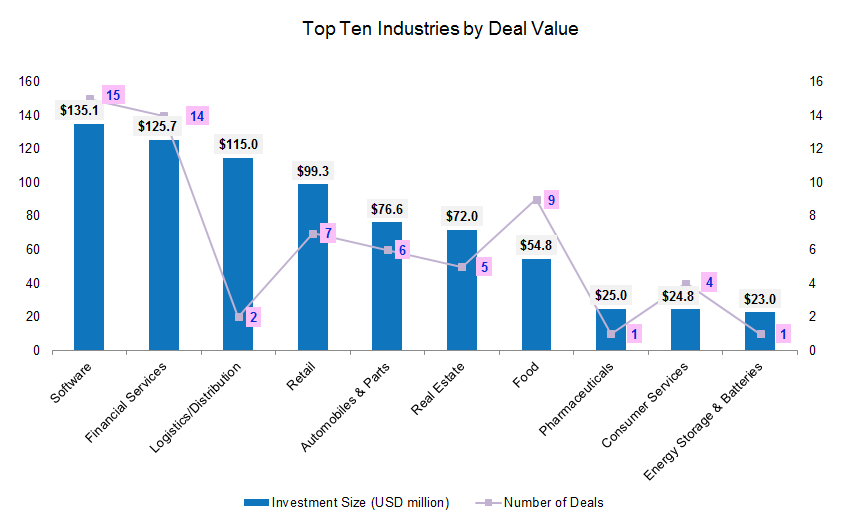

Software continues to shine

Software continued to remain the most funded industry in February with a total funding of $135 million across 15 deals. Within software, Capillary Technologies raised the largest round of $95 million in an extended Series D round to provide exits to existing investors and employees. Other deals included Interview Kickstart ($10 million), Scrut Automation ($9 million), Attentive Inc ($7 million), and Crux ($2.6 million).

Financial services followed with $125.7-million funding through 14 deals led by blockchain technology startup Avail’s $27-million round. Investment in Avail was led by Peter Thiel’s Founders Fund and crypto investment firm Dragonfly Capital.

Other prominent deals within financial services included Mswipe Technologies (20 million), Mufin Green Finance ($17 million), Moove ($10 million), OTO ($10 million), and Vidyut ($10 million).

Buoyed by Shadowfax, the logistics and distribution industry occupied the third spot with $115-million funding across a mere two deals. The other deal was Metalbook, a platform for the global metals supply chain, that raised $15 million in its Series A funding round led by Rigel Capital, with participation from FJ Labs as well as existing investors, Axilor Ventures, Foundamental, Stride Ventures, Trifecta Capital, and others.

Together the top three industries — software, financial services, and logistics and distribution — raised a total of $375.8 million, accounting for about 43% of the total value in February.

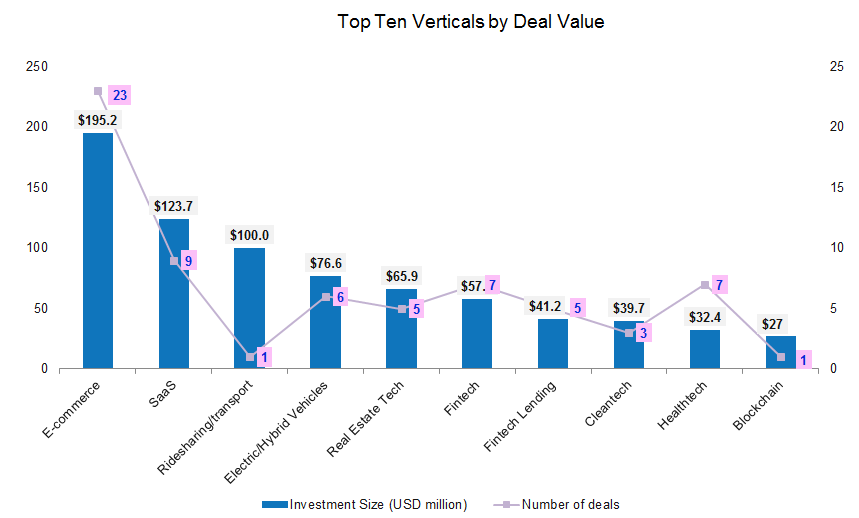

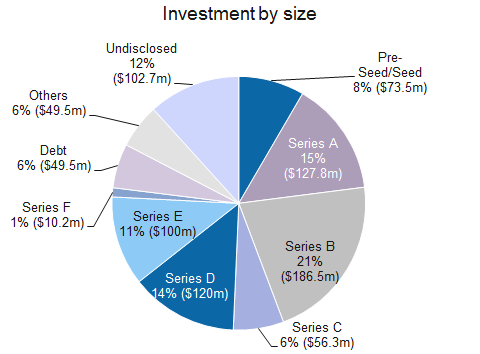

Early-stage deals steal the show

The value of pre-seed and seed stage deals increased 64% to $73.5 million across 30 transactions from $44.7 million across 32 transactions in January. Avail ($27 million), Pratech Brands ($6.3 million), Veera ($6 million), Khyaal ($4.2 million), upliance.ai ($4 million), ControlZ ($3 million), Crux ($2.6 million) were among those that raised seed rounds during the month.

Pre-Series A and Series A stage deals also surged to $136.6 million across 27 deals in February from $83.3 million across 23 deals in January. AstroTalk raised the largest Series A round worth $20 million from New York-based venture capital firm Left Lane Capital.

Funding in growth-stage startups saw an uptick in the month with investors pumping a total of $473 million in 16 companies between the Series B and F stages.

Startups that raised growth rounds in March included Cult.fit ($10.2 million Series F), Shadowfax ($100 million Series E), Capillary Technologies ($95 million Series D), Rentomojo ($25 million Series D), Captain Fresh ($25 million Series C), Zeno Health ($25 million Series C), River ($40 million Series B), Kushal’s Fashion Jewellery ($34 million Series B), Lohum ($23 million Series B), and Walko Food Company ($20 million Series B).

There were eight debt deals worth $49.5 million in February as against $58.7 million across five deals in January.

Most active investors

Venture investing platform Venture Catalysts, along with its accelerator fund 9Unicorns, emerged as the most active investor with six investments in total. These included hyperlocal content-driven commerce platform Knocksense, premium renewed smartphones brand ControlZ, proptech firm Bandhoo, two-wheeler-focused lending firm OTO, and healthtech platform Neodocs.

Fireside Ventures and Stride Ventures followed with four investments each. Fireside co-led investments in Dev Milk Foods (Frubon), iluvia (Renaura Wellness ), and Happi Planet, while Stride Ventures led funding in Pratech Brands and Moove.

Meanwhile, venture capital firms Antler, Blume Ventures, Indian Angel Network, Peak XV Partners, along with Surge, and SIDBI Venture Capital made three investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Venture fundraising hits nine-month low of $2.9b in Feb

Privately-held firms headquartered in mainland China, Hong Kong, Macau, and Taiwan raised a meagre $2.9 billion from venture investors in February. The fundraising value, down 12.5% month-on-month (MoM), was the lowest since May 2023.

Venture Capital

SE Asia Deals Barometer Report: Funding stays subdued at $388m in Feb amid megadeal drought

Southeast Asian startups did not see any letup in the subdued funding environment in February as total funding remained suppressed at $388 million, according to proprietary data collated by DealStreetAsia.