India Deals Barometer Report: Startup fundraising drops 18% sequentially to $3.64b in Feb

After an impressive start in January, startup fundraising in India tapered nearly 18% in value in February to touch $3.64 billion compared to $4.44 billion across 199 transactions in the previous month, according to proprietary data compiled by DealStreetAsia.

However, the deal value registered a three-fold jump compared to the corresponding period last year when startups raised a sum of $1.3 billion across 75 deals.

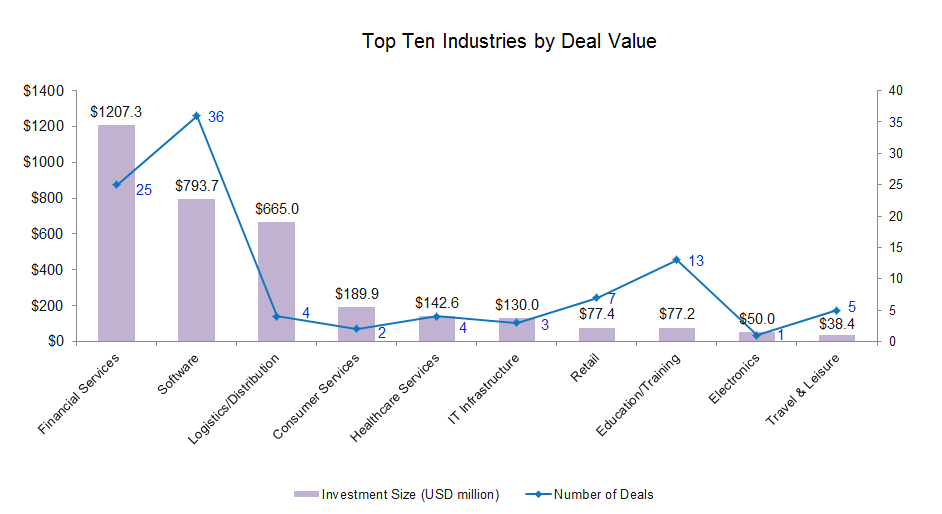

In terms of deal volume, there were 156 private equity and venture capital transactions in February this year led by financial services and software startups.

Of the total transactions in February, the value of as many 21 transactions was not disclosed.

There were at least 11 mega deals (worth $100m and above) in February, accounting for about 70% of the total deal value.

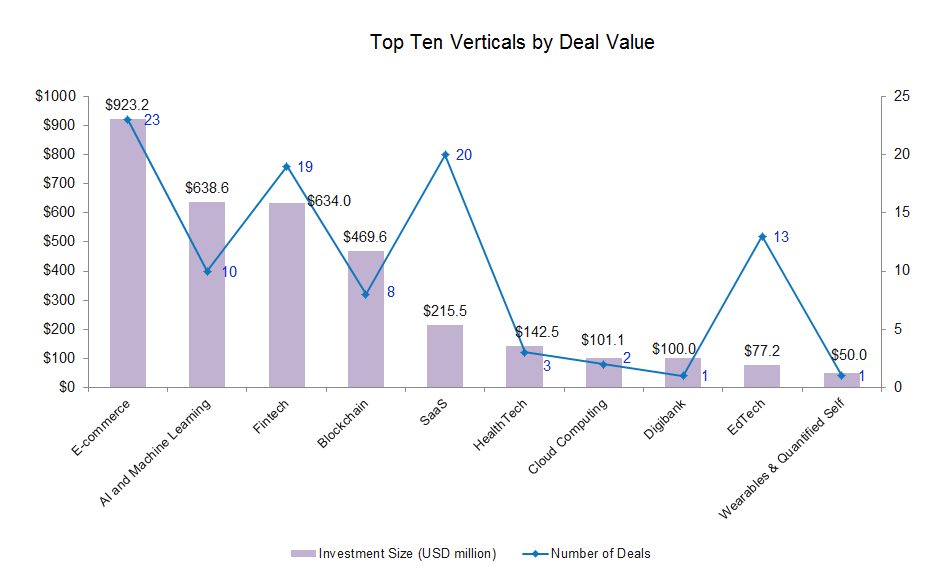

Polygon, a decentralized scaling platform for the ethereum blockchain, raised the largest round worth $450 million led by Sequoia Capital India, with participation from over 40 major venture capital firms, including SoftBank Vision Fund 2, Galaxy Digital, Galaxy Interactive, Tiger Global, Republic Capital.

India also produced at least five unicorns (startups valued at $1 billion and above) in the month as against four in the previous month. These include logistics and distribution platform ElasticRun, e-commerce logistics company XpressBees, home renovation and interiors platform Livspace, conversational automation platform Uniphore, and software startup Hasura.

Deals worth over $100m in Jan

| Startup | Headquarter | Investment Size (USD) | Investment Stage | Lead Investor(s) | Industry | Verticals |

|---|---|---|---|---|---|---|

| Polygon | Bengaluru | 450,000,000 | Undisclosed | Sequoia Capital India | Financial Services | Blockchain |

| Uniphore | Chennai | 400,000,000 | Series E | NEA | Software | AI and Machine Learning |

| ElasticRun | Pune | 300,000,000 | Series E | SoftBank Group | Logistics/Distribution | E-commerce |

| Xpressbees | Pune | 300,000,000 | Series F | Blackstone Growth, TPG Growth, ChrysCapital | Logistics/Distribution | E-commerce |

| Chargebee | Chennai | 250,000,000 | Series H | Tiger Global, Sequoia Global | Financial Services | Fintech |

| Glance | Bengaluru | 200,000,000 | Series D | Jio Platforms | Software | AI and Machine Learning |

| LivSpace | Bengaluru | 180,000,000 | Series F | KKR | Consumer Services | E-commerce |

| Pine Labs | Noida | 150,000,000 | Series L | Alpha Wave Global | Financial Services | Fintech |

| MediBuddy | Bengaluru | 125,000,000 | Series C | Quadria Capital, Lightrock India | Healthcare Services | HealthTech |

| Niyo | Bengaluru | 100,000,000 | series C | Accel, Lightrock India | Financial Services | Digibank |

| Hasura | Bengaluru | 100,000,000 | Series C | Greenoaks | IT Infrastructure | Cloud Computing |

Financial services continue to shine, software picks up too

Financial services startups led funding in February by collectively mopping up $1.2 billion across 25 transactions as against $567 million across 37 transactions last month. While Polygon raised the largest round, others including Chargebee, Pine Labs, and Niyo also clinched mega deals in the month.

Chargebee, an enterprise-focused subscription management platform, raised $250 million co-led by Tiger Global and Sequoia Capital at a valuation of $3.5 billion. Meanwhile, Pine Labs raised $150 million in a mix of primary and secondary funding from Alpha Wave Global and neobanking platform Niyo raised a $100-million round led by Accel and Lightrock India.

Software was the second most funded sector accounting for $793.7 million across 36 transactions. In comparison, software startups had raised $425.3 million across 34 transactions in January.

Among top deals, Uniphore raised $400 million in a round led by NEA, March Capital and other existing investors along with new entities, at a valuation of $2.5 billion.

Logistics and distribution followed software with $665 million in funding across four deals. ElasticRun ($300 million) and Xpressbees ($300 million) were two big transactions within logistics.

The top three sectors – financial services, software and logistics and distribution – garnered a total of $2.7 billion, accounting for about 74% of the total deal value in the month.

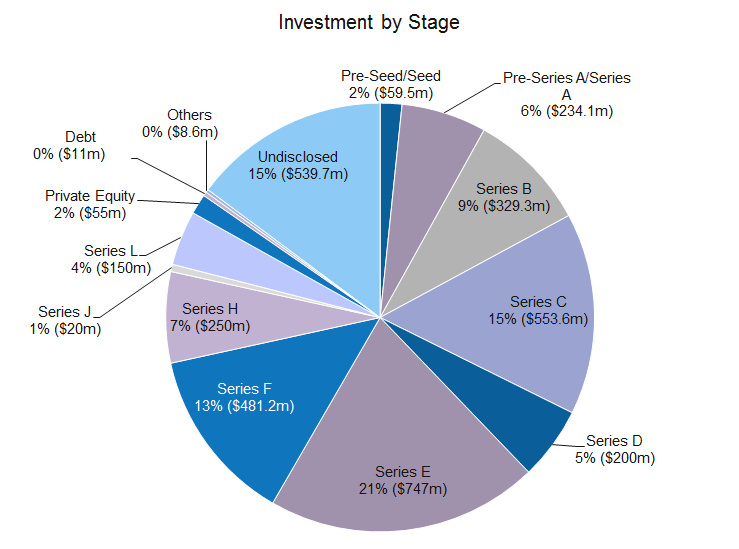

Growth-stage deals dominate pie

Growth-stage deals saw a marginal improvement in terms of value. Companies in Series B or post-Series B rounds collected an aggregate of $2.73 billion across 35 transactions in February as against $2.5 billion across 29 transactions in January.

The value of pre-seed and seed funding deals dropped substantially to $59.5 million from $113 million in January. In terms of deal count, too, February lagged behind January with just 47 pre-seed and seed deals compared to 71 in the previous month.

Invact Metaversity, Testsigma, Bullieverse, Peakperformer, Pillow Digital Technologies, Scrut Automation, OneTo11, RetainIQ, Data Sutram were some of the seed stage deals recorded during the month.

Startups in pre-Series A and Series A stages collectively garnered $234.1 million through 42 transactions, which is a drop of about 45% in value over January when $426.4 million was raised across 51 transactions.

There were about 3 debt deals worth $11 million, while two PE deals worth $55 million were closed in February.

Most active investors

Sequoia India, along with its startup accelerator programme Surge, emerged as the most active investor in February with a total of nine investments. The venture capital firm led investments for six startups, including Chargebee, edtech platform Scaler Academy, Polygon, coaching platform for managers Peakperformer, healthtech startup Kenko Health, and SaaS startup BiteSpeed.

Sequoia Capital India is reportedly looking to raise its largest, $2.8 billion fund that will focus on India and Southeast Asia. Sequoia closed its sixth India fund at $695 million in August 2018. Separately, the firm raised $200-million under its Surge programme, which invests in seed-stage startups based in India and Southeast Asia.

Accel, which invests in internet technology and software development industries, made a total of eight investments. These included Niyo, Spacejoy, RetainIQ, Testsigma, Sprinto, Airmeet, Facilio, and SuperShare.

Tiger Global Management, which has been actively investing in India for the past few years, occupied the third spot with six investments. Lighrock India and Venture Catalysts, along with its accelerator fund 9Unicorns, made five investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Slowdown continues in Feb, but interest in chip investments sustains

Greater China saw another month of market slowdown as private equity (PE) and venture capital (VC)...

Venture Capital

SE Asia Deals Barometer Report: Big-ticket transactions push up startup funding to nearly $2b in Feb

Southeast Asian startups raised at least $1.96 billion in private equity and venture capital transactions...