India Deal Review: Startup fundraising springs back in December to touch $1.1b

After a mostly gloomy 2023, Indian startups ended the year on a high note as private equity and venture capital investments more than doubled to $1.1 billion in December from $483.6 million in November, according to proprietary data compiled by DealStreetAsia.

At 76, the deal volume in December, however, remained unchanged from the previous month. Of these, the value of as many as 10 deals was not disclosed, the data showed.

On a year-on-year basis, the deal value was down 12% from $1.25 billion in the corresponding period of 2022, while deal volume dropped by a quarter from 102 in December 2022.

VC investments in India remained significantly subdued in 2023 as domestic and global investors refrained from allocating capital amid an extended funding crunch and uncertain market conditions. After a dull start, funding peaked in May when startups scooped up $1.55 billion across 89 transactions. However, fundraising stayed below the $1-billion mark until August and started to recover only from September.

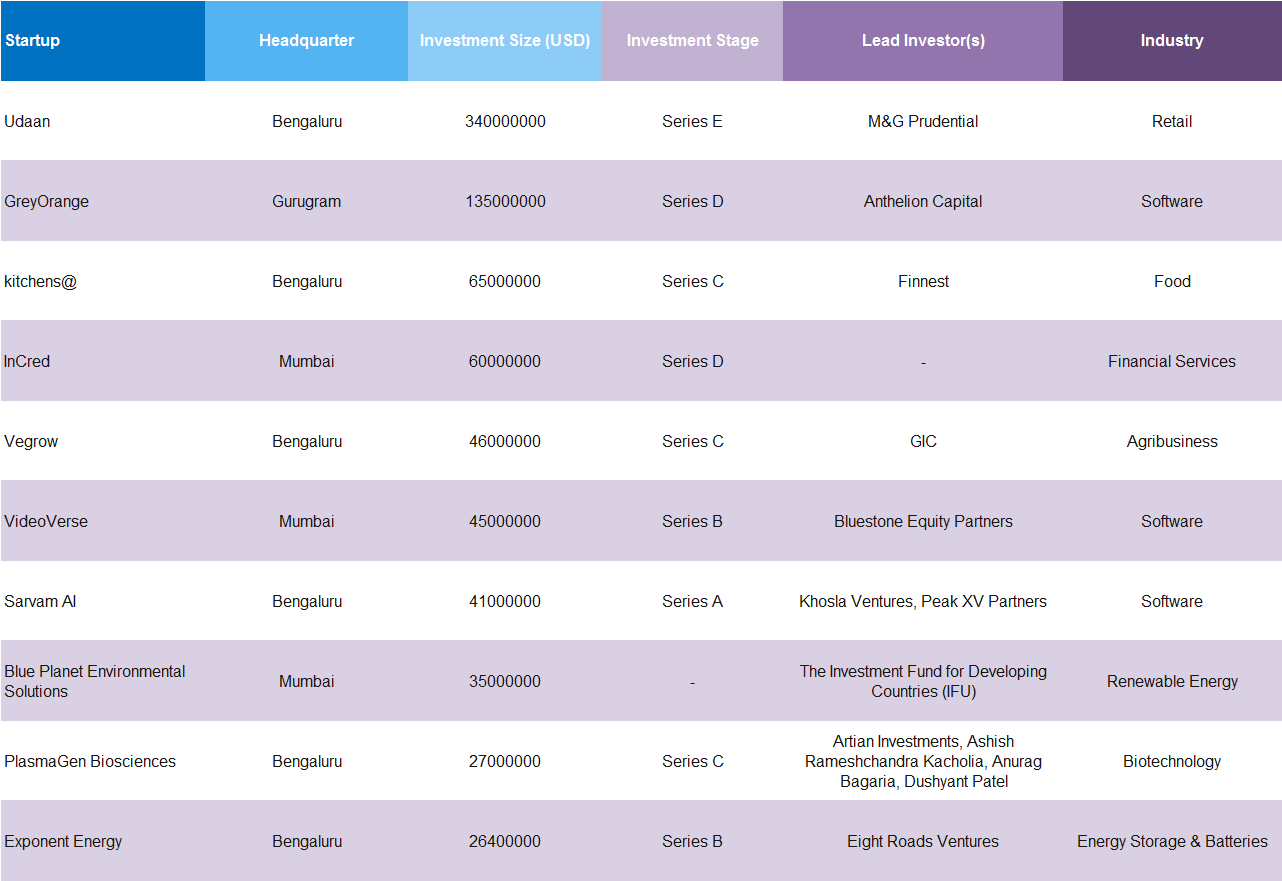

In terms of megadeals, only two transactions worth $100 million and above were sealed during the month as against none in November. These include Udaan’s $340-million Series E funding round led by M&G Prudential and GreyOrange’s $135-million financing led by Anthelion Capital.

Top 10 deals in December 2023

Source: DealStreetAsia

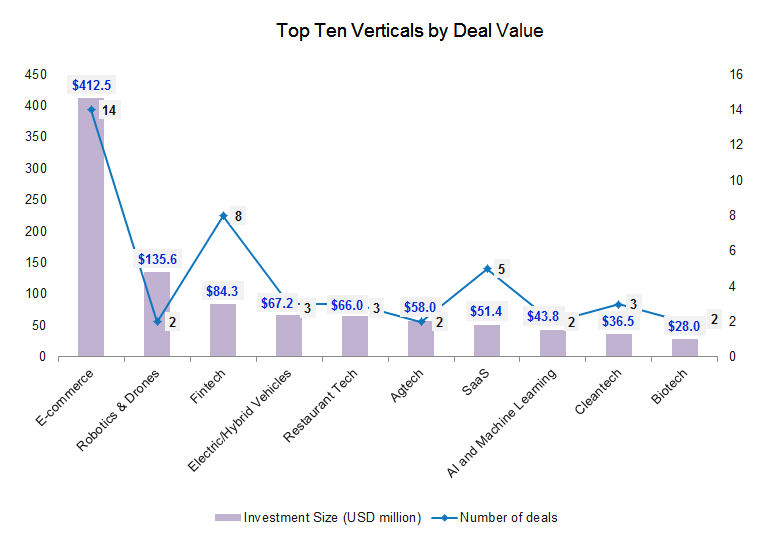

Source: DealStreetAsia

Other big transactions closed during the month include cloud kitchen startup kitchens@ ($65 million), non-banking finance company InCred ($60 million), B2B fruits marketplace Vegrow ($46 million), video-editing SaaS platform VideoVerse ($45 million), and generative artificial intelligence startup Sarvam AI ($41 million).

No startup entered the unicorn club in the month. Overall, only two startups bagged the unicorn tag in 2023, including Zepto and InCred Finance, as many late-stage startups were unable to raise money owing to unfavourable market conditions. In contrast, 24 startups with a combined valuation of $50 billion entered the unicorn club in 2022.

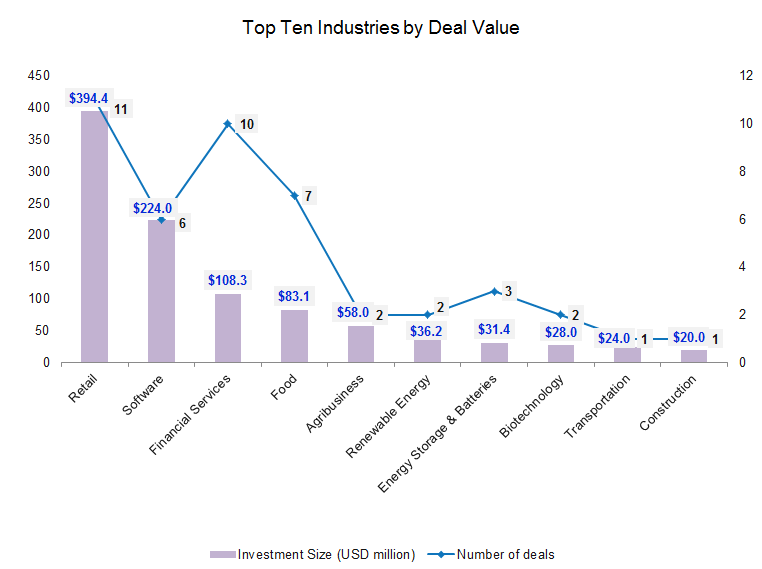

Retail tops the charts

Retail surpassed software and financial services to emerge as the most funded industry in December with total funding worth $394.4 million across 11 transactions. In comparison, six retail startups together raised a mere $15.2 million in November.

Within retail, business-to-business (B2B) e-commerce startup Udaan raised the largest round of $340 million led by UK savings and investment firm M&G Prudential. The round also saw participation from existing investors, including Lightspeed Venture Partners and DST Global.

Other prominent deals within retail include direct-to-consumer mattress maker The Sleep Company ($22 million), omnichannel fashion brand Snitch ($13 million), and sportswear and athleisure products platform Agilitas Sports ($12 million).

Software startups followed with a total $224-million funding across six deals in December as against $26 million in the previous month. GreyOrange’s $135-million round, led by Anthelion Capital, marked the biggest deal within software. VideoVerse ($45 million) and Sarvam AI ($41 million) were the other two big transactions within the industry.

The financial services industry followed with a total of $108.3 million across 10 deals. InCred raised the largest round worth $60 million within financial services, followed by RevFin ($14 million) PhiCommerce ($10 million), Ashv Finance ($10 million), and Digivriddhi Technologies ($6 million).

Several factors, including COVID-induced digitalisation, growth of digital infrastructure, rise in disposable income, and ease of online payments, among others, had shored up the demand for fintech startups in the past months.

Together, the top three industries – retail, software and financial services – raised a total of $726.8 million, accounting for about 66% of the total funding raised in December.

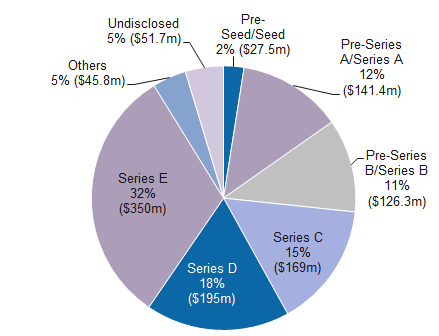

Growth-stage deals grab lion’s share

Growth-stage deals, defined as Series B or post-Series B rounds, accumulated $829.6 million across 14 deals, accounting for 75% of the deal value in the month. In comparison, 10 growth transactions together raised $270 million in November, accounting for 39.4% of the total deal value.

Udaan (Series E), Ashv Finance (Series E), Grey Orange (Series D), InCred (Series D), kitchens@ (Series C), Vegrow (Series C), PlasmaGen Biosciences (Series C), The Sleep Company (Series C), VideoVerse (Series B), Exponent Energy (Series B), and RDC Concrete (Series B) were among the startups that raised growth rounds in the month.

Fundraising by startups at pre-seed and seed stages halved to $27.5 million in December from $59.9 million in November. The volume was, however, up to 29 from 26 in the previous month. In the largest seed round, speciality chemicals sourcing and manufacturing platform Scimplifi raised $3.7 million from institutional investors 3one4 Capital and Beenext.

Other seed rounds during the month were closed by Oxyzen Express ($3 million), Finhaat ($3 million), LivNSense ($2.75 million), ShipGlobal ($2.5 million), Absolute Brands And Retail ($2.5 million), Entitled Solutions ($1.3 million), and Digital Paani ($1.2 million).

Startups at pre-Series A and Series A stages secured a total of $141.4 million through 17 transactions in December as against $129.7 million across 22 transactions in November. Sarvam AI raised the largest Series A round worth $41 million, followed by CoreEL Technologies ($16 million), Snitch ($13 million), and Fasal ($12 million).

Most active investors

Early-stage investor We Founder Circle (WFC), along with its accelerator platform EvolveX, was the most active investor in December with a total of six investments. EvolveX led funding in three startups including Ugees, TestnTrack, and Scandalous Food.

Launched in 2022, EvolveX has completed two cohorts, mentoring and funding at least 14 startups.

Venture capital firm 100X.VC, InfoEdge Ventures, Lightspeed Venture Partners, and Omnivore made at least three investments each. Other prominent investors in the month include BEENEXT, 3one4 Capital, Eight Roads Ventures, JITO Angel Fund, Fireside Ventures, and Matrix Partners India, among others.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Dec was the second best month for PE-VC dealmaking in 2023

Investors in Greater China-based startups made a dealmaking sprint in December as a total of 248 deals were sealed in the last month of 2023, up 13.2% from November. The deal count was the second highest in the year after August when 257 deals were sealed.

Venture Capital

SE Asia Deals Barometer Report: Startup funding hits five-month high of $1.16b in Dec

Startup fundraising in Southeast Asia ended 2023 on a positive note as privately-held companies in the region managed to scoop up $1.16 billion in funding in December, a five-month high.