India Deals Barometer Report: At $2.9b in April, startup funding lowest so far this year

Fundraising by Indian startups stood at $2.9 billion across 129 transactions in April, the lowest in a month so far this year, according to proprietary data compiled by DealStreetAsia.

Also, this is the first time in many months that India did not see any startup enter the unicorn club, a term used to describe privately held companies valued at atleast $1 billion.

The funding in April dropped about 27.5% over March, when startups had collectively mopped up $4 billion across 163 venture capital and private equity transactions. The total amount raised in January and February stood at $4.44 billion and $3.64 billion, respectively.

The deal value of 14 transactions was not disclosed during April.

There were at least eight mega-deals worth $1.82 billion in the month, accounting for about 62% of the total deal value. The biggest round of $805 million was raised by VerSe Innovation, the parent company of vernacular news aggregator Dailyhunt and maker of short video entertainment app Josh. The funding saw participation from investors such as Canada Pension Plan Investment Board (CPP Investments), Ontario Teachers’ Pension Plan Board (Ontario Teachers’), Luxor Capital, Sumeru Ventures, Sofina Group, Baillie Gifford and others.

Deals worth over $100m in April

| Startup | Headquarter | Investment Size (USD) | Investment Stage | Lead Investor(s) | Industry | Verticals |

|---|---|---|---|---|---|---|

| VerSe Innovation (Dailyhunt) | Bengaluru | 805,000,000 | Series J | Canada Pension Plan Investment Board (CPP Investments), Ontario Teachers’ Pension Plan Board, Luxor Capital, Sumeru Ventures | Media | Digital Media |

| Instoried | Bengaluru | 200,000,000 | Series B | GEM Global Yield LLC SCS | Software | AI and Machine Learning |

| Rapido | Bengaluru | 180,000,000 | Series D | Swiggy | Transportation Services | Ridesharing/Transport |

| CoinDCX | Mumbai | 135,000,000 | Series D | Pantera, Steadview | Financial Services | Blockchain |

| The Isprava Group | Mumbai | 130,000,000 | Undisclosed | the Nadir Godrej Family Office, the Burman Family Office | Real Estate Development & Operating Company | Real Estate Tech |

| Observe.ai | Bengaluru | 125,000,000 | Series C | SoftBank Vision Fund 2 | Software | SaaS |

| Rario | Gurugram | 120,000,000 | Series A | Dream Capital | Software | Blockchain |

| Turtlemint | Mumbai | 120,000,000 | Series E | Amansa Capital, Jungle Ventures, Nexus Venture Partners | Insurance | Insuretech |

Other startups that secured $100-million plus financing included artificial intelligence-based content startup Instoried, crypto exchange CoinDCX, bike taxi platform Rapido, luxury homes developer The Isprava Group, intelligent Workforce platform Observe.ai, cricket-focused non-fungible token (NFT) startup Rario and insurance technology platform Turtlemint.

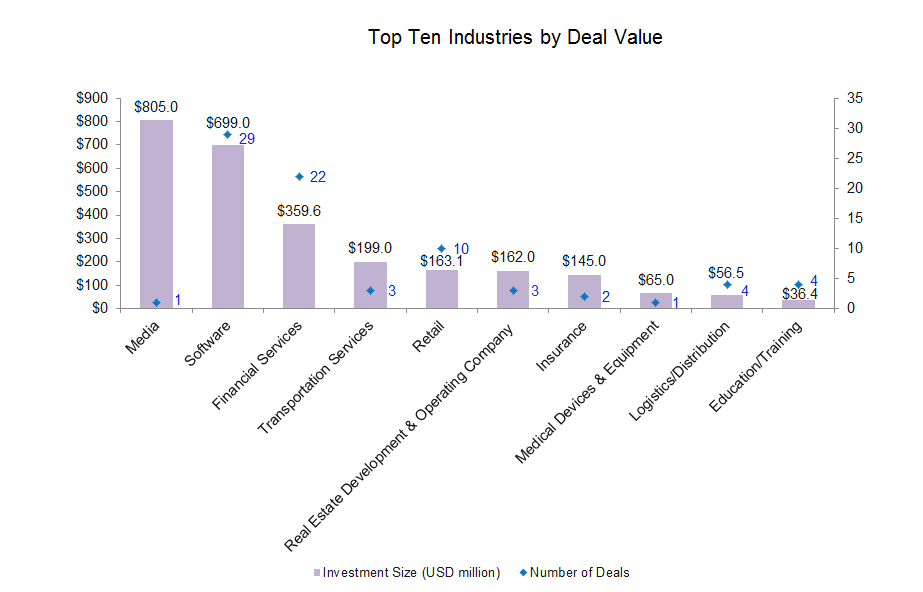

Media, software startups top funding

A single deal — VerSe Innovation — pushed the media industry to the top of the charts with a total of $805 million in its kitty. The total capital raised by the startup in the past year stood at $1.5 billion.

Software startups followed with a total of $699 million across 29 transactions. Instoried, Observe.ai and Rario were the top scorers, with Instoried receiving a capital commitment worth $200 million from US-based investment group GEM. Observe.ai raised $125 million in a new round of funding led by Softbank Vision Fund 2 that also saw participation from video conferencing platform Zoom while Rario secured $120 million funding from Dream Capital.

Financial services emerged as the third most-funded industry, raking in $359.6 million across 22 transactions. The top three industries – media, software and financial services – collectively garnered $1.86 billion, accounting for 63% of the total deal value.

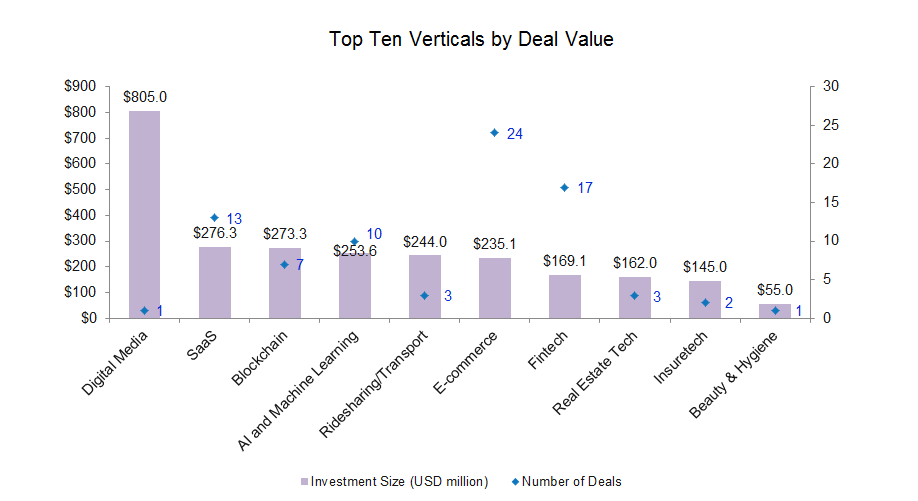

Within verticals, digital media, software-as-a-service (SaaS) and blockchain were the top scorers, accounting for 46% of the total deal value, or $1.35 billion.

Growth-stage deals account for the bulk value

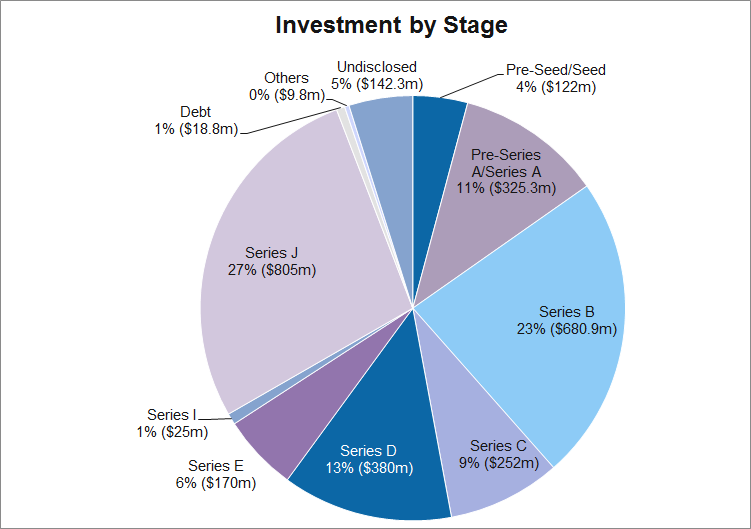

Companies in Series B or post-Series B rounds collected an aggregate of $2.3 billion across 34 transactions in April as against $2.7 billion through 35 investments in March. Startups that raised big growth rounds in the month included VerSe Innovation, Kinara Capital, CoinDCX, Turtlemint, Observe.ai, Believe and Rapido, among others.

Deal volumes were led by early-stage transactions in April. There were a total of 39 pre-seed and seed deals worth $122 million in the month as against 52 deals worth $73.5 million in March. Startups in pre-Series A and Series A stages mopped up about $325.3 million across 32 transactions as against $654 million across 43 transactions in the previous month.

There were about five debt deals worth $18.8 million as against 10 worth $446 million in March.

Most active investors

Sequoia India, along with its startup accelerator programme Surge, and early and growth-stage venture capital firm Accel were the most active investors in April with seven investments each. Sequoia led the funding for startups including live video and audio platform Dyte, software reliability platform Last9, fintech startup Hubble, restaurant management startup UrbanPiper, Pratech Brands and Rigi. Meanwhile, Accel was the lead investor in Spyne, Rigi, DSLR Technologies and Finbots.AI.

New York-based investment firm Tiger Global occupied the second spot with a total of six investments. It led the rounds for Cogoport, Itilite, Securden, UrbanPiper and Geniemode.

Alpha Wave Global, Venture Catalyst and its early-stage startup fund 9Unicorns, and WestBridge Capital made five investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startup funding value drops 42% to $2.7b in April

Greater China clocked a busy month of dealmaking in April with the completion of 170 venture deals...

Venture Capital

SE Asia Deals Barometer Report: Startup funding at four-month high of $2b in April

Venture capital (VC) and private equity (PE) funding in Southeast Asia rebounded in April...