China Deals Barometer Report: Startup funding slides in Sept to $7.2b, deal volume slips too

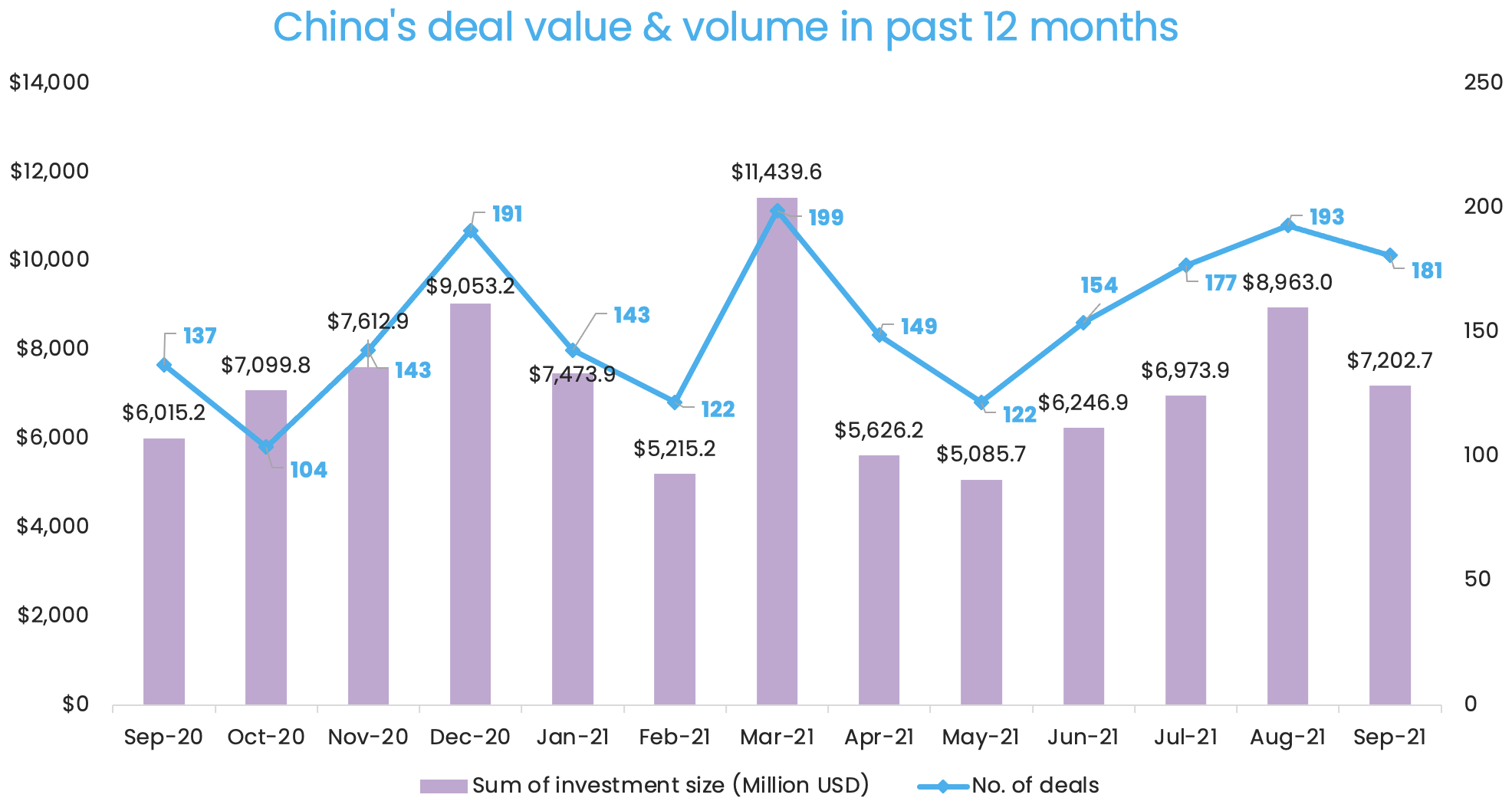

After three consecutive months of growth in dealmaking activity, financing into privately-held companies in Greater China cooled off in September with transaction value and volume recording a decline from the month of August.

Chinese firms raised a total of $7.2 billion, recording a 19.6% month-on-month fall from nearly $9 billion in August. September saw the deal tally touch 181 transactions, 6.2% lower than the 193 deals in the previous month this year, according to proprietary data compiled by DealStreetAsia.

However, the September numbers marked a significant growth when compared to the corresponding period last year. The monthly deal count was 32.1% more than September 2020, while deal value increased by 19.7% year-over-year.

In the month’s biggest funding round, Caocao Mobility, a ride-hailing business launched in 2015 by Chinese automaker Geely, raised 3.8 billion yuan (about $600 million). Didi Global rival Caocao pocketed the fresh capital at a time when the counterpart faces a cybersecurity investigation by Chinese authorities over concerns of its possession of a wide swathe of user data shortly after its New York listing on June 30.

FerroTec, which manufactures semiconductor wafers, secured another big-ticket investment at 3.3 billion yuan ($511 million) with backing from state-owned investors in China. China’s State Development & Investment Corp (SDIC), China SME Development Fund, and others invested in the round as Beijing aims for global dominance in chip design and manufacture.

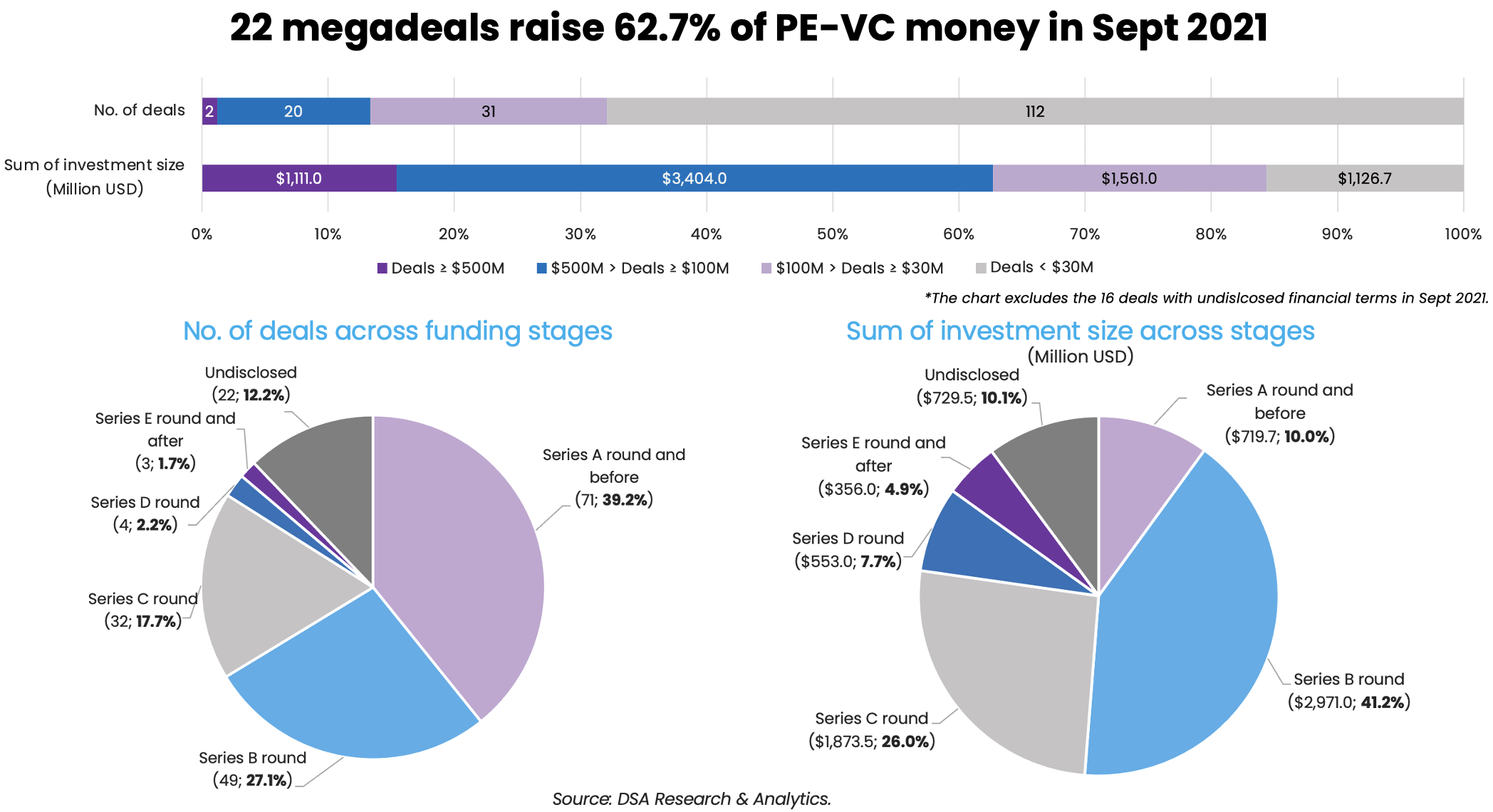

22 megadeals raise 62.7% of capital

Megadeals, or investments worth $100 million or more, contributed to the bulk of financing in the month. At over $4.5 billion, the combined value of 22 megadeals in September was lower than the value of 27 megadeals in August, which crossed $6 billion.

Even so, the size of megadeals was still prominent in the month, since 22 out of 181 deals, or 12.2% of all transactions, captured 62.7% of capital in the market.

Besides the two $500 million-plus investments in Caocao and FerroTec, there were 20 transactions in the range of $100-500 million. The biggest among them was an Alibaba-led, over-$300-million Series B round in self-driving technology developer DeepRoute.ai, and a $300-million investment that US automaker General Motors made into another self-driving firm Momenta, as investors spot great potential in the world’s largest auto market.

Other megadeals were raised by companies including COWAROBOT, which offers self-driving technology and solutions; Aulton New Energy, an operator of charging stations for electric vehicles (EVs); and SoftBank-backed robotics firm Agile Robots, whose $220-million round valued it at over $1 billion.

Startups at earlier funding stages were more popular than their growth- and later-stage peers in terms of deal count. Investors’ appetite for emerging businesses in Greater China retained, with 71 deals, or 39.2% of the month’s total deal count, being made at the Series A stage and before.

Deal count at the Series B stage followed with 49 deals. Less than one-quarter of deals was completed at the growth- and late-stage with 32 Series C deals, four Series D deals, and three deals at Series E stage and after.

Investors made bold bets on the Series B stage since this funding stage booked capital inflows of almost $3 billion, representing 41.2% of the total financing in the month. The month’s three biggest bets on Caocao, FerroTec, and DeepRoute.ai were all closed at the Series B stage.

The aggregate deal value at the Series C stage came second, accounting for about $1.9 billion, followed by that of the Series A stage and earlier, Series D, and Series E and beyond, respectively.

List of 22 megadeals in Sept 2021

| Startup | Headquarters | Investment size (USD) | Investment stage | Lead investor(s) | Other investor(s) | Industry | Vertical |

|---|---|---|---|---|---|---|---|

| Caocao Mobility | Hangzhou | $600 million | B | Transportation Services | Ridesharing /Transport | ||

| FerroTec | Hangzhou | $511 million | B | Zhejiang State-Owned Capital Operation, Sunic Capital | SDIC Chuangyi Industry Fund Management, Zhejiang Provincial Financial Development Company, CCB International, China SME Development Fund (Oriental Fortune Capital), BOCOM International, Qingdao Minxin, Shanghai Guosheng Group, Hangzhou Qiantang Industry Investment Fund, China Cinda Asset Management, CICC Pucheng Investment, CICC Capital, Orient Securities Capital Investment, Shanghai Free Trade Zone Equity Fund Management, Yangtze Optical Fibre and Cable Joint Stock | Semiconductors | N/A |

| DeepRoute.ai | Shenzhen, China/Fremont, the US | $300 million | B | Alibaba Group | Jeneration Capital, Geely, Fosun RZ Capital, Yunqi Partners, Glory Ventures | Automobiles, Other Vehicles & Parts | Autonomous Driving |

| Momenta | Beijing | $300 million | General Motors | Automobiles, Other Vehicles & Parts | Autonomous Driving | ||

| COWAROBOT | Shanghai | $250 million | C | Automobiles, Other Vehicles & Parts | Autonomous Driving | ||

| Aulton New Energy | Shanghai | $232 million | B | Guangzhou Finance Holdings, Guangzhou Kaide, Enze Capital (affiliated with Sinopec Capital) | Korea Investment Partners (KIP), CY Capital, Guangdong Merchant Venture Capital | Energy Storage & Batteries | Electric/Hybrid Vechicles |

| Agile Robots | Beijing/Munich | $220 million | C | SoftBank Vision Fund 2 | Chimera, GL Ventures, Sequoia Capital China, Linear Capital, Xiaomi, Foxconn Industrial Internet, Midas Investment | Hardware | Robotics & Drones |

| Keenon | Shanghai | $200 million | D | SoftBank Vision Fund 2 | CICC Alpha, Prosperity7 Ventures | Consumer Products | Robotics & Drones |

| New Carzone | Nanjing | $200 million | D | Asia Investment Capital | Alibaba Group, Dragon Capital | Automobiles, Other Vehicles & Parts | E-commerce |

| HAI ROBOTICS | Shenzhen | $200 million | C, D | C:5Y Capital; D: Capital Today | C: Sequoia Capital China, VMS Group, Scheme Capital, Source Code Capital, Walden International; D: Sequoia Capital China, 5Y Capital, Source Code Capital, 01VC, Legend Star | Logistics & Distribution | Robotics & Drones |

| eSign | Hangzhou | $186 million | E | Sequoia Capital China, IDG Capital, Hidden Hill Capital (affiliated with GLP) | Sealand Innovation Capital, GIG Asset Management, Wens Capital (affiliated with Wens Foodstuffs Group), Fortune Capital, Grand Flight Investment | Business Support Services | AI and Machine Learning |

| COSMOPlat (affiliated with Haier) | Qingdao | $155 million | B | China Life Technology and Innovation Fund | Guosheng Capital, Shanghai Guohe Capital, Shandong New Growth Drivers Fund Management, Hongtai Aplus, Qingyue Fund, Cowin Capital, Shenzhen TopoScend Capital | Internet | Internet of Things |

| Mech-Mind Robotics | Beijing | $155 million | C | Meituan, IDG Capital | Sequoia Capital China, Source Code Capital | Software | Robotics & Drones |

| Xtransfer | Shanghai | $138 million | D | D1 Capital Partners | Financial Services | Fintech | |

| Cider | Beijing | $130 million | B | DST Global | Greenoaks Capital, A16Z | Consumer Products | E-commerce |

| Cellular Biomedicine Group | Shanghai | $120 million | A | AstraZeneca-CICC Healthcare Industry Fund, Sequoia Capital China, Yunfeng Capital | GIC, TF Capital | Biotechnology | Biotech |

| XSKY (Beijing) Data Technology | Beijing | $110 million | E | Boyu Capital | Legend Capital, CICC Alpha, Broad Vision Funds, Kunlun Fund, Hundsun Technologies, Suzhou Yishang Equity Investment, Northern Light Venture Capital (NLVC), Qiming Venture Partners | Software | Big Data |

| IASO Biotherapeutics | Nanjing | $108 million | C | CDH Baifu | CCB International, Everbright Limited, Co-Stone Capital, CNCB Capital, Plaisance Capital, GL Ventures | Biotechnology | Biotech |

| DeltaHealth | Shanghai | $100 million | Swire Pacific | Eight Roads | Healthcare Services | N/A | |

| Black Sesame Technologies | Shanghai | $100 million | C, Strategy | C: Hubei Xiaomi Yangtze River Industry Fund | C: Wingtech Technology, FulScience, China Automotive Chip Industry Innovation Strategic Alliance, SummitView Capital, FutureX Capital, Oriza HUA, Lenovo Capital & Incubator Group, Sunic Capital; Strategic investment: Hubei Xiaomi Yangtze River Industry Fund, FulScience Automotive Electronics | Automobiles, Other Vehicles & Parts | Autonomous Driving |

| Nreal | Beijing | $100 million | C | NIO Capital, Yunfeng Capital, Hongtai Aplus | CPE, GP Capital, GL Ventures, Sequoia Capital China | Consumer Products | AR & VR |

| VisionX | Zhuhai | $100 million | B | Temasek Holdings, Lake Bleu Capital, Sequoia Capital China, Green Pine Capital Partners, Sherpa Healthcare Partners, 3H Health Investment, HighLight Capital (HLC) | Healthcare Specialist | N/A |

Auto & allied sector thrives

The automobile & parts industry topped in terms of deal value with the completion of 11 deals – largely on account of fundraising by China’s autonomous driving upstarts DeepRoute.ai, Momenta, COWAROBOT, and Black Sesame Technologies. Collectively, startups in the field raised close to $1.2 billion, or 16.6% of all financing.

This may just be a start of a potential acceleration in the growth of China’s autonomous driving sector. The Chinese authority last month unveiled its first national standards for autonomous driving, laying the foundation for carmakers to develop vehicles for future mobility. The standards, ranging from Level 0, which relies largely on human drivers, to Level 5 that enables “full driving automation,” will come into effect in March 2022.

Across other industries, the software space saw more transactions than any other sectors. Twenty-two software startups closed new investments in September, or 12.2% of deals in the month, although the $699.5 million raised was only a fraction of the total financing.

Semiconductors, a sector much touted by the Chinese government in its efforts to achieve global supremacy in tech, kept up its chase at second position in terms of deal count. Twenty-one semiconductor startups gathered a combined $936 million, up from last month when 18 such firms raised $447 million in total.

However, challenges to growth remain as this sector faces an acute shortage of tech talent. The deficiency of talent in China’s semiconductor industry doubled in 2019 to about 300,000 from 150,000 in 2015, according to a 2021 report by the China Institute for Educational Finance Research at Peking University cited by South China Morning Post.

Sequoia China captures 14 new deals

Sequoia Capital China, led by China’s famed rainmaker Neil Shen, again dominated as the most active investor in Greater China with capital injections into at least 14 deals in September. The value of the deals amounted to approximately $1.4 billion, which was also the most sizeable combined deal value compared to transactions backed by other investors.

Shen created Sequoia China in 2005 as the China franchise of Silicon Valley’s Sequoia Capital. The firm has invested in nearly 600 companies over the past 16 years, including some of China’s biggest tech firms like Alibaba, JD.com, Meituan, and Didi Global.

Sequoia China in mid-October filed with the US Securities and Exchange Commission (SEC) its plans of raising three new infrastructure-focused funds. Typically, it focuses on investments in the TMT, healthcare, consumer products and services sectors.

Sequoia China backed seven megadeals in the month. These fundraisers include robotics firm Agile Robots, warehouse robotics startup HAI Robotics, e-signature service eSign, industrial robot developer Mech-Mind Robotics, cell therapies firm Cellular Biomedicine Group, augmented reality (AR) startup Nreal, and medical device supplier VisionX.

Other active investment groups in September include CICC Capital, a flagship investment platform of Chinese investment bank China International Capital Corporation Limited (CICC); Cowin Capital, an equity investment firm in Shenzhen; and Shunwei Capital, which is backed by smartphone brand Xiaomi’s founder Lei Jun.

Most active investors in China’s PE-VC market (Sept 2021)

| Investment company | No. of deals | Total value of participated deals (USD) | Lead | Non-lead |

|---|---|---|---|---|

| Sequoia Capital China | 14 | $1361 million | 4 | 10 |

| CICC Capital and affiliates | 12 | $1140.5 million | 6 | 6 |

| Cowin Capital | 8 | $405 million | 3 | 5 |

| Shunwei Capital | 8 | $137 million | 6 | 2 |

| GL Ventures & Hillhouse Capital | 7 | $503 million | 2 | 5 |

| IDG Capital | 6 | $426 million | 4 | 2 |

| Xiaomi | 6 | $424 million | 4 | 2 |

| YuanBio Venture Capital | 6 | $116 million | 4 | 2 |

| Kaitai Capital | 6 | $58 million | 1 | 5 |

| 5Y Capital | 5 | $226 million | 3 | 2 |

| *If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Liya Su contributed to the story.

Note: In our monthly analysis for September 2021, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

Share this story with your friends and colleagues.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

India Deals Barometer Report: Fundraising by Indian startups falls 27% to $3.4b in September

Investments saw a drop for the second consecutive month since July, when startups…

Venture Capital

SE Asia Deal Barometer Report: Southeast Asia’s startups raise $2.8b in Sept, up 35% over Aug

Startups in Southeast Asia continued their dealmaking momentum in September, raising $2.8 billion…