Greater China Deals Barometer Report: Startup funding in Oct lowest since Feb 2020

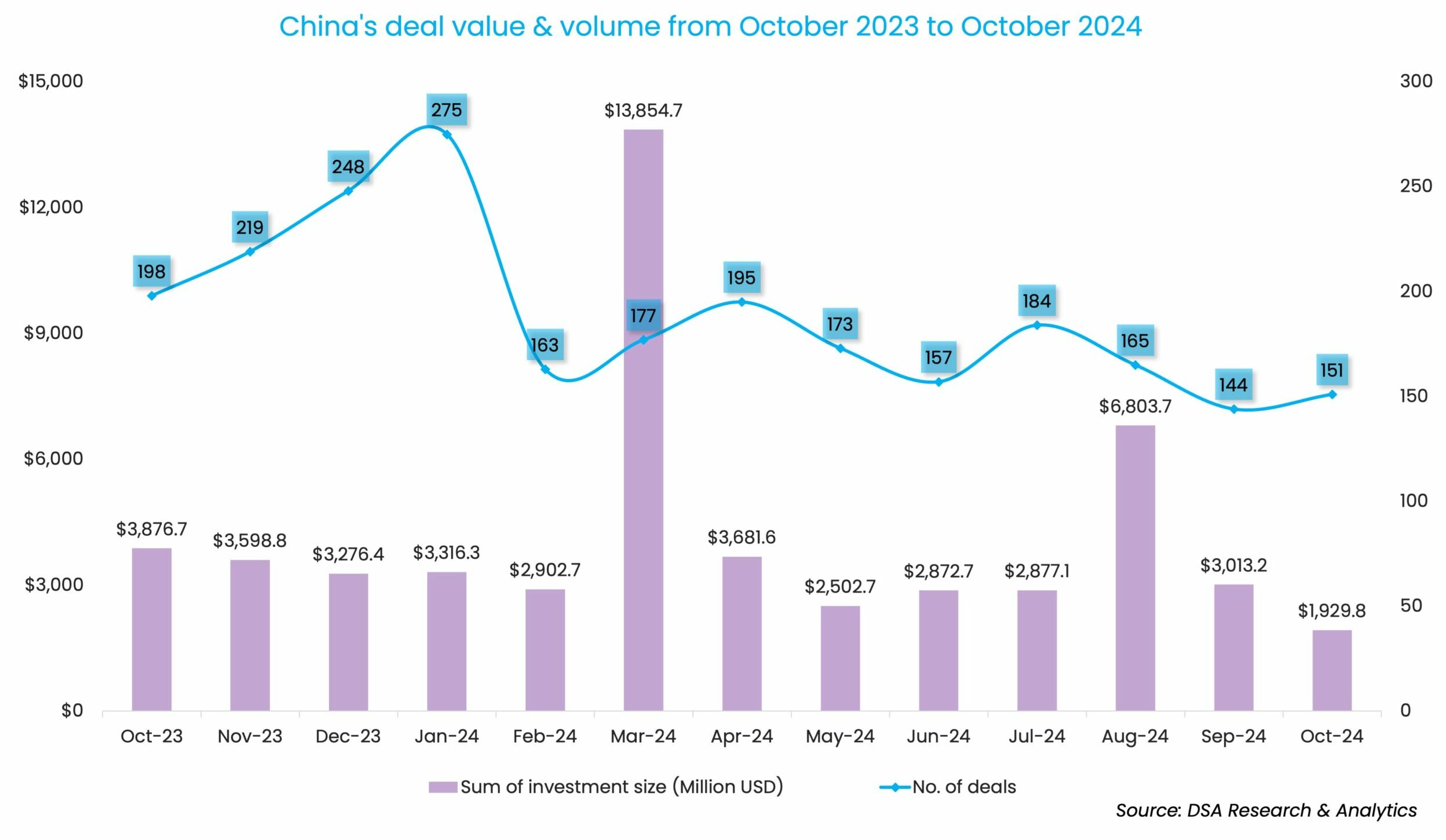

Startup funding activity Greater China suffered a steep 36% month-on-month decline in transaction value in October, a month that recorded transactions worth only $1.9 billion.

The monthly proceeds, the lowest since February 2020, joined the downward trajectory since August this year. The sudden drop in megadeals, or investments worth at least $100 million in October, contributed to the overall monthly decline in transaction value, according to DealStreetAsia’s proprietary data.

Despite the sharp decline in deal value, transaction activity in volume terms was a tad higher at 151 in October compared to 144 deals in September.

The monthly fundraising proceeds and deal count were 50% and 23.7%, respectively, lower than the level recorded in the same period of 2023 as startups continued to shiver through October 2024.

The month brought a sluggish start for Q4 as investors across mainland China, Hong Kong, Macau, and Taiwan awaited the unfolding of two high-profile macro events in November including the US presidential elections and the 12th session of the Standing Committee of the 14th National People’s Congress, China’s top legislature.

Overall, the first 10 months of 2024 saw startups in Greater China secure $43.8 billion — up only 0.3% from the corresponding period last year. At 1,784, the deal count was 15.9% down compared to the same period last year.

Megadeals see drop

Megadeals, which typically dominate the funding scene in the Greater China market, were the hardest hit in October, when only three such transactions took place, accounting for 30.8% of the total deal value.

GAC Leasing, the leasing unit of Chinese state-owned automobile maker GAC Group, topped the megadeal tally during the month. CA Personal Finance & Mobility, the consumer finance and mobility provider under French bank Crédit Agricole Group, is acquiring a 50% stake in the leasing unit for 2.1325 billion yuan ($299.8 million) via a reserved capital increase. The acquisition will enable CA Personal Finance to tap the nascent financial and operational leasing solutions market in China.

DiDi Autonomous Driving, the self-driving technology arm of DiDi Global, secured another $149 million in a Series C financing round, led by Chinese state-owned automobile manufacturer GAC Group. The proceeds are expected to help expand its R&D investment towards autonomous driving technology as well as the commercialisation of its first robotaxi.

In yet another megadeal, YSB, a digital pharmaceutical platform serving businesses outside hospitals in China, entered into agreements to acquire a 100% equity stake in Tiger Global-backed Yikuai Pharmaceutical Technology for around 1 billion yuan ($145.5 million).

List of megadeals (October 2024)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| GAC Leasing | Guangzhou | 299.8 | CA Personal Finance & Mobility (affiliated with Crédit Agricole Group) | Financial Services | Fintech | |||

| DiDi Autonomous Driving | Beijing | 149 | C | GAC Group | DiDi Global | Automobiles & Parts | Autonomous Driving | |

| Yikuai Pharmaceutical Technology | Changsha | 145.5 | M&A | YSB Inc | Healthcare IT | HealthTech |

Late-stage dealmaking activity continued to remain sluggish during the month in review. TenNor Therapeutics, a clinical-stage biotech firm specialising in the discovery and development of new drug products targeting bacterial infection and metabolic diseases, was the only deal at the Series E or later stages in the month.

The biotech firm secured 300 million yuan ($42.1 million) in the first close of its Series E round co-led by the investment unit of state-owned Zhongshan Investment Holdings and US-based AMR Action Fund.

While the A-share IPO activity is expected to stay muted for the rest of the year amid shifting regulatory landscape and cautious investor sentiment, the Hong Kong bourse showed signs of recovery in Q3, with a total of HKD 55.6 billion IPO proceeds, up 120% than Q3 2023, according to KPMG’s Q3 report.

Self-driving firms ride on funding tailwind

October saw a heightened investor interest in self-driving firms. Besides DiDi Autonomous Driving’s megadeal, several autonomous driving firms and solutions providers have secured funding from investors.

NYSE-listed auto parts supplier Aptiv picked up an 18% stake in Chinese self-driving technology provider MAXIEYE for 570 million yuan ($80.1 million).

GAC Group, for example, disclosed that it has received approval to inject $27 million into autonomous driving firm Pony.ai, which counts Japan’s Toyota Motor Corp and Chinese electric vehicle (EV) maker Nio’s investment arm Nio Capital among its backers.

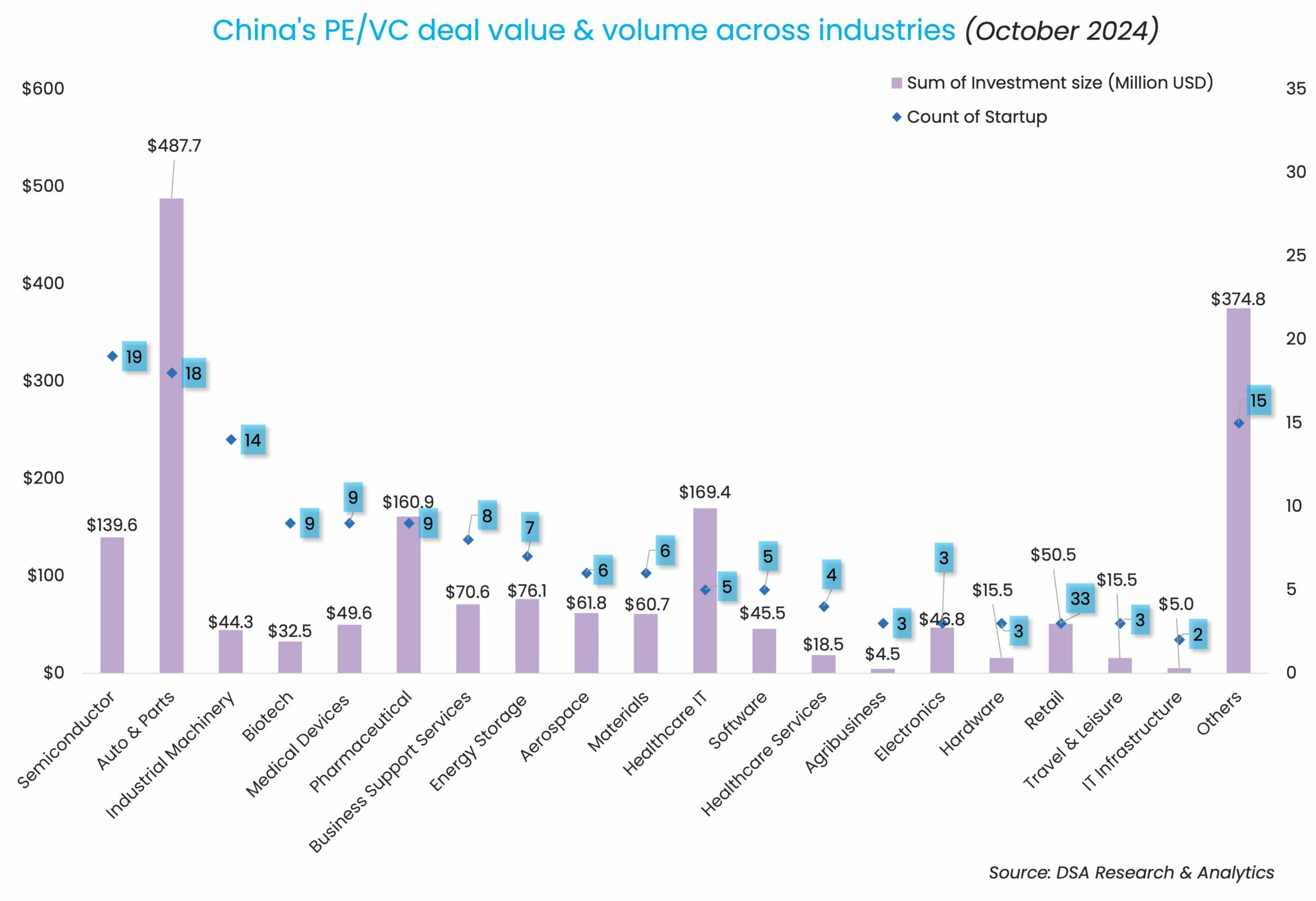

These deals helped push automobile & parts to become the most-invested sector, raking in $487.7 million through the completion of 18 deals. The semiconductor space stayed on top with 19 deals, despite raising only $139.6 million in total.

Cowin Capital tops investor list

Cowin Capital, one of China’s top VC and PE investment firms, became the most active investor of the month as it backed a total of six startups across the sectors of industrial machinery, energy storage, and semiconductors.

Founded in 2000 by former lawyer Zheng Weihe and his wife Huang Li, the NEEQ-listed firm has since managed over 30 billion yuan ($4.2 billion) in assets across both RMB and USD funds. The Shenzhen-based investment firm currently focuses on opportunities across deep tech, healthcare, and the digital economy.

Most active investors in China (October 2024)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead | |

|---|---|---|---|---|---|

| Cowin Capital | 6 | $21.5 | 5 | 1 | |

| Optics Valley Industrial Investment | 3 | $28 | 0 | 3 | |

| Qiming Venture Partners | 3 | $66.6 | 0 | 3 | |

| Tsing Ventures/ Tsinghua Innovation Ventures | 3 | $4.5 | 1 | 2 | |

| Three Squirrels | 3 | $50.5 | 3 | 0 | |

| GL Ventures | 3 | $3 | 3 | 0 | |

| GAC Group & affiliates | 3 | $253.8 | 2 | 1 | |

| State Development and Investment Corporation (SDIC) & affiliates | 3 | $119.2 | 3 | 0 |

Note: In our monthly analysis for October 2024, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Startup fundraising up 18% in October

Equity fundraising by startups in Southeast Asia rose 18% month-on-month in October but it remained below the psychologically important $1 billion threshold, as the absence of megadeals continued to suppress total capital raised.

Venture Capital

India Deals Barometer Report: Startup fundraising plunges 29% to $1.1b in October

Risk capital investors further tightened their purse strings in October, investing a mere $1.12 billion into Indian startups compared with $1.58 billion in September, according to proprietary data compiled by DealStreetAsia.