China Deals Barometer Report: PE-VC investments further retreat to $6.8b in Oct

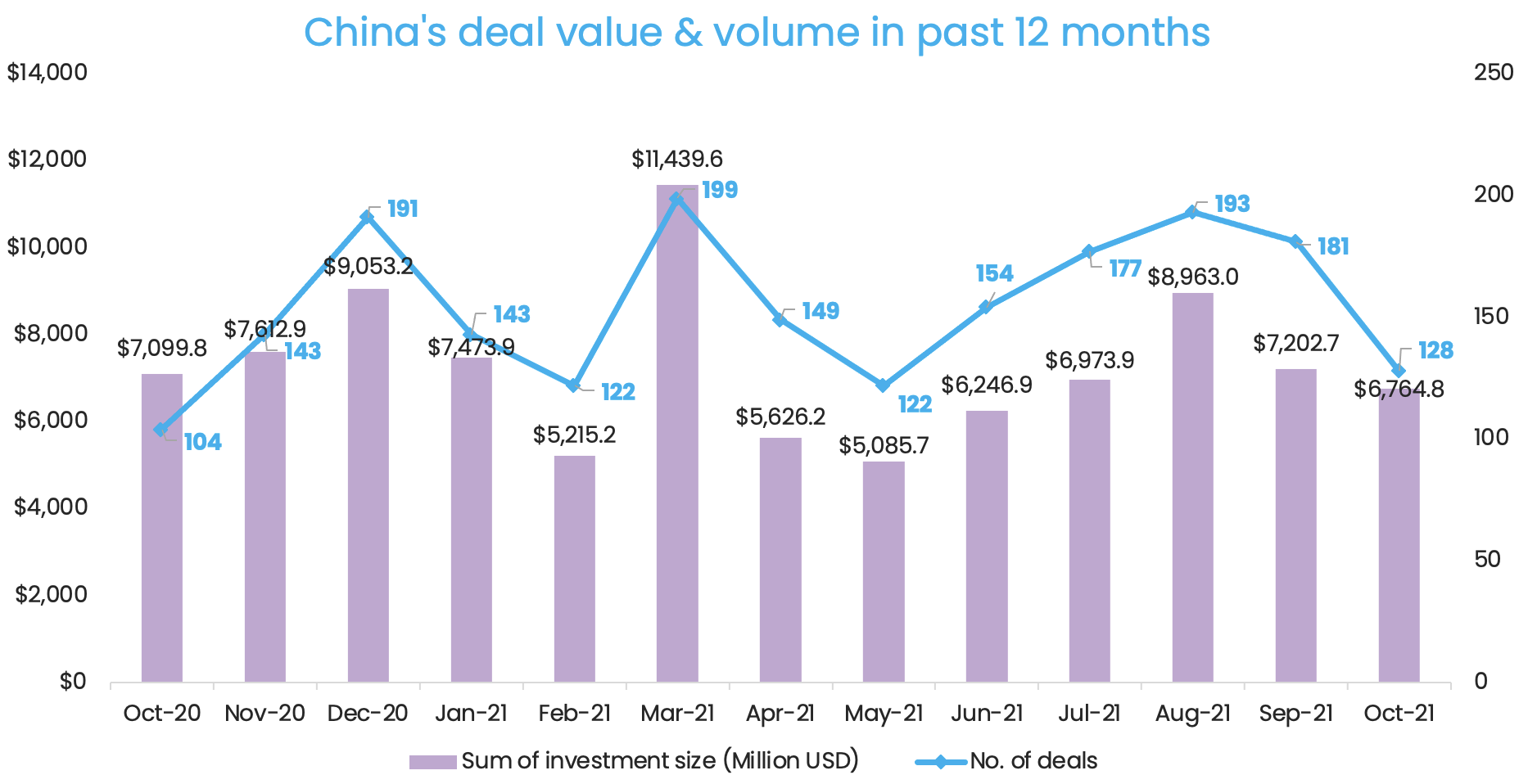

Dealmaking activity in Greater China further retreated in October 2021, continuing the decline witnessed in September.

Privately held companies in the region raised close to $6.8 billion across 128 private equity and venture capital transactions last month. That marks a 6.1% decline in deal value and a 29.3% fall in deal count compared with September, according to proprietary data compiled by DealStreetAsia.

But the market was still more vibrant than the same period last year when a total of 104 deals were sealed. The monthly deal value, however, was down 4.7%, compared with about $7.1 billion in October 2020.

Of the 128 PE-VC transactions logged in October, the value of 15 deals was not disclosed, the data shows.

Ride-hailing firm T3 Chuxing pocketed the month’s largest investment of 7.7 billion yuan ($1.2 billion). T3 Chuxing, a domestic rival to SoftBank Group-backed Didi Global, attracted new financing from a group of investors led by Chinese state-backed conglomerate CITIC Group. This is yet another big-ticket round in China’s ride-hailing space, following an investment of 3.8 billion yuan ($594.3 million) into Geely-backed Caocao Mobility in September.

Besides the billion-dollar deal, October saw the completion of three other transactions worth $500 million or more.

These include Envision Energy and Envision AESC, the two subsidiaries of energy firm Envision Group that collectively closed over $600 million; the Beijing-based maker of hairdryers Dreame that raised $563 million; and HT Aero, an urban air mobility (UAM) firm affiliated with Chinese electric vehicle (EV) brand Xpeng, which raised $500 million.

Megadeals account for 69.6% of financing in Oct

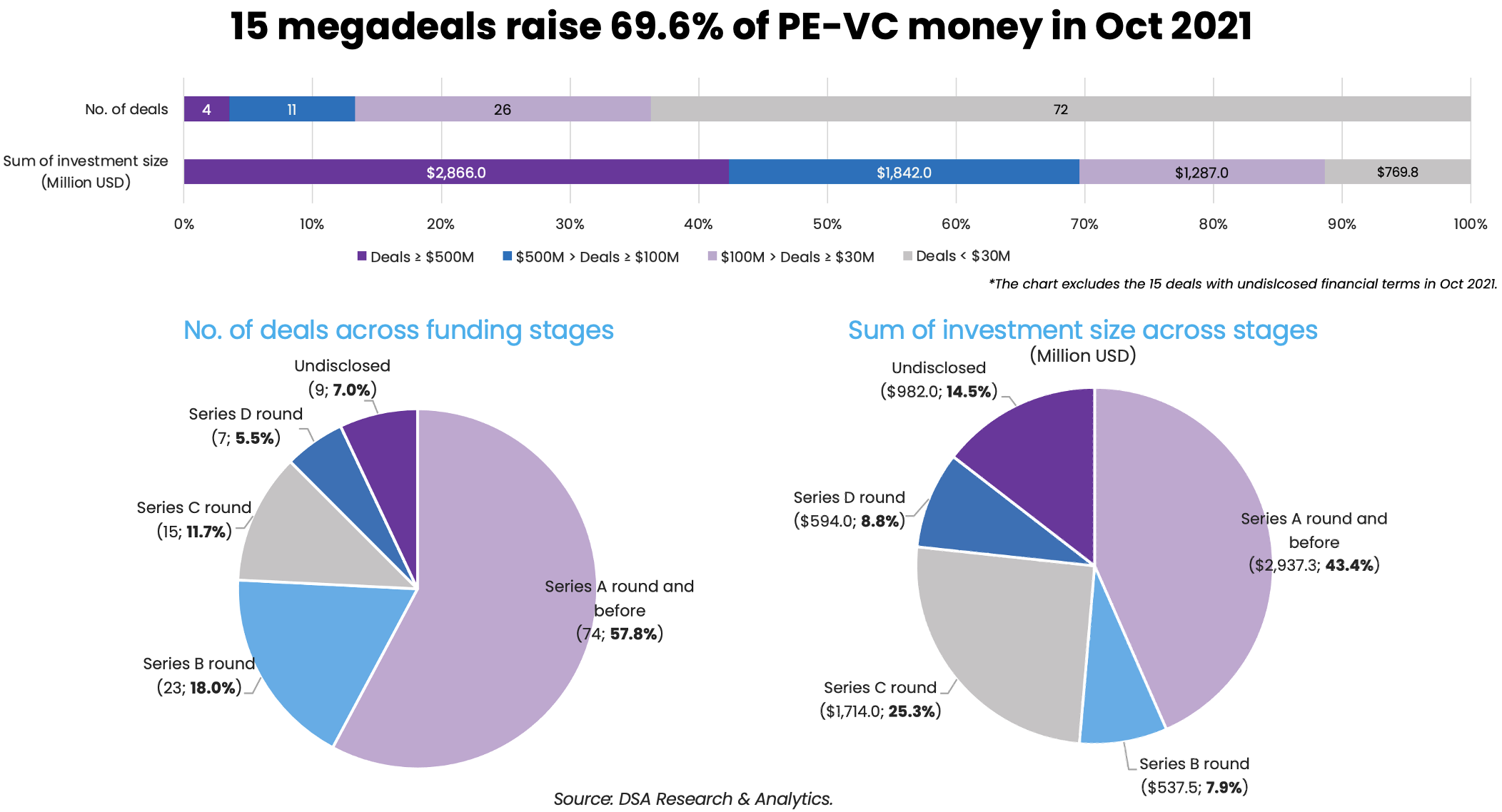

The capital collected across all megadeals – investments worth $100 million and more – was buoyed in October thanks to T3 Chuxing’s $1.2-billion fundraising.

At just over $4.7 billion, the combined deal value of the 15 megadeals in the month was 4.4% higher than the previous month. In September, 22 megadeals had gathered an aggregate of $4.5 billion.

The bulk of the capital continues to be concentrated in the hands of a few. Out of the 128 transactions, the 15 megadeals – 11.7% of the total deal count – accounted for 69.6% of the month’s funding. This share had stood at 62.7% in September and 67.2% in August.

In addition to the four colossal deals completed by T3 Chuxing, Envision, Dreame, and HT Aero, the value of 11 other investments fell in the $100-500 million ($100 million inclusive) basket.

These investments attracted the participation of renowned investors such as SoftBank Group Corp’s Vision Fund 2, Sequoia Capital China, and GL Ventures, with fundraisers coming from a wide range of industries like semiconductor, consumer brands, and healthcare.

List of 15 megadeals in Oct 2021

| Startup | Headquarters | Investment Size (USD) | Investment Stage | Lead Investor(s) | Investor(s) | Industry | Vertical |

|---|---|---|---|---|---|---|---|

| T3 Chuxing | Nanjing | $1,203 million | A | Yingtong Technology, Tongcheng, Virtue Capital | Auto & Parts | Ridesharing /Transport | |

| Envision Energy, Envision AESC | Shanghai | $600 million | Strategy | Primavera Capital | Renewable Energy | CleanTech | |

| Dreame | Beijing | $563 million | C | Huaxing Growth Capital, CPE | Country Garden Venture Capital, Yunfeng Capital, Stoneylake Asset, Taikang Asset Management, Skywalker Capital, Harvest Capital Management, Fortune Capital, Xiaomi Corporation, Shunwei Capital, IDG Capital | Consumer Products | Robotics & Drones |

| HT Aero | Guangzhou | $500 million | A | IDG Capital, 5Y Capital, Xpeng Auto | Sequoia Capital China, Eastern Bell Capital, GGV Capital, GL Ventures, Yunfeng Capital | Auto & Parts | Ridesharing /Transport |

| Huice | Beijing | $312 million | D | SoftBank Vision Fund 2 | CITIC Private Equity Funds Mangement (CPE), GL Ventures, GIC, Legend Capital | Retail | Saas |

| SJ Semiconductor | Wuxi | $300 million | C | Country Garden Venture Capital, Walden CEL Global Fund, CCB Private Equity Investment Management, CCB Trust, Guofang Capital, Huatai International, Shanghai Jinpu Guotiao, Oriza Rivertown, CICC Capital, Hua Capital Oriza Management | Semiconductor | N/A | |

| Worldwide Logistics | Shanghai | $264 million | Cainiao, COSCO Shipping | Sinovation Ventures, Yunqi Partners | Logistics & Distribution | Ridesharing /Transport | |

| Shandong Wego Interventional Medical Technology | Weihai | $155 million | A | XJ Capital | CCB International, Haitong-Fortis Yangtze River Growth Equity Investment, China-Belgium Direct Equity Investment Fund | Medical Devices | HealthTech |

| Lanhu | Beijing | $155 million | C+ | Software | Cloud Computing | ||

| Aqara | Shenzhen | $155 million | C | Shenzhen Capital Group, Joy Capital, China Telecom, Greenwoods Asset Management, Zhongyuan Capital, Unicom-CICC Capital | Consumer Products | Internet of Things | |

| NeuSAR | Shanghai | $101 million | Initial | CMG-SDIC Capital | Virtue Capital | Auto & Parts | Autonomous Driving |

| Leads Biolabs | Nanjing | $100 million | C | Loyal Valley Capital | Lapam Capital, DYEE Capital, Shenzhen Capital Group, AJ Securities, Rongchang Venture Capital, Zhenji Capital, Ennovation Ventures, Hankang Capital, Hosencare Brothers, Huaige Capital, Zhuangzhong Venture Capital, New Silkroad Investment | Biotech | Biotech |

| Yunxi Technology | Hangzhou | $100 million | D | Crescent Point | BOCOM International, Hupan Capital, Sequoia Capital China, Xiang He Capital | Marketing/Advertising | AdTech |

| PharmaLegacy | Shanghai | $100 million | Sequoia Capital China, GL Ventures | Prosperico Ventures, Med-Fine Capital. | Healthcare Services | HealthTech | |

| ShouTi Inc | Shanghai/San Francisco | $100 million | B | BVF Partners | Lilly Asia Ventures (LAV), Casdin Capital, Cormorant Asset Management, Janus Henderson Investors, Monashee Capital, Sage Partners, Stork Capital, Surveyor Capital, TCG X, Terra Magnum Capital Partners, Woodline Partners LP, TCG X, Terra Magnum Capital Partners, Woodline Partners LP, and co-founder and strategic partner Schrödinger, Eight Roads, F-Prime Capital Partners, Qiming Venture Partners, Sequoia Capital China, TF Capital, Wuxi AppTec | Pharmaceutical | Biotech |

Early-stage deals find favour

October saw a substantial rise in investments in the Series A stage and earlier.

Investors demonstrated a heightened interest in early-stage startups with 74 deals, or 57.8% of October’s total deal count, being made at the Series A stage and earlier. It compares to September when deals at this stage took up only 39.2% of the month’s deal count.

The total funding into the Series A stage and before also topped other funding stages. At $2.9 billion, transactions at the earliest stage mopped up 43.4% of all financing in October.

The increase was potentially due to investors’ concerns that Beijing’s tightening rules over initial public offerings (IPOs) of Chinese tech companies would create uncertainties regarding exits.

The regulators’ probe into Temasek- and Tiger Global-backed Didi Global, just a few days after its $4.4-billion US IPO, had caused its share price to plummet. In late July, shares of Chinese online education companies had slumped after Beijing stripped them of their ability to make a profit from teaching the school curriculum.

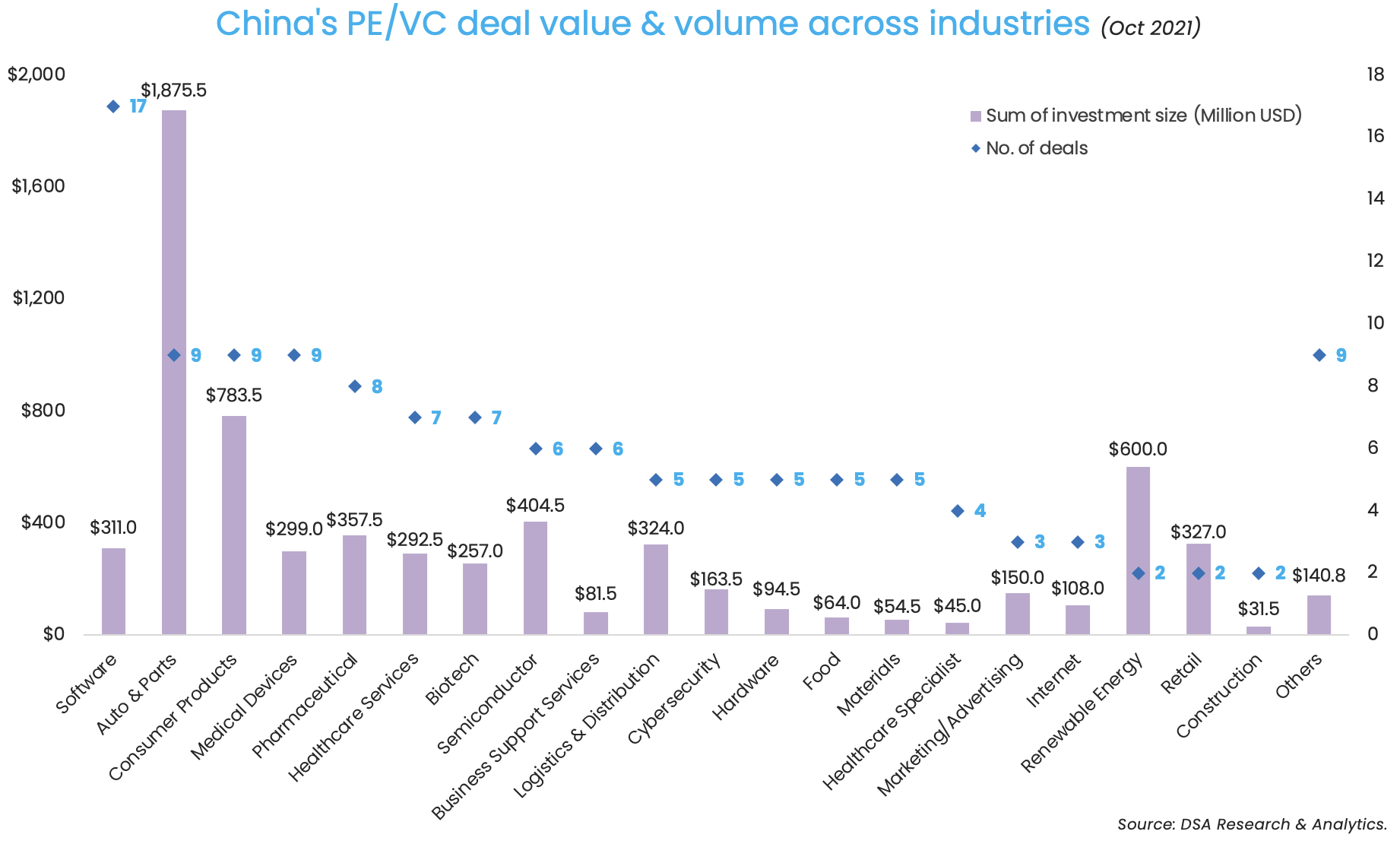

Continued interest in China’s auto & parts sector

The popularity of startups in the automobile & parts industry was sustained in October.

Startups in the sector led the pack with nearly $1.9 billion across nine deals in October. The segment had topped in September as well.

The investments in the automobile & parts industry in October were approximately 57.2% higher than that of September, mostly on account of T3 Chuxing’s $1.2 billion deal.

On top of that, Xpeng-backed HT Aero’s $500-million round and NeuSAR, an automotive software developer that secured 650 million yuan ($101 million), also contributed to the funding in the sector. Other smaller fundraisers in the field are mostly autonomous driving startups and manufacturers of electric/hybrid vehicles’ components.

Startups that offer technologies and solutions to enable next-generation mobility in China are on the rise. Their growth is expected to be expedited by the government’s efforts in promoting intelligent and eco-friendly vehicles to realise smart transportation, as well as its carbon neutrality target by 2060.

In terms of deal count, PE-VC transactions in the software industry outnumbered all other sectors with the completion of 17 deals. But the market is still in its early stage as most fundraisers in the month were in the Series B stage and before.

The two biggest transactions in the field both happened at the Series C stage. Lanhu, which operates an online product design collaboration platform, secured 1 billion yuan ($155 million) in a Series C+ round at a unicorn valuation of over $1 billion. The other deal was a $42-million Series C round in animated content platform Laihua.

The three industries of auto & parts, consumer products, and medical devices were tied for second place with the completion of nine deals each. Pharmaceutical, healthcare services, and biotech clocked eight, seven, and seven deals, respectively, which is an indication of long-standing investors’ interest in the overall health space in China.

GL Ventures, Sequoia China are top investors

GL Ventures, the VC arm of Asia’s PE major Hillhouse Capital Group, stepped up its investments to reach neck-and-neck with Sequoia Capital China.

The two companies each participated in at least 12 investments in October. But GL Ventures’ position as a lead investor in seven of the 12 deals gave it an edge over Sequoia China, which led five of the 12 transactions. The combined value of GL Ventures-backed deals amounted to almost $1.1 billion, or about 20.5% more than that of Sequoia China-backed deals.

GL Ventures was founded in February 2020 as a VC investment platform of Hillhouse, which was established in 2005 by one of China’s most famed rainmakers, Zhang Lei. It primarily focuses on early-stage investments across four areas, namely biopharmaceutical & medical apparatus, software services & technology innovations, consumer-oriented Internet & technologies, as well as emerging consumer brands & services.

Although the firm did not disclose the size of its managed capital, Xinhua News Agency, a state media in China, reported at the time of its inception that GL Ventures targeted to raise about 10 billion yuan ($1.6 billion). Its cheque size averages between 3 million yuan ($469,358.7) and $30 million, according to Xinhua.

Other active investment firms in October were Matrix Partners China, the China team of US VC firm Matrix Partners; Shunwei Capital, which is backed by smartphone brand Xiaomi’s founder Lei Jun; and Linear Capital, an investment firm focusing on data intelligence and frontier technology startups.

Most active investors in China’s PE-VC market (Oct 2021)

[table “” not found /]Liya Su contributed to the story.

Note: In our monthly analysis for October 2021, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

Share this story with your friends and colleagues.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

India Deals Barometer Report: Big-ticket deals push startup funding to $4.6b in October

Riding high on several big-ticket deals, Indian startups raised $4.65 billion across 162 ...

Venture Capital

SE Asia Deal Review: Startup funding falls to $1.6b in Oct on fewer megadeals

Fundraising by Southeast Asia’s privately-held companies cooled in October, after four...