Greater China Deals Barometer Report: Megadeal bounty lifts PE-VC funding in November

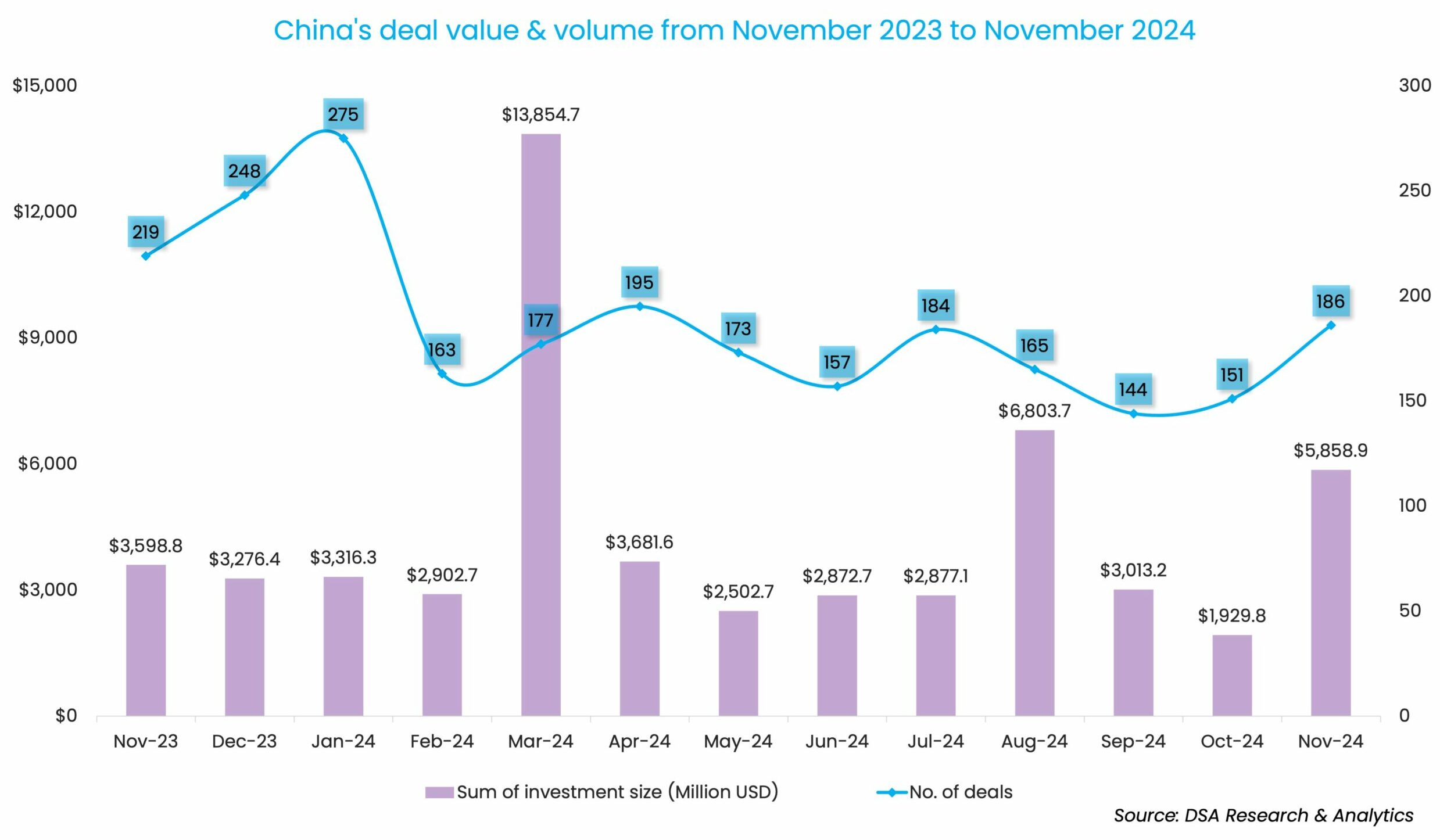

November witnessed a dealmaking sprint in Greater China as venture capital (VC) and private equity (PE) deal volume hit a seven-month high at 186, which was 23.2% higher than the previous month, according to proprietary data compiled by DealStreetAsia.

The deal value, too, tracked a significant upswing in November, as privately-owned firms in mainland China, Hong Kong, Macau, and Taiwan amassed around $5.9 billion, three times more than the $1.9 billion recorded in October.

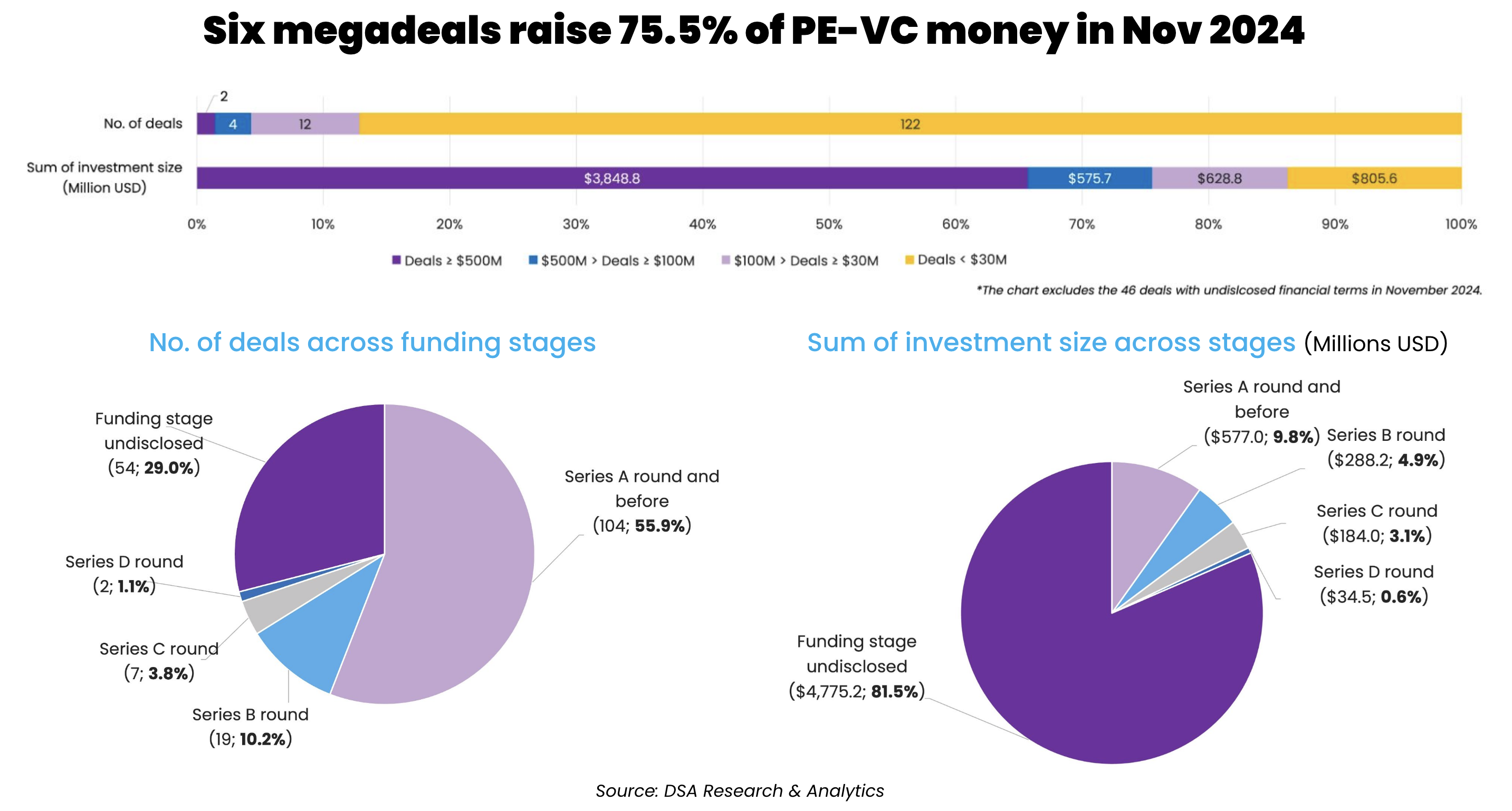

One major factor that drove up the monthly proceeds was the completion of six megadeals, or investments worth at least $100 million, which contributed to 75.5% of the total capital secured in November.

Although the monthly proceeds in November were up 63% compared to the same period last year, the deal count, which was down by 15.1%, is yet to come back to 2023 levels.

November also saw the historic comeback of Donald Trump as the 48th president of the US. Investment communities told DealStreetAsia that Trump’s incoming administration could have a profound impact on private markets and cross-border business amid intensifying tension between China and the US.

Meanwhile, China’s annual Central Economic Work Conference — which sets key targets for the country’s economy and its financial and banking sectors — held on December 9 & 10 vowed to continue the implementation of “a proactive fiscal policy and a prudent monetary policy” in its 2025 agenda.

Overall, as the Greater China market counts down to 2025, the first 11 months of 2024 saw startups snap up $49.6 billion — up 5% over the same period last year. At 1,970, the deal volume was down by 15.8%.

Two state-affiliated firms seal billion-dollar deals

Two billion-dollar deals dominated November’s startup funding scene, contributing to 65.7% of the total proceeds. Beijing Electronics Integrated Circuit Manufacturing, the integrated circuit manufacturing unit under state-owned Beijing Electronics Holding, snagged the largest deal of the month.

The chipmaker roped in a number of investors including Tianjin Jingdongfang Innovation Investment (affiliated with BOE Technology Group), Yan Dong Microelectronics, and E-Town Capital, among others, as it plans to use the almost-20-billion yuan ($2.8 billion) proceeds to finance its 12-inch wafer fab.

The second largest deal of the month was CNNP Rich Energy, a subsidiary of state-run nuclear firm China National Nuclear Power, which raised around 789.6 million yuan ($1.1 billion) in capital from several existing shareholders and new investors.

In yet another megadeal, SAIC Anji Logistics, the wholly-owned automotive logistics arm under state-owned automaker SAIC Motor, also roped in two new state-affiliated investors, snapping up 2 billion yuan ($275.7 million) in investment.

The rest of the megadeals were scattered across sectors including autonomous driving and pharmaceuticals.

While the A-share market tracked a drop of 68% and 61% in IPO proceeds and deal volume, respectively, compared to 2023, the Hong Kong bourse showed a 78% year-over-year growth in public listing proceeds, according to a recent report published by consulting firm KPMG. Analysts in the report commented that Chinese firms will increasingly shift their attention towards the Hong Kong bourse going forward.

But the positive momentum on Hong Kong’s stock exchange did not reflect in the late-stage dealmaking scene in Greater China, as there was no Series E or pre-IPO deal in the month.

List of megadeals (November 2024)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| Electronics IC Manufacturing | Beijing | 2758.1 | Tianjin Jingdongfang Innovation Investment (affiliated with BOE Technology Group), Yan Dong Microelectronics, E-Town Capital, Beijing Zhongfa Zhuli, Beijing State-owned Capital Operation and Management Company, Beijing Guoxin Juyuan Technology | Semiconductor | N/A | |||

| CNNP Rich Energy | Beijing | 1090.7 | China National Nuclear Corporation, China National Nuclear Corporation Capital Holdings, Beijing Guanghe Huihe New Energy, Zhejiang Zheneng Electric Power, China Life Asset Management Company, Sichuan Chuantou Energy, CITIC Securities Investment | Renewable Energy | N/A | |||

| SAIC Anji Logistics | Shanghai | 275.7 | Shanghai International Port Group, COSCO Shipping Holding | Logistics & Distribution | N/A | |||

| DeepRoute.ai | Shenzhen | 100 | C1 | Automobiles & Parts | Autonomous Driving | |||

| C Ray Therapeutics (Chengdu) | Chengdu | 100 | A+ | National Manufacturing Transformation and Upgrading New Materials Fund (managed by Shenzhen Capital Group), Tailong Capital | GL Ventures, 3SBio Inc, Guanghua Wutong | Pharmaceutical | N/A | |

| Zelostech/Zelos Technology | Suzhou | 100 | B1 | CDH Investments, Blue Lake Capital | Automobiles & Parts | Autonomous Driving |

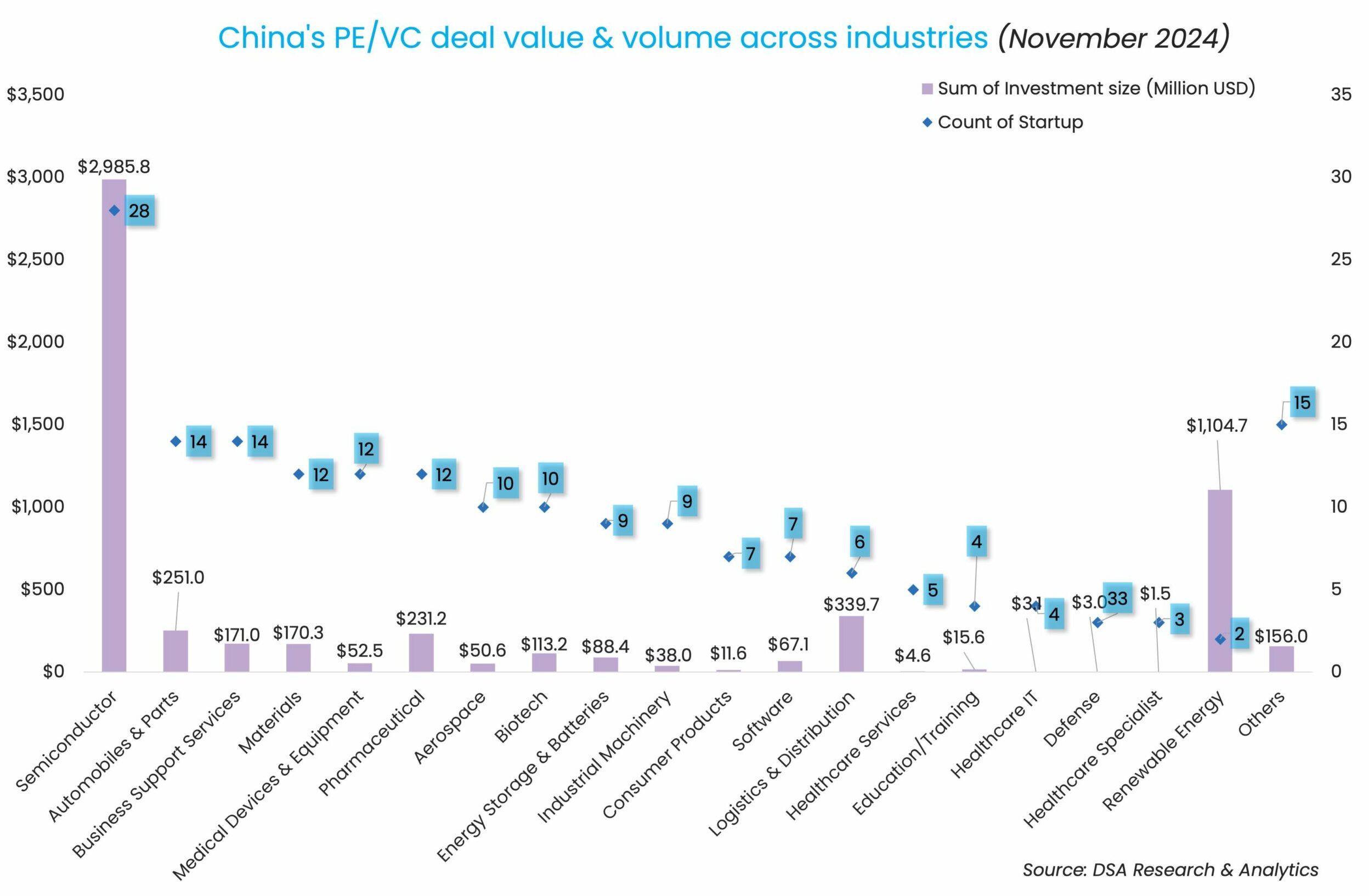

Semiconductor, renewable energy top the charts

Thanks to the two billion-dollar deals, semiconductor and renewable energy became the two most-invested sectors by deal value.

The semiconductor sector remained perched as the top industry, raking in almost $3 billion through the completion of 28 deals, while renewable energy secured $1.1 billion despite only closing two deals.

Both the sectors are of strategic importance to the country — CNNP Rich Energy’s raise comes at a time when China is aiming to reach peak emissions before 2030 and carbon neutrality before 2060, while Beijing Electronics Integrated Circuit Manufacturing’s investment rides on the country’s ambitions to become self-reliant in chipmaking amid intensifying crackdown from the US.

Addor Capital tops investor list

Chinese venture capital firm Addor Capital, backed by state-affiliated Jiangsu High-tech Investment Group, participated in eight deals to top the investor list. The eight startups raised a total of $49.5 million.

As one of the oldest VCs in the country, the Nanjing-headquartered firm has grown into an investment firm that focuses across a number of asset classes and strategies including PE/VC investment, private investment in public equity (PIPE), real estate, and fund-of-funds (FoFs).

The firm has so far seen four of its portfolio companies go public this year, with the most recent being local electronic magnetic functional materials and structures supplier Chengdu Jiachi Electronic Technology that went public via Shanghai’s tech-savvy STAR Market on December 5.

A number of blue chip venture capital firms including the likes of GL Ventures, the venture unit of global investment firm Hillhouse Investment; MPC (previously known as Matrix Partners China); and Lanchi Ventures (previously known as Bluerun Ventures) also stepped up their investments in November after startup funding showed signs of recovery in Q3.

Most active investors in China (November 2024)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Addor Capital | 8 | $49.5 | 2 | 6 |

| Cowin Capital | 7 | $21.5 | 5 | 2 |

| Shenzhen Capital Group | 6 | $186 | 4 | 2 |

| Legend Holdings & affiliates | 5 | $90.7 | 1 | 4 |

| GL Ventures (affiliated with Hillhouse Capital Group) | 5 | $168.7 | 2 | 3 |

| TusStar | 5 | $4.5 | 1 | 4 |

| CAS Star | 4 | $18.5 | 1 | 3 |

| Fortune Capital | 4 | $18.5 | 3 | 1 |

| SAIC Motor & affiliates | 3 | $84.5 | 1 | 2 |

| MPC (previously known as Matrix Partners China) | 3 | $111.7 | 1 | 2 |

| Lanchi Ventures (previously known as Bluerun Ventures) | 3 | $111 | 1 | 2 |

| China Reform Holdings Corporation | 3 | Investment sum undisclosed | 1 | 2 |

| Med-Fine Capital | 3 | $57.5 | 1 | 2 |

| QF Capital | 3 | $19.6 | 1 | 2 |

| SDIC Venture Capital & affiliates | 3 | $28 | 2 | 1 |

Note: In our monthly analysis for November 2024, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Fundraising plummets to seven-month low in Nov

Startup fundraising in Southeast Asia dropped to a seven-month low in November, according to proprietary data compiled by DealStreetAsia, highlighting a continued tightening investment environment for privately held companies across the region.

Venture Capital

India Deals Barometer Report: Growth-stage deals boost fundraising to $1.6b in Nov

Buoyed by food delivery platform Swiggy’s $605-million pre-IPO round, fundraising by Indian startups surged nearly 48% month-on-month to touch $1.66 billion in November, according to proprietary data compiled by DealStreetAsia. Among the top grossers were the logistics/distribution, consumers products, and financial services industries.