China Deals Barometer Report: Startup funding slumps 32% to a record low in May

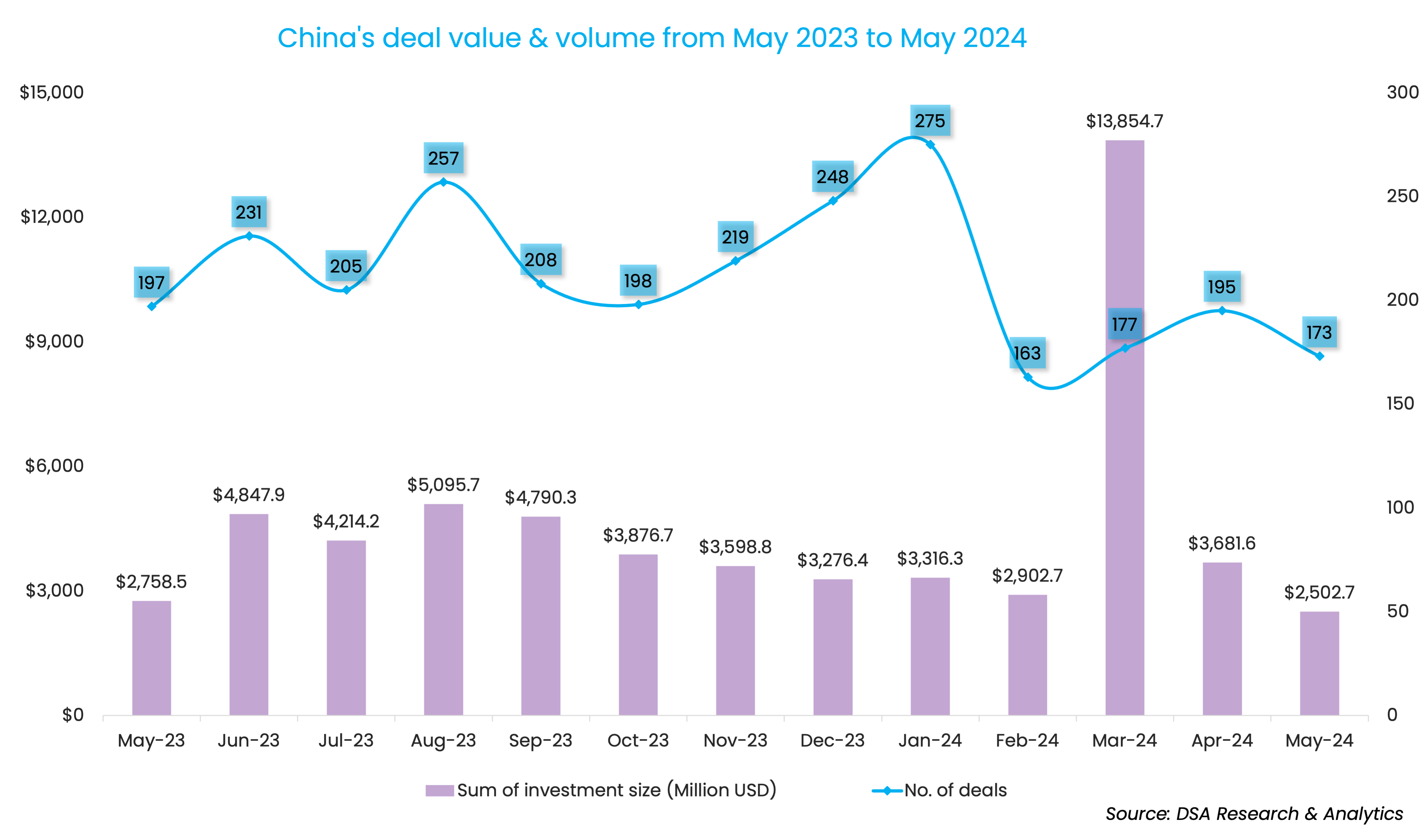

Venture capital funding for privately-held firms across mainland China, Hong Kong, Macau, and Taiwan plunged 32% to $2.5 billion in May over the previous month, as China’s uneven economic growth and ongoing geopolitical tensions weighed on investor sentiment. This was the lowest amount raised by Chinese startups since DealStreetAsia started tracking deals of all sizes in April 2020.

The number of venture deals in May stopped at 173, down 11.3% from April, according to proprietary data compiled by DealStreetAsia.

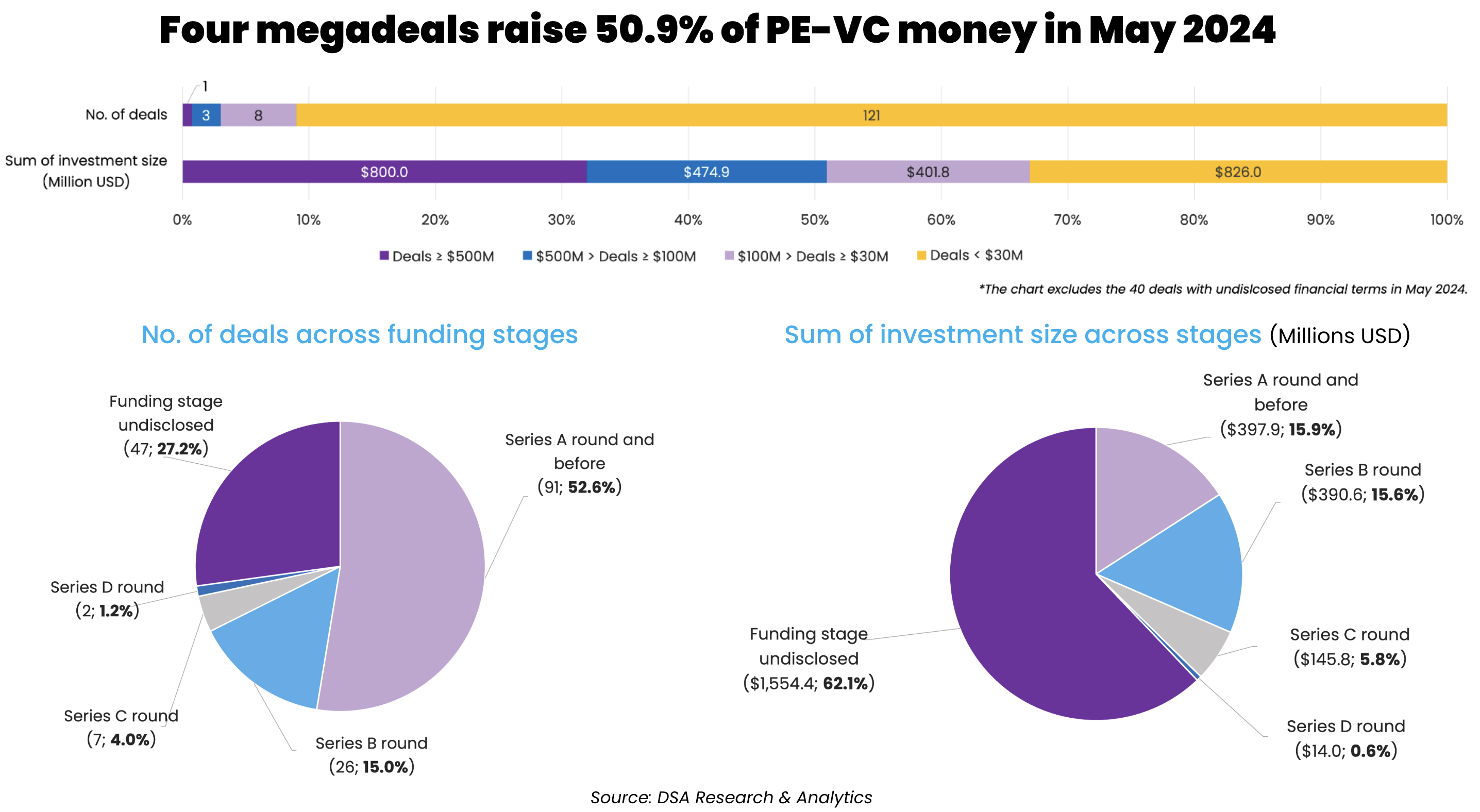

Although part of the drop can be attributed to the five-day “golden Week” Labour Day, the number of megadeals (deals worth $100 million or more) was even lower than in the week-long Lunar New Year holidays in February. There were just four megadeals amounting to $1.3 billion in May, compared with six megadeals which raised $1.7 billion in February.

However, startup fundraising for the first five months of 2024 managed to hold up despite the slump, largely due to the three billion-dollar deals in March that boosted the overall venture funding. The aggregate deal value of $26.3 billion in the first five months was 26.2% more than the $20.8 billion raised during the same period in 2023.

Generative AI firm clinches the biggest deal

The largest venture deal in May was raised by Moonshot AI, one of the most sought-after startups developing generative AI in China.

Alibaba Group Holding holds about 36% of preferred stocks in Moonshot AI, with its overall investment in the startup in the year ended March 31 totalling approximately $800 million, the Chinese e-commerce giant disclosed in its latest financial results published on May 24.

Nio Power, a subsidiary of the publicly-listed Chinese electric vehicle (EV) maker NIO, sealed the second-largest deal of the month. The firm, which provides electric vehicle (EV) battery-swapping solutions and facilities, pocketed 1.5 billion yuan ($207 million) in a strategic funding round from state-owned investment firm Wuhan Optics Valley Industrial Investment.

Chinese cybersecurity firm Chaitin Tech notched the third spot, as it raised over 1 billion yuan ($140.6 million) to pave the way for its future initial public offering (IPO); followed by telehealth platform TaiDoc Health, an associate firm of top Chinese insurer China Pacific Insurance, which raised 920 million yuan ($127.3 million) in its latest funding round.

Investments at Series A and earlier funding stages continued to dominate in May—there were 91 transactions in the earliest funding stages, accounting for half (52.6%) of the deal count. Meanwhile, dealmaking close to public listing stages continued to be bleak, with zero deals being sealed at Series E or after.

List of megadeals (May 2024)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| Moonshot AI | Beijing | 800 | Alibaba Group | Business Support Services | Robotics & Drones | |||

| Nio Power | Wuhan | 207 | Strategic Investment | Wuhan Guangchuang Fund (affiliated with Wuhan Optics Valley Industrial Investment) | Energy Storage & Batteries | Electric/Hybrid Vehicles | ||

| Chaitin Tech | Beijing | 140.6 | SIG Asset Management, SSF Zhongguancun Independent Innovation Fund (backed by China’s Social Security Fund and managed by Legend Capital) | CAS Investment, APU Investment, Yima Investment Management (affliated with Hundsun Technologies) | Cybersecurity | N/A | ||

| TaiDoc Health | Shanghai | 127.3 | Strategic Investment | SIG Asset Management (affiliated with Shanghai International Group), Mitsui Sumitomo Insurance Group, China Pacific Insurance, HongShan | Healthcare Services | HealthTech |

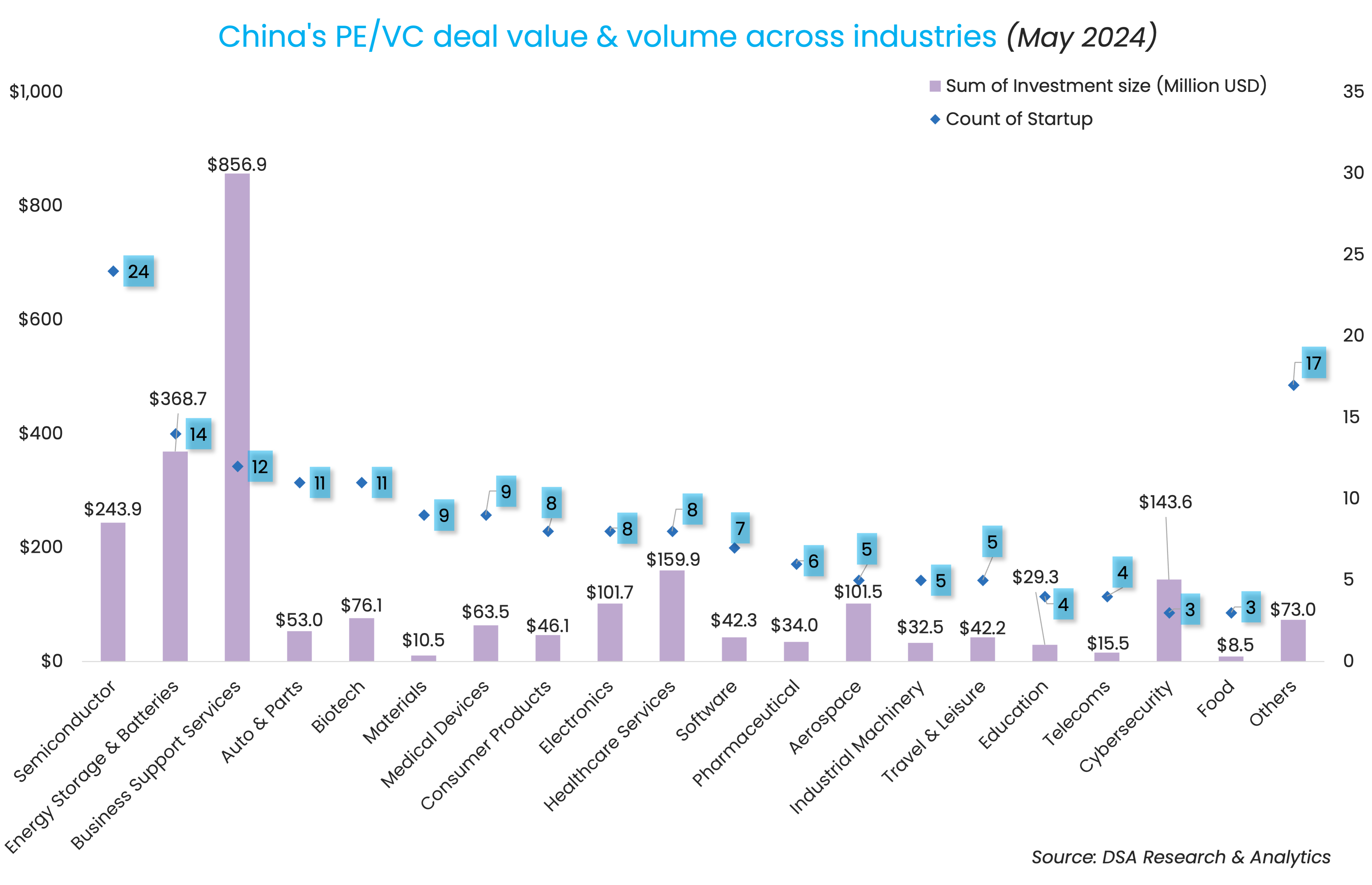

China amps up its semiconductor game

It comes as no surprise that China’s chip-making startups completed the most deals in May as the country continues to strive for semiconductor self-sufficiency. The strategic sector saw 24 startups raising a total of $243.9 million.

Most recently, China’s national fund investing in the semiconductor sector, known as the “Big Fund”, raised more than $47.5 billion for its third vehicle, roping in a slew of state-backed firms as limited partners including Industrial and Commercial Bank of China, Bloomberg reported.

Last month, Big Fund II was the co-lead investor in Shenyang Siasun Microelectronics Equipment, a subsidiary of China’s state-owned robotics manufacturer Siasun Robot & Automation, as the firm raised 400 million yuan ($55.3 million) in its first external equity fundraising round, making it the top semiconductor deal of the month.

Legend Holdings and affiliates top investor list

Chinese conglomerate Legend Holdings was the most active investor of the month both in terms of deal count and volume. The group injected around $182.6 million across six startups through its subsidiaries.

Despite investing in only two deals, Alibaba Group grabbed the limelight thanks to its investment disclosure on Moonshot AI. The Internet giant also invested 200 million yuan ($27.6 million) in Jingzhunxue, an edtech firm that plans to roll out AI-powered hardware for learning.

Most active investors in China (May 2024)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Legend Holdings & affiliates | 6 | 182.6 | 3 | 3 |

| CICC Capital & affiliates | 5 | 182.7 | 1 | 4 |

| E-Town Capital | 4 | 45.5 | 3 | 1 |

| Shunwei Capital | 4 | 29.5 | 2 | 2 |

| Fortune Capital | 4 | 83.2 | 2 | 2 |

| Vision Plus Capital | 3 | 69.2 | 1 | 2 |

| Cowin Capital | 3 | 17 | 1 | 2 |

| Alibaba Group | 2 | 827.6 | 0 | 2 |

Note: In our monthly analysis for May 2024, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new-economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Startup funding rebounds to five-month high of $878m in May

Capital raised by startups based in Southeast Asia rebounded in May, mostly because of three big-ticket deals sealed in the month, even as the overall fundraising environment remains subdued compared with 2023 levels.

Venture Capital

India Deals Barometer Report: At $1.9b, startup fundraising in May hits nearly two-year high

After encountering periods of uncertainty and slowdown, startup fundraising in India hit its highest in nearly two years at $1.9 billion in May as a result of a spurt in megadeals, according to proprietary data compiled by DealStreetAsia. The big-ticket deals had dried up over the last seven quarters owing to a prolonged funding winter.