China Deals Barometer Report: Three billion-dollar deals in March shore up Q1 venture funding

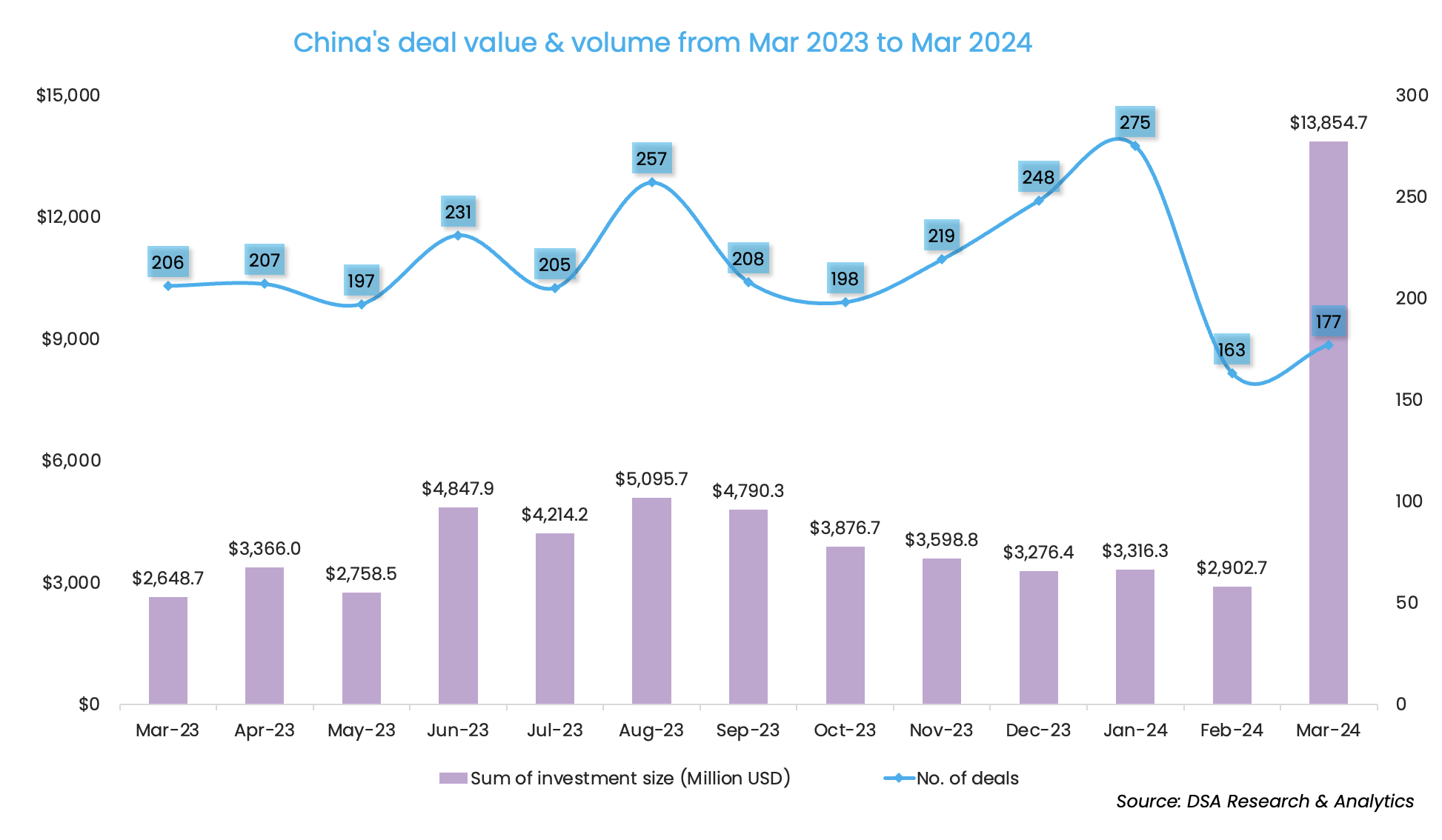

March was a record-breaking month for startup fundraising in Greater China after a cautious start to the year in January and muted dealmaking amid the Lunar New Year holidays in February.

Last month, 177 privately-held firms headquartered in mainland China, Hong Kong, Macau, and Taiwan raised almost $13.9 billion—the largest monthly deal value since DealStreetAsia started tracking deals in April 2020.

The monthly deal value skyrocketed 377.3% from the prior month, while the deal count was an 8.6% month-on-month (MoM) increase, according to proprietary data compiled by DealStreetAsia. The growth was largely due to three billion-dollar deals that accounted for 78.7% of the month’s total financing.

The big-ticket deals also gave a head start to fundraising in the first quarter of 2024 as deal value rose 36.6% year-on-year (YoY) in the first three months to $20.1 billion. The deal count remained flat in the period.

The retreat of US dollar investors, amid high interest rates and macro uncertainties, has created a dynamic shift in the 21-trillion-yuan (around $3 trillion) private fund industry in China that is now witnessing the dominance of RMB-denominated government capital in tech innovations and startup incubation.

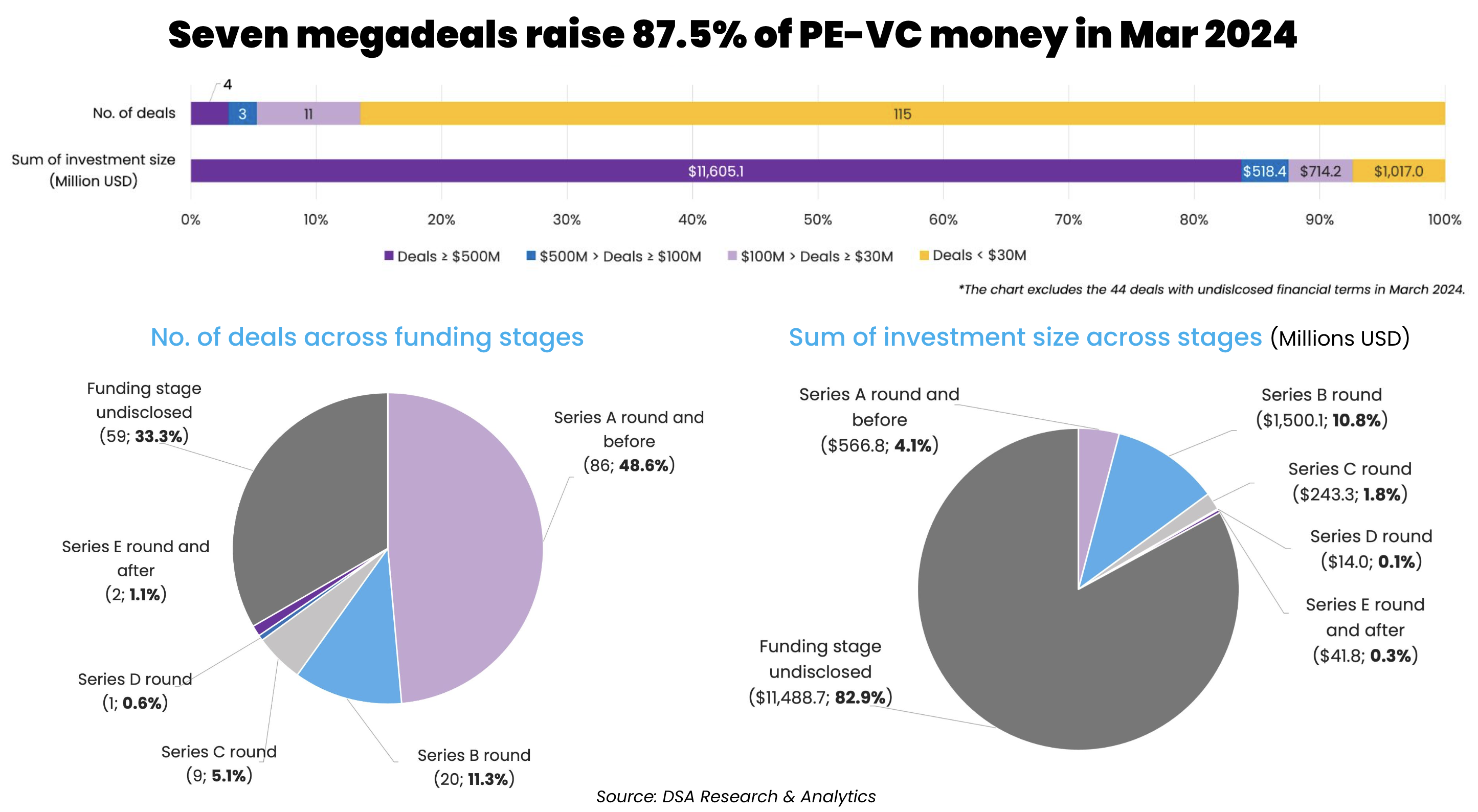

Megadeals account for 87.5% of monthly fundraising

March saw the completion of three deals worth over $500 million. The top fundraiser of the month was Chinese real estate behemoth Dalian Wanda’s shopping mall operation unit, which received an investment of $8.3 billion from a consortium led by private equity firm PAG.

ChangXin Technology Group, the holding firm of ChangXin Memory Technologies (CXMT), which was in the process of raising almost 10.8 billion yuan ($1.5 billion)—at a pre-money valuation of around 140 billion yuan ($19.4 billion)—was the second largest deal of the month.

This was followed by premium electric vehicle brand IM Motors’ 8-billion-yuan ($1.1 billion) Series B round as the firm sketches plans on new smart car models and technologies. The round was one of the largest investments by Chinese EV firms after CYVN Holdings, an investment vehicle majority-owned by the Abu Dhabi Government, injected $2.2 billion into EV maker NIO in December 2023.

The three billion-dollar investments above were part of the seven megadeals, or investments worth at least $100 million. The seven megadeals cumulatively raised $12.1 billion, or 87.5% of the month’s total financing. The big-ticket deals were across strategic sectors including EVs, renewable energy, and software.

Investments at Series A and earlier funding stages remained dominant in March—there were 86 transactions in the earliest funding stages, accounting for almost half (48.6%) of the deal count. Meanwhile, dealmaking slid sharply in companies approaching the public listing stages, as the exit outlook remains uncertain.

List of megadeals (Mar 2024)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| Newland Commercial Management | Dalian | 8300 | PAG, CITIC Capital, Ares Management, Platinum Peony (affiliated with Abu Dhabi Investment Authority), Mubadala Investment Company | Real Estate Development & Operating Company | N/A | |||

| ChangXin Technology Group (holding firm of ChangXin Memory Technologies) | Hefei | 1500 | Equity Financing | GigaDevice Semiconductor, Hefei Changxin Integrated Circuit, Hefei Industry Investment, CCB Financial Asset Investment, ICBC Asset Management, and others | Semiconductor | N/A | ||

| IM Motors | Shanghai | 1112.4 | B | Bank of China Asset Management | ABC Investment, Lingang Group, Contemporary Amperex Technology Co Ltd (CATL), Momenta, Qingtao Energy Development, and others | Automobiles & Parts | Electric/Hybrid Vehicles | |

| Huakong Power Group | Beijing | 692.7 | Tamarace Capital, Qingwang Fund | Renewable Energy | N/A | |||

| PATEO | Shanghai | 207.8 | Automobiles & Parts | Internet of Things | ||||

| Hozon New Energy Automobile | Shanghai | 200 | Hong Kong SAR Government | Automobiles & Parts | Electric/Hybrid Vehicles | |||

| UnionTech Software Technology | Beijing | 110.6 | B, B+ | B: Beijing Jiashu Investment, B+: Beijing Information Technology Industry Investment Fund | Software | N/A |

Showing 1 to 7 of 7 entries

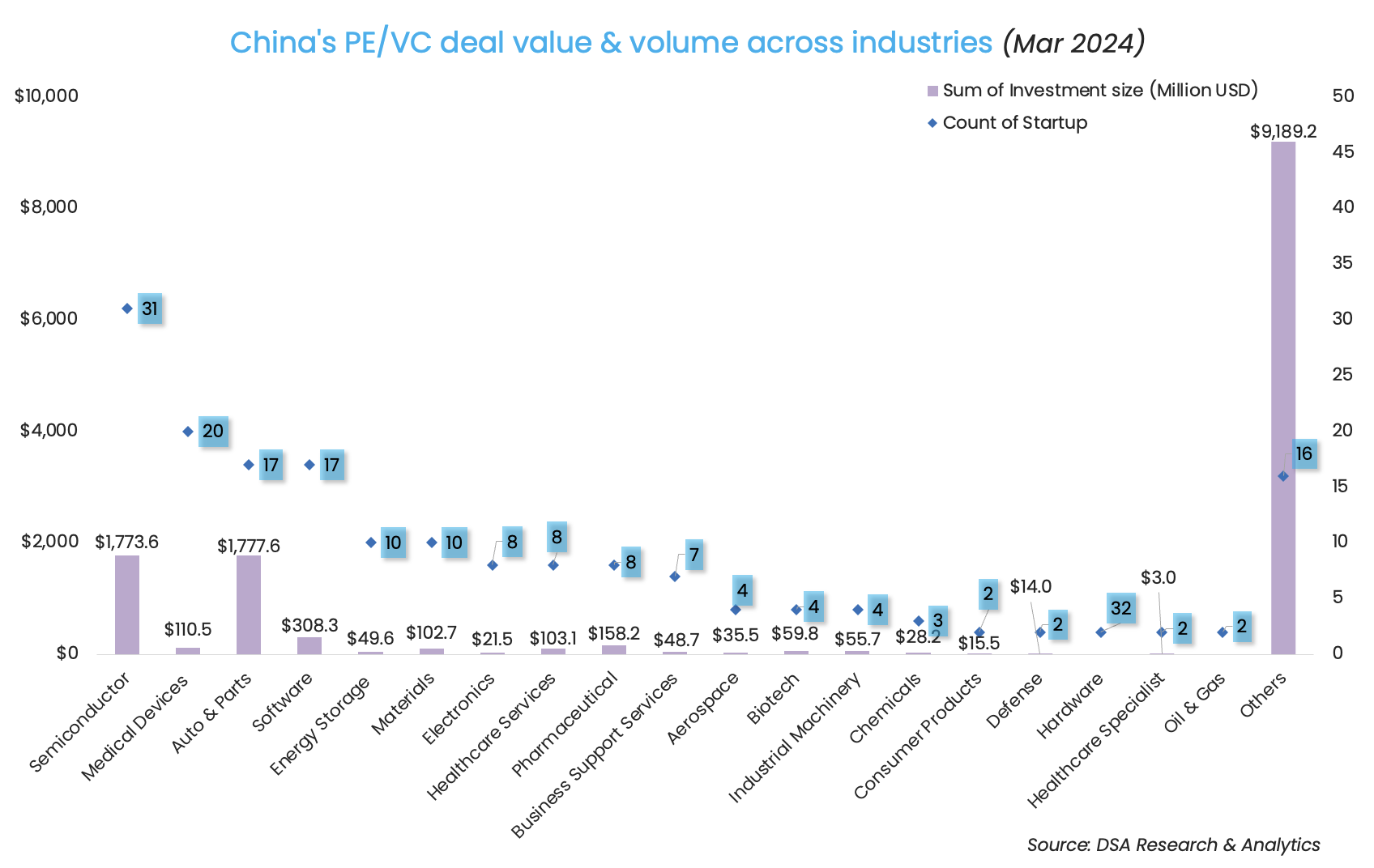

Chip-making firms go from strength to strength

Semiconductor remains the most sought-after sector for investors in China, as the country strives for self-reliance amid continuing Sino-US geopolitical tensions. Thirty-one chip-making firms sealed deals in March, raising an aggregate of $1.8 billion.

China has reportedly been in the process of raising over $27 billion for its largest chip-dedicated investment fund to date, according to a report published by Bloomberg in early March.

Also known as the Big Fund, the National Integrated Circuit Industry Investment Fund, which was set up in 2014 by the Ministry of Industry and Information Technology and Ministry of Finance to give a fillip to the Chinese circuit chip industry to achieve economic self-sufficiency, is currently raising funds from local governments and state-owned firms for its third fund, per the report.

The real estate sector topped in terms of deal value even though the sale of Dalian Wanda’s 60% stake in its mall unit to the PAG-led consortium was the only deal in the space. The move comes after the cash-strapped property giant’s plan to sell some of its core business units to prevent liquidations.

CAS Star is the top investor

CAS Star, a Chinese investment firm focusing on early-stage hard tech startups, was the most active investor by deal count, investing at least $69.8 million into six startups.

The firm, led by co-founding partner Mi Lei, a hard-tech industry veteran and researcher at the Xi’an Institute of Optics and Precision Mechanics of the Chinese Academy of Sciences (CAS), had invested in 420 deep-tech firms, as of May 2023. Dually-headquartered in Beijing and Xi’an, the firm currently oversees 8.1 billion yuan ($1.1 billion) in assets under management (AUM), according to its website.

Previously, CAS Star was the most active investor by deal sum in February, thanks to its participation in the megadeal of Shanghai Spacecom Satellite Technology.

Most active investors in China (March 2024)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| CAS Star | 6 | 69.8 | 2 | 4 |

| China Merchants Group & affiliates | 4 | 111.2 | 1 | 3 |

| Wuxi Venture Capital Group | 4 | 17 | 0 | 4 |

| Legend Holdings & affiliates | 3 | 28 | 0 | 3 |

| SAIC Motor & affiliates | 3 | 1140.4 | 1 | 2 |

| Shenzhen Capital Group | 3 | 29.7 | 1 | 2 |

| Addor Capital | 3 | 14 | 0 | 3 |

| Shunwei Capital | 3 | 42 | 1 | 2 |

| Z&Y capital | 3 | 41.8 | 0 | 3 |

| Baidu & affiliates | 3 | 43.3 | 0 | 3 |

Showing 1 to 10 of 13 entries

Note: In our monthly analysis for March 2024, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Startup funding hits three-month high of $498m in March Edit

Startups in Southeast Asia garnered approximately $498 million in funding in March—a 28% increase from the previous month and the highest amount raised so far this year, according to proprietary data compiled by DealStreetAsia.

Venture Capital

India Deals Barometer Report: PE/VC investments in startups breach billion-dollar mark in March

Private equity and venture capital investments in Indian startups surpassed the billion-dollar mark for the first time this year in March, touching $1.06 billion, according to proprietary data compiled by DealStreetAsia.