China Deals Barometer Report: PE-VC fundraising remains muted in Q1 despite uptick in March

Startup financing in Greater China showed some signs of recovery in March, although worries over another wave of regulatory crackdowns by Beijing still stand in the way of the market bouncing back to levels seen in 2021.

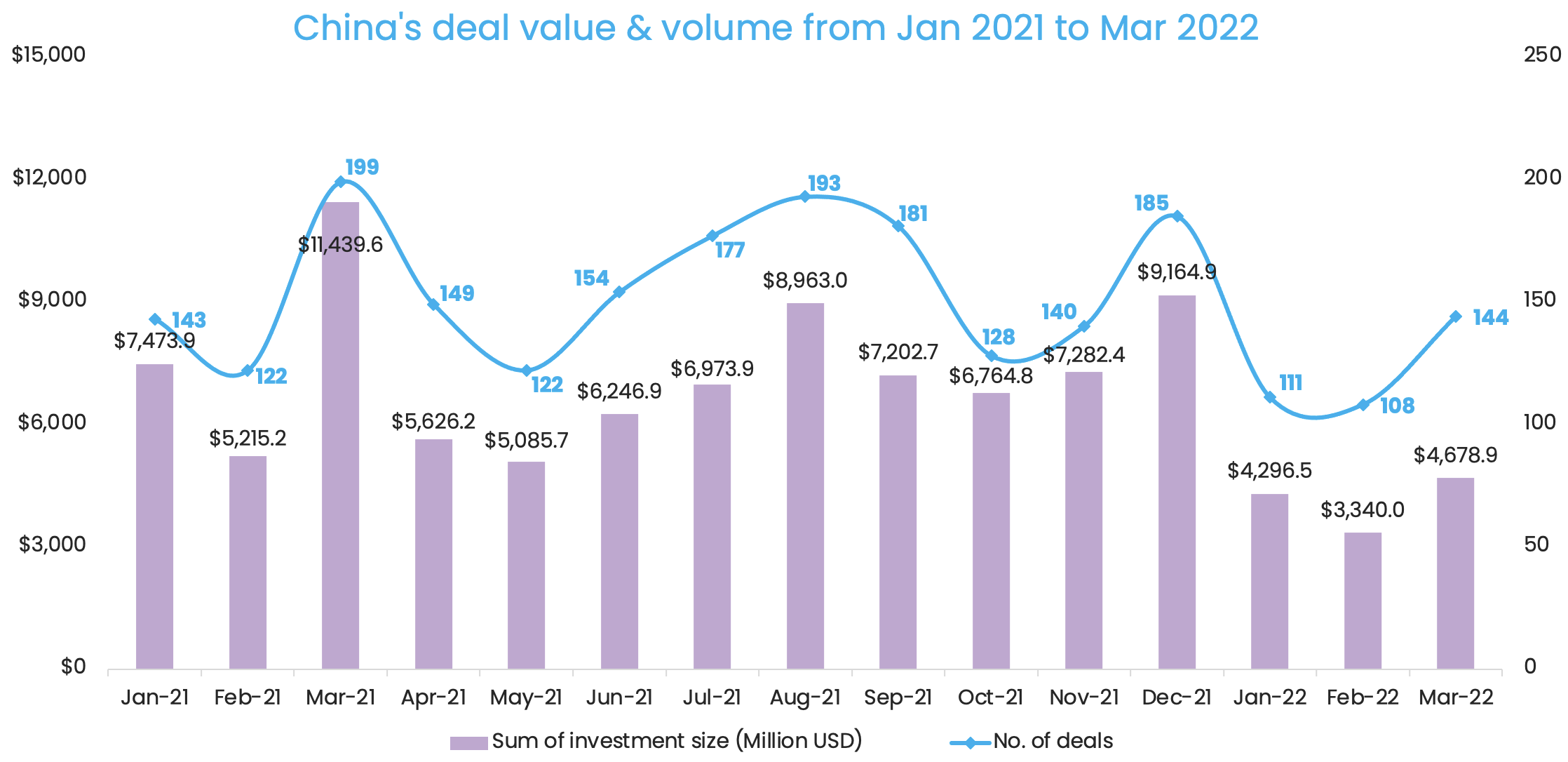

Privately-held companies raised close to $4.7 billion from 144 venture deals in March 2022. The total financing value increased by 40.1%, while the number of transactions grew by 33.3% compared with the previous month, according to proprietary data compiled by DealStreetAsia.

But the dealmaking activity in the first quarter of this year still lacks the vitality that was seen last year. Between January and March, Greater China-based startups completed a total of 363 venture deals, raising a combined $12.3 billion. The quarterly deal value almost halved from $24.1 billion in the same quarter of 2021, and the number of deals declined by 21.8% from 464 deals.

Investors are still jittery over the likelihood of a new round of government scrutiny of the tech sector, the prolonged Sino-US trade frictions, and Russia’s invasion of Ukraine, given Beijing’s close ties with Moscow.

Moreover, given the less-than-satisfactory performance of newly-listed companies on stock exchanges in Greater China in the first quarter of 2022, investors are expected to be more selective in making new bets.

Data compiled by China Venture, a Chinese media outlet that focuses on the private equity (PE) and venture capital (VC) market, show that 20 out of 84 newly-listed companies on mainland stock exchanges in Q1 2022 traded below their offering prices on market debut.

For companies that listed in Hong Kong in Q1 2022, the figure stood at 61.5%. The number of IPOs in the city also reduced to half of that in Q1 2021.

Real estate, auto & logistics lead megadeals

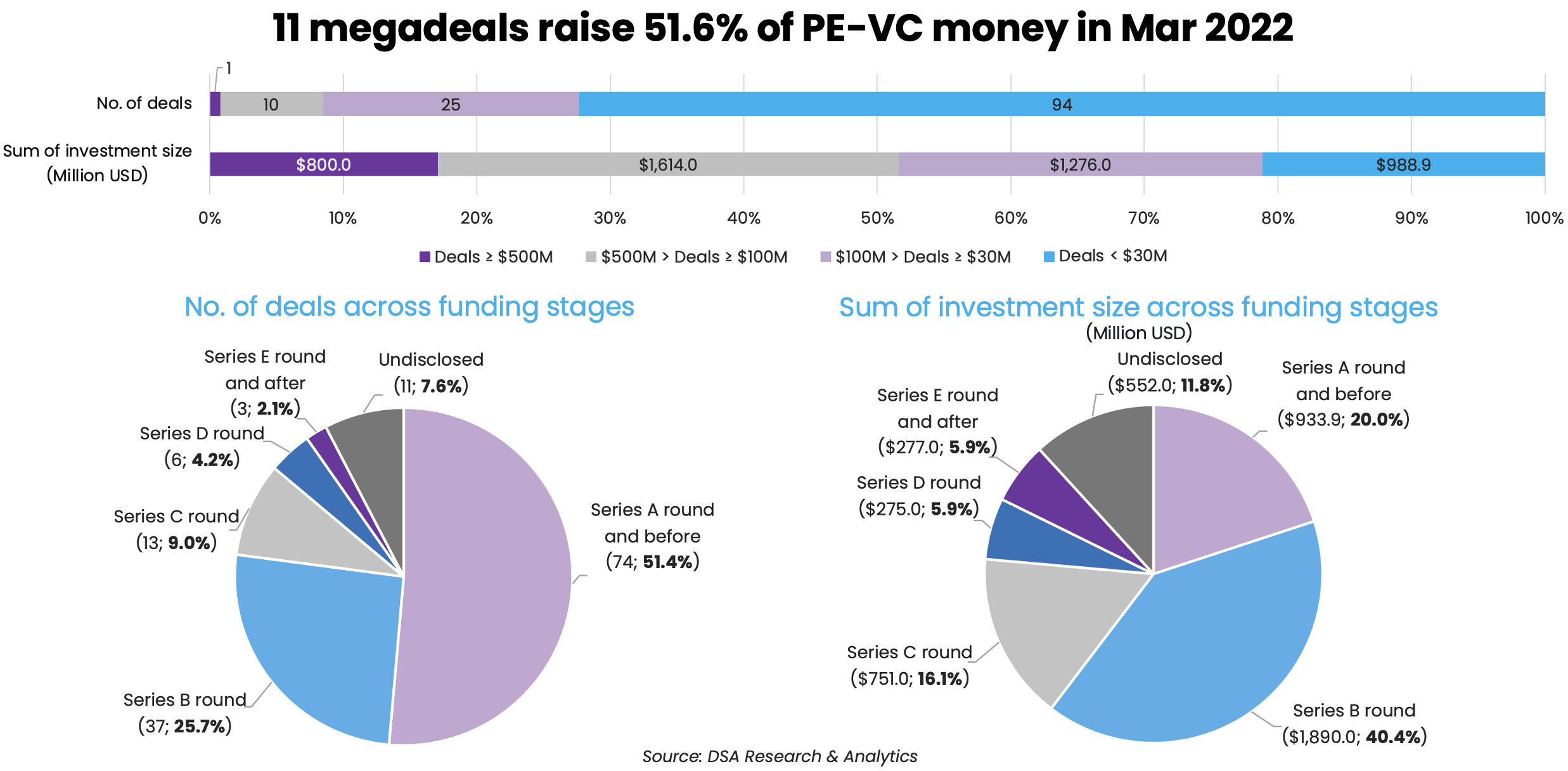

Megadeals at a size of $100 million and above contributed to the bulk of startup financing in March. The month marked the completion of 11 megadeals that collectively raised over $2.4 billion, or 51.6% of the total funding.

In comparison, in February, there were only eight megadeals worth approximately $1.4 billion. In January, 16 megadeals secured about $2.6 billion.

Among the 11 megadeals in March, the capital raised across the fields of semiconductor, consumer products, biotech, and software took up a sizeable chunk. But real estate and automobile-related businesses – including self-driving solutions and electric vehicle (EV) battery developers, as well as logistics service companies – demonstrated better capabilities in attracting big-ticket investments.

JD Property, the real estate arm of Chinese e-commerce giant JD.com, raked in about $800 million in a Series B round from investors including Warburg Pincus and Hillhouse Capital Group. As the biggest venture deal in March, its Series B round came just over one year after the completion of the firm’s Series A round at $700 million.

JD Property planned to use the new proceeds to expand business and strengthen its modern logistics infrastructure property management capabilities. JD.com would remain as the majority shareholder of JD Property after the completion of the deal.

SJ Semiconductor, which offers 12-inch wafer bumping and testing services, raised $300 million in a Series C round from investors like China’s CICC Capital, Country Garden Venture Capital (CGVC), and Walden CEL Global Fund. The deal, which was the second-largest in the month, valued the firm at over $1 billion and brought its total fundraising size to $630 million.

About $817 million worth of megadeals were made in startups that develop tech-enabled solutions to help enhance the efficiency of the traditional automobile and logistics industries.

As the latest fundraisers riding on a period of unprecedented acceleration across self-driving technology, robotaxis, lidars, chips for vehicle automation and beyond, EV batteries manufacturer Phylion received $236 million in new funding. Soterea, which offers intelligent solutions to enhance driving safety for commercial vehicles, and self-driving systems maker Zongmu Technology garnered $204 million and $157 million, respectively.

In the logistics space, CMST, an affiliate of China’s state-backed CMST Development, closed a $120-million Series D round to better serve cargo owners and truck drivers with its intelligent supply chain services platform. Another logistics platform startup Jumeng Gongjian secured $100 million in its Series B2 round to digitise the less-than-truckload (LTL) logistics market.

The $800-million investment in JD Property boosted Series B to become the best-funded investment stage with 40.4% of the invested capital in March. In terms of the deal count, Series A continued to lead, and earlier funding stages generally saw more active dealmaking than later ones.

List of 11 megadeals in March 2022

| Startup | Headquarters | Investment size (USD) | Investment stage | Lead investor(s) | Investor(s) | Industry | Vertical |

|---|---|---|---|---|---|---|---|

| JD Property | Beijing | $800 million | B | Warburg Pincus, Hillhouse Capital | Real Estate | Real Estate Tech | |

| SJ Semiconductor | Jiangyin | $300 million | C | Walden CEL Global Fund, CCB Private Equity Investment Management, CCB Trust, Country Garden Venture Capital, Huatai International, Oriza Rivertown, Oriza Hua Capital, CICC Capital | Semiconductor | N/A | |

| Phylion | Suzhou | $236 million | Shenzhen Capital Group | Energy Storage | Electric/Hybrid Vehicles | ||

| Soterea | Hangzhou/Tianjin | $204 million | B | Ping An Capital | SK China, Harvest Capital Management, Henan Investment Group | Auto & Parts | Autonomous Driving |

| JMGO | Shenzhen | $157 million | OPPO, IDG Capital, Lexun Tiancheng | Consumer Products | IoT | ||

| Zongmu Technology | Shanghai | $157 million | E | Dongyang State-Owned Assets Investment | Sunic Capital, Zuoyu Capital, Fellow Partners, Zhejiang Huzhou Huantaihu Group, Cantor Investment | Auto & Parts | Autonomous Driving |

| CMST | Nanjing | $120 million | D | China State-Owned Enterprise Mixed-Ownership Transformation Fund, Kwoyuen New Energy, Yuegao Capital, Henan Yuanhai Zhongyuan Logistics Industry Development Fund, Yuanhai (Qingdao) Industry Investment Fund, CMST Development | Logistics & Distribution | IoT | |

| XVERSE | Shenzhen | $120 million | A, A+ | A+: Sequoia Capital China; A: GL Ventures | A+: Temasek, CPE, Gaorong Capital, 5Y Capital, GL Ventures | Internet | N/A |

| InnoRNA | Shenzhen | $120 million | B | CDH Investments, Huaxing Healthcare Capital, HHF Capital | Biotech | Biotech | |

| Dianxiaomi | Beijing | $100 million | C | Tiger Global Management, Huaxing Growth Capital | GGV Capital, CDH Venture and Growth Capital (VGC), Gaorong Capital | Software | SaaS |

| Jumeng Gongjian | Hefei | $100 million | B2 | Fortuna Capital | IDG Capital | Logistics & Distribution | IoT |

Frenzied biotech dealmaking vs. stock rout

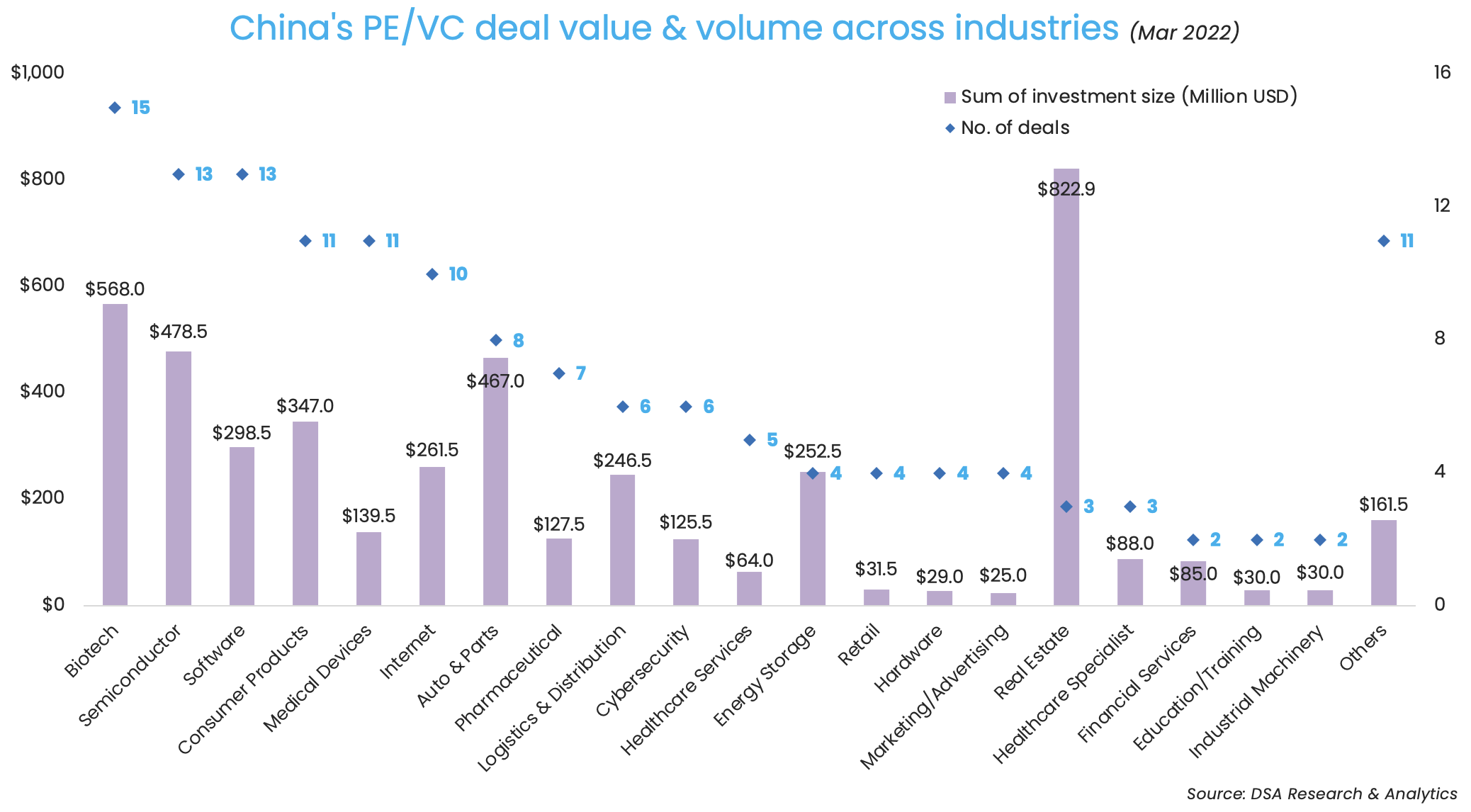

Real estate was perched firmly on top in terms of fundraising although only three deals were completed in the sector.

Biotech, which has emerged as a popular portfolio component in the past two years due to rising health awareness amid the COVID pandemic, ranked first in terms of the number of transactions in March. Biotech marked the completion of 15 deals worth a combined $568 million.

The biggest of all was a $120-million Series B round raised by InnoRNA, which intended to use the capital for the expansion of a new product pipeline and the development of messenger RNA (mRNA)-based therapeutics.

The transaction sizes of another three biotech deals fell in the range of $50-100 million. Publicly-listed drug maker Betta Pharmaceuticals agreed to pay $73 million for a 7.6% stake in Healthgen Biotechnology, a manufacturer of plant-based proteins and peptides for usage in cosmetic additives and pharmaceutical research.

MediLink Therapeutics collected $70 million in a Series B round co-led by LYFE Capital and Qiming Venture Partners to fund the clinical trials of its pipeline of biological drug candidates. Argo Biopharm completed a $63-million Series A round led by Loyal Valley Capital as it targeted to speed up the IND application of its cardiovascular disease and rare disease-focused pipelines.

In contrast to the dealmaking frenzy around private biotech startups, the performance of their listed counterparts was bleak, especially those that have yet to turn a profit. Shouyao Holdings Beijing, which went public on Shanghai’s Nasdaq-style STAR Market in March, now commands a market cap of less than 3.5 billion yuan ($549.7 million). That is a drop of about 42.9% from a post-money valuation of over 5 billion yuan ($785.3 million) when it closed its third venture round in 2020.

Similarly, the market cap of Hong Kong-listed CANbridge Pharmaceuticals fell to less than HK$2 billion ($255.2 million) in roughly five months from its pre-IPO valuation of 3.4 billion yuan ($534 million). Also, Broncus Holding Corp, which was valued at 4.7 billion yuan ($738.2 million) before its Hong Kong listing last September, lost more than three-quarters of its market cap.

As investors continued to be bullish on rising healthcare and pharmaceutical needs from China’s shifting demographic, they were also clearly cautious of late-stage biotech investments, as 13 out of the 15 biotech deals in March were made in Series A and Series B funding stages.

GL Ventures is the top investor

GL Ventures, the VC arm of Asia-focused PE powerhouse Hillhouse, overtook Sequoia Capital China to become the most active investor in March. It participated in 11 deals, collectively worth $247.5 million.

The two-year-old, dual-currency VC company led five of the 11 deals it participated in. This includes one megadeal, i.e., the first tranche of a $120-million Series A round by 3D user-generated content (UGC) platform XVERSE. The other 10 deals included a $31 million series pre-A round in UniXell, which develops cell therapies for the treatment of cancer and neurogenerative disorders, and nine deals at a size of $15 million or smaller across a range of sectors such as auto & parts, medical devices, retail, semiconductor, and software.

Hillhouse set up GL Ventures in early 2020 to primarily invest in early-stage startups in four areas — biopharmaceutical and medical apparatus, software services, and technological innovation, consumer-oriented Internet and technologies, and emerging consumer brands and services. Chinese state media Xinhua News Agency reported that the arm started with a 10-billion-yuan ($1.6 billion) fund, and could write cheques worth between 3 million yuan ($471,038.9) and $30 million.

Most active investors in Greater China (Mar 2022)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| GL Ventures | 11 | $247.5 million | 5 | 6 |

| Sequoia Capital China | 9 | $265 million | 3 | 6 |

| Shenzhen Capital Group | 6 | $404 million | 3 | 3 |

| IDG Capital | 6 | $303.5 million | 2 | 4 |

| China Merchants Group and affiliates | 6 | $152 million | 3 | 3 |

| CICC Capital | 5 | $440 million | 3 | 2 |

| Country Garden Venture Capital (CGVC) | 5 | $325 million | 2 | 3 |

| CDH Investments | 5 | $317 million | 4 | 1 |

| Gaorong Capital | 5 | $297 million | 1 | 4 |

| Cowin Capital | 5 | $135.5 million | 2 | 3 |

| *If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

IPO prospects

Exits through IPOs on stock exchanges in Greater China could still be abundant this year given the solid Q1 performance. A KPMG report shows that the Shanghai stock exchange ranked first globally with total IPO fundraisings of $17.3 billion in Q1 2022, accounting for over 33.1% of the capital raised across stock exchanges worldwide.

Although Hong Kong had a slow start in the quarter with only HK$13.8 billion ($1.8 billion) raised across 15 listings, the report projects the city’s IPO market to gain more traction in the second half of this year with its pipeline of more than 150 listing applicants.

Liya Su contributed to the story.

Note: In our monthly analysis for March 2022, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

- Caocao Mobility

- CICC Capital

- FerroTec

- semiconductor

- Sequoia Capital China

- software

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

India Deals Barometer Report: Startups raise $4b in March, record 10% jump from Feb

Indian startups raised about $4 billion in funding across 163 private equity (PE) and venture capital (VC) transactions...

Venture Capital

SE Asia Deals Barometer Report: PE-VC funding dips 25% to $1.46b in March

Venture capital (VC) and private equity (PE) funding in Southeast Asia slowed by 25% in March...