Greater China Deals Barometer Report: Startup funding declines 41% YoY in June as investor caution continues

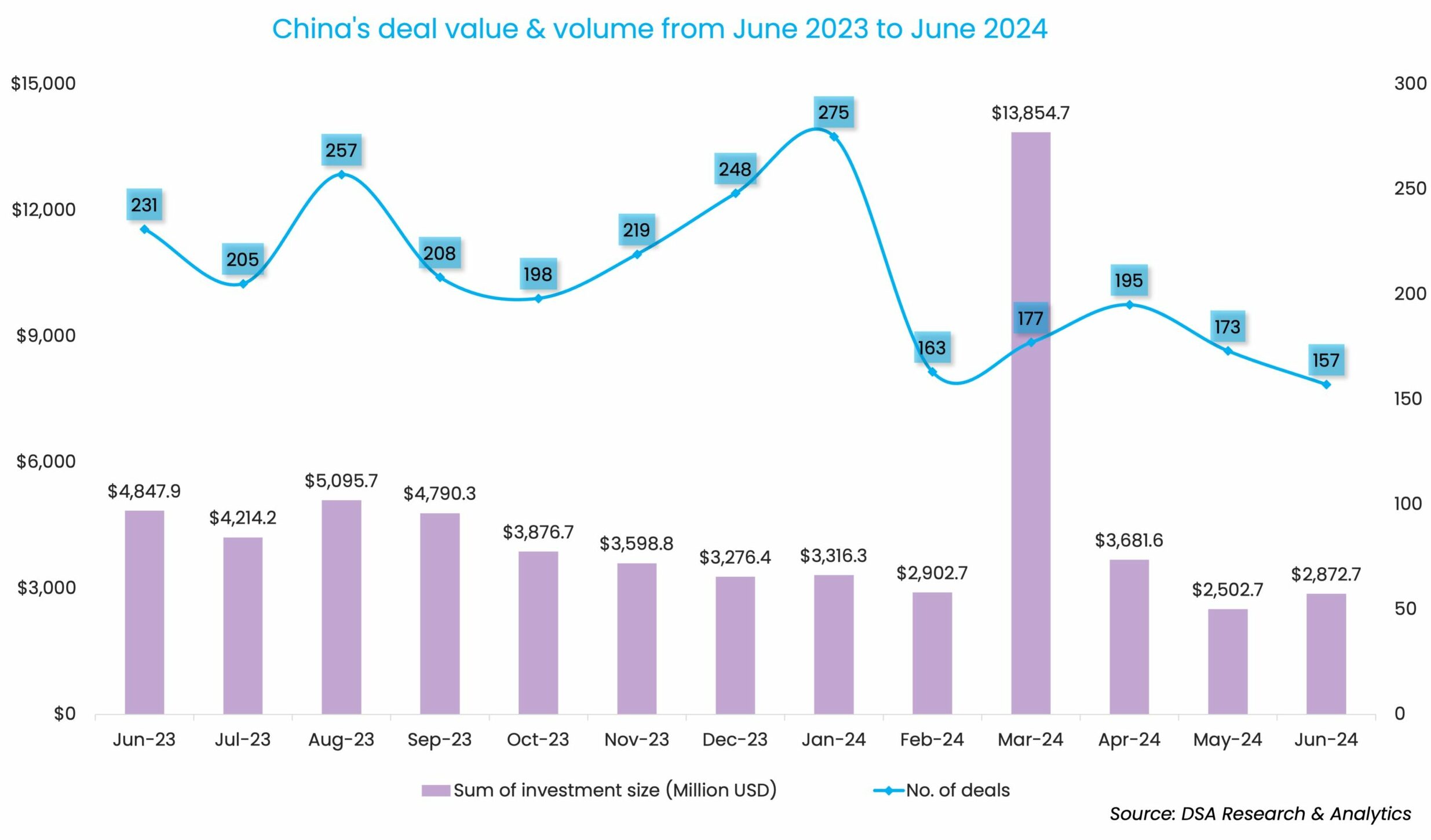

Startup financing in Greater China logged a 41% year-on-year (YoY) decline in June as macro uncertainties, geopolitical tensions, and a tepid exit landscape continue to dampen investor interest.

In June 2024, privately held companies headquartered in mainland China, Hong Kong, Macau, and Taiwan raised nearly $2.8 billion through the completion of 157 deals compared to $4.8 billion across 231 transactions in the corresponding period last year, according to proprietary data compiled by DealStreetAsia.

June saw a month-on-month (MoM) uptick of 14.8% in deal value thanks to the completion of seven megadeals or investments worth at least $100 million. However, deal volume continued to slide since April 2024, down by 9.2% MoM.

Overall, the first half of 2024 saw the completion of 1,140 venture deals raising $29.1 billion. Venture investors pledged 13.5% more capital in H1 2024, although the deal count was 9% less than the same time last year.

Megadeals dominate startup funding scene

Megadeals emerged as a major contributor securing almost $1.8 billion via seven transactions, accounting for 62.1% of the total deal value.

Regional Link Telecom Services Holdings, the copper and fibre connection access service arm under Hong Kong’s major telecom group PCCW, sealed the biggest deal of the month after China Merchants Capital announced its plans to acquire a 40% stake in the fiber unit for $870 million.

The second-largest deal of the month was Space Pioneer, which pocketed over 1.5 billion yuan ($207 million) in a Series C+ round of financing to advance its product portfolio including medium and large liquid launch vehicles and rocket engines.

In another megadeal, Youibot Robotics, which develops autonomous mobile robots (AMRs) and automation solutions, completed its Series C funding round, counting Hefei Dongcheng Industry Investment, a state capital investor in Hefei City in eastern China, among investors.

The remaining megadeals are scattered across automobile, aerospace, biotech, and semiconductor industries.

Series A and earlier funding stages dominated the deal count. At 85, early-stage deals accounted for 54.1% of the total deal count while collectively raising $579.4 million, or 20.2% of the total startup funding.

In the largest Series A fundraising, KargoBot, an autonomous driving startup developing eco-friendly robo trucks — incubated by China’s largest ride-hailing company Didi Global — raised 600 million yuan ($82.6 million) to speed up the mass adoption and commercialisation of its Level 4 self-driving technologies designed for a truck fleet.

Late-stage deal-making activity stayed sluggish, with only one deal being sealed at Series E or after.

List of megadeals (June 2024)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| Regional Link Telecom Services Holdings Limited | Hong Kong | 870 | Equity Financing | China Merchants Capital | Telecoms | N/A | ||

| Space Pioneer/Tianbing Technology | Beijing | 207 | C+ | Liangxi Technology and Innovation Industry Fund-of-Funds (managed by Broad Vision Fund), Wuxi Industry Development Group, CMG Media Convergence Industry Investment Fund, and others | Aerospace | Space Tech | ||

| Youibot Robotics | Hefei | 193 | C | Hefei Dongcheng Industry Investment | Logistics & Distribution | Robotics & Drones | ||

| LeeKr Technology | Shanghai | 137.8 | C | Hangzhou Fuchunwan Xincheng Development Fund, CyberNaut, Hefei Construction Investment and Holding, Hefei Baohe Linghang Fund, and others | Automobiles & Parts | Electric/Hybrid Vehicles | ||

| MinoSpace Technology | Beijing | 137.7 | C1 | Wuxi Economic Development Zone Shangxian Industry Investment Fund (managed by SIP Oriza PE Fund Management) | Liangxi Technology and Innovation Industry Fund-of-Funds (managed by Broad Vision Funds), Qingdao Huizhu Anfulan | Aerospace | Space Tech | |

| Starshine Semiconductor | Wenzhou | 137.6 | B | China Mobile, Wenzhou Wanxin District Industry Investment Platform | Semiconductor | N/A | ||

| METiS Pharmaceuticals | Hangzhou | 100 | C | CICC Capital | Taiping Hong Kong Insurance Innovation and Technology Venture Fund (affiliated with China Taiping Insurance Group) | Biotech | HealthTech |

Aerospace startups rise to prominence

Aerospace startups have been riding on tailwinds in June as the country further pushes the so-called “low-altitude economy” – driven by the range of manned and unmanned aviation activities.

Shanghai-based eVTOL aircraft developer Volant Aerotech is one of the firms tapping into the low-altitude economy. The firm sealed another nine-digit funding round bringing its total fundraising this year to at least 300 million yuan ($41.4 million).

June recorded two megadeals in the space tech sector with Space Pioneer’s Series C+ round and satellite manufacturer MinoSpace Technology’s Series C1 round.

MinoSpace Technology completed the fifth-largest megadeal of June – securing a total of 1 billion yuan ($137.7 million) in a round led by the Wuxi Economic Development Zone Shangxian Industry Investment Fund.

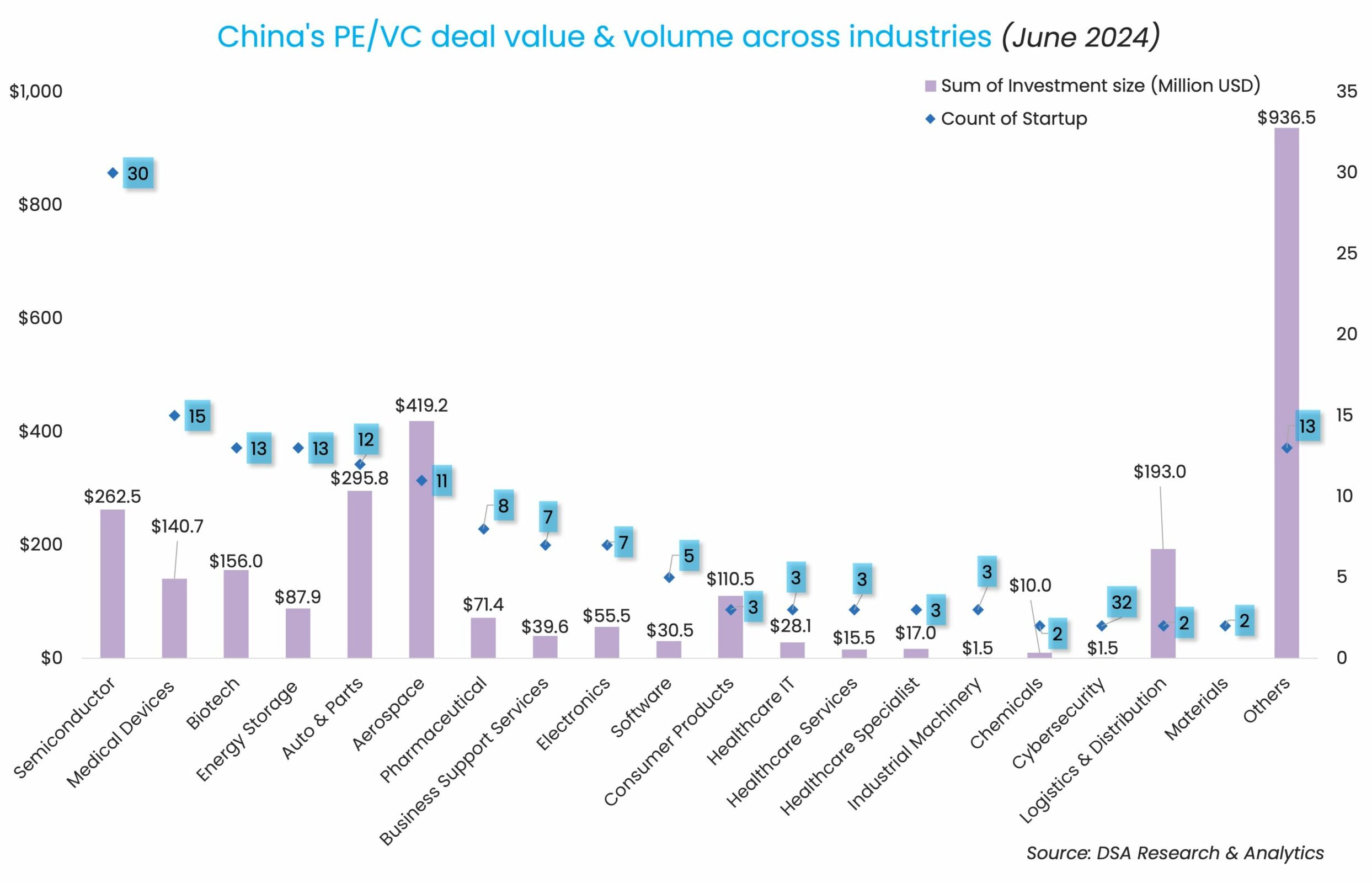

The two megadeals contributed to 82.2%, or $344.7 million of the total aerospace funding of the month. Overall, a total of 11 aerospace startups raised $419.2 million in June.

Semiconductor startups sealed the most deals in June, with the completion of 30 deals raising a total of $262.5 million. Thanks to China Merchants Capital’s 40% stake acquisition at Regional Link, telecom emerged as the most-invested sector by deal sum.

Qiming is the most active investor

Venture capital major Qiming Venture Partners was the most active investor of the month in terms of deal count. The firm splurged a total of $138.4 million across four startups.

Founded in 2006, Qiming, which manages 11 US dollar funds and seven RMB funds with $9.5 billion in capital raised, invests in early- and growth-stage opportunities across the technology and consumer and healthcare industries, according to its website.

State-owned China Merchant Group topped the investor list in terms of deal value mostly thanks to its investment into the copper and fibre connection access service arm under the telecom group controlled by Hong Kong billionaire Richard Li.

The month also saw US-headquartered Matrix Partners rebranding its China unit from Matrix Partners China to MPC, making it one of the latest China-focused VC firms to shed its Silicon Valley lineage.

Most active investors in China (June 2024)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Qiming Venture Partners | 4 | $138.4 | 1 | 3 |

| Wuxi Venture Capital Group | 3 | $44.3 | 1 | 2 |

| CICC Capital | 3 | $114 | 3 | 0 |

| Oriza Holdings & its affiliates | 3 | $153.2 | 2 | 1 |

| China Merchants Group & its affiliates | 3 | $870 | 1 | 2 |

| MiraclePlus | 3 | $4.5 | 0 | 3 |

| Shenzhen Capital Group | 2 | $15.5 | 1 | 1 |

| Legend Holdings & its affiliates | 2 | $14 | 1 | 1 |

Note: In our monthly analysis for June 2024, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries and over 45 new-economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Startup fundraising falls 11% in June as investors sign smaller cheques

Startup funding in Southeast Asia dipped in June, after hitting a five-month high in May, in another reminder of the stubborn challenges that persist in private capital fundraising in the region.

Venture Capital

India Deals Barometer Report: Startup funding in June crosses $2b for first time in two years

The funding winter that beset India’s startup landscape is showing signs of thawing. The month of June saw private funding for local startups cross the $2-billion mark for the first time in two years, finds data compiled by DealStreetAsia.