China Deals Barometer Report: At 236 PE-VC transactions, dealmaking volume dips a tad in July

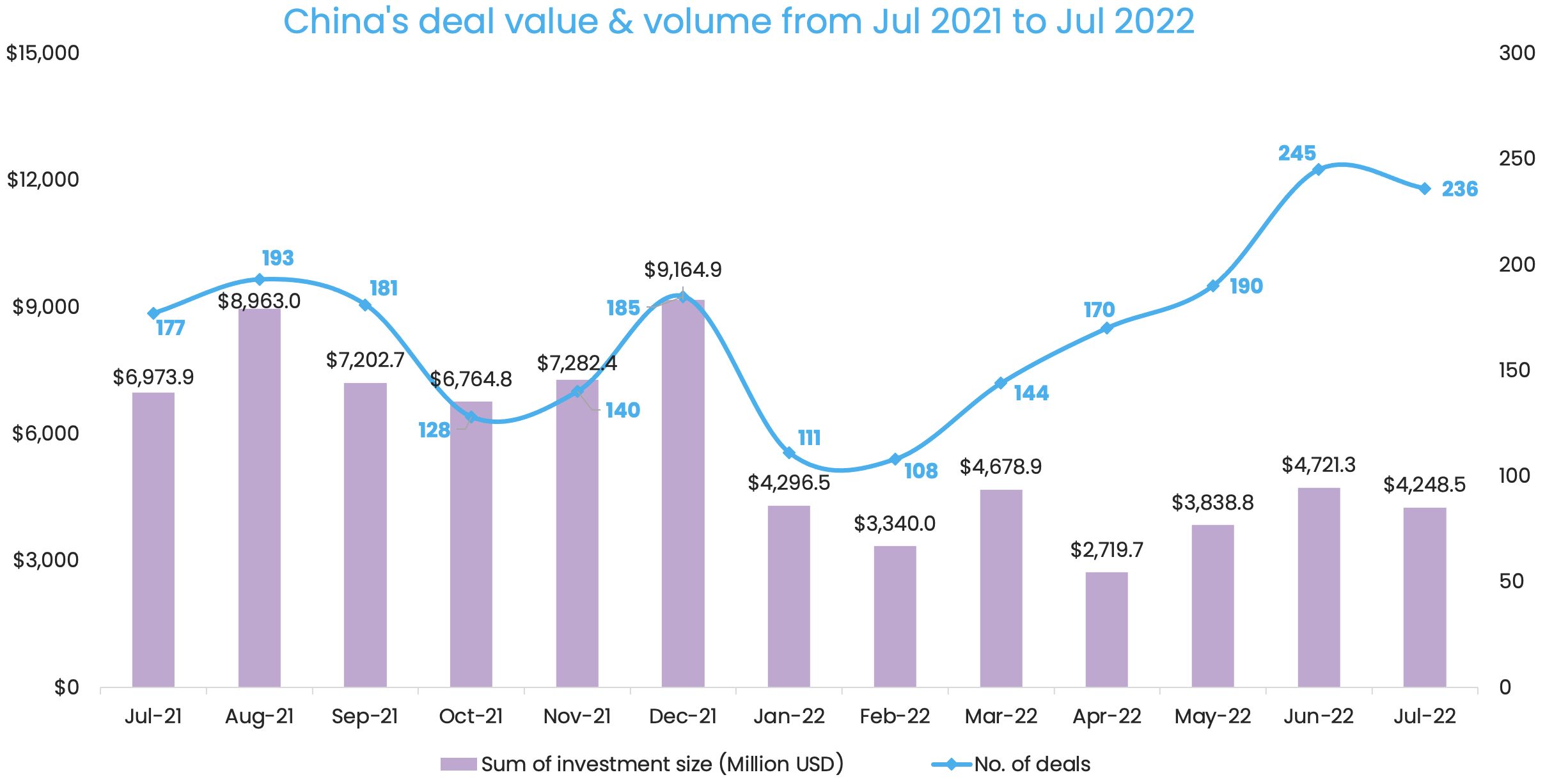

Dealmaking in Greater China slackened in July but still managed to remain at elevated levels as startups sealed 236 venture investments worth a combined $4.2 billion.

The deal value in July decreased by 10% from June, while the deal count declined slightly by 3.7% from the previous month, according to proprietary data compiled by DealStreetAsia. Despite the brake in startup financing month-over-month (MoM), the past month showcased decent market vitality compared with the same time last year when the deal count was a mere 177, or 33.3% less.

However, the fundraising sum so far this year is not as rosy. The aggregate deal value of $27.8 billion in the first seven months of 2022 was not even 60% of that in the same period last year, indicating some degree of hesitation among investors to make heavy bets at a time of global market slowdown.

Chipmakers secure six of July’s 11 megadeals

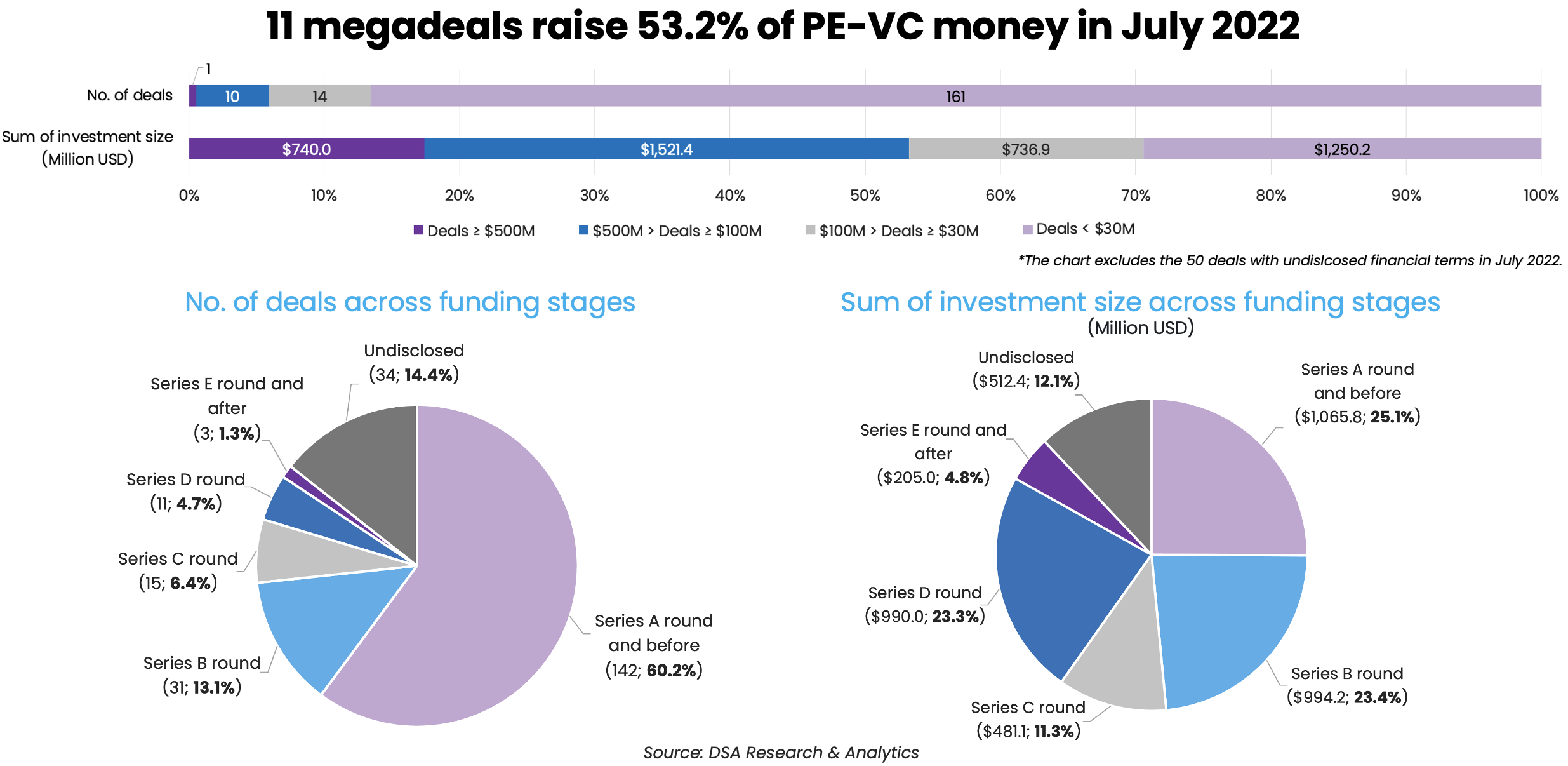

Billion-dollar deals were absent in July, but the month saw the completion of one deal worth over $500 million and another 10 megadeals in the range of $100-500 million.

RT Advanced Materials, a producer of lithium-ion battery materials, pocketed the largest venture deal last month. It closed approximately $740 million in a Series D round from investors including Shang Qi Capital, the private equity (PE) arm of Chinese state-owned automaker SAIC Motor.

Ranking second was a $267-million strategic investment raised by GCL Semiconductor, a domestic developer of silicon materials used in integrated circuits (ICs). Chinese electrical appliance company TCL Technology said it had agreed to make the investment to “enhance core competitiveness in the IC material field” as China moves forward with its “tech self-reliance” and “domestic replacement” targets.

The remaining nine megadeals, which fell within the range of $100-200 million, were completed across the sectors of semiconductor, biotech, healthcare services, industrial machinery, and consumer products. Notably, six of the 11 megadeals last month happened in the semiconductor industry, signalling shifted investors’ interest amid Beijing’s push to develop its hard tech.

The earlier the funding stage, the more active is the dealmaking scene. In July, Series A and earlier stages recorded 142 deals, or 60.2% of the month’s deal count, retaining the title of the most popular funding stage. Its nearly-$1.1 billion capital raised accounted for 25.1% of the total deal value, ranking first despite a dip from June’s 33%.

Due to a rise in growth-stage megadeals, the proportion of capital inflows into Series B, Series C, and Series D funding stages widened to 23.4%, 11.3%, and 23.3% of July’s deal value, respectively. In June, Series B-D stages contributed to 16.9%, 9.5%, and 6.6% of the total financing respectively.

List of megadeals (July 2022)

| Startup | Headquarters | Investment size (Million USD) | Investment stage | Lead investor(s) | Other investor(s) | Industry | Vertical |

|---|---|---|---|---|---|---|---|

| RT Advanced Materials | Daye | $740 | D | Shang Qi Capital | Energy Storage & Batteries | CleanTech | |

| GCL Semiconductor | Xuzhou | $267 | Strategic Investment | TCL Technology | Semiconductor | N/A | |

| Frontera Therapeutics | Suzhou | $160 | B | Boyu Capital, Sequoia Capital China, OrbiMed, Creacion Ventures | Biotech | Biotech | |

| ClinChoice | Shanghai/Washington | $150 | E | Legend Capital | Taikang Life Insurance, Sherpa Healthcare Partners, Lilly Asia Ventures, Apricot Capital | Healthcare Services | N/A |

| MetaX Integrated Circuits | Shanghai | $150 | Pre-B | CCTV Financial Media Industry Investment Fund, Chaos Investment | Shanghai Guosheng Group, Hermitage Capital, Puchao Capital, China Internet Investment Fund, Matrix Partners China | Semiconductor | AI and Machine Learning |

| JAKA Robotics | Shanghai | $150 | D | Temasek Holdings, TrueLight Capital, Softbank Vision Fund 2, Prosperity7 Ventures | Industrial Machinery | Robotics & Drones | |

| SiEngine Technology | Wuhan | $148.2 | A | Sequoia Capital China | Boyuan Capital, China Fortune-Tech Capital, Vision Knight Capital, Shanghai Guosheng Capital, Hundreds Capital, Cedarlake Capital, YUEXIU Industrial Investment Fund Management, ICBC International, Neusoft Capital | Semiconductor | Internet of Things |

| Origin Quantum Computing Technology | Hefei | $148.2 | B | Shenzhen Capital Group’s Hotland Innovation Asset Management | CITIC Securities, China International Capital Corporation (CICC), Bank of China Group Investment Limited (BOCGI), Tianjin Biotechnology Innovation and Incubation Center | Semiconductor | Big Data |

| Iluvatar CoreX | Shanghai | $148 | C+, C++ | Beijing Financial Street (BFS) Capital, HOPU Investments, HOPU-ARM Innovation Fund | ZGC Science City Technology Growth Fund, Shanghai Guosheng Group, Vista Investment, Ding Xiang Capital, Greater Bay Investment Group, Shanghai Free Trade Zone Equity Fund Management | Semiconductor | AI and Machine Learning |

| JLSemi | Shanghai | $100 | C | CITIC Capital, SummitView Capital | Inno-Chip, GP Capital-Xinchao Group joint fund | Semiconductor | Internet of Things |

| XPeng Robotics | Shenzhen | $100 | A | IDG Capital | XPeng Inc | Consumer Products | Robotics & Drones |

Investing in ‘China chip’

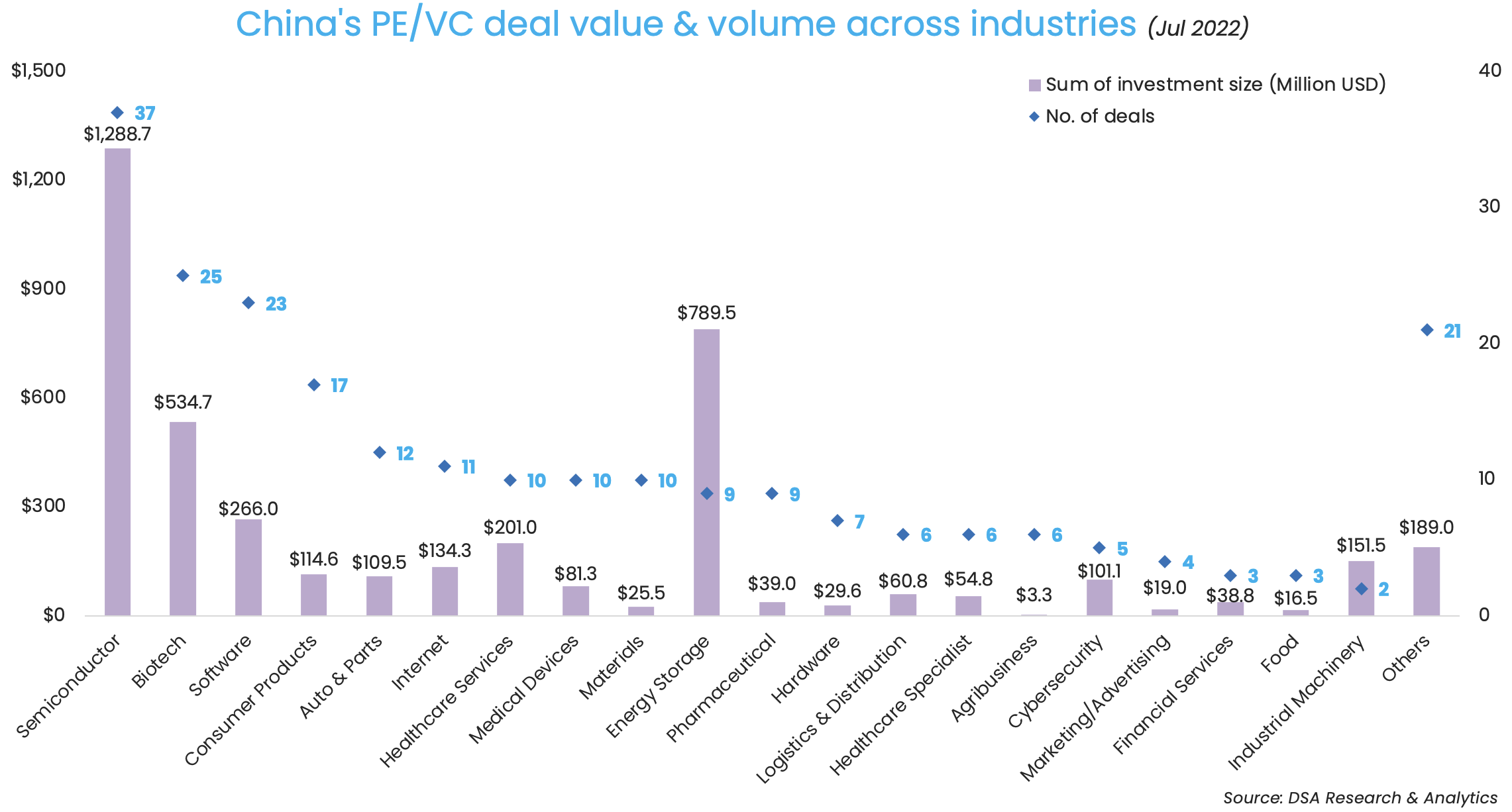

Semiconductor, biotech, and software went on to be the darlings of the venture world as the three industries took the lead in deal count with the completion of 37, 25, and 23 deals last month, respectively.

Investing in “China chip” has become an unstoppable trend. Driven by the government’s policy support and a rising global demand for chips, China mounted to become the world’s largest semiconductor market as sales of chips in the country rose 27.1% to $192.5 billion in 2021 from the year before. Globally, sales of chips increased by 26.2% to $555.9 billion last year, according to the World Semiconductor Trade Statistics (WSTS).

Semiconductor startups collectively raised almost $1.3 billion in July, up 24.1% from the previous month, while the deal count of 37 represented a significant MoM growth of 42.3%.

The semiconductor industry alone registered six megadeals. In addition to the aforementioned IC material developer GCL Semiconductor, other megadeal fundraisers included graphics processing units (GPUs) designers MetaX Integrated Circuits and Iluvatar CoreX; auto chip startup SiEngine Technology; quantum computing firm Origin Quantum; and JLSemi, which offers high-speed Ethernet communication chips.

Biotech was not far behind with the completion of 25 deals, but investors in the sector did take a breather in July. Their total cheque value more than halved to $534.7 million from the previous month, while the deal count reduced by 21.9% MoM.

Frontera Therapeutics, a clinical-stage biotech startup with operations in both China and the US, raked in $160 million in a Series B round as July’s biggest biotech venture deal. The investment, which brought the startup’s total fundraising size by far to $195 million, was jointly led by Sequoia Capital China and Boyu Capital.

As the only biotech megadeal last month, Frontera’s investment was followed by two mid-sized transactions, namely innovative vaccine and adjuvant producer MaxHealth Biotechnology’s $74.2-million Series B round; and a $60-million deal completed by NovoCodex Biopharmaceuticals, a subsidiary of Shanghai-listed drugmaker Zhejiang Medicine. The remaining 22 biotech deals were all worth below $50 million and largely happened at early funding stages.

State-linked investors join Top 10 list

Sequoia Capital China remained perched on top of the list of most active investors with participation in eight deals worth a combined $342.7 million.

There was a remarkable growth in the number of state-linked investors who joined their market-driven counterparts in the list of top 10 investors.

At least half of the 10 most active investors in July have affiliations with the Chinese government at the central or local level, potentially an indication that China’s state capital is increasingly flowing into its startup ecosystem to support tech growth.

Oriza Holdings, a state-owned investment firm in eastern China’s Suzhou City, ranked third last month with investments in six deals across the fields of biotech, pharmaceutical, materials, semiconductor, and software — although it was not the lead investor in any of the transactions. China International Capital Corporation (CICC), the first Sino-foreign joint venture (JV) in the country’s investment banking sector, followed closely with capital injections into five deals.

Other state-linked investors in the list include Shenzhen Capital Group, a venture capital (VC) group built in 1999 by the municipal government in southern China’s Shenzhen City. The VC giant currently has about 431.4 billion yuan ($63.6 billion) in total assets under management (AUM).

Another top-10 investor China Fortune-Tech Capital, which specialises in semiconductor investments, was launched with the support of China’s largest chipmaker, the state-owned Semiconductor Manufacturing International Corporation (SMIC). There was also Fortune Capital, which claims to be a “market-driven” VC backed by China’s state capital.

Most active investors in China (July 2022)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Sequoia Capital China & Sequoia China Seed Fund | 8 | $342.7 | 4 | 4 |

| Legend Capital | 7 | $255 | 7 | 0 |

| Oriza Holdings and affiliates | 6 | $31.5 | 0 | 6 |

| CICC and affiliates | 5 | $286.3 | 3 | 2 |

| Shunwei Capital | 5 | $63.4 | 3 | 2 |

| Qiming Venture Partners | 5 | $40 | 3 | 2 |

| Shenzhen Capital Group | 4 | $193.2 | 2 | 2 |

| China Fortune-Tech Capital | 4 | $178.2 | 1 | 3 |

| Fortune Capital | 4 | $33 | 4 | 0 |

| Kaitai Capital | 4 | $24.5 | 2 | 2 |

| *If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Note: In our monthly analysis for July 2022, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

India Deals Barometer Report: Indian startup funding hits 21-month low in July at $885m, less than half of June

With macro headwinds in the backdrop, fundraising by Indian startups through private equity and venture capital...

Venture Capital

SE Asia Deals Barometer Report: Startup funding up 36% sequentially in July as megadeals recover

Startups in Southeast Asia raised at least $1.9 billion in funding in July, recording a 36% jump from June...