China Deals Barometer Report: Strong PE-VC dealmaking in January raises hopes for 2023

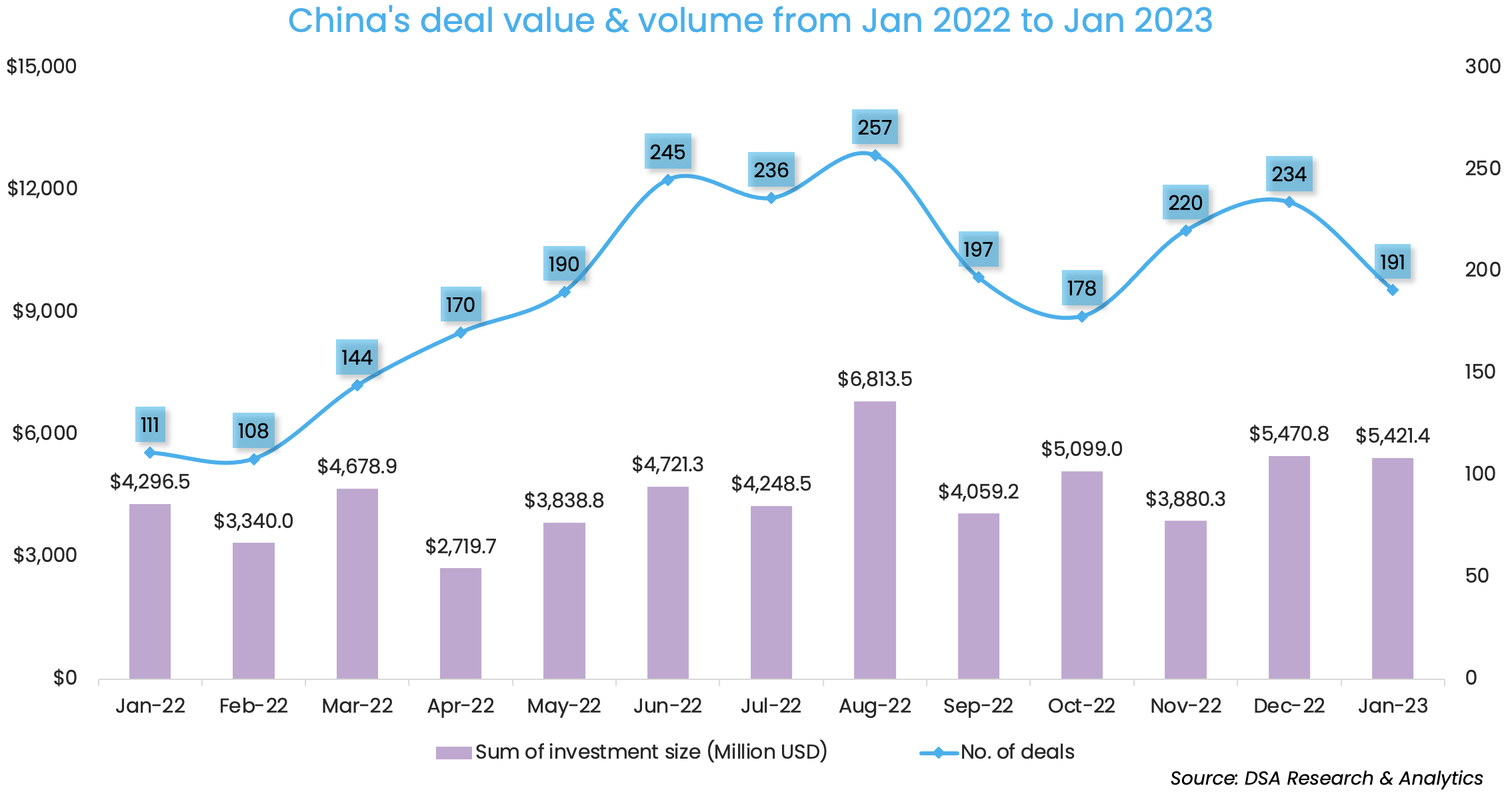

Despite January being a historically weak month in Greater China for private equity and venture capital dealmaking, due to the week-long Lunar New Year holidays, startup fundraising held up smartly last month.

In the first month of 2023, privately-held companies headquartered in mainland China, Hong Kong, Macau, and Taiwan raised $5.42 billion — only a tad lower than the previous month’s $5.47 billion, show proprietary data compiled by DealStreetAsia.

The strong fundraising came despite an 18.4% month-on-month fall in the number of PE-VC deals to 191.

Dealmaking activity in January 2023 was more promising than a year ago — fundraising value rose 26.2%, while deal volume was up 72.1%., from January 2022.

These numbers signal a recovery in PE-VC dealmaking activity as China opens up for businesses following the lifting of its stringent zero-COVID policy on December 7.

The International Monetary Fund (IMF) has said that China’s economy will expand by 5.2% in 2023, compared with 3% in 2022. However, the financial agency added that it continues to watch China with caution as “significant economic challenges” abound in the world’s second-largest economy.

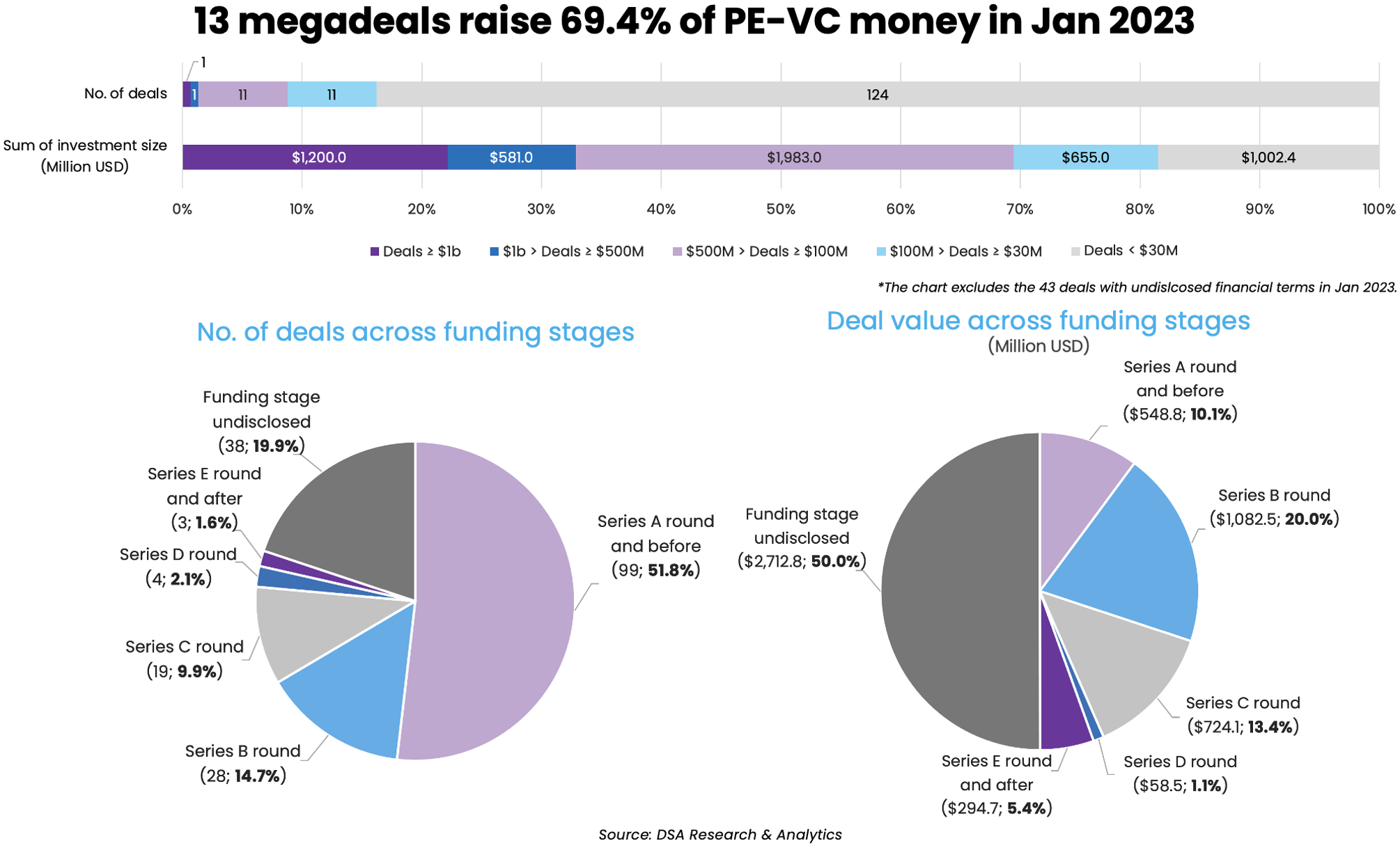

More megadeals prop up fundraising

There were 13 megadeals — transactions worth at least $100 million — in January, compared with nine in the previous month.

The 13 big-ticket deals raised a combined $3.7 billion, which was up from December’s $3.2 billion, and accounted for 69.4% of the total startup financing in January 2023.

In the biggest megadeal, Ant Group’s online lending arm Ant Consumer Finance obtained the regulatory nod to increase its registered capital by 10.5 billion yuan ($1.2 billion), heralding a new chapter for China’s internet industry after a year-long regulatory revamp of the sector.

Hangzhou Jintou Digital Technology Group, Sunny Optical Technology, and Zhejiang Transfar participated in the deal, which accounted for nearly a quarter of the overall investment in January. Following the deal, Hangzhou Jintou Digital became Ant Consumer Finance’s second-biggest shareholder after parent Ant Group.

In another megadeal in January, Kelun Biotech, a subsidiary of Shenzhen-listed Kelun Pharmaceutical, secured $581 million from its parent firm and a number of notable investors such as Chinese VC firm IDG Capital and American pharmaceutical major Merck Sharp & Dohme.

The third biggest megadeal was the $294.7 million pre-IPO funding round of Kuntian New Energy, a manufacturer of anode materials used in lithium-ion batteries.

| Startup | Headquarters | Investment size (Million USD) | Investment stage | Lead investor(s) | Other investor(s) | Industry | Vertical |

|---|---|---|---|---|---|---|---|

| Ant Consumer Finance | Chongqing | 1200 | Registered Capital Raise | Hangzhou Jintou Digital Technology Group, Sunny Optical Technololgy, Zhejiang Transfar | Financial Services | Fintech | |

| Kelun Biotech | Chengdu | 581 | Equity Financing | Kelun Pharmaceutical, IDG Capital, Merck Sharp & Dohme, CMG-SDIC Capital (a fund co-launched by s China Merchants Capital and SDIC), Gygnus Real, Longyi Technology, Yunqi Xinneng Venture Investment Center, Xingling Equity Investment, Anling Weijian Equity Investment, Wenjiang Emerging Industry Venture Investment Fund, Wutong Juke Business Management, Cinda Capital Management, Kexin Lunda Investment, Liangheng Equity Investment, Likang Equity Investment Center, LAV Kecheng Hong Kong, Daoyi Business Management, Wang Jingyi (Individual Investor), Kelun Huizhi Business Management Center (affiliated with Kelun Pharmaceutical), Kelun Huicai Business Management Center (affiliated with Kelun Pharmaceutical), Kelun Huide Business Management Center (affiliated with Kelun Pharmaceutical) | Pharmaceutical | Biotech | |

| Kuntian New Energy | Shijiazhuang | 294.7 | Pre-IPO | SK China, Sinopec Capital (affiliated with Sinopec Group), Fosun Capital, SANYI Group, China Broadband Capital, Hana Financial Group, Xiamen C&D Corporation Limited, Haifeng Investment | Energy Storage & Batteries | N/A | |

| Anhui Huasun Energy | Xuancheng | 294.7 | B | China National Building Material (CNBM) | Guolian Jintou Zhiyuan Private Fund Management, Chuanghe Xincai (Xiamen) Manufacturing Transform and Upgrade Fund Partnership, Jiuwan Equity Investment Fund, Hidden Hill Capital (affiliated with GLP), Dayone Capital,Hefei Industry Investment Group, Kungang Equity Investment, Nuoyan Capital, Puhua Capital | Renewable Energy | CleanTech |

| Wison Heavy Industry | Nantong | 221.1 | Nantong Industry Investment Fund | Energy Storage & Batteries | CleanTech | ||

| GenScript ProBio | Shanghai | 220 | C | Legend Capital | Genscript Biotech Corporation | Healthcare Services | Biotech |

| BioRay Pharmaceutical | Taizhou | 217.9 | Biotech | Biotech | |||

| Yuze Semiconductor | Chuxiong | 177.6 | B | National Green Development Fund | Goldstone Investment (affiliated CITIC Securities), SDIC Venture Capital, Zhejiang Provincial Seaport Investment & Operation Group, Ningbo Development & Investment Group, Chuxiong Shicheng Xiangtou Group | Semiconductor | N/A |

| Leading Interconnect Semiconductor Technology | Shenzhen | 136 | Equity Financing | Avary Holding | Semiconductor | N/A | |

| Newlink Group | Qingdao | 103 | Energy Storage & Batteries | Electric/Hybrid Vehicles | |||

| Keda New Energy Technology | Fujian | 111 | B | Fenghe Capital, Capital Development Investment Fund | Energy Storage & Batteries | N/A | |

| HighTide Therapeutics | Shenzhen | 107 | C, C+ | A fund set up by China Development Bank Capital & Guangdong Hengjian Investment Holdings Company Limited | Yuexiu Industrial Investment Fund Management, Yuthai Investment | Biotech | Biotech |

| ATLATL Innovation | Shanghai | 100 | GL Ventures | Biotech | Biotech |

Deals by funding stage

Investments in Series A and earlier stages accounted for over half (99) of January’s total deal count. However, the early-stage deals amassed only $548.8 million, or 10.1% of the total deal value.

There were 38 investments with undisclosed funding stages. While that comprises only 19.9% of January’s deal count, they accounted for half of the total deal value, mainly because six megadeals did not disclose their funding stage. These were Ant Consumer Finance, Kelun Biotech, Wison Heavy Industry, BioRay Pharmaceutical, Newlink Group, Keda New Energy Technology, Leading Interconnect Semiconductor Technology, as well as ATLATL Innovation.

Series E and later funding stages only booked three deals in January worth an aggregate of $294.7 million or 5.4% of the total deal value, which signifies that investors remain selective and cautious with late-stage investments.

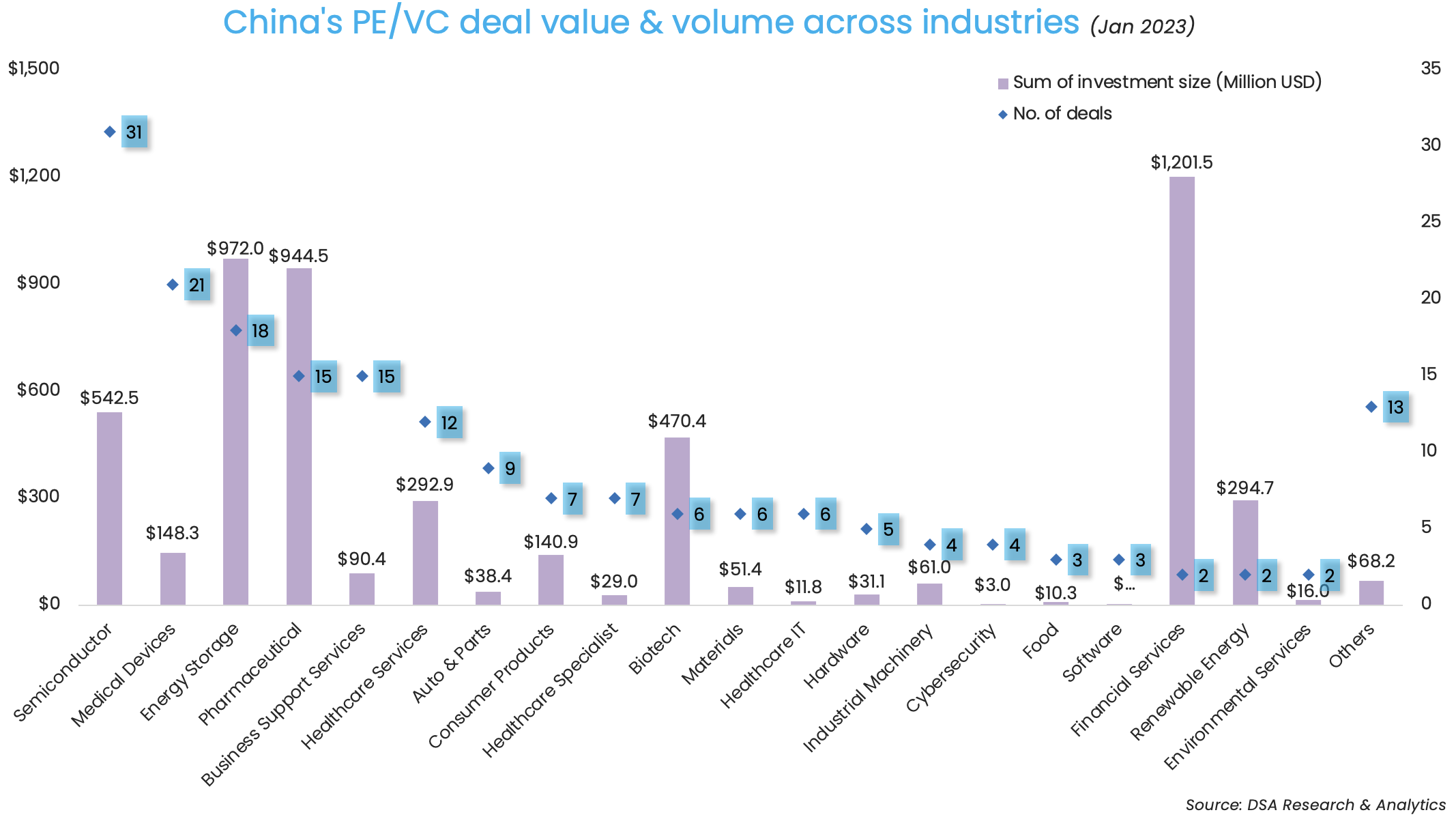

Fintech was the most funded vertical

Thanks to Ant Consumer Finance’s $1.2 billion megadeal, financial services was the most funded sector in January despite clocking only two deals.

Energy storage, which saw 18 deals worth a combined $972 million, was the second-most funded industry. Wison Heavy Industry, a subsidiary of clean energy technology provider Wison Offshore & Marine, bagged $221 million in one of the top deals in the sector.

China has set a target to become carbon neutral before 2060, which has prompted companies across the renewable energy, waste recycling, and energy management sectors to jump on the cleantech bandwagon.

In another megadeal in the sector, Beijing-based Newlink Group, which leverages the power of AI and big data technologies to digitise energy transportation, snapped $133 million via its subsidiaries. The transaction included a private placement of $30 million in its Nasdaq-listed subsidiary NaaS Technology.

Pharmaceuticals ranked third in terms of deal value, with the completion of 15 venture deals worth $944.5 million.

Semiconductor, Medical devices, and Energy Storage were the top sectors by deal volume in January.

SDIC and affiliates were the top investors

The State Development & Investment Corporation (SDIC), one of China’s largest state-owned investment holding companies, and its affiliates were the top investors of January, participating in seven deals, alongside other investors. The seven startups raised $831.2 million.

The firm and its affiliates had ranked tenth in December.

Qiming Venture Partners, a venture capital (VC) firm that has backed some of China’s biggest tech companies, ranked as the second most active investor in the month. The firm injected a total of $66.8 million into five startups.

Founded in 2006, Qiming Venture Partners currently manages eleven US dollar funds and seven RMB funds with $9.4 billion in assets under management.

Shenzhen Capital Group, an investment firm based in southern China’s Shenzhen City, also participated in five deals in January. However, the deal sizes were relatively smaller. Shenzhen Capital Group’s investees raised only $3 million in the month.

Investment company No. of deals Total value of participated deals (Million USD) Lead Non-lead

State Development & Investment Corporation (SDIC) and affiliates 7 831.2 5 2

Qiming Venture Partners 5 66.8 3 2

Shenzhen Capital Group 5 3 3 2

Shenzhen High-Tech Investment Group 4 3 2 2

GL Ventures 3 194.1 1 2

CITIC Securities 3 177.6 2 1

Guokai Manufacturing Transformation and Upgrading Fund 3 72.5 3 0

Sichuan Academian Fund 3 38.4 1 2

HighLight Capital (HLC) 3 26 0 3

Northern Light Venture Capital (NLVC) 3 17.5 1 2

*Total value of participated deals (Million USD)” refers to the total amount of capital raised by the respected startup in the round, including capital from the listed investor as well as other participating investors. If one deal is backed by only two investors, we consider neither of the two investors as a lead investor.

GL Ventures, Hillhouse Capital’s VC unit, participated in three deals alongside other investors, but these deals were of decent sizes and garnered $194.1 million. GL Ventures was the second top investor in January based on the amount raised by the investees.

Note: In our monthly analysis for January 2023, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Startup funding falls below $1b mark in Jan, 40% lower than Dec

Amid fears of a recession looming large, startup funding in Southeast Asia dropped...

India Deals Barometer Report: Fundraising by startups slackens to touch $1.25b in Dec

The new year failed to cheer up the Indian startup ecosystem as venture investments ...