Greater China Deals Barometer Report: Fundraising hits four-month low in Feb

Anxious investors slowed capital deployment in Greater China in February after the Donald Trump administration imposed a 10% levy on all Chinese imports to the US that month. Geopolitical tensions continue to escalate as Beijing and Washington exchange tit-for-tat tariffs, impacting dealmaking.

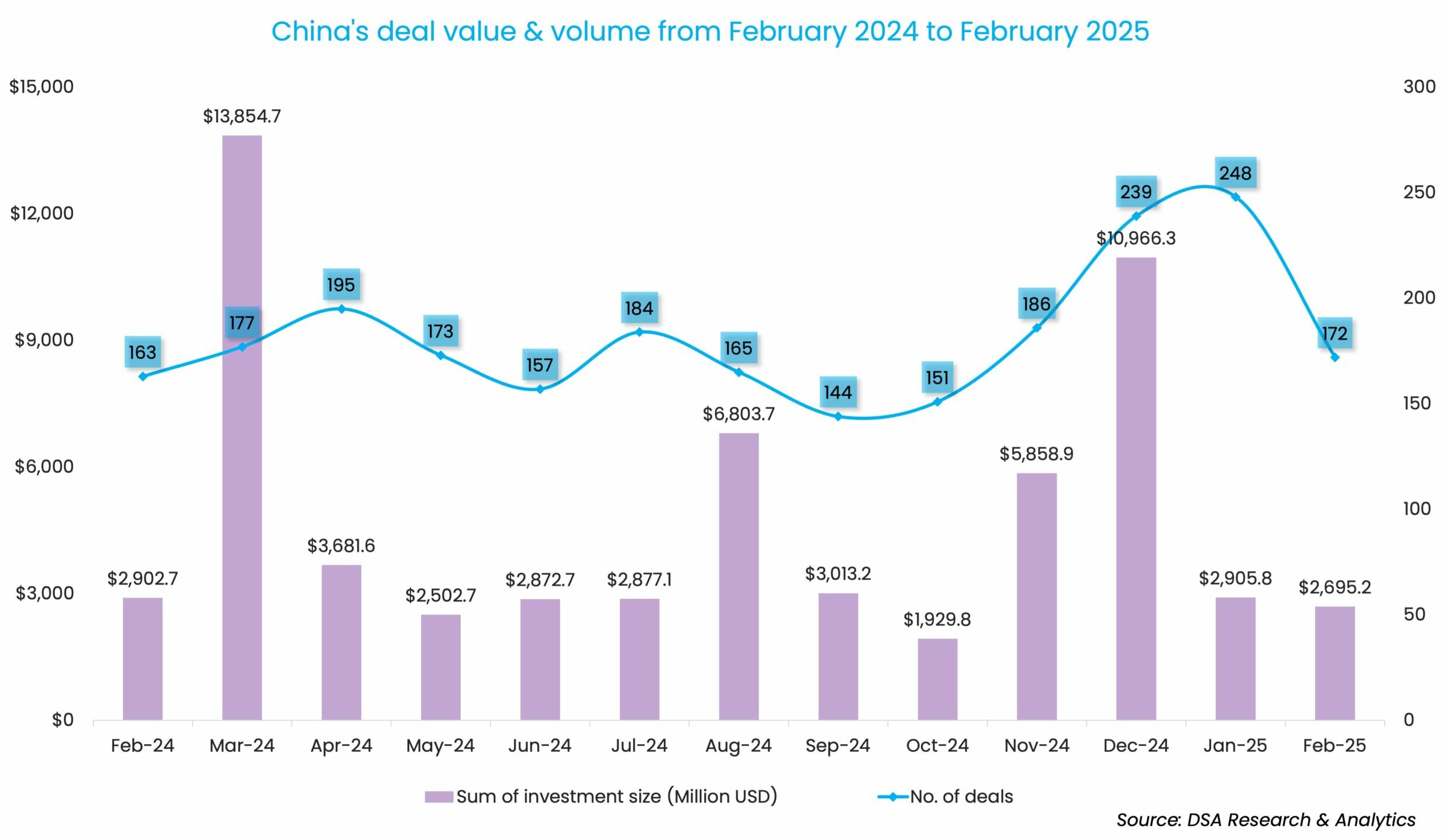

Privately-held firms headquartered in mainland China, Hong Kong, Macau, and Taiwan raised around $2.7 billion through the completion of 172 deals from venture investors in February. Deal volume was down by 30.6% month-over-month (MoM) in February, while deal value was down by 7.2% MoM, according to proprietary data compiled by DealStreetAsia.

On a year-on-year basis, the monthly deal count was 5.5% higher than in February 2024, while the funding value was 7.1% lower than the $2.9 billion recorded a year ago.

Tailwinds for New Energy commercial vehicle firms

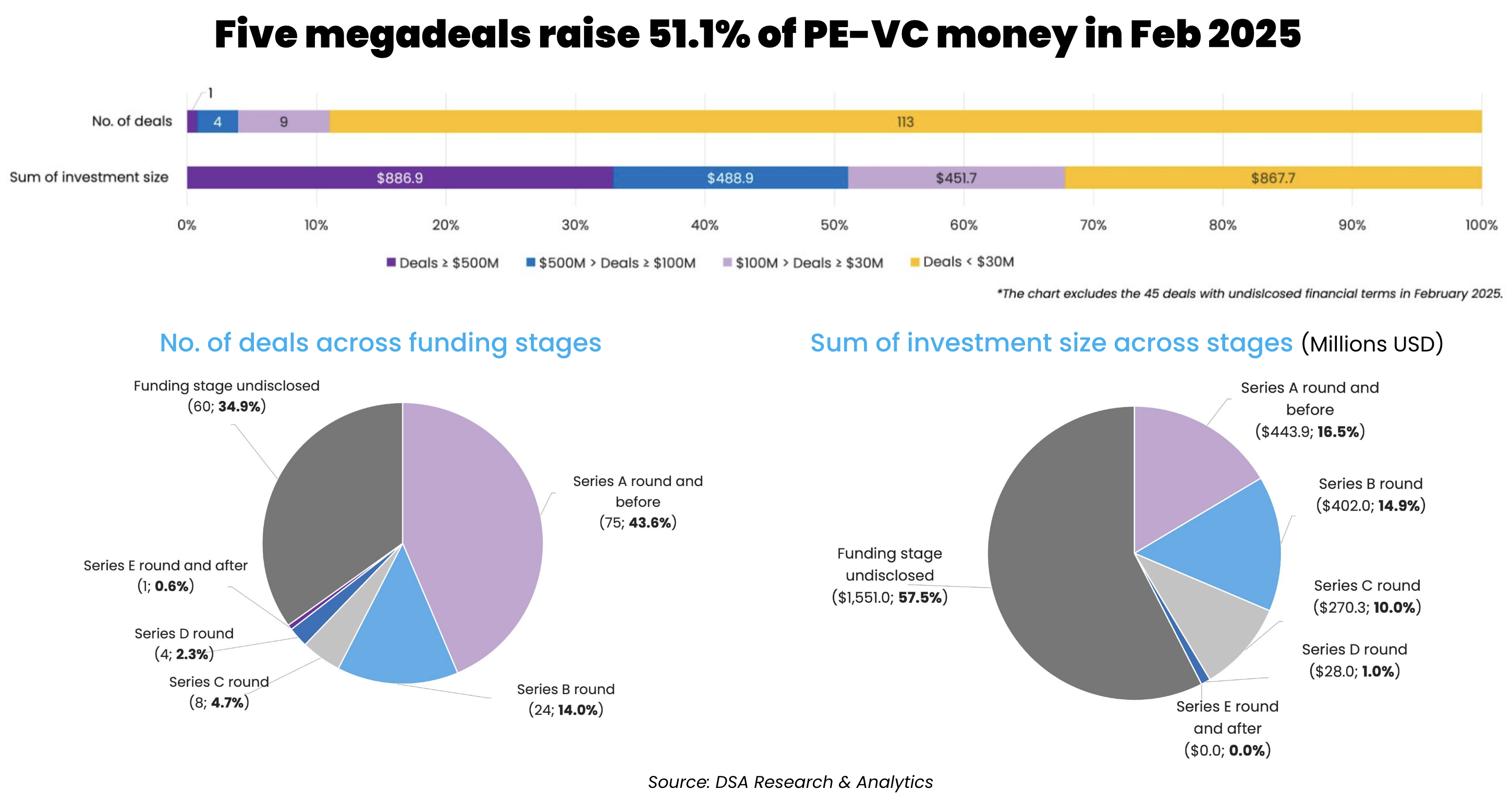

There were five megadeals (transactions worth at least $100 million) in February, which together amassed $1.4 billion, or 51.1% of the total proceeds in the month. However, no cheque size crossed the billion-dollar threshold. In comparison, there were seven megadeals in January

XCMG AUTO, a manufacturer of new energy heavy trucks, raised around 6.4 billion yuan ($886.9 million) in a strategic investment from 30 investors—the largest venture deal in February and also the largest-ever deal in the commercial vehicle space in the past five years. XCMG AUTO is a subsidiary of heavy machinery manufacturer XCMG Machinery.

Chinese robovan developer Neolix Technologies, too, secured 1 billion yuan ($137.3 million) in an extended Series C round in February to accelerate the commercialisation of Level 4 autonomous vehicles in the logistics industry, particularly for urban deliveries.

In yet another megadeal, Chinese logistics investment and fund management platform Gaolu Group secured $150 million in a funding round led by Singapore-based private credit investor Orion Capital Asia.

Early-stage investments in February stood at 75, accounting for 43.6% of the total deal count, despite securing only 16.5% of the total proceeds. In January, early-stage investments had accounted for 48.4% of the total deal count and contributed 32.7% of the month’s total proceeds.

Late-stage dealmaking also lagged, with only one deal in the Series E or later stages. In contrast, there were seven late-stage deals in January.

List of megadeals in China (Feb 2025)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| XCMG Auto Manufacturing | Xuzhao | 886.9 | Strategic Investment | China Reform Holdings Corporation, CCB Investment, BOC Financial Asset Investment, National Green Development Fund, CMG-SDIC Capital | Sinopec Capital, China Logistics, China Cinda Asset Management, and others | Automobiles & Parts | Electric/Hybrid Vehicles | |

| Gaolu Group | Shanghai | 150 | Orion Capital Asia | Logistics & Distribution | N/A | |||

| Neolix Technologies | Beijing | 137.3 | C+ | CICC Capital, Zhangjiang Fund, Vinno Capital | Automobiles & Parts | Autonomous Driving | ||

| Omnisun Information Materials (IOM) | Changsha | 101.6 | B | Comprehensive Reform Experiment (Shenzhen) Fund (set up by Kunpeng Capital, China Reform Holdings Corporation) | Konfoong Materials International, Hunan Xingxiang Investment Holding Group, and others | Semiconductor | N/A | |

| Klook | Hong Kong | 100 | Vitruvian Partners | Travel & Leisure | Travel Tech |

Showing 1 to 5 of 5 entries

Investors bet on everything AI

Private market investors have been sanguine about everything AI. Chinese President Xi Jinping’s rare meeting with Chinese tech leaders in February has given investors a confidence boost with regards to AI-related startups.

A total of 15 companies providing AI-powered solutions or products cumulatively raised at least $944.5 million in February. This includes embodied AI startup Galaxea AI; AI infrastructure firm SiliconFlow; and AI image generation startup LibLib AI.

The fundraising figure is set to grow as AI adoptions and applications become an integral part of almost every business.

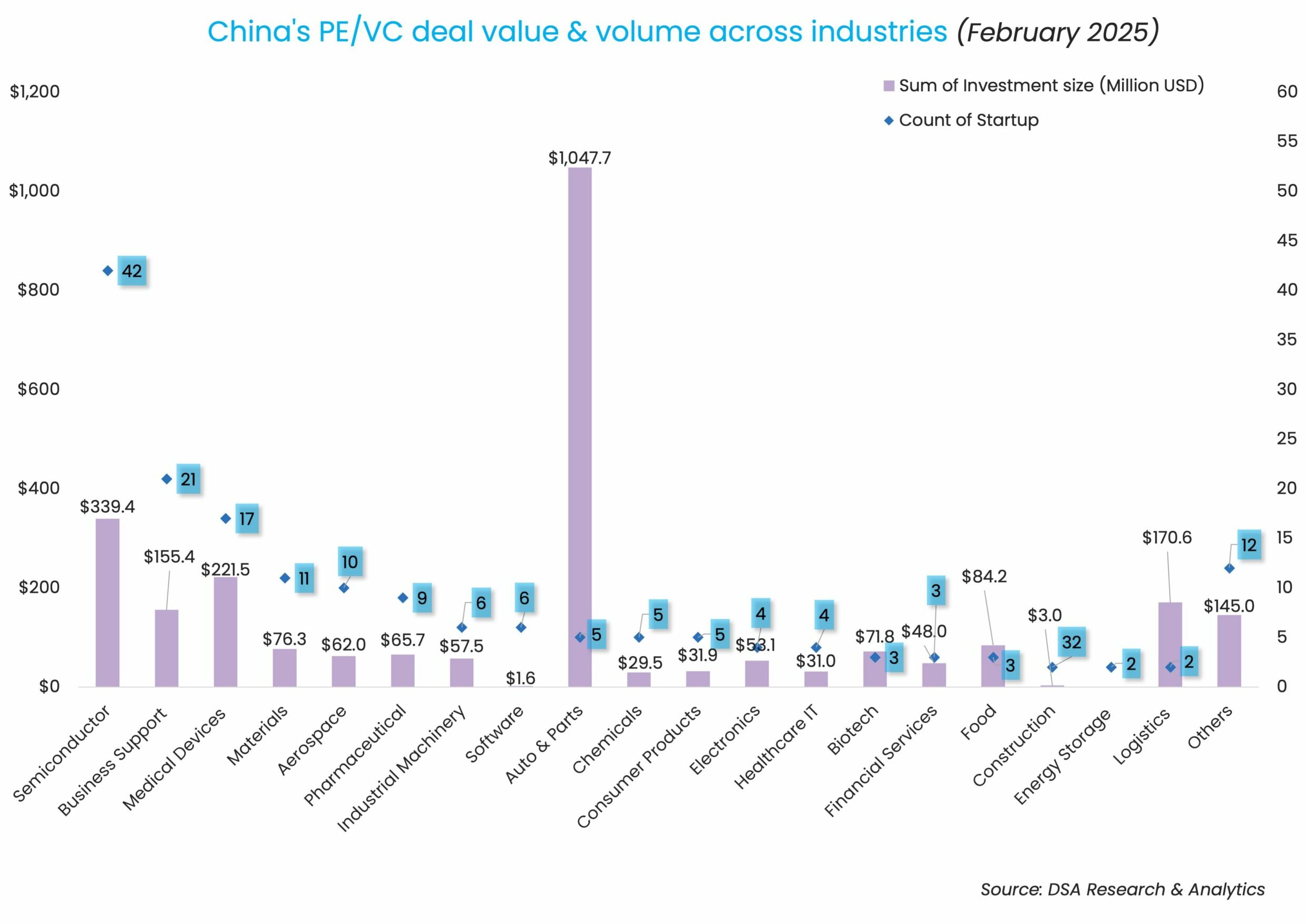

Semiconductors continued to lead in deal count, with the completion of 42 transactions. Automobiles & Parts, too, led the PE-VC activity by deal value. The Auto & Parts sector raised over $1 billion, despite the completion of only five deals.

SDIC & affiliates top investor list

State-owned investment holding firm State Development and Investment Corporation Group (SDIC) topped the investor list in February, as the firm and its subsidiaries backed seven firms that raised a combined $928.9 million.

Most active investors in China (Feb 2025)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| State Development and Investment Group & affiliates | 7 | 928.9 | 6 | 1 |

| Addor Capital | 5 | 43.5 | 2 | 3 |

| Legend Holdings & affiliates | 4 | 29.5 | 2 | 2 |

| Shenzhen Capital Group | 4 | 117.1 | 3 | 1 |

| CAS Star | 4 | 18.5 | 2 | 2 |

| Truesino Fund | 4 | 4.5 | 3 | 1 |

| Pudong Innovation Investment | 3 | 4.5 | 1 | 2 |

| Jolmo Capital | 3 | 4.5 | 1 | 2 |

| CICC Capital | 3 | 1051.8 | 1 | 2 |

| G&O Capital | 3 | 14 | 1 | 2 |

Showing 1 to 10 of 15 entries

Note: In our monthly analysis for February 2025, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Startup funding jumps 81.6% MoM in Feb

Southeast Asia’s startup ecosystem saw a notable rebound in February, following a subdued start to 2025, with startups in the region raising $247 million across 32 equity deals.

Venture Capital

India Deals Barometer Report: Fundraising hits a snag in Feb as big cheques dry up

After recovering from a prolonged funding winter and soaring in the second half of 2024, startup fundraising hit a snag again in February this year. Compared to January, the funding value was down 48.4%, while the deal volume fell nearly 13.6%, according to proprietary data collated by DealStreetAsia.