China Deals Barometer Report: Venture fundraising hits nine-month low of $2.9b in Feb

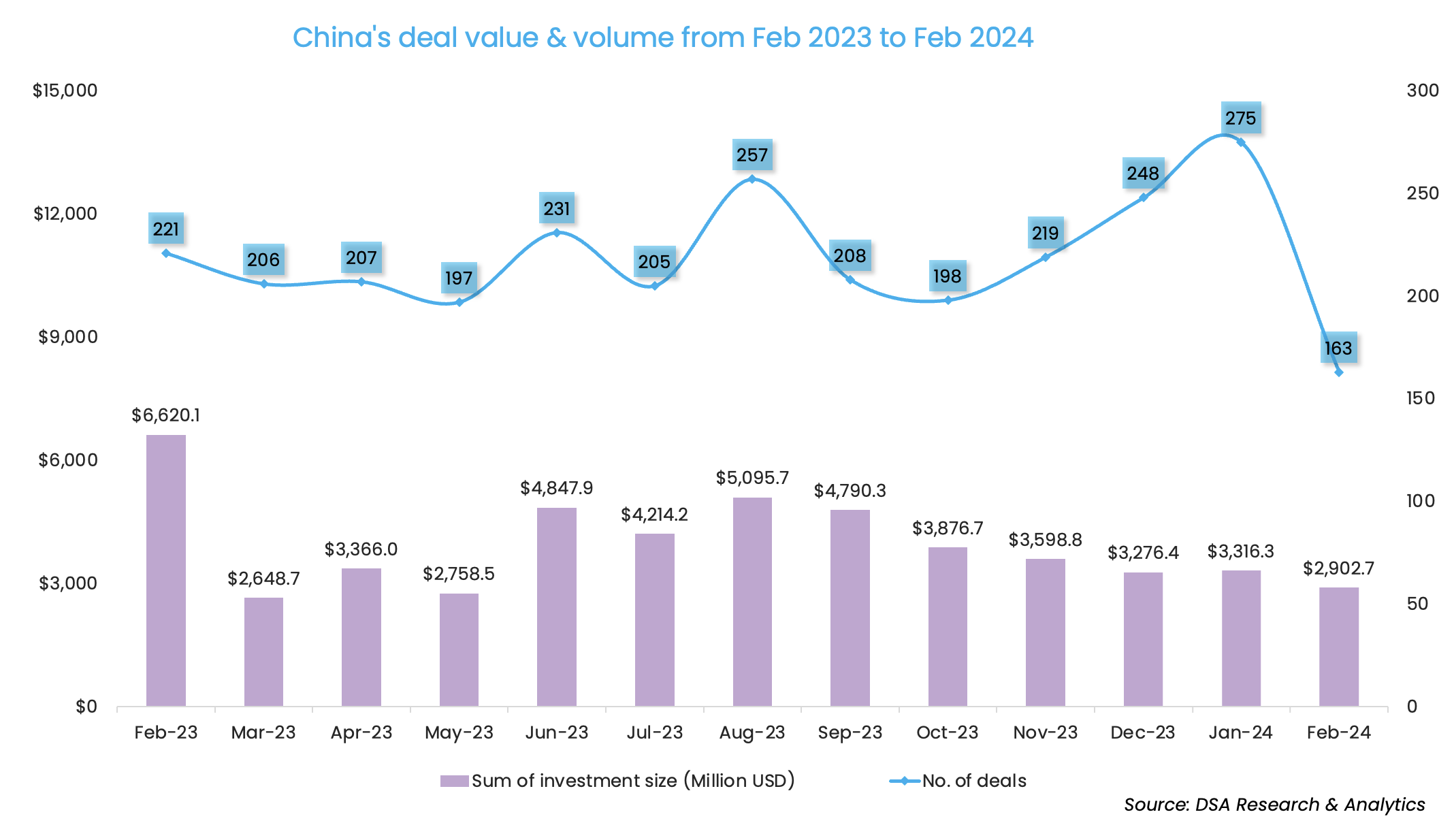

Privately-held firms headquartered in mainland China, Hong Kong, Macau, and Taiwan raised a meagre $2.9 billion from venture investors in February. The fundraising value, down 12.5% month-on-month (MoM), was the lowest since May 2023.

While some of the drop can be attributed to the week-long Lunar New Year holidays in February, the weakness in fundraising shows that the venture capital market is still grappling with the challenges of a difficult exit landscape, geopolitical tensions, and macroeconomic uncertainties.

The 163 private equity and venture capital deals recorded in February were 40.7% less than those in January, and also the lowest since March 2022, according to proprietary data compiled by DealStreetAsia.

On a year-on-year basis, the monthly deal count was 26.2% less than in February 2023, while the funding value was 56.2% less than the $6.6 billion recorded a year ago, reflecting a serious downturn.

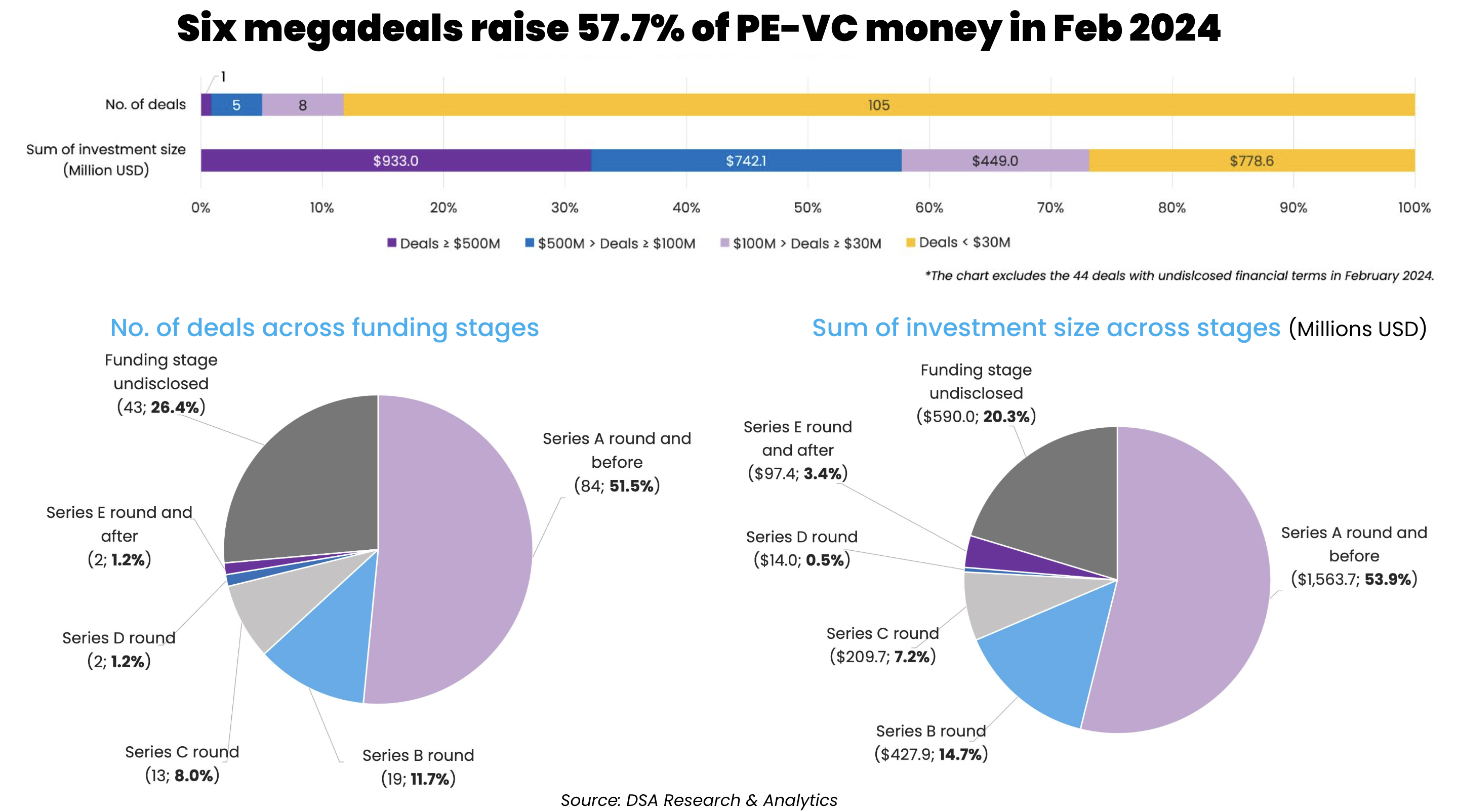

Megadeals account for almost 58% of the total funding

February saw the completion of only one deal worth over $500 million. In total, there were six megadeals—transactions valued at at least $100 million—that amassed around $1.7 billion in total, or 57.5% of the total deal value.

In the biggest megadeal in February, Shanghai municipal government-backed Shanghai Spacecom Satellite Technology (SSST) pocketed 6.7 billion yuan ($933 million) in a Series A funding round for the construction of a low-orbit satellite constellation. Led by the National Manufacturing Transformation and Upgrading Fund, the funding round saw the participation of CAS Capital, Guosheng Capital, and Hengxu Capital (affiliated with SAIC Motor Corp).

The second-largest deal was sealed by pig-farming firm SciGene. Tongwei Agricultural Development, a subsidiary of Shanghai-listed photovoltaic new energy firm Tongwei, paid 1.65 billion yuan ($229.3 million) for a 30% stake at SciGene. The transaction valued the firm at 5.5 billion yuan ($764.2 million).

In another megadeal, Unitree Robotics, a maker of quadruped robots, secured 1 billion yuan ($139 million) in a Series B2 round participated by the likes of Chinese food delivery giant Meituan, deeptech venture capital firm Source Code Capital, and CITIC Securities-affiliated Goldstone Investment.

The remaining three megadeals happened across industries like semiconductors, pharmaceuticals, and automobiles.

Deals in the Series A and earlier stages remained an investor favourite in February. Series A and earlier stages recorded the completion of 84 deals, or 51.5% of the month’s deal count, while the $1.6 billion capital raised at this funding stage accounted for 53.9% of the deal value.

In contrast, there was little activity in late-stage financing. The fundraising of Chinese biopharmaceutical firm Evopoint Biosciences was the only deal that took place in the Series E stage in the month. Led by Tencent Investment and Shanghai-based state investor Guoxin Investment, the firm snapped 700 million yuan ($97.4 million) in the round.

Megadeals of February 2024

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| Spacecom Satellite Technology/Yuanxin Satellite Technology | Shanghai | 933 | A | National Manufacturing Transformation and Upgrading Fund | Shanghai Alliance Investment CAS Capital, Guosheng Capital, Hengxu Capital (affiliated with SAIC Motor Corp), Haitong Securities, and others | Aerospace | Space Tech | |

| SciGene | Hefei | 229.3 | Equity Financing | Tongwei Agricultural Development (affiliated with Tongwei) | Agribusiness | AgTech | ||

| Unitree Robotics | Hangzhou | 139 | B2 | Meituan, Source Code Capital, Goldstone Investment (affiliated with CITIC Securities), Shenzhen Capital Group, China Internet Investment Fund, and others | Consumer Products | Robotics & Drones | ||

| Semiconductor Integrated Display Technology | Wuhu | 139 | Yes | A | Wuhu Construction Investment, Sichuan Manufacturing Industry Fund, Ruicheng Fund, Xingzhong Venture Capital, Kunyan Capital, and others | Semiconductor | N/A | |

| Simcere Zaiming | Haikou | 134.8 | FIIF (managed by CS Capital) | Zhongshen Xinchuang, Apricot Capital, Zhonghe Capital | Pharmaceutical | Biotech | ||

| Zelos Technology | Suzhou | 100 | A | Meituan | Baidu Ventures (BV), Xianting Fund, Seekdource, Blue Lake Capital, Xiamen C&D Emerging Industry Equity Investment, Unicorn | Automobiles & Parts | Autonomous Driving |

Showing 1 to 6 of 6 entries

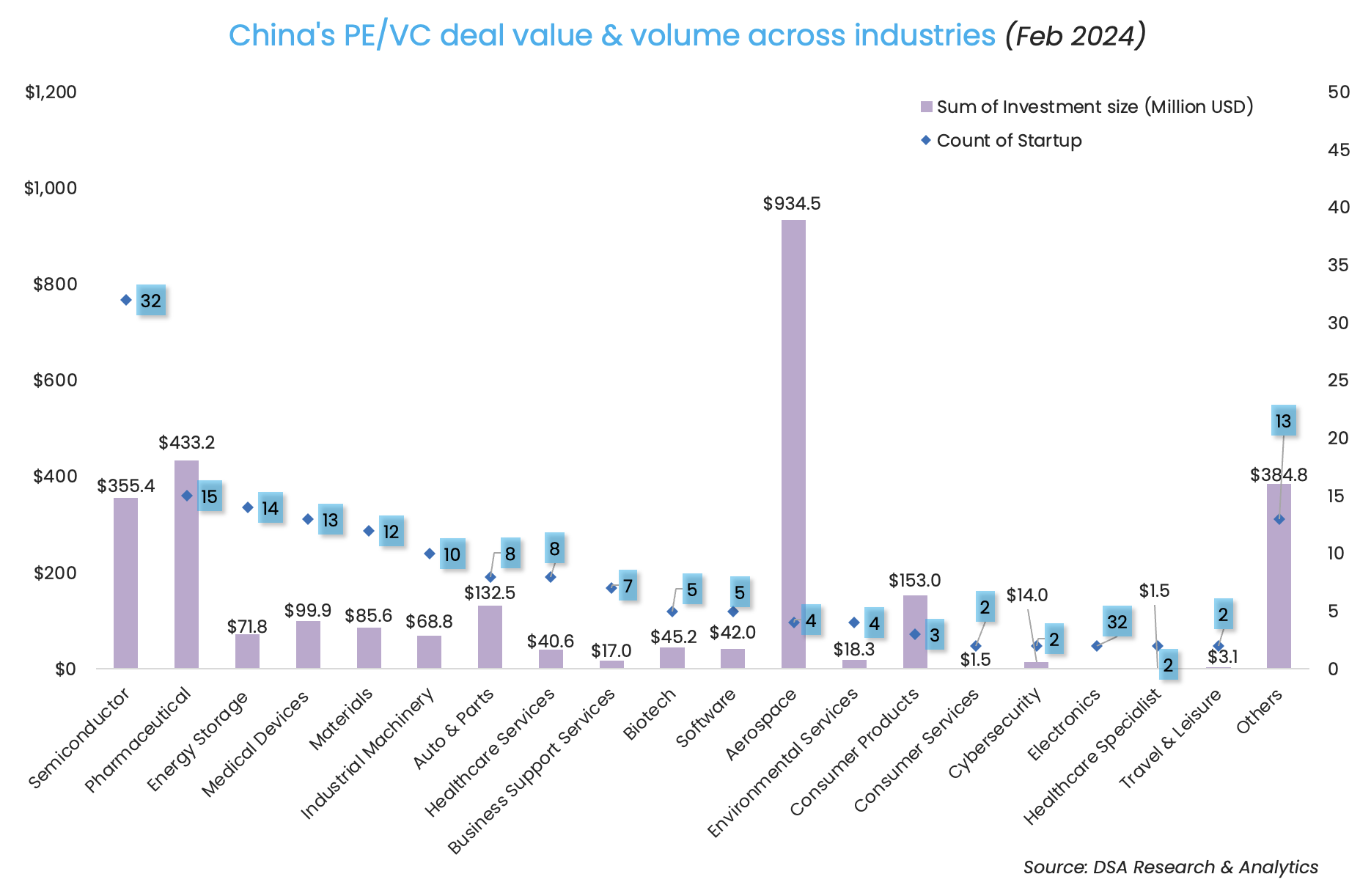

Space tech deals raise the most funds

Thanks to the megadeal sealed by SSST, aerospace was the top industry in terms of deal value. Private rocket developers including Galactic Energy and Orienspace have sealed big rounds in December 2023 and January 2024 respectively.

China expects to make around 100 space launch missions in 2024, up from the 67 launches conducted in 2023, state media reported on February 27.

Meanwhile, chip-making firms topped in terms of deal count, with the completion of 32 deals.

Wuhu-based Semiconductor Integrated Display Technology (SIDTEK), which engages in the production of micro-OLED display products, a critical component of near-eye electronics devices that require tiny and high-resolution displays, notched over 1 billion yuan ($139 million) in a Series A funding round.

The round roped in several state-affiliated investors including Wuhu Construction Investment, Sichuan Manufacturing Industry Fund, and Meishan Tianfu Guidance Fund.

However, except for SIDTEK’s megadeal, which accounted for 39% of the total $322.5 million semiconductor funding, big-ticket investments were scarce in the sector.

Shenzhen Capital Group tops investor list

The Shenzhen Capital Group, an investment firm based in southern China’s Shenzhen City, was the most active investor in the month, injecting $210.7 million into five privately owned firms.

Set up in 1999 by the Shenzhen municipal government and commercial shareholders, the firm oversees 473.9 billion yuan ($65.8 billion) in assets under management (AUM). As of 2023, the firm has injected 107.2 billion yuan ($14.9 billion) into 1,785 firms, of which 263 went public across 17 capital markets worldwide, according to the company website.

CAS Star, a Chinese investment firm that focuses on early-stage hard tech startups, was the most active investor by deal sum, despite injecting capital into three firms. The firm, led by co-founding partner Mi Lei, a hard-tech industry veteran and researcher at the Xi’an Institute of Optics and Precision Mechanics of the Chinese Academy of Sciences (CAS), made itself to the top of investor list thanks to its participation in the megadeal of Shanghai Spacecom Satellite Technology.

Top Investors of February 2024

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Shenzhen Capital Group | 5 | 210.7 | 3 | 2 |

| Legend Holdings & affiliates | 4 | 29.5 | 0 | 4 |

| China Merchants Group & affiliates | 4 | 51.7 | 0 | 4 |

| Cowin Capital | 4 | 31 | 2 | 2 |

| CICC Capital | 4 | 43.5 | 2 | 2 |

| GF Xinde Investment | 3 | 28 | 1 | 2 |

| CoStone Capital | 3 | 42 | 1 | 2 |

| Addor Capital | 3 | 17 | 1 | 2 |

| Goldport Capital | 3 | 4.5 | 2 | 1 |

| CAS Star | 3 | 933.1 | 1 | 2 |

Showing 1 to 10 of 14 entries

Note: In our monthly analysis for February 2024, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Funding stays subdued at $388m in Feb amid megadeal drought

Southeast Asian startups did not see any letup in the subdued funding environment in February as total funding remained suppressed at $388 million, according to proprietary data collated by DealStreetAsia.

Venture Capital

India Deals Barometer Report: Startup fundraising increases a tad to touch $876m in Feb

Fundraising by Indian startups rose marginally to touch $876 million across 106 private equity and venture capital transactions in February from $853 million in January, according to proprietary data compiled by DealStreetAsia.