China Deals Barometer Report: Startup funding jumps 26% in Dec to $9.2b as chipmakers take off

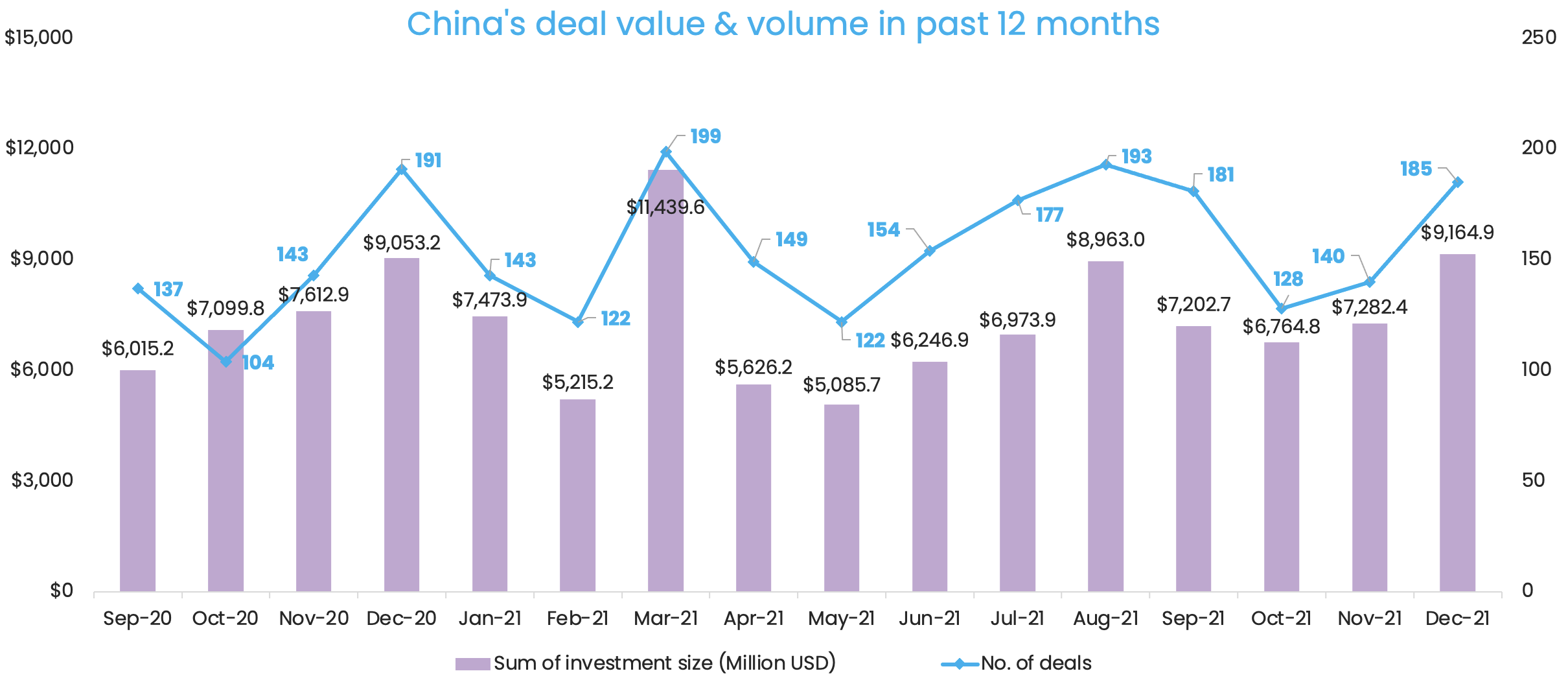

Startup investments ended on a high note in 2021 with almost $9.2 billion being raised across 185 deals in Greater China last month with hard tech, healthcare, and software industries continuing their deal-making momentum entering the new year.

In December, the deal value expanded by 25.9%, and the number of transactions rose by 32.1% as compared to November, when a total of $7.3 billion was raised across 140 deals, according to proprietary data compiled by DealStreetAsia.

Dealmaking in the second half of 2021 also fared better than the first six months with the completion of 1,004 deals worth approximately $46.4 billion in total. In H1, Greater China-based startups secured $41.1 billion across 889 deals.

Chip designing house Chipone Technology pocketed over $1 billion in the month’s biggest funding round led by Beijing-based hard tech investment firm Oceanpine Capital. This big-ticket transaction followed months of hectic dealmaking in China’s semiconductor industry, driven by a global chip supply crunch and Beijing’s determination to achieve tech self-reliance.

Developers of eco-friendly cars and related charging and energy storage solutions have garnered the interest of investors looking to cash in on the carbon neutrality theme.

SVOLT Energy Technology, an EV battery maker and energy storage solutions provider, secured $943 million in its third major fundraising success last year. Backed by Bank of China Group Investment and asset manager CDH Investments, the startup had completed a Series B round at $1.6 billion and a Series A round at $550.2 million earlier the year.

Renowned investors IDG Capital and hedge fund Coatue Management made heavy bets on a nascent player NIUTRON, despite the competition among more established predecessors including NIO, Xpeng, and Li Auto already heating up. IDG and Coatue backed a $500-million Series A round in NIUTRON, a new energy vehicle (NEV) brand created in 2018 by Li Yinan, who had earlier founded Nasdaq-listed electric scooter firm NIU Technologies. The startup plans to start selling its first SUV model in H1 2022 and roll out delivery in September.

Megadeals contribute to surge in funding

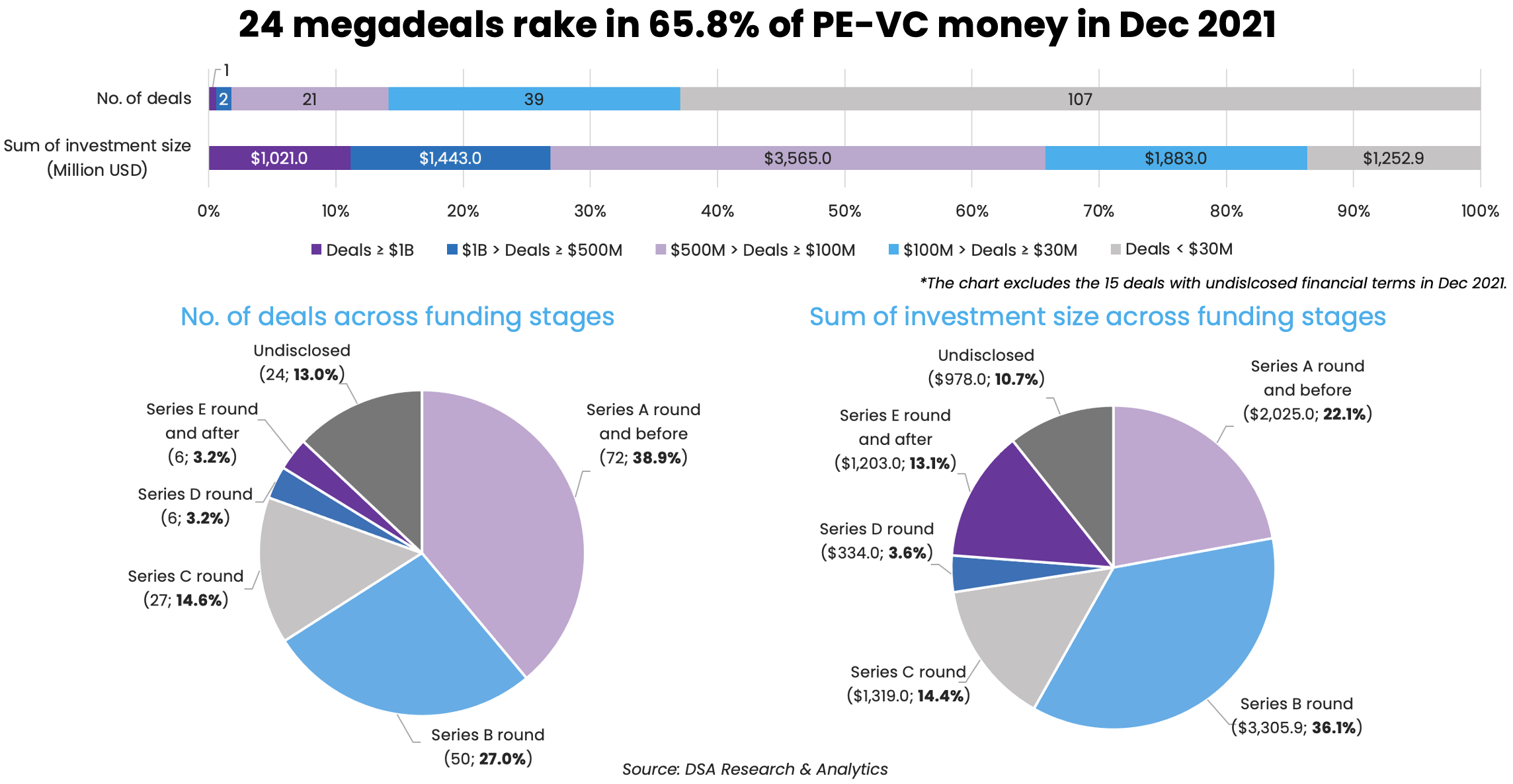

One of the key contributors to December’s funding surge was megadeals, or investments worth at least $100 million, which increased to 24 deals as compared to 15 in November.

Excluding Chipone, SVOLT and NIUTRON, there were 21 deals in the range of $100-500 million that collectively gathered over $6 billion, up 17.6% from $5.1 billion one month earlier.

Startups across biotech, medical devices, consumer products, semiconductor, auto & parts, energy storage, and renewable energy demonstrated stronger capability in raising larger cheques than counterparts.

Their deep-pocket investors include Sequoia Capital China, CDH Investments, Legend Capital, private equity firm Primavera Capital Group, Chinese insurer PICC’s investment unit PICC Capital, and Goldstone Investment, which is affiliated with investment bank CITIC Securities, among others.

Earlier-stage startups showed greater appeal to investors in the Greater China market. In terms of deal count, the Series A round and before ranked first with the completion of 72 investments, or 38.9% of the month’s total deal count. Series B round came second with 50 deals, followed by 27 Series C deals, six Series D deals, and six at Series E round and after.

In terms of deal value, the Series B stage led the pack with over $3.3 billion in financing, which was 36.1% of all capital raised in the market last month. Series A stage followed with $2 billion, after which were Series C stage with $1.3 billion, Series E stage with $1.2 billion, and Series D stage with $334 million, respectively.

List of 24 megadeals in Dec 2021

| Startup | Headquarters | Investment size (USD) | Investment stage | Lead investor(s) | Investor(s) | Industry | Vertical |

|---|---|---|---|---|---|---|---|

| Chipone Technology | Beijing | $1,021 million | E | Oceanpine Capital | UNIC Capital Management, CCB Private Equity Investment Management, GGV Capital, Prosperity Investment, CITIC Private Equity (CPE), Beijing Singularity Power Investment Management, Silk Road Huachuang Investment Management | Semiconductor | N/A |

| SVOLT Energy Technology | Changzhou | $943 million | B+ | CDH Investments, China Mobile Capital, PreIPO Capital, China’s Industrial Bank, PICC Capital, Taikang Asset Management, Sichuan Energy Investment, Han’s Laser Technology Industry Group, Changzhou Xingyu Automotive Lighting Systems | Energy Storage | Electric/Hybrid Vechicles | |

| NIUTRON | Beijing | $500 million | A | IDG Capital, Coatue Management | Auto & Parts | Electric/Hybrid Vechicles | |

| Beijing ESWIN Technology Group | Beijing | $392 million | C | Goldstone Investment, China Internet Investment Fund (CIIF) | Shang Qi Capital, China Development Bank Capital, China InnoVision Capital, IDG Capital, Legend Capital, Liu Yiqian (Individual Investor) | Semiconductor | IoT |

| ZTO Freight | Jiaxing | $300 million | B | Logistics & Distribution | IoT | ||

| Vastai Technologies | Shanghai | $251 million | B1, B2 | Alibaba Group, PICC Capital, Matrix Partners China, 5Y Capital | China Life Investment Management, Mirae Asset Global Investments, CoStone Capital, THU Capital, Redpoint China Ventures, Glory Ventures, Yuan Capital | Semiconductor | AI and Machine Learning |

| Huadian Fuxin Energy Corporation Limited | Beijing | $236 million | China Life Insurance Group, China Reform Holdings, China Southern Power Grid Company, National Green Development Fund (NGDF) | Renewable Energy | CleanTech | ||

| Thousand Oaks Biopharmaceuticals | Nantong | $236 million | Goldstone Investment, CDH Shanghai Dinghui Bai Fu Wealth Management (CDH Investments) | Biotech | Biotech | ||

| Avistone | Beijing | $200 million | A | Vivo Capital | Primavera Capital, Bain Capital | Biotech | Biotech |

| ABclonal Technology | Wuhan | $189 million | D | Sequoia Capital China, CMB International Capital, Lucion Venture Capital | Loyal Valley Capital, Taikang Asset Management | Biotech | Biotech |

| Jiangsu Meike Solar Science & Technology | Zhenjiang | $188 million | B | Beijing Financial Street Capital | State Power Investment Corp (SPIC), Huaneng Capital (China Huaneng Group), China Merchants Capital, CCB Investment, Cloudview Capital | Renewable Energy | CleanTech |

| Innoforce Pharmaceuticals | Hangzhou | $157 million | A | Yanchuang Capital, South China Venture Capital (SCVC) | Quan Capital, Quan Capital Management, Advantech Capital, Triwise Capital, CICC Capital, Highrun Capital, Euland Venture, Panlin Capital, S&G Capital | Biotech | Biotech |

| Haomo.AI | Beijing | $157 million | A | GL Ventures, Meituan, Qualcomm Ventures, Shoucheng Holdings Limited (affiliated with Shougang Group) | Auto & Parts | Autonomous Driving | |

| DERA | Beijing | $157 million | C | China Reform Fund, CICC Capital | China Unicom CICC, CITIC New Future Investment, Shenzhen Capital Group, Hongta Innovation Investment, Nanjing Yihua Capital, Shinefore Venture Capital, Yunhang Capital | Semiconductor | N/A |

| FTXT Energy Technology | Shanghai | $141 million | A | CMG-SDIC Capital, PICC Capital | Energy Storage | Electric/Hybrid Vechicles | |

| ANTIY | Beijing, Harbin | $141 million | C | Cybersecurity | N/A | ||

| Innogen Pharmaceutical Technology | Shanghai | $120 million | Youshan Capital, China Growth Capital | CICC Qide Fund, V Star Capital, China Everbright Limited, Everest Venture Capital, DYEE Capital, Cash Capital, Pudong Investment Holdings, Lanting Capital, Cowin Capital, Xiaochi Capital | Biotech | Biotech | |

| SyMap Medical | Suzhou | $100 million | VMS Group, Primavera Capital Group | Sequoia Capital China, Simiao Equity Investment | Medical Devices | N/A | |

| Suzhou Rainmed Medical Technology | Suzhou | $100 million | D | Ping An Capital | Seresia Asset Management, Lighthouse Canton | Medical Devices | HealthTech |

| Chaowanzu | Beijing | $100 million | B | Sequoia Capital China, Gaorong Capital | Bertelsmann Asia Investments (BAI), K2 Angel Partners, Panda Capital | Consumer Products | E-commerce |

| T11 Food Market | Beijing | $100 million | B | Alibaba Group | MSA Capital, Redview Capital | Retail | E-commerce |

| Shanghai LePure Biotech | Shanghai | $100 million | B+ | Legend Capital, Hillhouse Capital Group, New Alliance Capital, HM Capital | Medical Devices | Biotech | |

| Xbiome | Shenzhen | $100 million | B | Sky9 Capital, 5Y Capital, Legend Capital, Primavera Capital Group, Gaorong Capital, HIKE Capital | Biotech | HealthTech | |

| Robosen Robotics | Shenzhen | $100 million | B, B+ | B+: Cedarlake Capital | Rencent Capital, Lightspeed China Partners, Sequoia Capital China, Dayone Capital, Glacier Capital | Consumer Products | Robotics & Drones |

Investments in Chinese chipmakers grow further

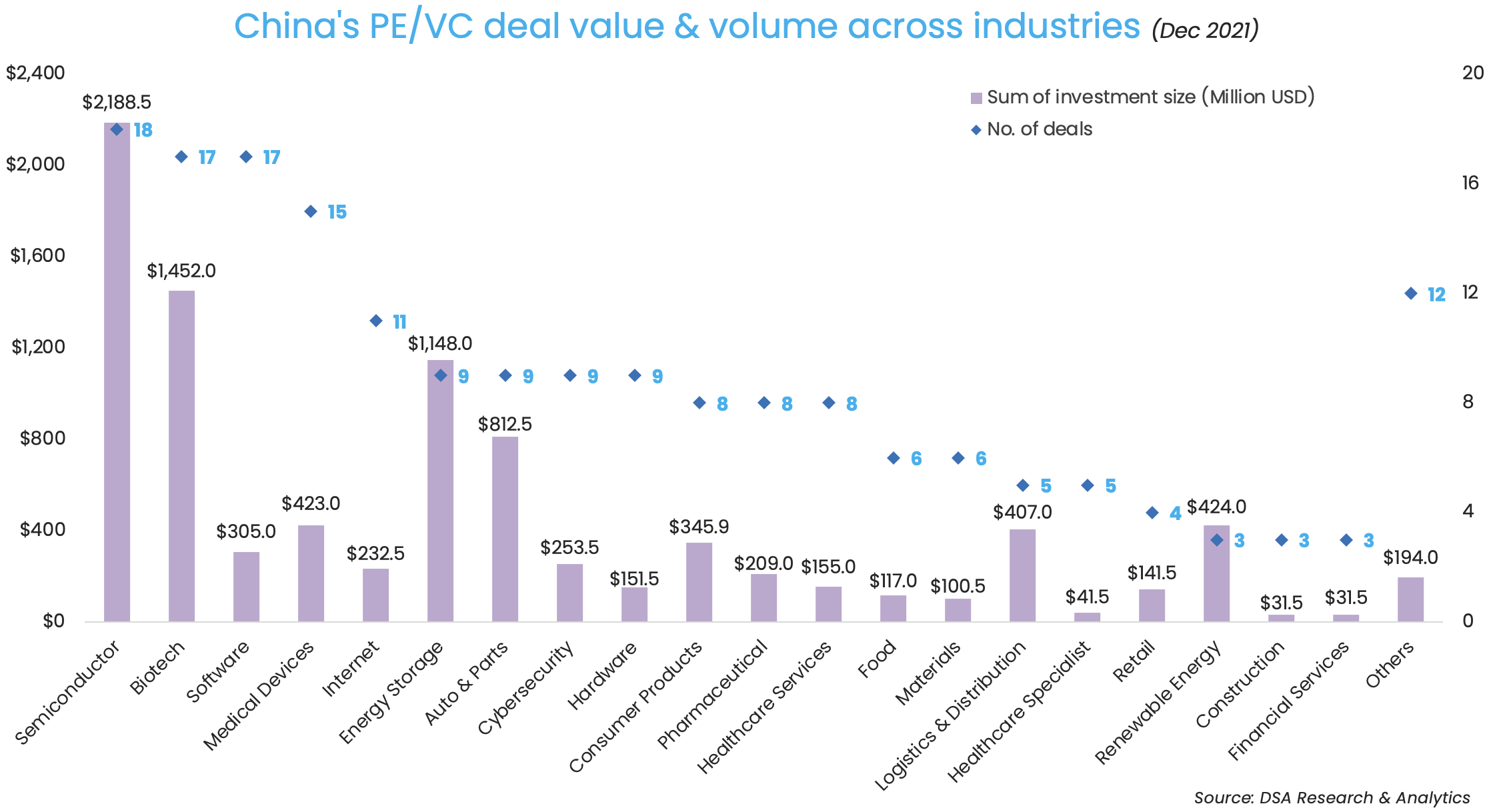

Investors have acted on the opportunities emerging from the chronic global chip shortage across industries such as cars and consumer appliances, driving up dealmaking activity in China’s semiconductor sector to a new high.

The semiconductor industry overtook biotech and software to top in December, with nearly $2.2 billion being raised across 18 deals. It marked a sustained growth from $1.4 billion across nine deals in November and $404.5 million across six deals in October.

While Chipone’s billion-dollar Series E round contributed to 46.7% of the total chip investment, there were another three megadeals, each at over $100 million – potentially an indication of the budding market competition landscape.

The artificial intelligence of things (AIoT) chips provider Beijing ESWIN Technology Group raised $392 million in a Series C round led by Goldstone Investment and the 100-billion-yuan ($15.7 billion) China Internet Investment Fund (CIIF).

AI chip startup Vastai Technologies raked in $251 million in its Series B1, B2 rounds co-led by e-commerce giant Alibaba Group. DERA, which designs enterprise-level solid-state drives (SSD) – storage devices that use integrated circuit (IC) assemblies to store data – secured $157 million in a Series C round.

Sequoia China ups stake in carbon-neutral deals

Sequoia Capital China retained its perch as the most active investor in Greater China with participation in at least 16 deals worth a combined $832 million.

In December, the firm invested in four megadeals across the biotech, medical devices, and consumer products sectors. It injected capital into medical devices maker SyMap Medical and consumer robots firm Robosen Robotics. Sequoia China also co-led a $189-million Series D round in ABclonal Technology, which offers reagents for life science research, and a $100-million Series B round in online designer toy platform Chaowanzu.

An investor of some of China’s biggest tech giants including Alibaba and food delivery firm Meituan, Sequoia China has backed about 600 companies since its inception in 2005 with focuses on the TMT, healthcare, and consumer goods & services fields.

The bellwether of China tech investments partnered with clean energy major Envision Group in March 2021 to set up a 10-billion-yuan ($1.6 billion) carbon-neutral technology fund.

Other active investment firms in the month were GL Ventures, the venture capital arm of Asia’s Hillhouse Capital Group; Legend Capital, an investment platform of China’s Legend Holdings; investment banking firm CICC and its affiliated funds, among others.

Most active investors in China’s PE-VC market (Dec 2021)

| Investment company | No. of deals | Total value of participated deals (USD) | Lead | Non-lead |

|---|---|---|---|---|

| Sequoia Capital China | 16 | $832 million | 6 | 10 |

| GL Ventures | 12 | $432 million | 7 | 5 |

| Legend Capital and affiliates | 8 | $671.5 million | 3 | 5 |

| CICC and affiliates | 8 | $525 million | 5 | 3 |

| CDH Investments | 6 | $1,477 million | 2 | 4 |

| IDG Capital | 6 | $964.5 million | 2 | 4 |

| 5Y Capital | 6 | $407 million | 3 | 3 |

| Gaorong Capital | 6 | $386 million | 2 | 4 |

| Cowin Capital | 6 | $153 million | 2 | 4 |

| Shunwei Capital | 6 | $146 million | 1 | 5 |

| *If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Note: In our monthly analysis for December 2021, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

Liya Su contributed to the story.

Share this story with your friends and colleagues.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

India Deals Barometer Report: Indian startups mop up $4.86b in PE-VC funding in Dec, deal count at two-year high

Indian startups raised over $4.86 billion in December 2021 across a record 201 private equity (PE) and venture capital (VC) transactions...

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising slows 65% to $1.8b in Dec

Startups in Southeast Asia amassed as much as $1.8 billion in December, registering a 65% drop from November’s record $5.2 billion...