China Deals Barometer Report: PE-VC investments

grow for third consecutive month to $9b in Aug

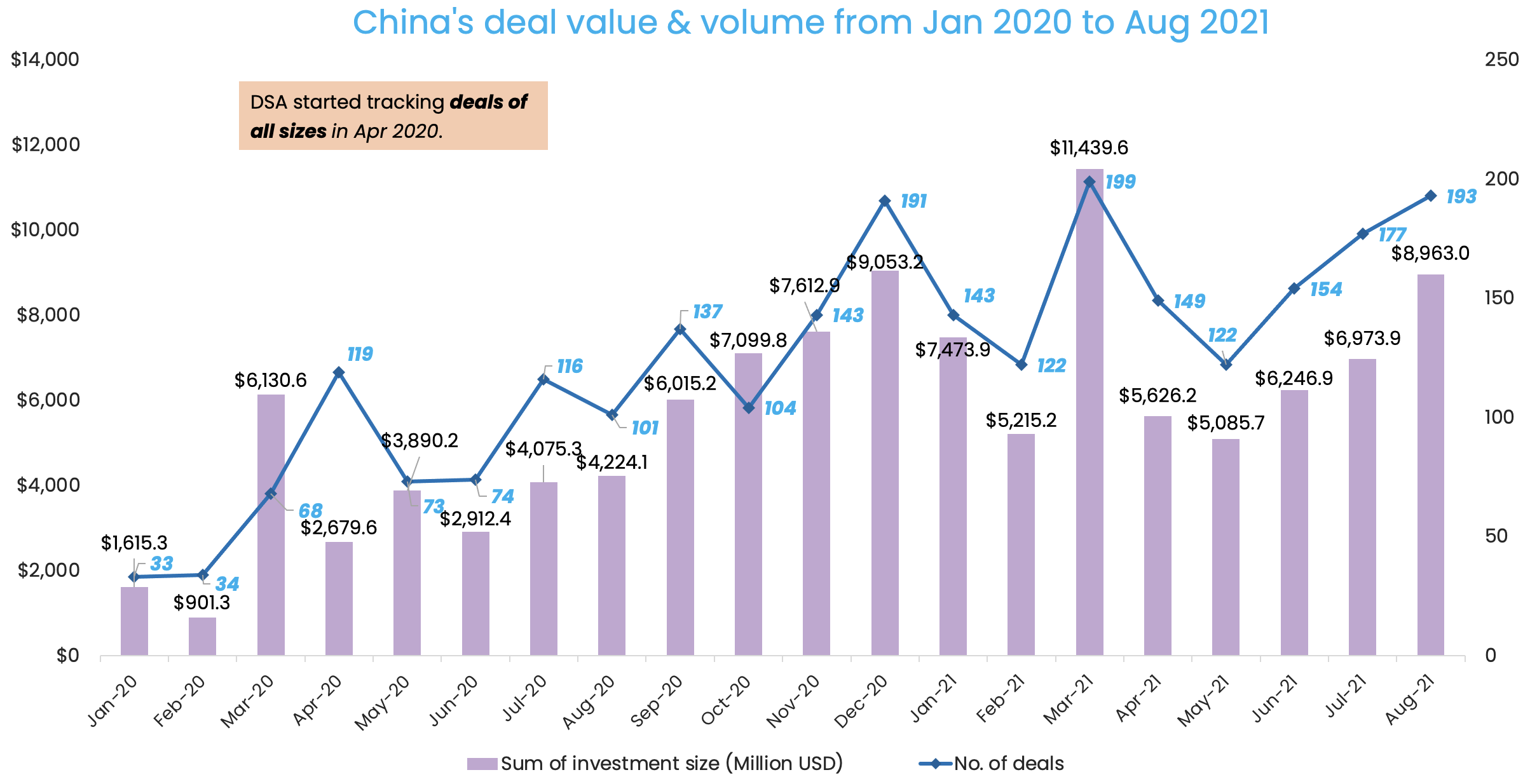

Investments in privately-held companies in Greater China rose for a third consecutive month to reach almost $9 billion in August 2021, up 28.5% from July.

Private equity (PE) and venture capital (VC) firms made at least 193 transactions into startups across mainland China, Hong Kong, and Taiwan last month, up 9%, compared with 177 deals in July, according to proprietary data compiled by DealStreetAsia.

August’s numbers represent significant increases from the same period last year. The number of PE-VC deals grew 91.1% from August 2020, while the monthly deal value more than doubled.

While there were no billion-dollar transactions in August, China’s Suzhou Abogen Biosciences raised over $700 million — the biggest investment in the month — led by seven investors including Singapore’s Temasek, to support the clinical development of its potential COVID-19 vaccine.

Two other companies had $500 million funding rounds. Electric vehicle (EV) startup Leapmotor secured $692 million in a strategic investment led by CICC Capital; while Zeekr Intelligent Technology, an EV brand by Chinese automaker Geely, closed a pre-Series A round at $500 million from investors including Intel Capital, battery maker CATL, and online video site Bilibili.

Megadeals at peak levels

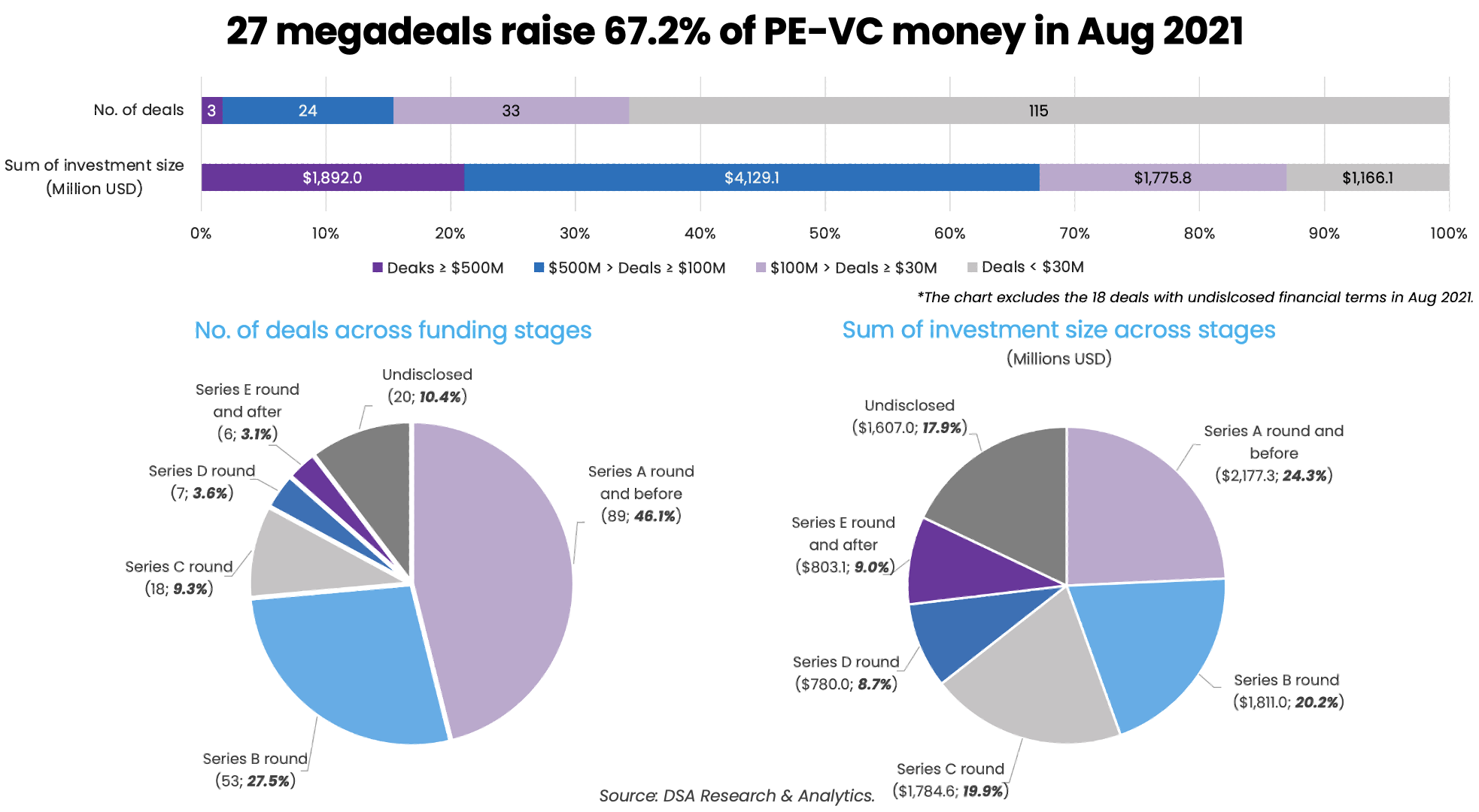

The number of megadeals — defined as transactions worth $100 million and above — rose to annual peak levels of 27. Their combined value amounted to over $6 billion, accounting for 67.2% of the month’s total funding.

The resurgence of megadeals followed months of weakened interest in writing big-ticket cheques. The number of megadeals in each of the four months between April and July was no more than 20, after March topped at 27 megadeals that raised nearly $7.9 billion.

Besides the three aforementioned $500 million-plus investments, there were 24 deals in the range of $100-500 million. The biggest among them include artificial intelligence (AI)-based drug discovery platform XtalPi’s $400-million Series D round; an over-2-billion-yuan Series C round by digital healthcare payment service MediTrust Health; and energy tech firm Newlink Group’s 2-billion-yuan Series E round.

Investors remained bullish on startups in their Series B round and earlier as transactions in the early stage continued to account for a bulk of the deal count in August. Close to half (46.1%) of the deals happened at Series A round and earlier, followed by deals in their Series B round, which accounted for over a quarter (27.5%) of the deal count.

In terms of deal value, the two funding stages also accounted for the biggest chunk of financing in August, with about $2.2 billion (24.3%) going into Series A deals and over $1.8 billion (20.2%) going into Series B deals.

Investors’ appetite for early-stage portfolios is expected to grow, after Chinese President Xi Jinping on September 2 unveiled the country’s plan of setting up a new stock exchange in the capital city of Beijing to serve small and medium-sized enterprises (SMEs). This will add to the existing mainland bourses in Shanghai and Shenzhen in southern China, as well as the financial markets in Hong Kong.

Among growth- and late-stage deals, funding in the Series C stage led the pack, with almost $1.8 billion in total. There were 18 Series C deals, seven Series D deals, and six deals in Series E round and later. The funding stages of 20 investments were not disclosed.

The 27 megadeals in Aug 2021

| Startup | Headquarters | Investment Size (USD) | Investment Stage | Lead Investor(s) | Investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|

| Suzhou Abogen Biosciences | Suzhou | $700 million | C | Temasek Holdings, Invesco Developing Markets Fund, Loyal Valley Capital, GL Ventures, Yunfeng Capital, Lilly Asia Ventures (LAV), Boyu Capital | Youshan Capital, Gaorong Capital, Firstred Capital, Octagon Capital, Kaiser, 5Y Capital, MSA Capital, Alwin Capital, Yingke PE, Tiger Jade Capital (affiliated with Hangzhou Tigermed Consulting), AIHC Capital, Winfast Holding, Oriental Spring, Legend Capital, Qiming Venture Partners, HighLight Capital, PICC Capital Equity Investment, BioTrack Capital, CTS Capital | Biotechnology | Biotech |

| Leapmotor | Hangzhou | $692 million | Strategic Investment | CICC Capital | Hangzhou Capital, CITIC Construction, CITIC Dicastal | Automobiles, Other Vehicles & Parts | Electric/Hybrid Vechicles |

| ZEEKR Intelligent Technology | Ningbo | $500 million | Pre-A | Intel Capital, Contemporary Amperex Technology Co Limited (CATL), Bilibili, Cathay Fortune Corporation, Boyu Capital | Automobiles, Other Vehicles & Parts | Electric/Hybrid Vechicles | |

| XtaIPi | Shenzhen | $400 million | D | OrbiMed Healthcare Fund Management, HOPU Investments | Sino Biopharmaceutical, Sequoia Capital China, 5Y Capital | Pharmaceuticals | HealthTech |

| MediTrust Health | Shanghai | $308 million | C | Boyu Capital, Janchor Partners | Lilly Asia Ventures (LAV), China International Capital Corporation (CICC), B Capital Group, Bank of China Group Investment, China Everbright Limited, Lake Bleu Capital, AIHC Capital, New Alliance Capital, Sinovation Ventures, Huaxing Growth Capital, Shanghai Healthcare Capital, Marathon Venture Partners | Healthcare Services | HealthTech |

| Newlink Group | Beijing | $308 million | E | China Merchants Capital | CICC Capital | Internet | CleanTech |

| Inceptio Technology | Shanghai | $270 million | B | JD Logistics, Meituan, PAG | Eight Roads Ventures, Deppon Logistics, IDG Capital, CMB International, CMG-SDIC Capital, Mirae Assets, Broad Vision Funds, Hidden Hill Capital, CATL, NIO Capital, Eastern Bell Capital | Automobiles, Other Vehicles & Parts | Autonomous Driving |

| Kuaikan Manhua/Kuaikan World (Beijing) Technology | Beijing | $240 million | CCB International, One Store, Tencent, Coatue Management, Tiantu Capital | Consumer Services | N/A | ||

| Yuanxin Technology | Beijing | $232.1 million | F | Springhill Fund, B Capital Group, Hel Ved Capital Management, Orbimed, United Overseas Bank (UOB), E Fund Management, Ab Initio Capital, BOC International, INCE Capital, CITIC Securities, Kunling Capital, Index Capital | Healthcare Services | HealthTech | |

| OrbusNeich Medical Group Limited | Hong Kong | $200 million | Shenzhen Capital Group, Red Earth Healthcare Investment Fund | CCB International, CICC Biomedical Fund (affiliated with CICC Capital), China Merchants Securities Investment, Shenzhen Share Capital Healthcare Fund | Medical Devices & Equipment | N/A | |

| Fujian Deer Technology | Longyan | $182 million | A | China's National Manufacturing Transformation and Upgrade Fund, China's National Fund for Technology Transfer and Commercialisation, Sequoia Capital China, Fortune Capital, Shenzhen Capital Group, SDIC Venture Capital | HY Capital, Cowin Capital, CMS Capital, China Industrial Securities Investment Management, State Grid Corporation of China, China Resources Microelectronics, Transfar Group, Tsinghua Holdings Capital (TH Capital), SAIF Partners China, Triniti Capital, Cloud Capital, Xuhui Capital, Richland Capital, Ningbo Painuo, Luxin Venture Capital Group, Xiamen Torch Group, Xiamen Meiya Pico Information, Shenzhen HTI Group, Nanjing Yang Zi State-Owned Investment Group, Fujian Venture Investment Management, Longyan Investment & Development Group, Minxi Xinghang State-Owned Investment & Operation, Furui Innovation Emerging Industry Investment | Materials | N/A |

| Jiangsu Meike Solar Energy Science and Technology | Yangzhong | $155 million | A, A+ | Addor Capital, Sinopec Capital, Astronergy/Chint Solar | Huagai Capital, Junrun Capital, Cloudview Capital, Anhua Venture Capital, Yangzhong Financial Holding Group | Renewable Energy | CleanTech |

| Beijing Health Guard Biotechnology | Beijing | $155 million | Pre-IPO | CCB International, Yunfeng Capital, Yingke PE, Jiangxi Jemincare Group | Biotechnology | Biotech | |

| MetaX/MetaX Integrated Circuits (Shanghai) | Shanghai | $155 million | A | China Structural Reform Fund, China Internet Investment Fund (CIIF) | Sequoia Capital China, Matrix Partners China, Lightspeed China Partners, CTC Capital, Guochuang Zhongding, Intelligent Connected Industry Fund, Shanghai Sci-Tech Innovation Centre Capital, Lenovo Capital & Incubator Group, CMG-Jintai, Fosun RZ Capital, Oriental Fortune Capital, Cantor Jungle | Semiconductors | AI and Machine Learning |

| Shanghai Longcheer Technology | Shanghai | $154 million | C | China Internet Investment Fund (CIIF) | Yunfeng Capital, GP Guotiao Fund (affiliated with GP Capital), Shanghai Chaoyue Moer Fund, Forebright Capital, HuaXu (Guangzhou) Industrial Investment Fund Management | Consumer Products | Internet of Things |

| HOSE EKUAIBAO/Beijing Hose Information Technology | Beijing | $154 million | D | SoftBank Vision Fund 2 | Tiger Global Management, Sequoia Capital China, Mandra Capital, Future Capital | Financial Services | Saas |

| JOINN Biologics | Beijing | $150 million | B | CPE | Green Pine Capital Partners (GPCP), Hongtai Aplus, Yingke PE, HT Capital, Huagai Capital | Pharmaceuticals | HealthTech |

| Probio Cayman/GenScript ProBio | Nanjing | $150 million | A | Hillhouse Capital | Biotechnology | Biotech | |

| Trinomab Biotech | Zhuhai | $108 million | A+ | CMB International, Sunshare Capital Management, CICC Qide (CICC Capital), Riverhead Capital, Shenzhen Guozhong Venture Capital Management, Superstring Capital, Tenykin Capital | Biotechnology | Biotech | |

| Shukun Technology | Beijing | $108 million | Goldman Sachs Asset Management, Primavera Capital Group, Sequoia Capital China, Marathon Venture Partners, Jane Street Capital, Sage Partners, WT China Focus Fund, Weilai Qichuang Fund | Healthcare Services | HealthTech | ||

| Pulse Medical Imaging Technology (Shanghai) | Shanghai | $100 million | C | GL Ventures, Philips, Goldman Sachs Asset Management, Boyu Capital | Linden Asset Group (LAG), Insight Capital | Healthcare Specialist | HealthTech |

| DEEPEXI | Beijing | $100 million | B | Xingtou (Beijing) Capital Management, Guotai Junan International | BOCOM International, SPDB International, Rencent Capital | Software | Big Data |

| QCraft | Beijing | $100 million | A+ | Yunfeng Capital, Genesis Capital | Dragonball Capital (affiliated with Meituan), IDG Capital | Automobiles, Other Vehicles & Parts | Autonomous Driving |

| Nanos Medical | Shanghai | $100 million | C, D | C: 6 Dimensions Capital, Eight Roads Ventuers; D: Yunfeng Capital | C: Sino-Ocean Capital, Jieshi Investment; D: Marathon Venture Partners, 6 Dimensions Capital, Eight Roads Ventures, Jieshi Investment | Medical Devices & Equipment | N/A |

| Ionova Life Science | Shenzhen | $100 million | Tsing Song Capital, Shenzhen Capital Group, Greater Bay Area Homeland Development Fund | Lilly Asia Ventures (LAV), DYEE Capital | Biotechnology | Biotech | |

| YGL | Hangzhou | $100 million | D1, D2 | D1: SDP Investment; D2: Goldman Sachs Asset Management | Consumer Services | Robotics & Drones | |

| Genuine Biotech | Shenzhen | $100 million | B | Efung Capital, Yingke PE | DESANO, ABC Capital, China Fortune Financial Group | Biotechnology | Biotech |

Biotech dealmaking tops again amid bullish IPO market

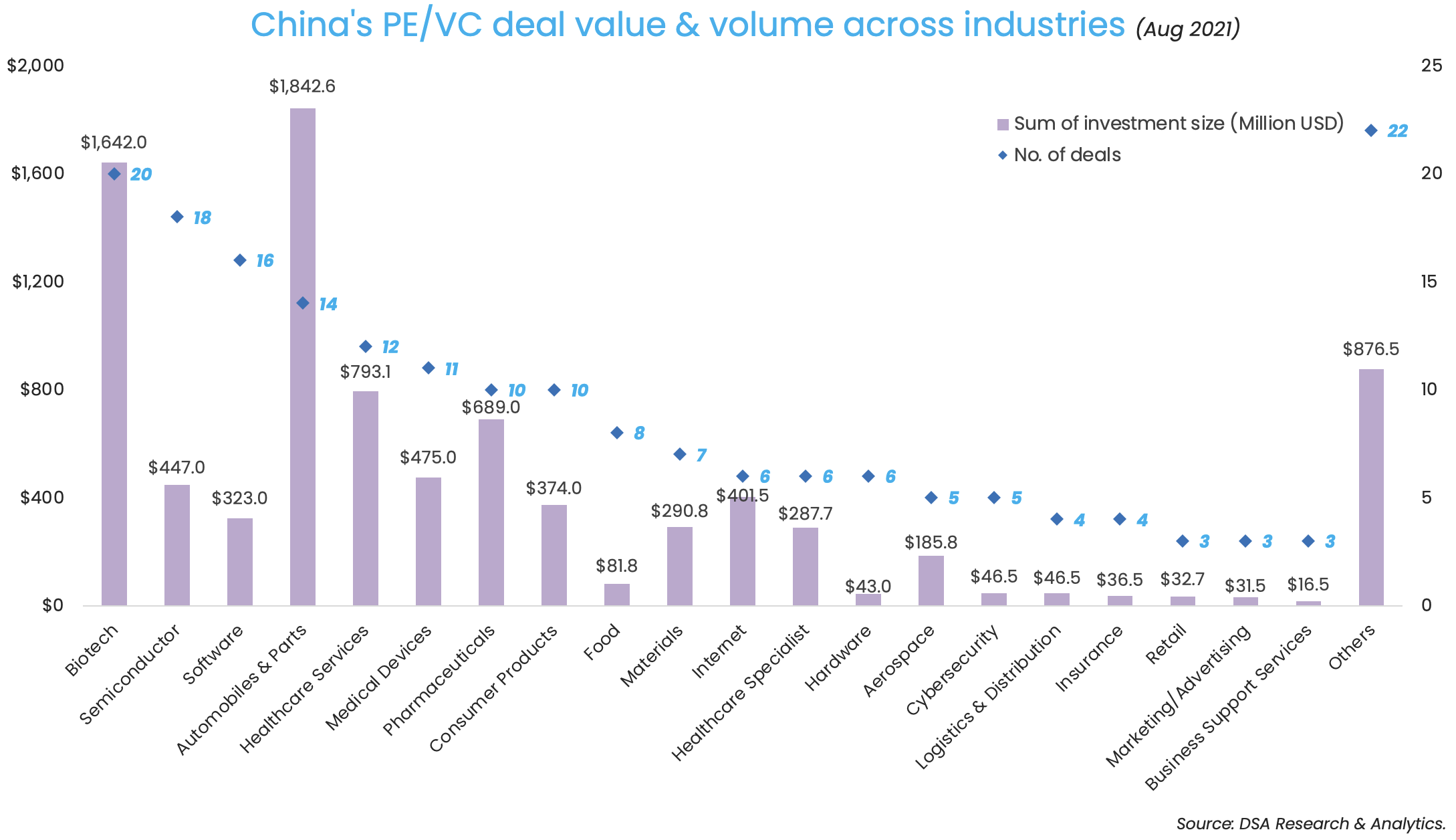

Investors’ inclination for biotech investments in July extended to August as well, as the sector saw the completion of 20 deals worth over $1.6 billion.

Biotech firm Suzhou Abogen Biosciences’ $700 million-plus Series C round was the biggest of all, in addition to another five megadeals — protein-based biologics developer Health Guard; Probio Cayman, a CDMO unit of Hong Kong-listed Genscript Biotech; human antibody drugs maker Trinomab Biotech; Ionova Life Science, which develops medicines for cancer treatment; and Genuine Biotech, a firm that advances drugs for the treatment of oncology, cardiovascular and other diseases.

The overall health market — biotech and other health-related sectors such as healthcare services, medical devices, pharmaceuticals, healthcare specialist, and healthcare IT — collectively recorded 61 transactions raising a combined $3.9 billion. The sector is seemingly immune to the country’s recent Big Tech crackdown.

The numbers represent 31.6% of August’s total deal count and 43.5% of the month’s deal value.

Enthusiasm in biotech investments is likely to sustain, partly because the listing reforms across bourses such as the Hong Kong stock exchange and Shanghai’s Nasdaq-style STAR Market have given rise to exits from these mostly pre-profit or pre-revenue companies.

The world’s second-largest IPO market, Hong Kong recorded 21 listings by healthcare companies in January-August 2021, which is about one-third of total primary listings in the city during the period, according to official statistics. That includes nearly half of biotech issuers that went public under Chapter 18A, a listing regime that the regulator introduced in April 2018 to allow pre-revenue biotech businesses to tap the city’s public market.

Sequoia China top investor leads with 16 deals totaling $1.2b

Sequoia Capital China — an early investor in tech giants like Alibaba, JD.com, and TikTok-owner ByteDance — remained perched on top as the most active investor in Greater China with capital injections into at least 16 startups.

As the bellwether of early-stage tech investments in the country, Sequoia China topped our monthly fund ranking list nine times out of ten. In the previous months, it made 13 deals in July; 13 in June;15 in May; and 15 in April.

The aggregate value of its participated deals amounted to $1.2 billion, largely on account of five megadeals. These megadeals were in AI drug discovery platform XtalPi; electronic chemicals manufacturer Fujian Deer Technology; semiconductor firm MetaX Integrated Circuits; e-invoicing startup HOSE EKUAIBAO; and Shukun Technology, which uses AI to power medical imaging diagnosis.

Of the 16 deals, four were made through its Sequoia China Seed Fund, a vehicle that the firm uses to invest in startups at the seed and angel stage. Since its inception three years ago, Sequoia China Seed Fund has registered over 5 billion yuan ($776.2 million) in assets under management (AUM) and investments into nearly 200 startups across the fields of TMT, healthcare, consumer services, and beyond as of August 2021.

Other active PE-VC investment groups in August include Hillhouse Capital’s VC unit GL Ventures; investment banking firm China International Capital Corporation (CICC) and its subsidiaries; China’s Oriza Holdings and affiliated funds; as well as VC major Qiming Venture Partners.

Most active investors in China's PE-VC market (Aug 2021)

| Investment company | No. of deals | Total value of participated deals (USD) | Lead | Non-lead |

|---|---|---|---|---|

| Sequoia Capital China and affiliates | 16 | $1,203.5 million | 4 | 12 |

| GL Ventures | 11 | $993 million | 8 | 3 |

| CICC and affiliates | 9 | $1801.2 million | 4 | 5 |

| Oriza Holdings and affiliates | 9 | $209.8 million | 2 | 7 |

| Qiming Venture Partners | 7 | $935.2 million | 3 | 4 |

| China Merchants Group and affiliates | 7 | $667.2 million | 3 | 4 |

| Shenzhen Capital Group | 7 | $559.5 million | 6 | 1 |

| Lightspeed China Partners | 7 | $406.3 million | 4 | 3 |

| Matrix Partners China | 7 | $381.3 million | 3 | 4 |

| Lilly Asia Ventures | 6 | $1,235 million | 2 | 4 |

| *If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Note: In our monthly analysis for August 2021, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

Liya Su contributed to the story.

Share this story with your friends and colleagues.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

India Deals Barometer Report: After hitting a record high, startup funding in India falls to $4.6b in August

India startups raised $4.68 billion across 257 deals in the first quater of 2021 to touch a five-quater high.

Venture Capital

SE Asia Deal Barometer Report: VC funding in startups dips 48% to $652m in August

South East Asia based venture capital (VC) firms closed five funds in Q1, raising $694 million in total…