China Deal Review: At $6.8b in Aug, PE-VC dealmaking scales new 2022 peak

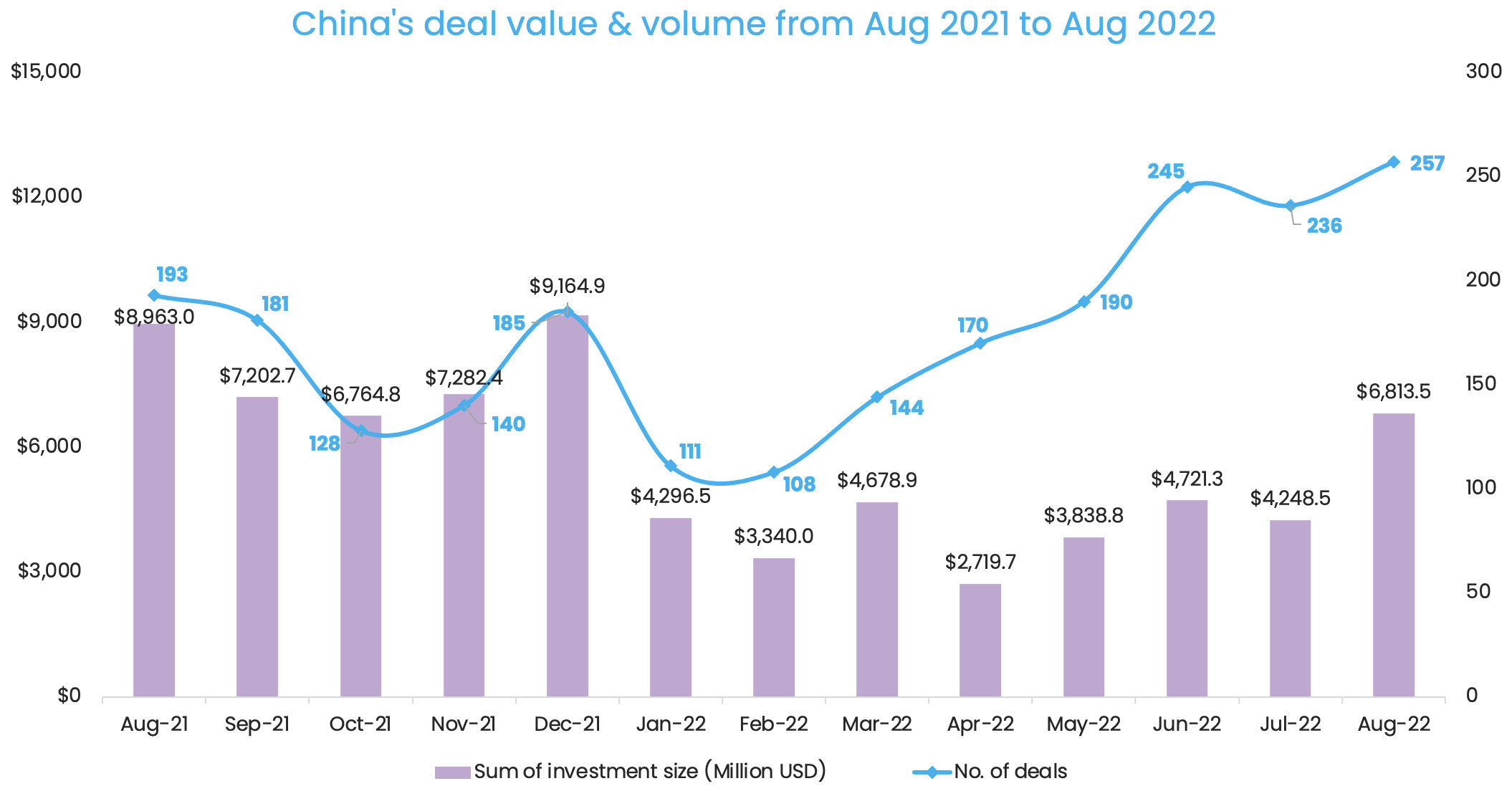

August was a month of record dealmaking in the Greater China market, as startups raised $6.8 billion across 257 venture deals — the highest so far this year in terms of both monthly deal value and deal count.

Due to a rise in megadeals, the total fundraising in August was 60.4% higher than in July, when startups had bagged over $4.2 billion. The month’s deal count marked a slight increase of 8.9% from 236 deals in the previous month, according to proprietary data compiled by DealStreetAsia.

Venture investors have turned out to be more active this year, although their appetite for underwriting big-sized cheques has been dampened by global market volatility. This reflects in the year-over-year (YoY) comparison. The deal count in August was 33.2% more than the same month last year, but deal value declined 24%.

Collectively, startups in Greater China completed 1,461 venture deals worth almost $34.7 billion in the first eight months of 2022. While the deal count represented a 16% increase over the same period in 2021, the aggregate deal value was just 60.8% of that in Jan-August 2021.

Sunwoda EVB raises August’s only billion-dollar deal

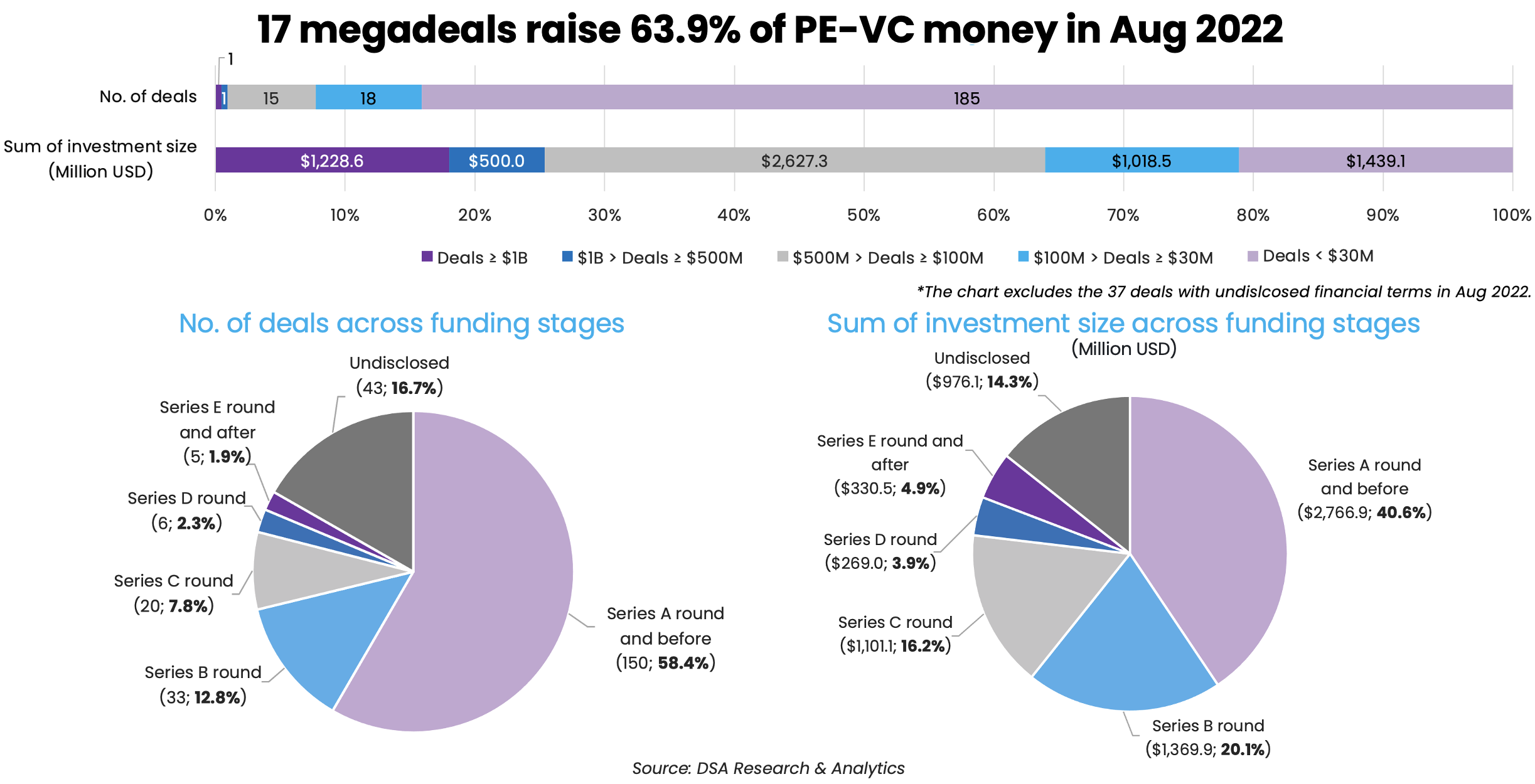

A billion-dollar investment in the EV sector propped up fundraising in August. Besides, there was also one $500 million transaction and 15 other megadeals, or those with a size of $100 million or above. The 17 large-ticket deals accounted for 63.9% of the $6.8-billion-plus funding in August.

Sunwoda Electric Vehicle Battery, an EV battery solutions provider affiliated with Chinese publicly-listed Sunwoda Electronic, raised over $1.2 billion across two tranches of its Series A round. As the biggest venture deal last month, Sunwoda EVB’s Series A round attracted professional investment institutions such as Source Code Capital, as well as strategic investors in the automotive industry including EV company Li Auto and China’s state-owned automakers GAC Group and SAIC Motor Corp.

Ranking second was an investment in Black Sesame Technologies, which offers autonomous driving chips to carmakers including BYD, SAIC Motor, and FAW Group, The startup pocketed over $500 million in its Series C round with the backing of Chinese equity investment firm SummitView Capital, China Industrial Bank, and others.

The remaining 15 megadeals were across a wide range of industries including biotech, auto & parts, energy storage & batteries, aerospace, internet, logistics & distribution, medical device, software, and more.

Investors continued to favour startups in their early funding stages, retaining confidence in the long-term tech development of China — the world’s second-largest incubator of unicorns, or privately-held companies worth over $1 billion. But the lingering pandemic and a stagnant stock market have weighed on the listing prospects of IPO-bound startups, leading to a subdued investor sentiment at the growth- and late-stage funding.

Dealmaking became far less active in funding stages that are closer to a public listing. In August, Series A and earlier stages recorded the completion of 150 deals, or 58.4% of the month’s deal count, while the $2.8 billion capital raised at this funding stage accounted for 40.6% of the deal value.

List of megadeals in Aug 2022

| Startup | Headquarters | Investment size (Million USD) | Investment stage | Lead investor(s) | Other investor(s) | Industry | Vertical |

|---|---|---|---|---|---|---|---|

| Sunwoda Electric Vehicle Battery | Shenzhen | $1,228.6 | A | Meituan, Li Auto | GAC Group, SAIC Motor, Source Code Capital, Broad Vision Funds, CoStone Capital, Shenzhen Capital Group | Energy Storage & Batteries | Electric/Hybrid Vehicles |

| Black Sesame Technologies | Shanghai | $500 | C, C+ | SummitView Capital | Industrial Bank, GF Xinde Investment Management, Hina Group, North Beta Capital, Xin Ding Capital, El Camino Capital, Yangtze River Investment Fund Management | Automobiles & Parts | Autonomous Driving |

| Ruigu Shop | Shanghai | $400 | Primavera Capital Group, Ontario Teachers’s Teachers’ Venture Growth (TVG) | Source Code Capital, Taikang Life Insurance, GLP (普洛斯), Xiamen C&D Emerging Industry Equity Investment, Eastern Bell Capital, CDH Venture and Growth Capital, Chengwei Capital | Internet | E-Commerce | |

| Taibang Biologic Group | Beijing | $300 | Abu Dhabi Investment Authority (ADIA), GIC | China Life, Cinda Kunpeng | Biotech | Biotech | |

| Viiyong | Luoding | $289.8 | B, B+ | Electronics | N/A | ||

| Sironax (Beijing) | Beijing | $200 | B | Yunfeng Capital, Gaorong Capital | Temasek Holdings, Invus, F-Prime Capital, Eight Roads, ARCH Venture Partners, K2 Venture Partners, MSA Capital, Abu Dhabi Investment Authority (ADIA), CBC Group, Jiangyuan Investment, Superstring Capital, Future Innovation Fund | Biotech | Biotech |

| NTX | Shanghai | $200 | C2 | Centurium Capital | Materials | CleanTech | |

| Xiangdao Chuxing | Shanghai | $148 | B | SAIC Group, Momenta, Gaoxing Management & Consulting (高行管理咨询) | Automobiles & Parts | Autonomous Driving | |

| Qiyuan Green Power | Shanghai | $147.3 | A | Energy Storage & Batteries | Electric/Hybrid Vehicles | ||

| Jayson New Energy Technology | Shanghai | $147.3 | A | Panorama Capital | Energy Storage & Batteries | Electric/Hybrid Vehicles | |

| EVHouse | Chongqing | $144.9 | A | Shandong Weiqiao Pioneering Group, SoftBank China Venture Capital (SBCVC) | Automobiles & Parts | Electric/Hybrid Vehicles | |

| OriCell Therapeutics (Shanghai) | Shanghai | $120 | B | Qiming Venture Partners, Quan Capital | Shanghai Sci-Tech Innovation Centre Capital, Sinopharm Capital, Suzhou Fund, Boquan Equity Investment Management, Xiamen C&D Emerging Industry Equity Investment | Biotech | Biotech |

| Tan Yun | Yingkou | $117 | Pre-IPO | Beijing Financial Street Capital Operation Group, SDIC Venture Capital, CICC Capital | Tang Xing Capital, Haitong New Energy Private Equity Management, Capitech Venture Capital, Qinke Capital, Liaochuang Investment, Hangxin Capital, Yunxing Huiyuan, Hefang Capital, Jinxing Investment, Cash Capital | Aerospace | Space Tech |

| Dianxiaomi | Shenzhen | $110 | D | SoftBank Vision Fund 2, Sequoia Capital China | Tiger Global Management, GGV Capital, Huaxing Growth Capital | Software | E-Commerce |

| Jinjiang Electron | Chengdu | $103 | A, A+, B | Hillhouse Capital Group | Xinda Kunpeng, Guanghua Wutong, Yuanheng Lizhen, Shandong Weigao Group Medical Polymer, HM Capital, | Medical Devices & Equipment | N/A |

| Geek+/GeekPlus Technology | Beijing | $100 | E1 | Intel Capital, Vertex Growth, Qingyue Capital Investment | Logistics & Distribution | Robotics & Drones | |

| Bao Pharmaceuticals | Shanghai | $100 | B | Oriental Fortune Capital | Haitong Innovation Captial Management, Sun Rock Capital Management, Jintong Capital, CenterLab, Findowin Capital | Biotech | Biotech |

Semiconductor, software, and biotech lead in deal count

Semiconductor, software, and biotech once again led in deal count with the completion of 33, 31, and 23 transactions in the month, respectively. But due to a lack of megadeals, their fundraising scales fell behind the energy storage & batteries sector, which came first in terms of the deal value thanks to Sunwoda EVB’s Series A round.

Investors flocked in seeking to capture the growth potential of China’s semiconductor industry. Nineteen of the world’s 20 fastest-growing chip companies over the four quarters between Q3 2021 and Q2 2022 hail from China. That compared with just eight in the year-ago period, according to data compiled by Bloomberg.

August saw semiconductor startups complete 33 venture deals, raising a combined $435.4 million. Since there was no megadeal, the month’s total chip financing was only one-third of the $1.3 billion registered in July.

Sineva, a producer of key raw materials used in integrated circuit (IC) manufacturing, secured the biggest chip deal at $72.1 million from lead investors including CICC Capital and Guokai Manufacturing Transformation and Upgrading Fund, a 50-billion-yuan ($7.2 billion) state fund tasked with lifting China’s traditional manufacturing industry. All the other chip investments last month were lower than $50 million, and over half of August’s chip deals happened in Series A or earlier rounds.

Software startups followed closely with the completion of 31 deals. Although their total financing only stood at $333.3 million, it was still 25.3% more than the $266 million booked in July.

The sector’s small fundraising scale is due to the fact that most software startups — whether they target corporate clients under a Software-as-a-Service (SaaS) business model or utilise cutting-edge technologies from artificial intelligence (AI) to cloud computing to advance industries such as consumer electronics, automotive, and telecommunications — are still in their nascent stages.

E-commerce SaaS platform Dianxiaomi bagged $110 million in a Series D round as the only software megadeal. The new round, which came less than six months after its $100-million Series C round, was jointly led by SoftBank’s Vision Fund 2 and Sequoia Capital China with participation from other first-tier investment firms including Tiger Global Management, GGV Capital, and Huaxing Growth Capital.

The remaining 30 software deals were all below $50 million. And like the chip sector, 16 out of the 31 software deals in August were raised at Series A round and earlier.

Top investors step up early-stage dealmaking

In light of a gloomy near-term listing prospect, blue-chip investors in the venture market are raising their stakes in early-stage dealmaking.

Sequoia Capital China, the Neil Shen-led bellwether of tech investments in China, topped the investor list in August with participation in 17 deals worth a combined $264 million.

This early backer of tech giants, including e-commerce heavyweight Alibaba Group and TikTok’s Chinese owner ByteDance, made 11 out of the 17 deals through its Sequoia China Seed Fund, a unit that focuses on angel and seed investments across China’s TMT, consumer services, healthcare, and industrial technology areas.

To double down on this effort, Sequoia China last month announced the official launch of a new accelerator programme YUÈ to provide China’s emerging startups with “systematic entrepreneurship courses, resources, and services”, it wrote in a post on its WeChat official account.

YUÈ, which comes roughly four years after the establishment of its Seed Fund, is an addition to Sequoia Capital’s global accelerator network, which already covers India and Southeast Asia with Sequoia India’s initiative Surge, as well as Europe and the US through Sequoia Arc.

Another top investor Legend Holdings also increased its bets at the early funding stage, as the Chinese conglomerate backed a total of eight venture deals through its subsidiaries. Collectively, its investee companies raised $269.3 million.

Its Lenovo Capital and Incubator Group, which focuses more on startup incubation, contributed to five of the group’s eight investments in August. In comparison, Legend Capital, an affiliate that specialises in early- and growth-stage venture capital (VC) deals, injected capital into three deals.

Most active investors in Greater China (Aug 2022)

| Unlinked | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Sequoia Capital China & Sequoia China Seed Fund | 17 | $264 | 6 | 11 |

| CICC Capital and affiliates | 10 | $293.9 | 9 | 1 |

| Legend Capital & Lenovo Capital and Incubator Group | 8 | $269.3 | 4 | 4 |

| China Merchants Group and affiliates | 7 | $112 | 3 | 4 |

| SAIC Motor and affiliates | 6 | $1420.6 | 2 | 4 |

| Shenzhen Capital Group | 6 | $1345.5 | 4 | 2 |

| Fosun Group and affiliates | 6 | $143.1 | 3 | 3 |

| Gaorong Capital | 5 | $373.1 | 4 | 1 |

| Qiming Venture Partners | 5 | $333.1 | 3 | 2 |

| SDIC and affiliates | 5 | $226.5 | 2 | 3 |

| Hillhouse Capital Group & GL Ventures | 5 | $134 | 3 | 2 |

| *If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Note: In our monthly analysis for August 2022, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

Despite economic headwinds, fundraising by Indian startups recovers to touch $1.2b in Aug

After hitting a 21-month low in July, fundraising by Indian startups bounced back in August as venture capital...

Venture Capital

SE Asia Deals Barometer Report: At $5.3b, funding hits year's highest in Aug on the back of megadeals

Startups in Southeast Asia raised at least $5.3 billion in August, the highest so far in 2022...