China Deals Barometer Report: After historic lows in March, startup funding revives in April

After recording a historic low in March this year, dealmaking bounced back in China in April, as investors pumped in $3.4 billion in the startup ecosystem across 207 deals.

In terms of value, this is a 27.1% jump from March, according to proprietary data compiled by DealStreetAsia. The number of deals clocked last month, however, did not show much of a change – it stood at 206.

While the increase in deal value brings temporary relief to the startup fraternity, it’s still far from the $6.2 billion that venture capitalists invested in startups in February.

This is primarily because of the paucity of mega deals last month.

Even as the nationwide lockdown was lifted from China late last year, fund managers are still taking a cautious approach towards fresh investments – especially when it comes to doling out large amounts to companies – due to the macro market uncertainty.

In terms of a year-over-year (YoY) comparison, the deal volume in April 2023 registered a 23.8% jump from the same month last year, while the total amount pumped in by investors saw a 21.8% increase.

When it comes to the first four months of this year, startups in Greater China collectively garnered $18.1 billion across 825 venture deals. The deal value booked a 20.1% growth over the same period in 2022, while deal volume spiked 54.8%.

Late-stage deals dry up

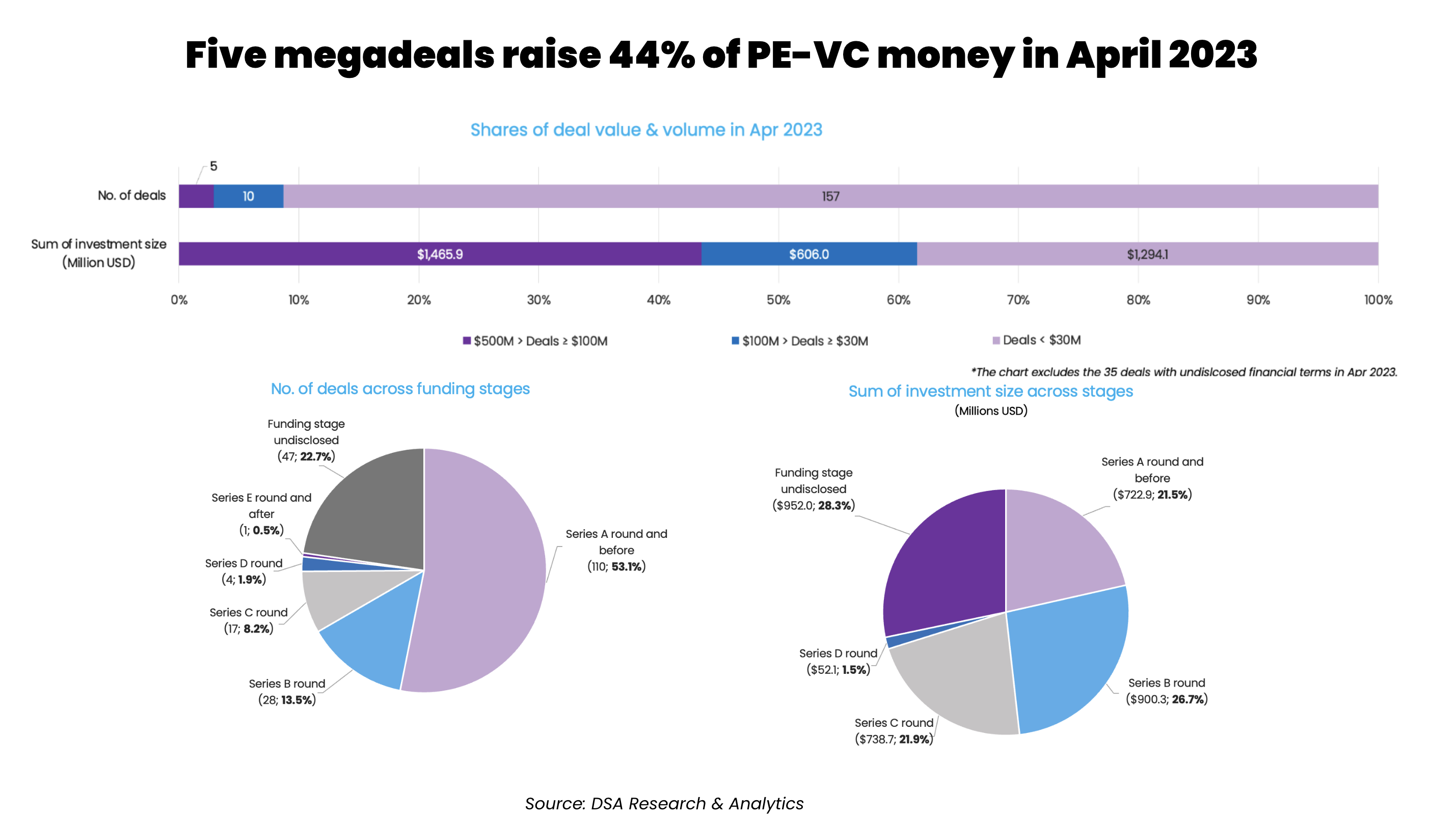

While billion-dollar deals were scarce in April, the month saw the completion of just five megadeals (valued at $100 million or more), wherein startups amassed a total of $1.5 billion, making up for 43.6% of the month’s total fundraising.

In the biggest transaction, Libode New Material Co Ltd, which makes lithium-ion battery cathode materials, bagged 2.578 billion yuan-($375.2 million) in its Series B round. The Yibin City-headquartered firm plans to accelerate its initial public offering (IPO) plan, after roping in investors like CICC Capital, the flagship private equity (PE) platform of China International Capital Corp Ltd (CICC), and Chinese state-owned automaker GAC Group’s GAC Capital.

In another megadeal, chip maker SJ Semiconductor secured nearly $340 million in its Series C extension round, bringing the firm’s valuation to $1.8 billion. The round joined by Legend Capital took the firm’s total capital raised to $1 billion.

In the third biggest deal, drug development firm Hasten Biopharma raised $315 million in a funding round co-led by Asian healthcare-focused investment firm CBC Group and Abu Dhabi sovereign wealth fund Mubadala.

Megadeals of April 2023

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| China Merchants Group and its affiliates | 7 | 155 | 4 | 3 |

| Legend Capital | 6 | 582.4 | 4 | 2 |

| CAS Holdings’ affiliates | 6 | 262.3 | 3 | 3 |

| CICC Capital and affiliates | 5 | 488.6 | 1 | 4 |

| State Development & Investment Corporation (SDIC) and affiliates | 5 | 87 | 4 | 1 |

| Leaguer Capital | 4 | 449.2 | 1 | 3 |

| Addor Capital | 4 | 58.2 | 2 | 2 |

| Bluerun Ventures | 4 | 33.4 | 1 | 3 |

| Oriza Holdings and affiliates | 4 | 369 | 0 | 4 |

| Shenzhen High-Tech Investment Group | 3 | 17.5 | 1 | 2 |

| China Capital Management (affiliated with CSC Financial) | 3 | 418.7 | 1 | 2 |

| Cowin Capital | 3 | 31.9 | 2 | 1 |

| CoStone Capital | 3 | 31.9 | 1 | 2 |

| V Fund | 3 | 101.4 | 1 | 2 |

| GL Ventures (affiliated with Hillhouse Capital Group) | 3 | 29 | 3 | 0 |

| Ivy Capital | 3 | 16 | 1 | 2 |

| Nio Capital | 3 | 58.2 | 2 | 1 |

| Goldport Capital | 3 | 4.5 | 0 | 3 |

| Vertex Ventures | 3 | 48.7 | 1 | 2 |

| Gaorong Capital | 3 | 87 | 0 | 3 |

| *”Total value of participated deals (Million USD)” refers to the total amount of capital raised by the respected startup in the round, including capital from the listed investor as well as other participating investors. If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Even as investments in Series A and earlier stages accounted for $53.1% of April’s total deal count; in early-stage deals, startups amassed only $722.9 million which makes up for 21.5% of the total deal value.

There were 47 investments, wherein startups did not divulge their funding stages. Although that comprised only 22.7% of the total deal count, they booked for the largest deal value of $952 million. In two of the five megadeals clocked by companies namely Hasten Biopharma and Sangon Biotech, the funding stages were undisclosed.

Chinese chip makers grab investor interest

Investments in China’s semiconductor startups continued to gain momentum as the country strived for self-sufficiency. Semiconductor was the most-funded industry in April, which saw 31 startups raising a total of $813.4 million.

It is important to note that 41.8% of the funding in the chipmaking industry came from SJ Semiconductor’s $340-million-Series C extension round, which goes on to signal that the rest of the firms clocked mostly small-sized deals with an average deal value of $15.8 million.

In 2022, the Chinese government drew up a plan to invest 12.1 billion yuan ($1.8 billion) to support 190 chipmaking firms that are listed in either Shanghai or the Shenzhen stock exchanges, stated local media outlet Ijiwei. The number signifies the country’s efforts amid escalating chip wars with the US.

Business support services were the second-most invested sector, with the number of deals standing at 23 worth $64.5 million. It was the sector that saw the only pre-IPO-stage investments.

Energy storage took the third slot, with 16 startups raising a total of $586.6 million. Energy storage solutions provider Dalian Rongke Power’s 1-billion-yuan ($145.4 million) Series-B investment was the only megadeal that took place in the sector. Legend Capital, the fund management arm of Legend Holdings, led the round.

China Merchants Group units most active investors

China Merchants Capital, an associated asset management firm between Chinese state-owned China Merchants Group and Singapore-based GLP, invested $153.5 million across six startups. Meanwhile, China Merchants Venture Capital Management, a Shenzhen-based subsidiary of China Merchants Group, also invested $1.5 million into one startup in April.

The affiliates together pumped in $155 million across seven privately-owned firms, making it the top investor of the month.

Legend Capital, the fund management arm of Legend Holdings, was the second top investor of the month by pumping in $582.4 million across six firms.

Top investors of April 2023

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| China Merchants Group’s affiliates | 7 | 155 | 4 | 3 |

| Legend Capital | 6 | 582.4 | 4 | 2 |

| CAS Holdings’ affiliates | 6 | 262.3 | 3 | 3 |

| CICC Capital and affiliates | 5 | 488.6 | 1 | 4 |

| State Development & Investment Corporation (SDIC) and affiliates | 5 | 87 | 4 | 1 |

| Leaguer Capital | 4 | 449.2 | 1 | 3 |

| Addor Capital | 4 | 58.2 | 2 | 2 |

| Bluerun Ventures | 4 | 33.4 | 1 | 3 |

| Oriza Holdings and affiliates | 4 | 369 | 0 | 4 |

| Shenzhen High-Tech Investment Group | 3 | 17.5 | 1 | 2 |

| China Capital Management (affiliated with CSC Financial) | 3 | 418.7 | 1 | 2 |

| Cowin Capital | 3 | 31.9 | 2 | 1 |

| CoStone Capital | 3 | 31.9 | 1 | 2 |

| V Fund | 3 | 101.4 | 1 | 2 |

| GL Ventures (affiliated with Hillhouse Capital Group) | 3 | 29 | 3 | 0 |

| Ivy Capital | 3 | 16 | 1 | 2 |

| Nio Capital | 3 | 58.2 | 2 | 1 |

| Goldport Capital | 3 | 4.5 | 0 | 3 |

| Vertex Ventures | 3 | 48.7 | 1 | 2 |

| Gaorong Capital | 3 | 87 | 0 | 3 |

| *”Total value of participated deals (Million USD)” refers to the total amount of capital raised by the respected startup in the round, including capital from the listed investor as well as other participating investors. If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Note: In our monthly analysis for April 2023, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising falls 66% YoY to $751m in April

Fundraising in Southeast Asia stayed below the psychologically-important $1 billion mark for the fourth straight month in April...

India Deals Barometer Report: Startups rake in $1b in April, down 24% from March

As investors continue to deploy their cash selectively, and more judiciously, funding for Indian startups fell to $1 billion...