China Deals Barometer Report: Startup funding value drops 42% to $2.7b in April

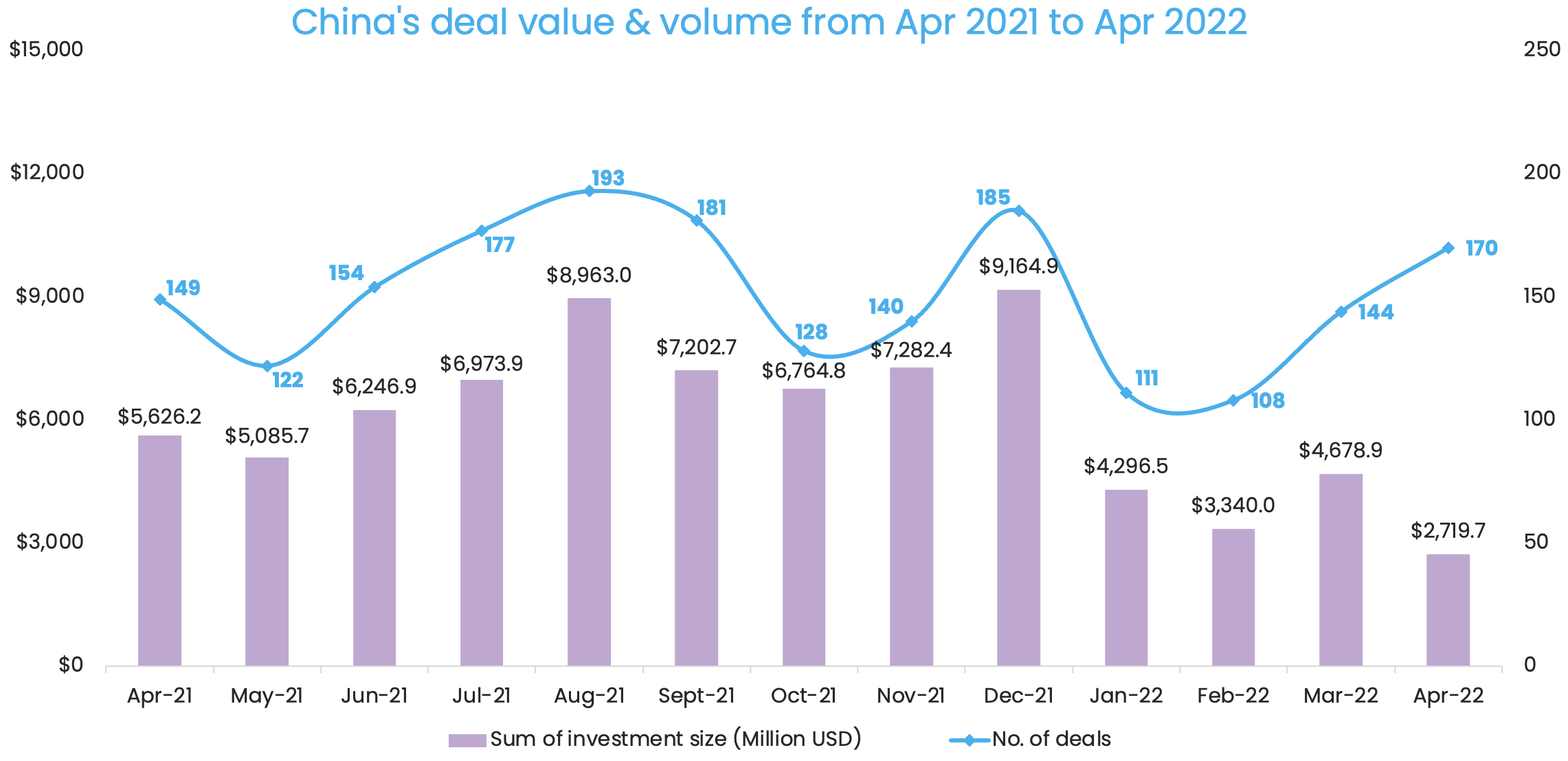

Greater China clocked a busy month of dealmaking in April with the completion of 170 venture deals, but the total funding value was down 41.9% from the previous month as smaller-sized, early-stage deals took the bulk of the investments.

Privately held companies raised over $2.7 billion from 170 venture deals during the month. The number of transactions grew 18.1% compared with March, according to proprietary data compiled by DealStreetAsia.

The monthly deal count was also 14.1% higher compared with April 2021, but the total funding value of $2.7 billion was less than half of the $5.6 billion recorded in the same month last year.

Megadeals drop as late-stage investors tighten purse strings

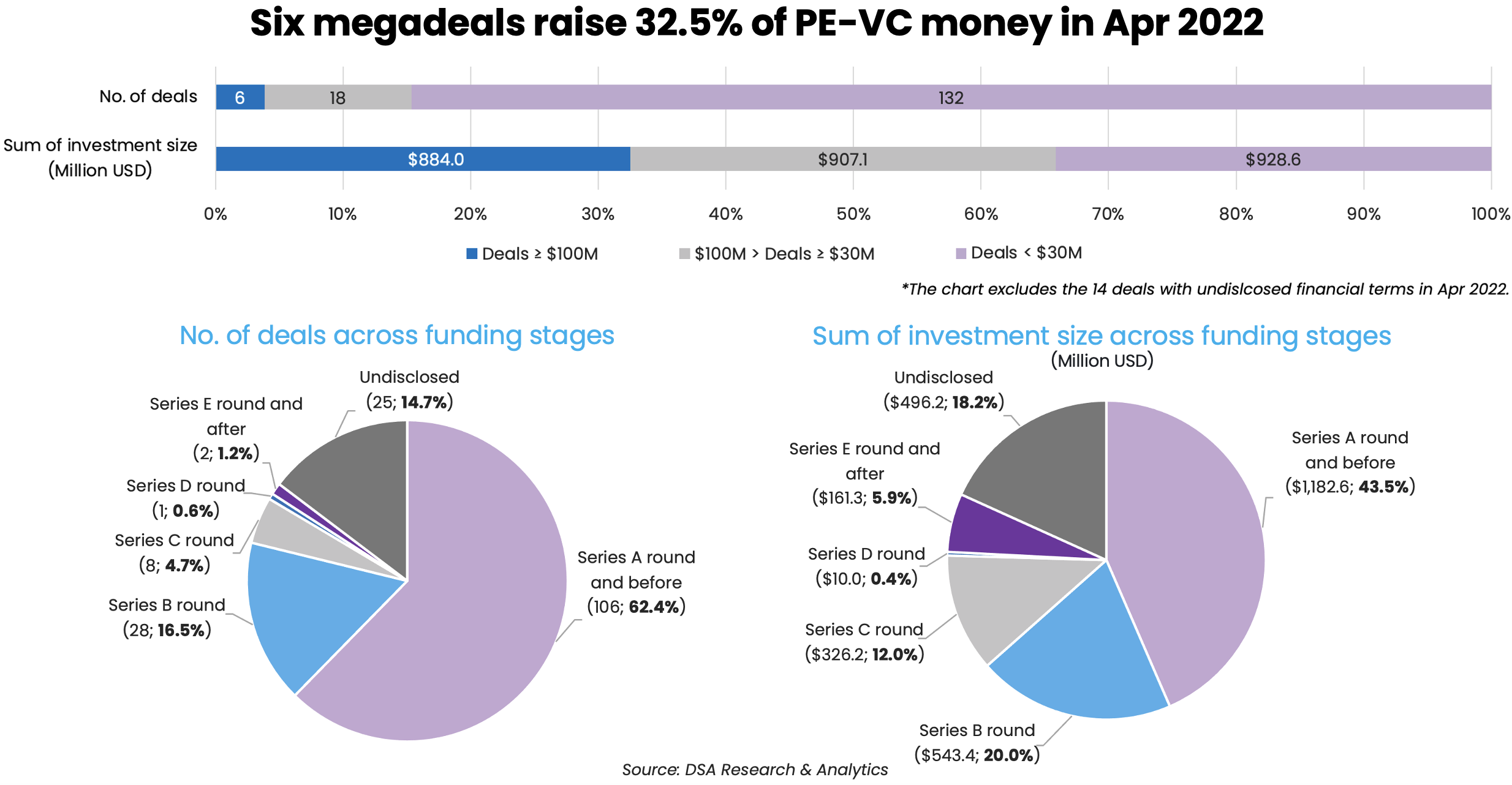

A major reason for the drop in overall funding value was the lack of big-ticket deals. Only six companies closed an investment of $100 million or more, compared with 11 megadeals in March.

In terms of the deal value, megadeals – or investments worth at least $100 million – collectively secured $884 million in April, representing 32.5% of the month’s total financing.

The number of megadeals has been on a general downhill trend in the first four months of this year, with February booking eight mega-deals compared with 16 in January.

Guangdong Gaojing Solar Energy Technology was the biggest fundraiser, raking in 1.6 billion yuan ($251 million) in a Series A round to invest in the construction of photovoltaic (PV) silicon wafers production facilities. Existing investors IDG Capital and Huafa Group, a state-owned group in southern China’s Zhuhai City, as well as new investors such as China Life Investment Management and Midea Capital invested in the deal.

Ruqi Mobility, a ride-sharing platform backed by Tencent and Chinese state-owned automaker GAC Group, raised the second-biggest investment – a Series A round at over 1 billion yuan ($152 million). They were followed by China-US biotech startup METiS Pharmaceuticals, which pocketed a total of $150 million from two funding rounds.

The remaining megadeals happened across the Internet and software industries with metaverse infrastructure developer XMOV raising $130 million in its Series B, C rounds, as well as software-as-a-Service (SaaS) startups Hangzhou Zhiyi Technology and ShadowBot each closing $100 million.

Investments were largely made in startups at Series A, B stages as investors saw high inflation in startup valuation at the growth and mature stages, especially those close to an initial public offering (IPO).

“[Investment activity] across the seriously inflated middle- and late-funding stage is taking the hardest hit,” Wang Ran, founding partner at CEC Capital, wrote in a post on his WeChat account earlier this month. He wrote that China’s venture market is undergoing a winter, and surviving investors should “fasten their seat belts” as up to 80% of investment institutions have slowed down on dealmaking.

With 106 deals, the Series A and earlier stage accounted for 62.4% of the deal count while the nearly $1.2 billion raised at this funding stage represented 43.5% of the deal value.

List of megadeals in Apr 2022

| Startup | Headquarters | Investment size (USD) | Investment stage | Lead investor(s) | Other investor(s) | Industry | Vertical |

|---|---|---|---|---|---|---|---|

| Guangdong Gaojing Solar Energy Technology | Zhuhai | $251 million | A | IDG Capital, Huafa Group, China Life Technology Innovation Fund, CCB Principal Asset Management, Utrust Fund, Shenzhen Investment Holdings, Aikosolar, Midea | Energy Storage | CleanTech | |

| Ruqi Mobility | Guangzhou | $153 million | A | GAC Group | Pony.ai, WeRide, SPARX Group, Pilgrim Partners Asia, Guangzhou Industrial Investment and Capital Operation Holding Group, Guangzhou Gongkong Capital Management | Auto & Parts | Ridesharing |

| METiS Pharmaceuticals | Hangzhou | $150 million | PICC Capital, China Life Private Equity Investment, Sequoia Capital China, 5Y Capital, CMB International, Lightspeed China Partners, Monolith | Pharmaceutical | Biotech | ||

| XMOV | Shanghai | $130 million | B,C | C: SoftBank Vision Fund 2 | Fresh Capital, Jinsha Capital, Sequoia Capital China, 5Y Capital, Northern Light Venture Capital, Index Capital | Internet | AR & VR |

| Hangzhou Zhiyi Technology | Hangzhou | $100 million | GL Ventures, Xiang He Capital, CE InnovationCapital, Zoo Capital | Legend Capital, Yonghua Capital | Software | SaaS | |

| ShadowBot | Hangzhou | $100 million | C | Goldman Sachs | GGV Capital, GL Ventures | Software | SaaS |

Healthtech fuels growth for medical device developers

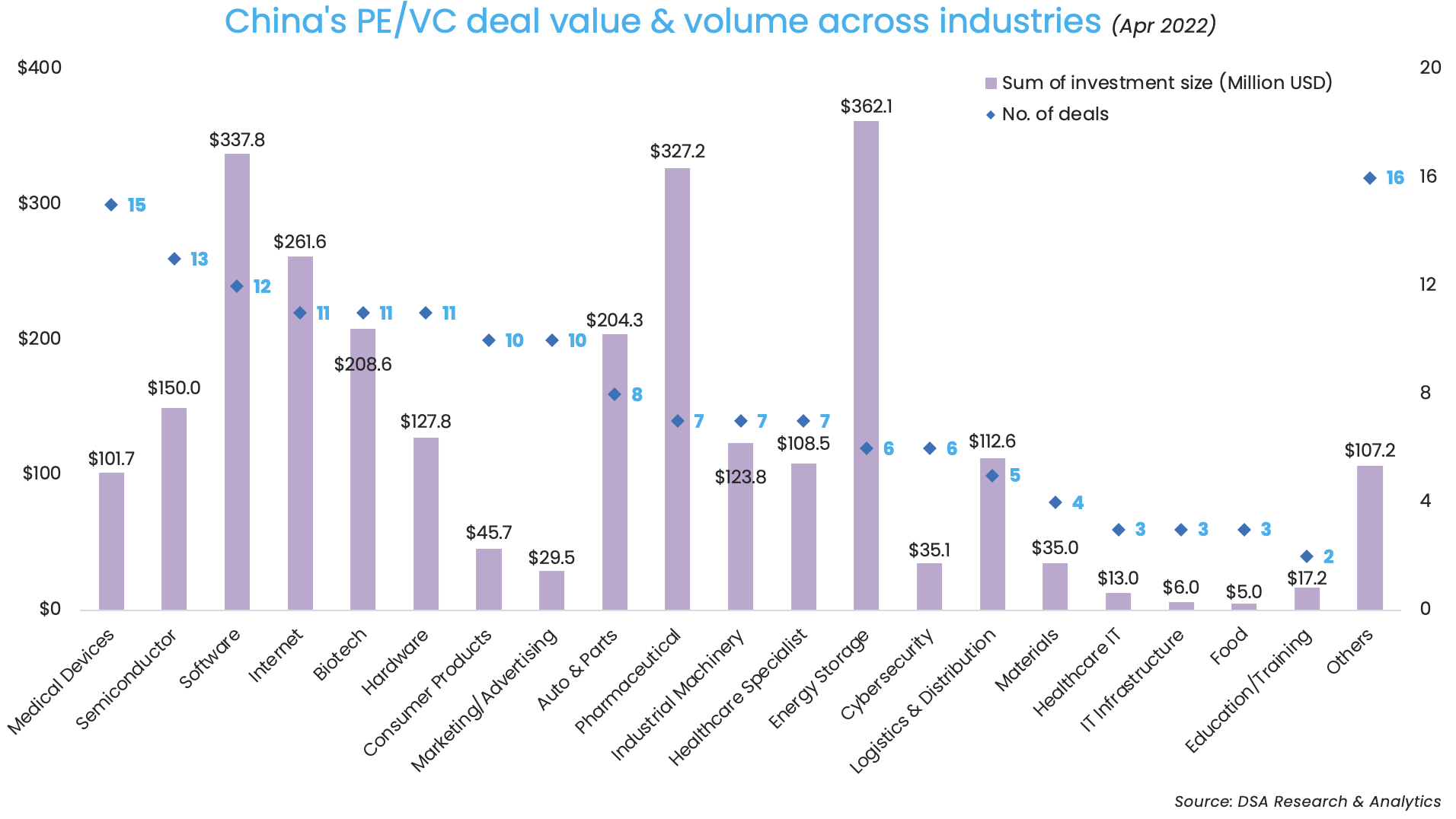

While energy storage ranked as the best-funded industry in April, medical devices, semiconductor and software completed the highest number of transactions with 15, 13 and 12 deals, respectively.

The 15 medical device companies raised an aggregate of $101.7 million, with the largest deal being an eight-digit Chinese yuan investment in Hangzhou-based CuraWay that mainly develops medical devices for minimally invasive surgeries. While CuraWay did not specify the financial details of the deal, the description pegged its fundraising at a size of at least 100 million yuan ($15 million).

The absence of megadeals is an indication that most medical device fundraisers are still at the early funding stage – more specifically – at the angel, Pre-A, A, or B stage in the case of last month. More than half of the 15 companies that raised funds are involved in healthtech, such as surgical robots, gene chips and medical AI.

Semiconductor remained an investment hotspot with the completion of 13 deals worth $150 million in total. Despite the absence of megadeals, startups in the sector attracted top-tier investors, including Sequoia Capital China, Matrix Partners China and Qiming Venture Partners.

One-Chip, whose products range from gene-sequencing devices to polymerase chain reaction (PRC) machines, raised the biggest amount with the completion of its Series B+ round at 150 million yuan ($23.3 million). All other semiconductor deals happened at the early funding stage from angel to Series B.

Software came in third with 12 startups raising a combined $337.8 million. The two $100-million investments completed by SaaS companies Zhiyi Technology and ShadowBot contributed to 59.2% of the capital.

The rest included a mid-sized deal by Laiye, a developer of intelligent automation software and solutions. Laiye closed $70 million in the third tranche of an oversubscribed Series C round from PE firm HOPU Magnolia to fuel the firm’s expansion across overseas markets.

Sequoia China, its seed fund top investor list

Tech investment heavyweight Sequoia Capital China and its investment unit focusing on the seed and angel stage, Sequoia China Seed Fund, were the most active investment group in April with participation in at least 14 deals.

Sequoia China joined hands with investors such as China’s PICC Capital, China Life Private Equity Investment and 5Y Capital to back biotech startup METiS Pharmaceuticals in its new fundraise of $150 million. As a returning investor, it also participated in the $130-million investment in metaverse infrastructure developer XMOV, alongside SoftBank Vision Fund 2, Northern Light Venture Capital (NLVC) and others. In addition to the two megadeals, the investment group also injected capital into another 12 transactions, all at a size of less than $20 million.

An investor in some of China’s biggest tech giants such as Alibaba and food delivery firm Meituan, Sequoia China has backed about 600 companies since its inception in 2005 with focus on the techonology-media-telecom (TMT), healthcare and consumer goods and services sectors. The Sequoia China Seed Fund, launched in 2018, booked over 5 billion yuan ($743.6 million) in assets under management (AUM) and investments across almost 200 early-stage startups as of August 2021.

Besides Sequoia China, Legend Capital, the investment unit of Chinese conglomerate Legend Holdings; VC major GGV Capital; Beijing-based investment firm IDG Capital; and Shenzhen Capital Group, co-founded by the local government in southern China’s Shenzhen City, were also among the most active investors in April.

Most active investors in Greater China (Apr 2022)

| Investment company | No. of deals | Total value of participated deals (USD) | Lead | Non-lead |

|---|---|---|---|---|

| Sequoia Capital China & Sequoia China Seed Fund | 14 | $370.65 million | 7 | 7 |

| Legend Capital and affiliates | 6 | $209.2 million | 2 | 4 |

| GGV Capital | 6 | $191.5 million | 1 | 5 |

| IDG Capital | 5 | $270.9 million | 3 | 2 |

| Shenzhen Capital Group | 5 | $94 million | 2 | 3 |

| Yonghua Capital | 4 | $104.5 million | 2 | 2 |

| Matrix Partners China | 4 | $71.85 million | 3 | 1 |

| Gaorong Capital | 4 | $47.5 million | 2 | 2 |

| Shunwei Capital | 4 | $46.5 million | 1 | 3 |

| 5Y Capital | 3 | $360 million | 2 | 1 |

| *If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Liya Su contributed to the story.

Note: In our monthly analysis for April 2022, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

- Caocao Mobility

- CICC Capital

- FerroTec

- semiconductor

- Sequoia Capital China

- software

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

India Deals Barometer Report: At $2.9b in April, startup funding lowest so far this year

Fundraising by Indian startups stood at $2.9 billion across 129 transactions in April...

Venture Capital

SE Asia Deals Barometer Report: Startup funding at four-month high of $2b in April

Venture capital (VC) and private equity (PE) funding in Southeast Asia rebounded in April...