China Deals Barometer Report: Nov dealmaking falls short of last year despite uptick from Oct

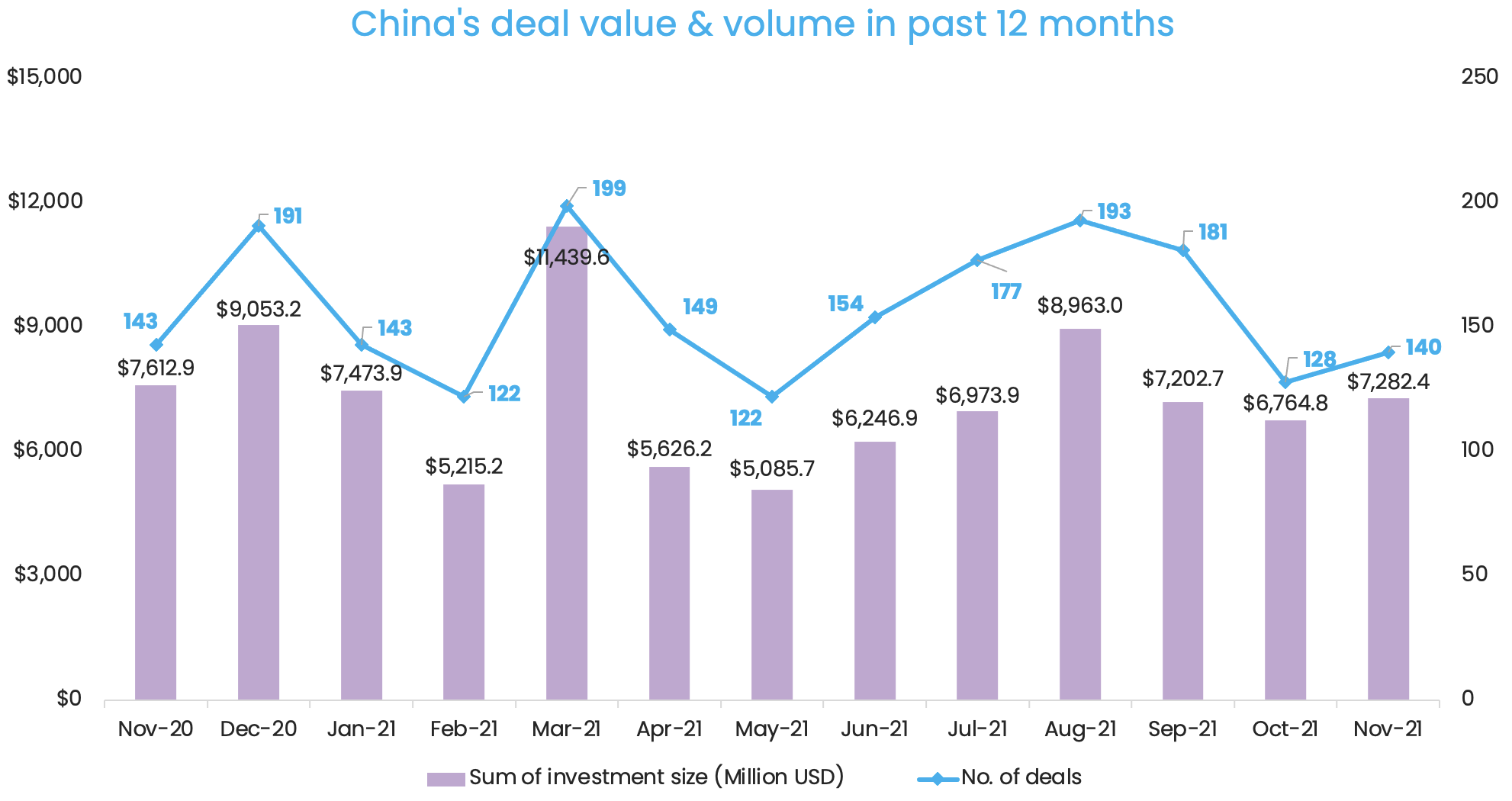

Startups in the Greater China region raised nearly $7.3 billion across 140 private equity (PE) and venture capital (VC) deals in November.

The deal count was an increase of 9.4% from October, while total deal value also grew by 7.7% month-on-month, according to proprietary data compiled by DealStreetAsia.

However, dealmaking activity showed less vitality compared with November 2020 when Greater China startups collected $7.6 billion across 143 PE-VC deals. In the past month, the aggregate startup funding was down 4.3% year-over-year (YoY). The deal count fell 2.1% from November 2020.

The monthly investment size was propped up by two billion-dollar deals: In November’s largest funding round, GTA Semiconductor, a developer of intelligent integrated circuits (ICs) for applications in areas like auto electronics and power management, raked in 8 billion yuan ($1.26 billion). Chinese IC design house Huada Semiconductor led the round, with participation from investors including Cathay Capital.

Greentech player Envision Group closed the second-biggest financing. The provider of renewables, hydrogen, battery, and digital solutions attracted an investment of over $1 billion from Sequoia Capital China, Singapore sovereign wealth fund GIC, and Primavera Capital. In October, the firm’s subsidiaries, Envision Energy and Envision AESC, collectively raised over $600 million.

November also saw the completion of a $500-million deal by Momenta. The autonomous driving startup raised fresh capital in an extended Series C round from investors including US automaker General Motors, Singapore state investor Temasek Holdings, and Japan’s Toyota Motor Corp. The deal followed a $300-million financing in September and a $500-million financing in March, bringing the size of the Series C round to over $1 billion.

Megadeal funding upsizes

Besides the investments in GTA, Envision, and Momenta, several sizeable megadeals contributed to the bulk of the capital raised in the month.

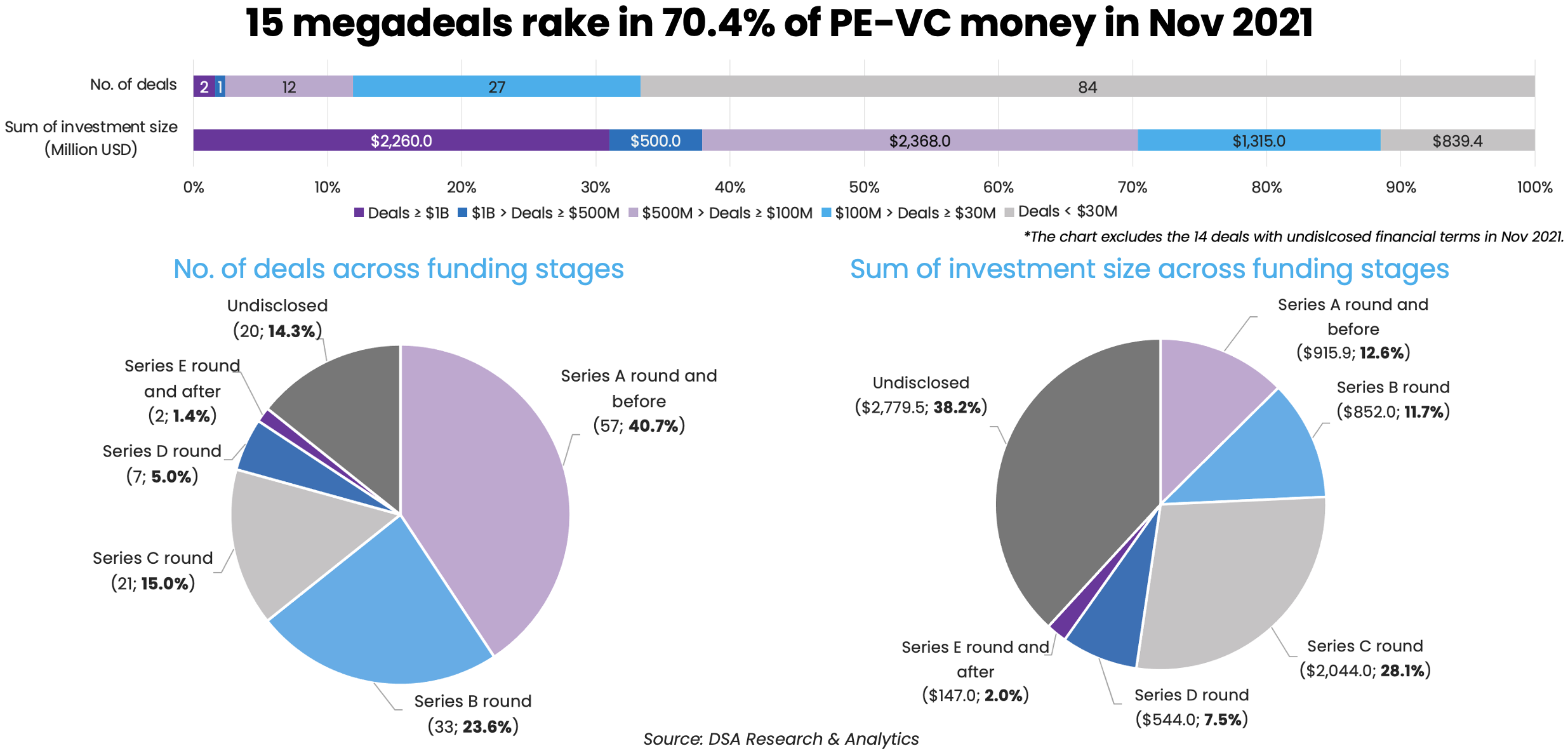

Fifteen megadeals, which refer to investments worth atleast $100 million, gathered over $5.1 billion in November. The total value of these megadeals was 8.5% more than that in the previous month, when 15 megadeals amassed just over $4.7 billion.

The megadeals in November accounted for 70.4% of the total funding. This share had stood at 69.6% in October, 62.7% in September, and 67.2% in August.

The value of 12 megadeals fell within the range of $100-500 million ($100 million inclusive). They attracted renowned investors, such as SoftBank Group Corp, Sequoia Capital China, KKR & Co, and Goldman Sachs, to make bets on industries ranging from biotech and insurance to the internet and software.

Startups in their earlier funding stages completed more deals than their growth- and late-stage counterparts. Fundraisers in the Series A round and earlier led the pack with 57 deals, or 40.7% of the month’s total deal count. Deal count at the Series B stage followed with 33 deals.

Less than one-quarter of transactions were made at the growth- and late-stage with 21 Series C deals, seven Series D deals, and two deals at Series E round and after.

Investors made bold bets on Series C deals since over $2 billion, or 28.1% of the month’s financing, flowed into fundraisers at the stage. It also reflected on the composition of megadeals — seven of the 15 largest investments of $100 million and over happened at the Series C stage.

The aggregate deal value at the Series A stage came second, at $915.9 million, followed by that of the Series B stage, Series D stage, and Series E stage.

List of 15 megadeals in Nov 2021

| Startup | Headquarters | Investment size (USD) | Investment stage | Lead investor(s) | Investor(s) | Industry | Vertical |

|---|---|---|---|---|---|---|---|

| GTA Semiconductor | Shanghai | $1,260 million | Cathay Capital | Semiconductor | CleanTech | ||

| Envision Group | Shanghai | $1,000 million | Strategic investment | Sequoia Capital, GIC Private Ltd, Primavera Capital | Renewable Energy | CleanTech | |

| Momenta | Beijing | $500 million | C+ | General Motors, Temasek, Bosch, Toyota, SAIC Motor, Yunfeng Capital | Auto & Parts | Autonomous Driving | |

| Hesai Technology | Shanghai | $370 million | D | Xiaomi Corporation, GL Ventures, Meituan, CPE, Xiaomi Industry Investment | Hardware | N/A | |

| Moore Threads | Beijing | $313 million | A | Source Code Capital, Shanghai Guosheng Group, Bohai Sheng (Hubei) Industrial Fund Management | CCB International, Qianhai FOF, China Merchants Securities | Software | AI and Machine Learning |

| Suzhou Abogen Biosciences | Suzhou | $300 million | C+ | SoftBank Vision Fund, 5Y Capital | Chimera Abu Dhabi, IMO Ventures, Mirae Asset Financial Group, Fortune Ocean, Jinyi Capital | Biotech | Biotech |

| Datong Insurance | Beijing | $235 million | Equity financing | DCP | China Merchants Venture, Zhongwei Capital, Huagai Capital | Insurance | Insuretech |

| Edge Medical Robotics | Shenzhen | $200 million | C | Boyu Capital,Temasek Holdings, Sequoia Capital China | OrbiMed, Octagon Capital, Sage Partners, Greater Bay Area Homeland Investments, Mirae Asset Financial Group, Guoce Capital, China state-owned enterprise mixed-ownership reform fund, Firstred Capital, Lingang Lanwan Capital, LYFE Capital, 3H Health | Healthcare Specialist | Robotics & Drones |

| Gaussian Robotics | Shanghai | $188 million | C | SoftBank Vision Fund 2, Capital Today | Jinyi Capital, Meituan, Bluerun Ventures, Grand Flight | Business Support Services | Robotics & Drones |

| VOMMA(Shanghai) Technology | Shanghai | $155 million | C | 5Y Capital, KKR&Co.Inc | GGV Capital | Consumer Products | N/A |

| Tripod | Nanjing | $155 million | Huatai Securities’ Huatai Guoxin Fund, Huatai Ruihe Fund | Healthcare Services | HealthTech | ||

| Cyclone Robotics | Shanghai | $150 million | C | CMC Capital Partners, Goldman Sachs | Lavender Hill Capital Partners(LHCP), Zhongwei Capital, V Fund, DCM, Matrix Partners China, Source Code Capital | Software | Saas |

| Shanghai Zhenyun Technology | Shanghai | $102 million | C | DragonBall Capital | Ab Initio Capital (ABI), Unicorn Capital Partners, C&D, Redpoint China Ventures, Blue Lake Capital, Eastern Bell Capital | Internet | E-commerce |

| Meican | Beijing | $100 million | E | Centurium Capital | Food | Saas | |

| Singleron Biotechnologies | Nanjing | $100 million | B | Lake Bleu Capital | Firstred Capital, MSA Capital,Sherpa Healthcare Partners, Lilly Asia Ventures (LAV), ARCH Venture Partners, CDG Capital, CDH Investments, Superstring Capital, 3w Global Investment, SBCVC | Biotech | Biotech |

China’s chip developers taking off

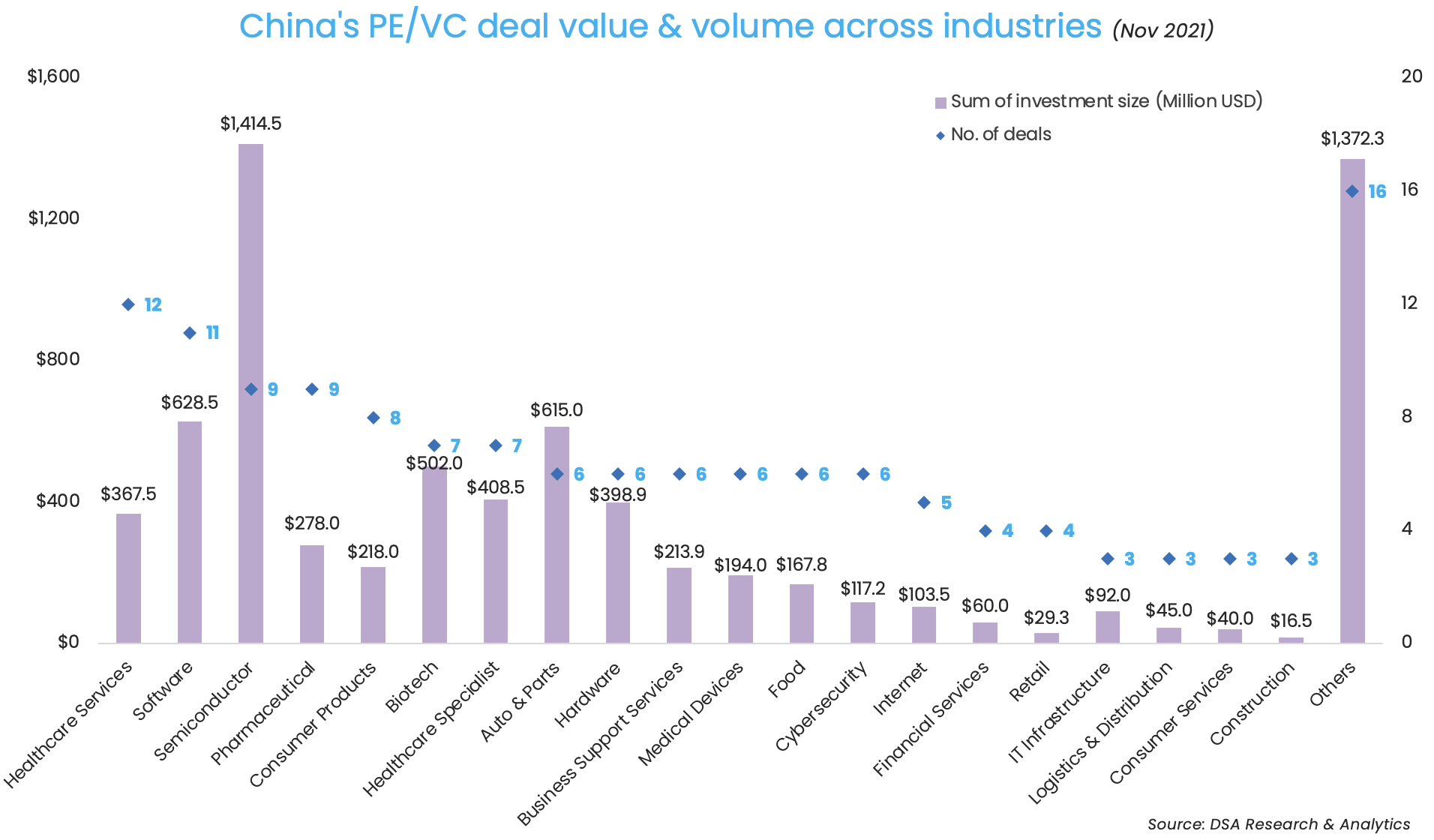

Investments in China’s semiconductor startups are heating up, as the government ramps up efforts to achieve technology self-reliance amid its trade tensions with the US. Startup funding in the field topped in November, with over $1.4 billion being raised across nine deals.

While the deal count increased, compared with six in October, it is important to note that $1.26 billion, or 90% of the capital in the field, came from GTA’s new round. The remaining money was largely raised across deals of lower than $50 million, except for North Ocean Photonics’ Series B+ round that is worth close to 400 million yuan ($63 million).

Financing in the semiconductor industry is expected to grow as the global chip shortage drags on. Tech-market researcher Gartner Inc projects global chip manufacturers to pour about $146 billion into capital expenditures in 2021. That would be an approximately one-third increase from 2020 and 50% higher than 2019. That investment would be more than double the industry spending of five years ago.

Healthcare services led the pack in terms of deal count. PE-VC investments in the area outnumbered all other industries with the completion of 12 deals in the month. The biggest fundraiser was Tripod, a contract research organisation (CRO) that closed a new round of nearly 1 billion yuan ($155 million) led by China’s Ruihua Investment Management, Lilly Asia Ventures, and GL Ventures.

Another two healthcare services providers sealed sizeable deals, namely Jianhai Technology, which raised 500 million yuan ($78 million) in a Series B+ round, and Landing Med, which completed a Series D round of 320 million yuan ($50 million).

Sequoia China is top investor

Sequoia Capital China, the bellwether of tech investments in China, retained its perch on top as the most active investor in Greater China with participation in at least 11 deals worth a combined $1.5 billion.

Sequoia China was created in 2005 by Neil Shen as the China franchise of Silicon Valley’s Sequoia Capital. The firm has invested in about 600 companies over the past 16 years, including some of China’s biggest tech firms like e-commerce giants Alibaba and JD.com, food delivery firm Meituan, and ride-hailing service provider Didi Global.

Matrix Partners China, affiliated with Matrix Partners in the US, ranked second with participation in seven deals. The total value of Matrix China-backed deals only reached $198 million, because six of the seven investments were small-cheque deals at the early funding stage of Series A round or earlier.

It only invested in one growth-stage deal, namely a $150-million Series C round in Cyclone Robotics, a developer of robotic process automation (RPA) software.

ByteDance investor Source Code Capital and Shunwei Capital, which is backed by smartphone brand Xiaomi’s founder Lei Jun, were tied for third place. Other active investment firms in October were Hillhouse Capital’s VC arm GL Ventures, Xiaomi, and early-stage venture firm GSR Ventures.

Most active investors in China’s PE-VC market (Nov 2021)

| Investment company | No. of deals | Total value of participated deals (USD) | Lead | Non-lead |

|---|---|---|---|---|

| Sequoia Capital China | 11 | $1,537 million | 6 | 5 |

| Matrix Partners China | 7 | $198 million | 4 | 3 |

| Source Code Capital | 6 | $571 million | 4 | 2 |

| Shunwei Capital | 6 | $36 million | 4 | 2 |

| GL Ventures | 5 | $410 million | 3 | 2 |

| Xiaomi and affiliates | 5 | $395 million | 3 | 2 |

| GSR Ventures | 5 | $105.5 million | 2 | 3 |

| ZWC Partners | 4 | $401.5 million | 2 | 2 |

| GGV Capital | 4 | $189.7 million | 3 | 1 |

| Plum Ventures | 4 | $15.5 million | 1 | 3 |

| *If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Liya Su contributed to the story.

Note: In our monthly analysis for November 2021, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

Share this story with your friends and colleagues.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

India Deals Barometer Report: Indian startups raise $4.55b across 154 PE, VC transactions in November

The startup ecosystem in India is bustling with activity. Private equity (PE) and venture capital (VC) firms pumped...

Venture Capital

SE Asia Deals Barometer Report: Startup funding touches new record at $5.2b in November

The startup fraternity in Southeast Asia has reasons to cheer. Even as the adverse impacts of the COVID-19 pandemic are still...