India Deals Barometer Report: Big-ticket deals push startup funding to $4.6b in October

Riding high on several big-ticket deals, Indian startups raised $4.65 billion across 162 private equity and venture capital transactions in October, according to proprietary data compiled by DealStreetAsia. This is a jump of about 37% in value over September when startups had collectively raked in $3.4 billion from risk capital investors.

Deal volume, however, was down 16% from 193 in September owing to a drop in early-stage deals. Of the total transactions in the month, the value of 22 deals was undisclosed, the data showed.

October alone saw six startups enter the unicorn club (startups value at $1 billion and above). They included meat startup Licious, crypto exchange platform CoinSwitch Kuber, digital insurance company Acko, online portal for new and used cars CarDekho, digital payments firm MobiKwik, and internet restaurant company Rebel Foods.

India has already produced 34 unicorns so far this year. An earlier Nasscom report had stated that India will have 50 unicorns by the end of this year.

There were about 16 mega deals (that were worth $100 million or more) in the month, which accounted for about 70% of the total deal value.

| Startup | Headquarter | Investment Size (USD) | Investment Stage | Lead Investor(s) | Industry | Verticals |

|---|---|---|---|---|---|---|

| PharmEasy | Mumbai | 350,000,000 | Undisclosed | Amansa Capital, Sanne Group | Pharmaceuticals | E-commerce |

| Byju’s | Bengaluru | 296,000,000 | Series F | Oxshott Venture Fund | Education/Training | EdTech |

| CoinSwitch Kuber | Bengaluru | 260,000,000 | Series C | Andreessen Horowitz (a16z), Coinbase Ventures | Financial Services | Blockchain |

| Cred | Bengaluru | 251,000,000 | Series E | Tiger Global Management, Falcon Edge Capital | Financial Services | Fintech |

| Groww | Bengaluru | 251,000,000 | Series E | ICONIQ Growth | Financial Services | Fintech |

| CarDekho | Jaipur | 250,000,000 | Series E | LeapFrog Investments | Automobiles Other Vehicles & Parts | E-commerce |

| Acko General Insurance Ltd | Mumbai | 225,000,000 | Series D | General Atlantic, Multiples Private Equity | Insurance | Insuretech |

| OfBusiness | Gurugram | 200,000,000 | Series F | Tiger Global Management | Financial Services | Fintech |

| Rebel Foods | Mumbai | 175,000,000 | Series F | Qatar Investment Authority | Food | Restaurant Tech |

| Drip Capital | Mumbai | 175,000,000 | Series C | TI Platform | Financial Services | Fintech Lending |

| Dhani Services Ltd | Mumbai | 160,000,000 | Equity | General Catalyst, Sameer Gehlaut | Financial Services | Fintech |

| Twin Health | Chennai | 140,000,000 | Series C | Undisclosed | Healthcare Specialist | HealthTech |

| Hubilo | Ahemdabad | 125,000,000 | Series B | Alkeon Capital | Internet | SaaS |

| DeHaat | Patna | 115,000,000 | Series D | Sofina, Lightrock India | Agribusiness | AgTech |

| Open | Bengaluru | 100,000,000 | Series C | Temasek | Financial Services | Digibank |

| Porter | Bengaluru | 100,000,000 | Series E | Tiger Global Management, Vitruvian Partners | Logistics/Distribution | SaaS |

In the month’s biggest deal, online pharmacy PharmEasy closed a funding round worth nearly $350 million ahead of its initial public offering (IPO). Of that, around $204 million reportedly came in through primary infusion from Amansa Capital, ApaH Capital, Janus Henderson, OrbiMed, Steadview Capital, Abu Dhabi’s sovereign wealth fund ADQ, Neuberger Berman and Sanne Group. The company raised another $130-140 million via secondary share sale, The Economic Times reported.

In another big deal, Byju’s raised an additional funding of around Rs2,200 crore led by New York-based Oxshott Venture Fund. Other investors in the round included Edelweiss’s Crossover Opportunities Fund, IIFL, Verition Multi-Strategy Master Fund, and XN Exponent Holdings.

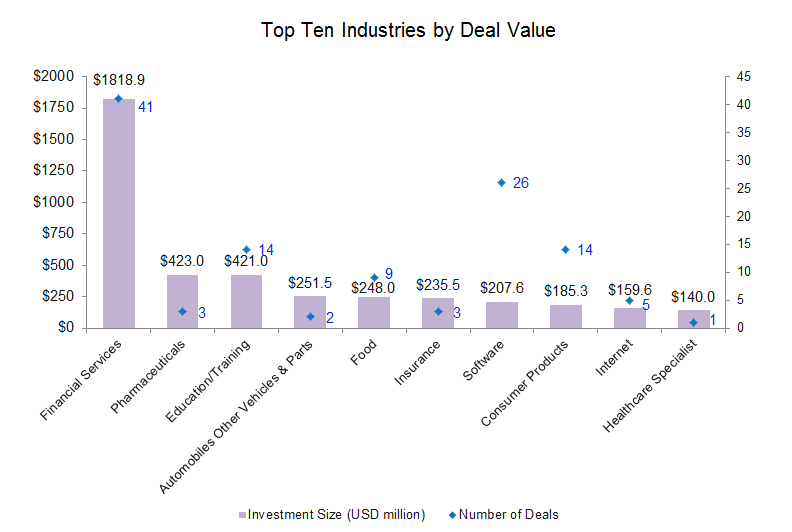

Financial services grabs top spot

Tech investments in India have been on the rise since the onset of the pandemic, particularly in the financial services space. Startups within financial services raised a whopping $1.8 billion across 41 transactions in October, accounting for about 39% of the total deal value in the month.

Within financial services, CoinSwitch Kuber raised the largest round of $260 million in Series C funding round from a clutch of investors at a valuation of $1.9 billion.

Pharmaceuticals industry moved up to the second spot led by PharmEasy fundraise and garnered $423 million in total funding across three transactions. Online pharmacies have emerged as one of the biggest beneficiaries of the pandemic-induced lockdown in India. India’s online pharmacy market is estimated to grow to $2.7 billion by 2023 from about $360 million currently, according to a report by EY last year.

Education was the third most funded industry with a total of $421 million in its kitty.

Together, the three industries – financial services, pharmaceuticals and education – accounted for about 59% of the total deal value.

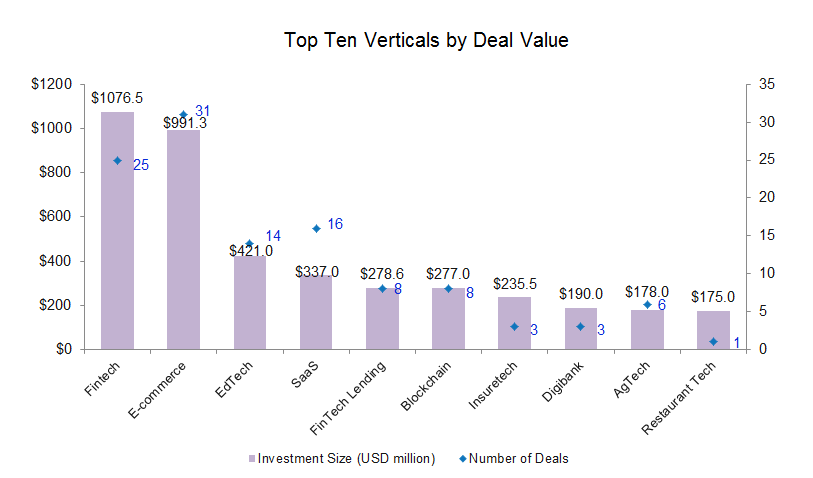

Within verticals, fintech startups grabbed the lion’s share at $1 billion in total funding while e-commerce followed with $991.3 million.

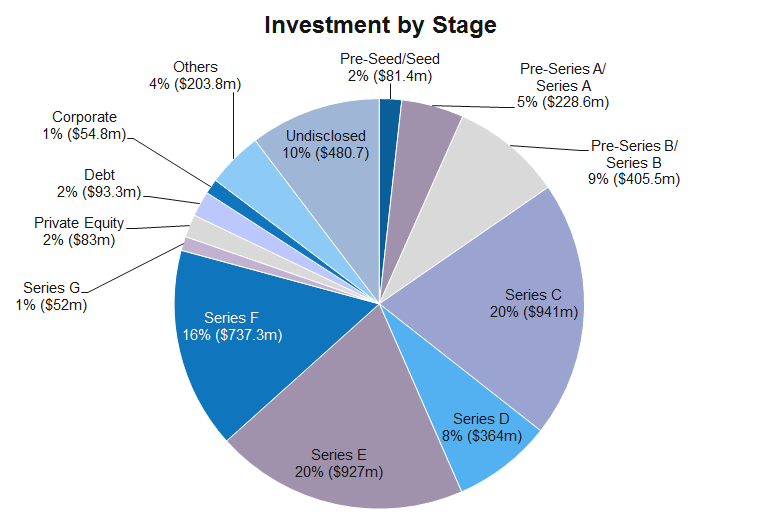

Growth-stage deals account for bulk share

In terms of value, growth-stage startups led fundraising in October. Companies in Series B or post-Series B rounds collected an aggregate of $3.4 billion through 34 investments as against $2.45 billion through 36 investments in September. This comes to about 70% of the total deal value in the month.

Deal volumes were led by early-stage transactions in October but saw a dip over September. The month saw 48 deals worth $81.4 million as against 77 transactions worth $93.6 million in September.

Startups in pre-Series A and Series A stages raked in about $228.6 million across 39 transactions as against $343.8 million across 46 transactions in the previous month.

Most active investors

Venture Catalysts, along with its early-stage startup fund 9Unicorns, was the top investor in October with at least 20 investments compared to 14 in September. Their investments included AI-driven SaaS platform Toch.ai, silk-tech startup ReshaMandi, direct-to-consumer jewellery brand Melorra, vehicle interface solution provider Numadic, content startup Instoried, and pregnancy and parenting app Healofy, among others.

Sequoia Capital India occupied the second spot with at least 10 investments including those in intra-city logistics company Porter, fintech platform Groww, online beauty store Purplle, trade finance company Drip Capital, agritech startup DeHaat, and financing solutions startup Progcap.

Tiger Global made at least eight investments in October while Titan Capital made six investments. Accel, Blacksoil, Inflection Point Ventures and LetsVenture made at least five investments each.

Share this story with your friends and colleagues.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: PE-VC investments further retreat to $6.8b in Oct

Dealmaking activity in Greater China further retreated in October 2021, continuing the decline witnessed in September...

Venture Capital

SE Asia Deals Barometer Report: Startup funding falls to $1.6b in Oct on fewer megadeals

Fundraising by Southeast Asia’s privately-held companies cooled in October, after four...