India Deals Barometer Report: Growth-stage deals boost fundraising to $1.6b in Nov

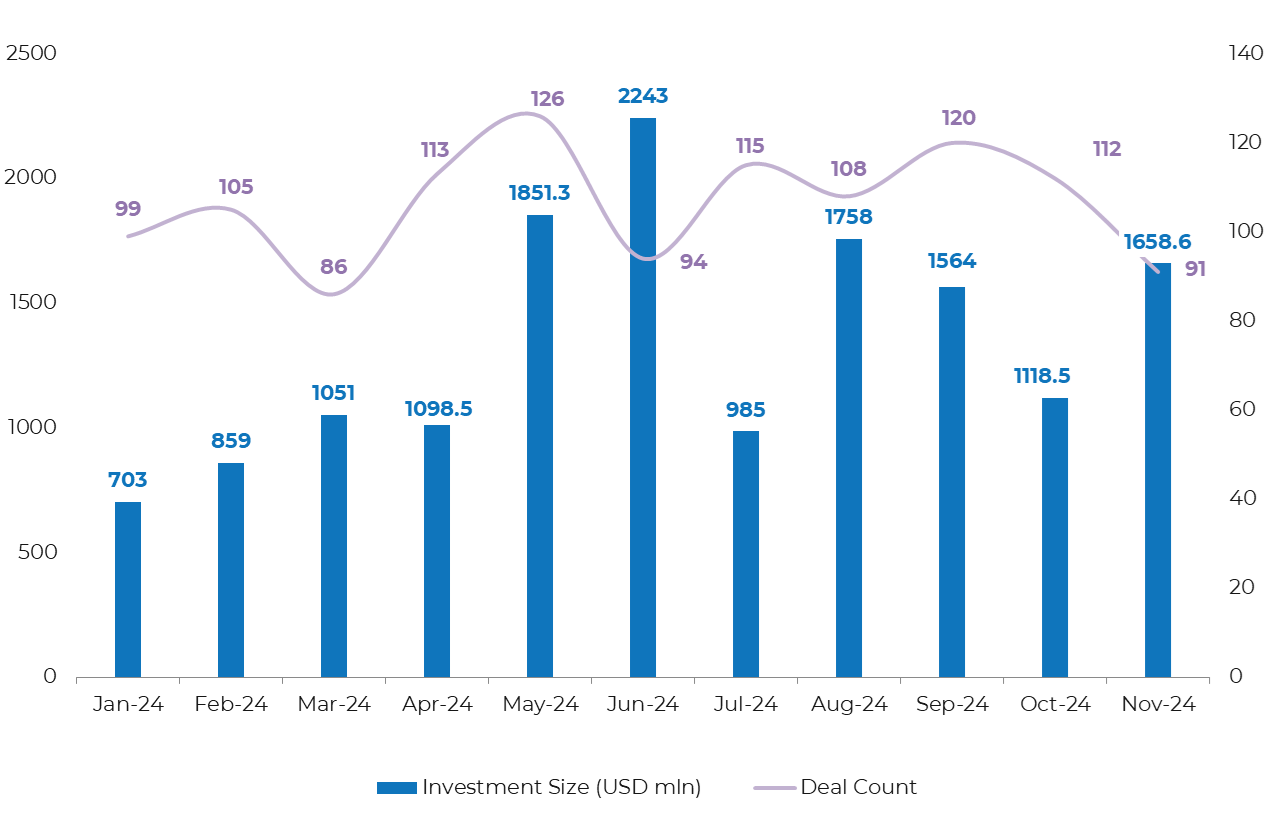

Buoyed by food delivery platform Swiggy’s $605-million pre-IPO round, fundraising by Indian startups surged nearly 48% month-on-month to touch $1.66 billion in November, according to proprietary data compiled by DealStreetAsia. Among the top grossers were the logistics/distribution, consumers products, and financial services industries.

At 91, however, the volume of venture capital (VC) and private equity (PE) transactions was down 19% from October’s tally of 112 deals. The values of nine deals were undisclosed during the month, the data showed.

On a year-on-year basis, the total deal value more than tripled from $483 million in November 2023 across 75 transactions.

While fundraising by Indian startups began on a tepid note in 2024, it stayed upwards of $1 billion for the most part of the year, particularly in the second half. Investments this year peaked in June when startups scooped up $2.24 billion from 94 transactions. The total funding raised by local startups increased 37% to $12.1 billion in the first nine months of 2024. Deal count, too, went up by 37% on a year-on-year basis to 966.

Startup fundraising in India

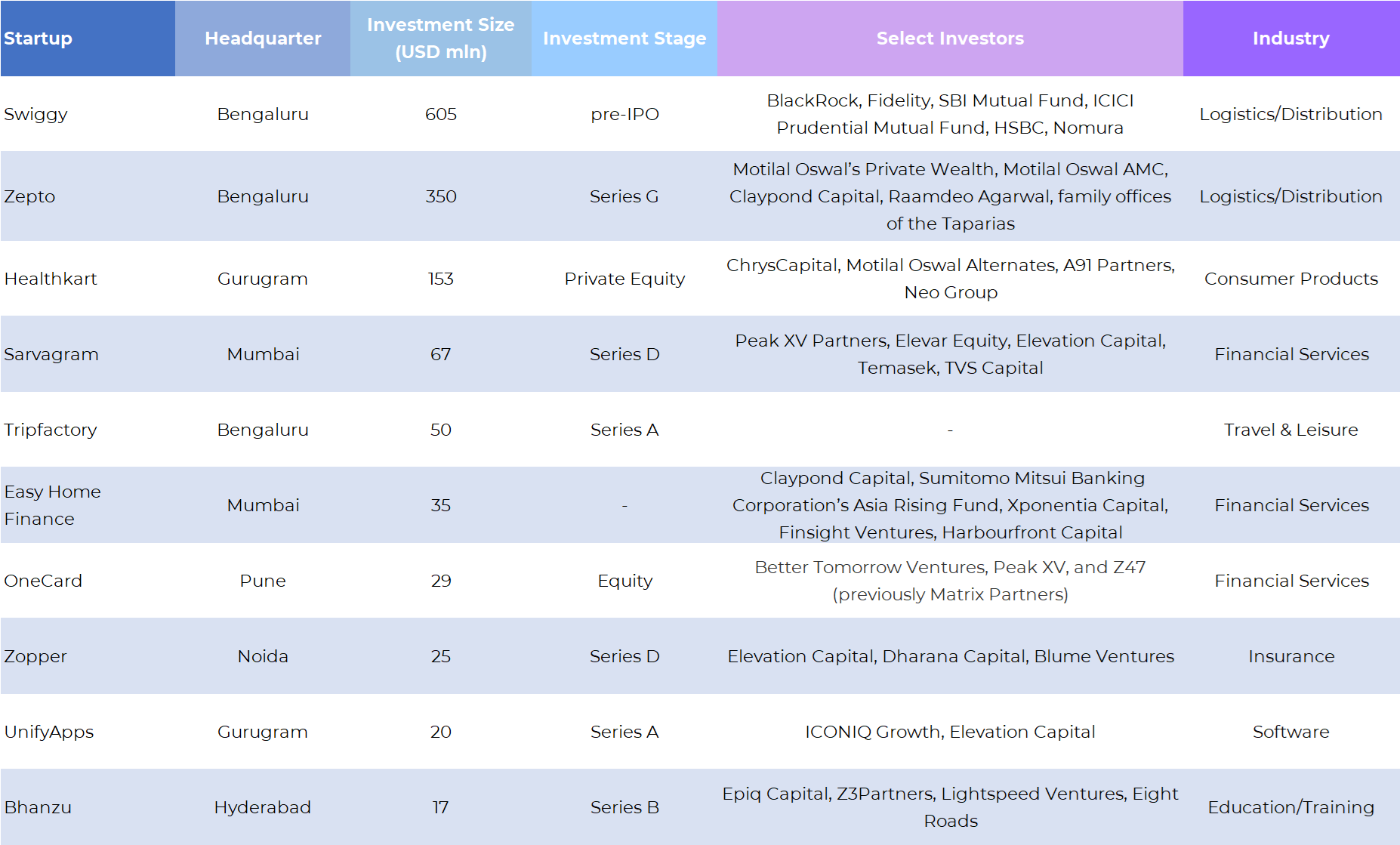

Megadeals, or deals upwards of $100 million, increased to three in November, raking in a total of $1.1 billion or 51% of the month’s total deal value. Besides Swiggy, the other two big transactions closed in the month were by Zepto and Healthkart. In comparison, two megadeals worth $285 million were closed in October.

Top 10 funding deals in Nov 2024

Swiggy led funding in the month with $605 million in total proceeds, while IPO-bound quick commerce firm Zepto raised $350 million in its third funding round this year, led by Motilal Oswal’s private wealth division. The round also saw participation from Motilal Oswal AMC, Claypond Capital, Raamdeo Agarwal, along with family offices of the Taparias, Mankind Pharma, RP Sanjiv Goenka Group, Cello, Haldiram Snacks, Sekhsaria, Kalyan, Happy Forgings, and Mothers Recipe (Desai Brothers).

Separately, omnichannel nutrition platform HealthKart raised $153 million in a fresh round of funding led by ChrysCapital and Motilal Oswal Alternates. Neo Group and HealthKart’s existing investor A91 Partners also participated in the round.

No startup made it to the unicorn club in November. Unicorn is a moniker used to describe a privately held startup company with a valuation of over $1 billion.

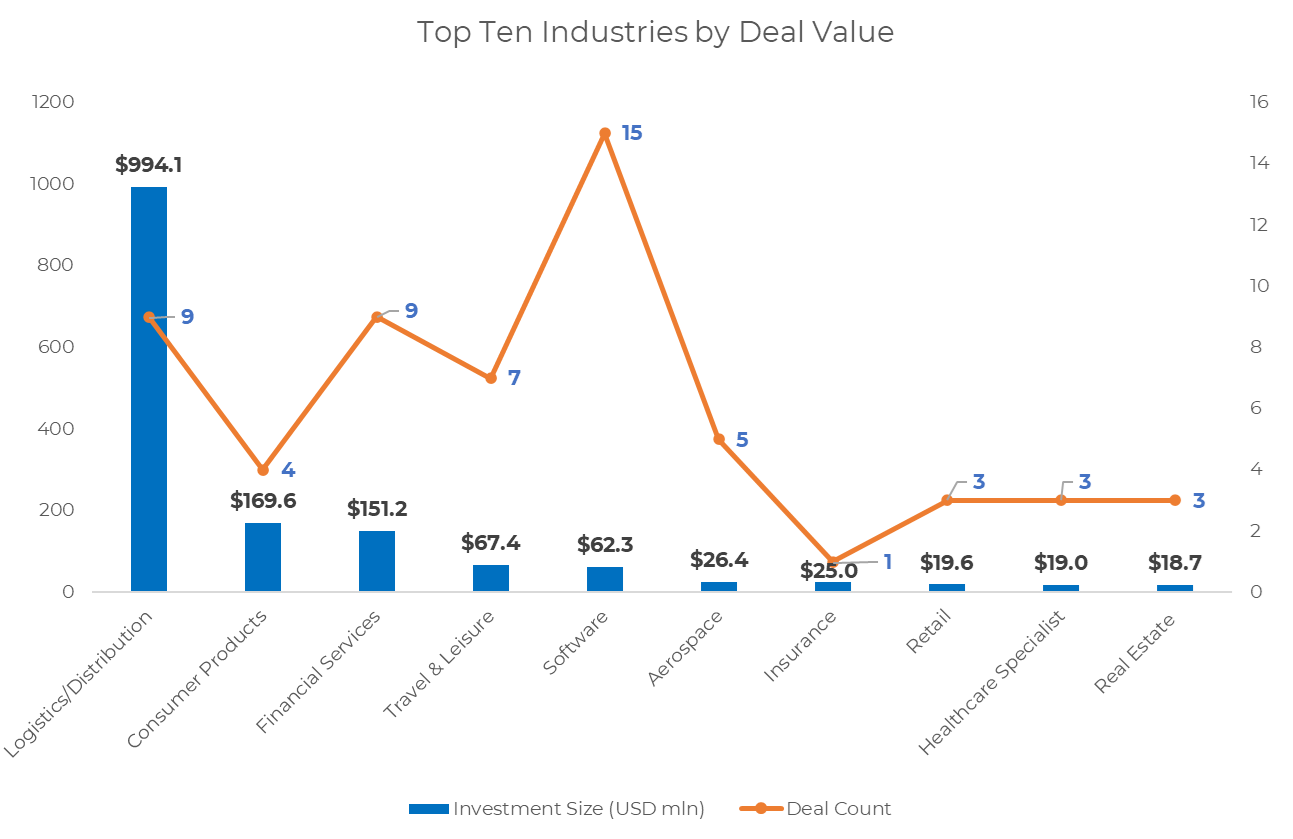

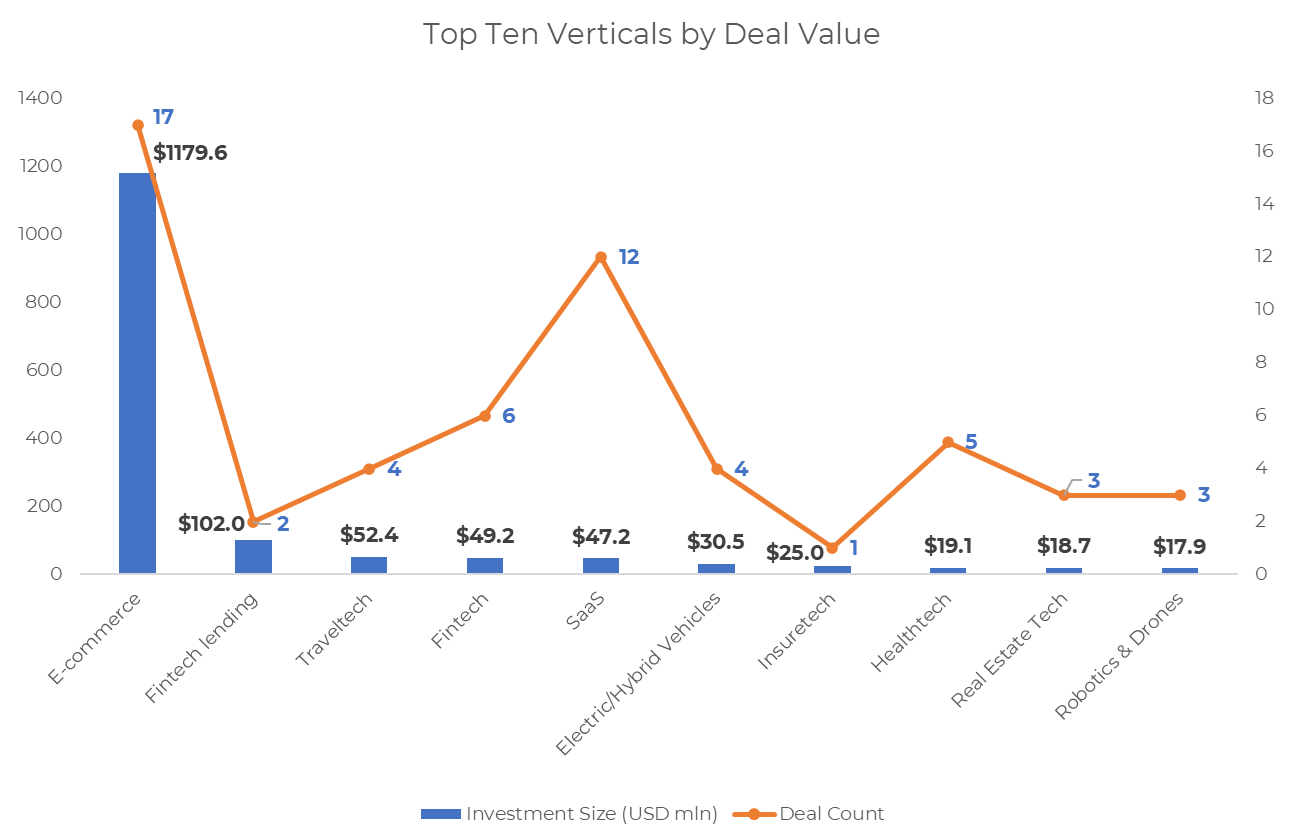

Logistics accounts for 60% share

Broken by industry, logistics/distribution made it to the first place with total funding proceeds worth $994 million from nine deals. While Swiggy and Zepto were the key drivers, other deals included Wheelocity ($15 million), Locad ($9 million), Blitz ($6 million), Elchemy ($5.6 million), and Swish ($2 million).

The consumer products industry managed to secure a position in the top three after raking in a total of $169.6 million across four transactions. Healthkart, a consumer nutrition platform offering fitness products and services, scored the highest funding worth $153 million within the industry followed by Candytoy Corporate ($13 million), All Things Baby ($3.6 million), and Earth Rhythm.

Meanwhile, financial services startups slipped to the third spot, garnering a total of $151 million from nine deals compared to $274 million from 11 deals in October. Within financial services, rural credit startup SarvaGram topped with a $67-million funding in its Series D round led by Peak XV Partners. The round also saw participation from existing shareholders Elevar Equity, Elevation Capital, Temasek and TVS Capital.

The other notable deal within the industry was mortgage-tech startup Easy that raised $35 million in its Series B funding round led by Claypond Capital and Sumitomo Mitsui Banking Corporation’s Asia Rising Fund.

Together, the top three industries – logistics/distribution, consumer products, and financial services – raised a total of $1.3 billion, accounting for about 78% of the total deal value in the month.

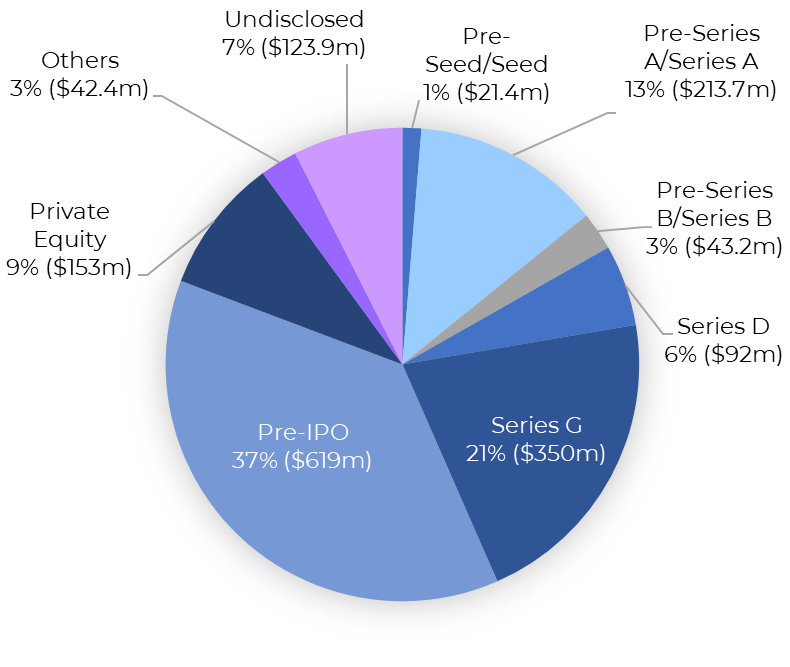

Growth-stage deals shine

Growth-stage deals (including pre-IPO and private equity rounds) led funding with a share of about 75% of the total deal value in November as against 56% in October. Companies in the Series B or post-Series B rounds collected an aggregate of $1.24 billion through 11 investments in the month compared with an aggregate of $629.7million raised last month across 15 transactions.

Growth rounds in November were raised by Swiggy ($605 million), Zepto ($350 million), Healthkart ($153 million), SarvaGram ($67 million), Zopper ($25 million), Bhanzu ($16.5 million), The ePlane Company ($14 million), Solarworld Energy Solutions ($13 million), Vee Healthtek, and Uniqus Consultech.

While growth- and late-stage investments increased in the month, early-stage funding dropped to less than one-third from October. Pre-seed and seed stage deals collectively raised a mere $21.4 million from 22 deals in November as against $90 million from 35 deals in October.

Abyom SpaceTech raised the largest seed round of $2.5 million from startup networking platform SCOPE Ventures. Other seed rounds in the month were closed by Beyond Appliances ($2 million), PeLocal Fintech ($2 million), Assure Clinic ($1.8 million), Airbound ($1.7 million), Pulse ($1.4 million), and Taqtics ($1.2 million), among others.

Meanwhile, pre-Series A and Series A funding grew 82% to $213.7 million from 32 deals in November from $117.6 million through 19 deals in the previous month. Marking the largest Series A round, global travel platform Tripfactory raised $50 million from a prominent international corporate group headquartered in India. Other new shareholders who joined the company’s captable include Vani Kola, Mohandas Pai, and Ranjan Pai.

Other Series A transactions in the month included UnifyApps ($20 million), OneCell Diagnostics ($16 million), Candytoy Corporate ($13 million), Equal ($10 million), ALT Mobility ($10 million), CynLr ($10 million), Ennoventure ($8.9 million), and Marut Dronetech ($6.2 million).

Top investors

InfoEdge Ventures, an early-stage VC fund backed by InfoEdge and Temasek; and Venture Catalysts, along with its accelerator fund 100Unicorns, were the top investors in November with at least five investments each.

InfoEdge Ventures invested in startups including Nexstem, 30 Sundays, Funstop Games, Elchemy, and CynLr, while Venture Catalysts backed companies including Assure Clinic, Ukhi, ParkMate, and Pikndel.

Venture capital firm Blume Ventures, Elevation Capital, Inflection Point Ventures, Speciale Invest, and Unicorn India Ventures occupied the second place with four investments each. Blume’s investments in the month included Zopper, Billion Hearts, Equal, and Vecmocon Technologies.

Meanwhile, Peak XV Partners, Lightspeed, and Anicut Capital made three investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

Greater China Deals Barometer Report: Megadeal bounty lifts PE-VC funding in November

November witnessed a dealmaking sprint in Greater China as venture capital (VC) and private equity (PE) deal volume hit a seven-month high at 186, which was 23.2% higher than the previous month, according to proprietary data compiled by DealStreetAsia.

Venture Capital

SE Asia Deals Barometer Report: Fundraising plummets to seven-month low in Nov

Startup fundraising in Southeast Asia dropped to a seven-month low in November, according to proprietary data compiled by DealStreetAsia, highlighting a continued tightening investment environment for privately held companies across the region.