Greater China Deals Barometer Report: PE/VC deal volume sinks to two-and-a-half-year low in Sept

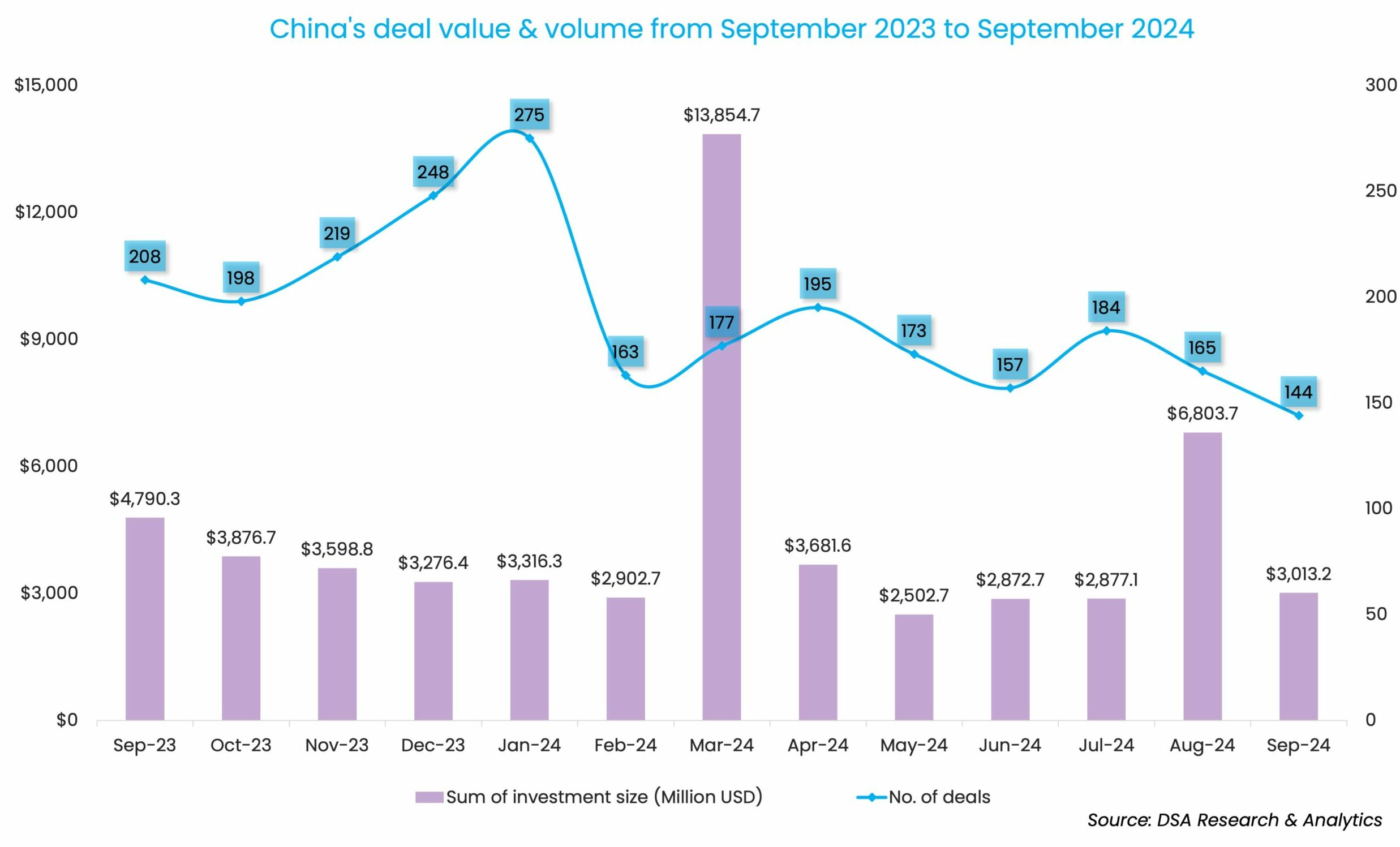

Greater China’s dealmaking activity saw its coldest winter in September as investors sealed a meagre 144 deals, the lowest since March 2022. The deal count was down 12.7% from the previous month.

The bleak dealmaking scene, which came against the backdrop of geopolitical tensions, macroeconomic slowdown, and China’s IPO curbs, deterred investors from pledging capital in startups, especially those at the late stage.

Privately held companies headquartered in mainland China, Hong Kong, Macau, and Taiwan raised around $3 billion in September, down 55.7% from the previous month, according to DealStreetAsia’s proprietary data. This was a far cry from the peak of $4.8 billion in the same month last year. The deal count slipped 30.8% from September 2023.

Although the market saw a number of favourable developments, including the recent interest rate cuts in the US and China’s A-share market rally triggered by the series of market stimulus in late September, it remains to be seen whether a rebound is underway.

The first nine months of 2024 saw the completion of 1,633 deals securing over $41.8 billion. Venture investors committed 5.2% more capital during the said period, although the deal count was 15.1% less.

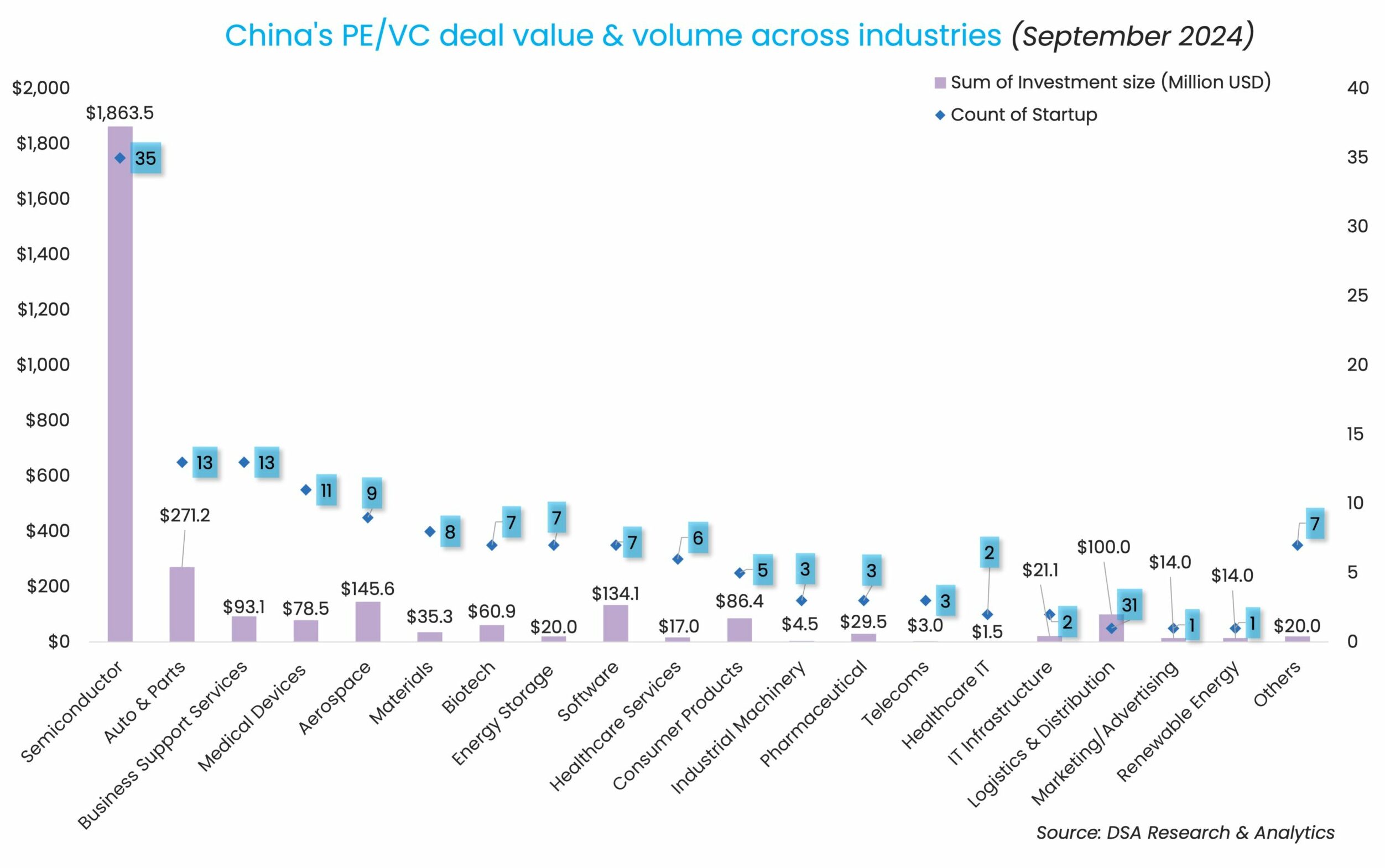

Chipmakers clinch biggest deals

The largest venture deal in September was raised by Hefei Wanxin Integrated Circuit Limited Company, the wholly-owned subsidiary of Shanghai-listed Chinese semiconductor foundry business Nexchip.

Wanxin pocketed 9.55 billion yuan ($1.36 billion) from a couple of external investors, including ABC Financial Asset Investment and Gongrong Jintou (Beijing) Emerging Industry Equity Investment Fund, as the firm sets to expand its production facilities for 12-inch wafers. With a planned overall investment of 21 billion yuan ($2.98 billion) in the Phase III project, the facilities are estimated to churn out about 50,000 wafers every month.

AscenPower, also known as Guangdong Xinyueneng Semiconductor, was another semiconductor firm that raked in mega funding in September.

The firm snapped 1 billion yuan ($142.4 million) in a Series A funding round co-led by Yuecai Fund, the largest policy-driven state-owned investment platform in China’s Guangdong province. SDIC Venture Capital, the investment management company founded by the state-owned State Development and Investment Corporation (SDIC), also led the funding round.

Although semiconductor remains one of the most-invested sectors, the two megadeals could bring a possible turnaround from Q2, a particularly sluggish time for chipmakers in the country, as the deal count hit a four-quarter low.

Overall, the month saw the completion of four megadeals that accounted for 59.2% of the PE-VC proceeds. The rest of the two megadeals were completed by warehouse robot maker Quicktron and electric vehicle (EV) maker Hozon New Energy Automobile.

Investments at Series A and earlier funding stages sustained the downward trend in deal value seen since August, compared with the monthly average between January and July 2024. Although companies in their Series A and earlier stages sealed 65 deals, or 45.1% of the month’s deal count, they snapped only $506.8 million, or 16.8% of the total investments of the month.

While the early-stage deal value marked a recovery from August’s 8.1%, it remained far from the monthly average of 23.7% in Jan-July 2024.

On the other hand, dealmaking close to public listing stages continued to be bleak, with zero deals being sealed at Series E or after.

List of megadeals (September 2024)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| Wanxin Integrated Circuit | Hefei | 1360 | Nexchip, ABC Financial Asset Investment, Gongrong Jintou (Beijing) Emerging Industry Equity Investment Fund | Semiconductor | N/A | |||

| Hozon New Energy Automobile | Shanghai | 182.6 | BTG Pactual, Sertrading | Automobiles & Parts | Electric/Hybrid Vehicles | |||

| Xinyueneng Semiconductor/AscenPower | Guangzhou | 142.4 | A | Guangdong Semiconductor and Integrated Circuit Industry Equity Investment Fund II (managed byYuecai Fund), SDIC Venture Capital Management | Shenzhen Capital Group, Guangzhou Industry Investment Holding Group, Nansha Technology Financial Holding Group, a fund under China’s National Council for Social Security Fund, Boyuan Capital | Semiconductor | N/A | |

| Quicktron | Shanghai | 100 | D | Farglory Group, Wuxi Liangxi Tech Innovation Industry Investment Fund, Jin Dujuan Capital, Weifang Yuanfei Industry Fund | Logistics & Distribution | AI and Machine Learning |

Chinese EVs fundraise to go global

September saw Chinese electric vehicle (EV) brand Hozon New Energy Automobile seal a 1 billion Brazilian reais ($182.6 million) worth of financial support from Brazilian bank BTG Pactual and Sertrading, a Brazilian firm that specialises in importing aircraft. The proceeds will help foster EV adoption in Brazil, per the release.

The investment signifies how Chinese EVs have been increasingly going global to capture growth from overseas markets. The country exported over 4 million cars in 2023, making it the largest auto exporter in the world, with 30%, or 1.2 million, of the exports being EVs.

Europe remains the primary market for Chinese EV exports, accounting for 54.2% of China’s total EV exports last year, according to BBVA Research, the research department of Spanish bank BBVA.

But things could turn around soon, as the European Commission announced to impose higher tariffs of up to 45% against Chinese EVs on October 4.

Nonetheless, auto & parts remained one of the top invested sectors in September, raising $271.2 million through 13 deals. Semiconductor remained the most-invested sector, securing an aggregate of over $1.8 billion through 35 deals.

Top investor

Shenzhen Capital Group, the venture investment vehicle of the Shenzhen government, participated in seven deals to top the investor list. The seven startups raised a total of $201.9 million.

Most active investors in China (Sept 2024)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Shenzhen Capital Group | 7 | $201.9 | 2 | 5 |

| Innoangel Fund | 4 | $31.0 | 1 | 3 |

| Fortune Capital | 4 | $112.2 | 2 | 2 |

| SDIC Venture Capital & affiliates | 4 | $219.3 | 2 | 2 |

| Shenzhen High-Tech Investment Group | 3 | $3.0 | 1 | 2 |

| Qiming Venture Partners | 3 | $98.2 | 3 | 0 |

| Shunwei Capital | 3 | $84.2 | 3 | 0 |

| CICC Capital | 3 | $44.0 | 1 | 2 |

| BAIC Capital | 3 | $22.6 | 1 | 2 |

| Vertex Ventures | 3 | $24.0 | 1 | 2 |

| CJL Holdings | 3 | $28.0 | 0 | 3 |

| 01VC | 3 | $17.0 | 0 | 3 |

Note: In our monthly analysis for September 2024, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Startups raise a modest $230m in Sept as deal volume plunges

Startup fundraising in Southeast Asia remained subdued in September, as large-ticket investments remained scarce and the number of equity deals dropped to a 12-month low.

Venture Capital

India Deals Barometer Report: Startup funding dips a tad to $1.6b in Sept

After a robust month for dealmaking in August, Indian startups witnessed a marginal dip in funding in September as they collectively raked in about $1.6 billion from 121 private equity and venture capital transactions, according to proprietary data compiled by DealStreetAsia.