India Deals Barometer Report: Growth-stage deals boost startup funding in Aug

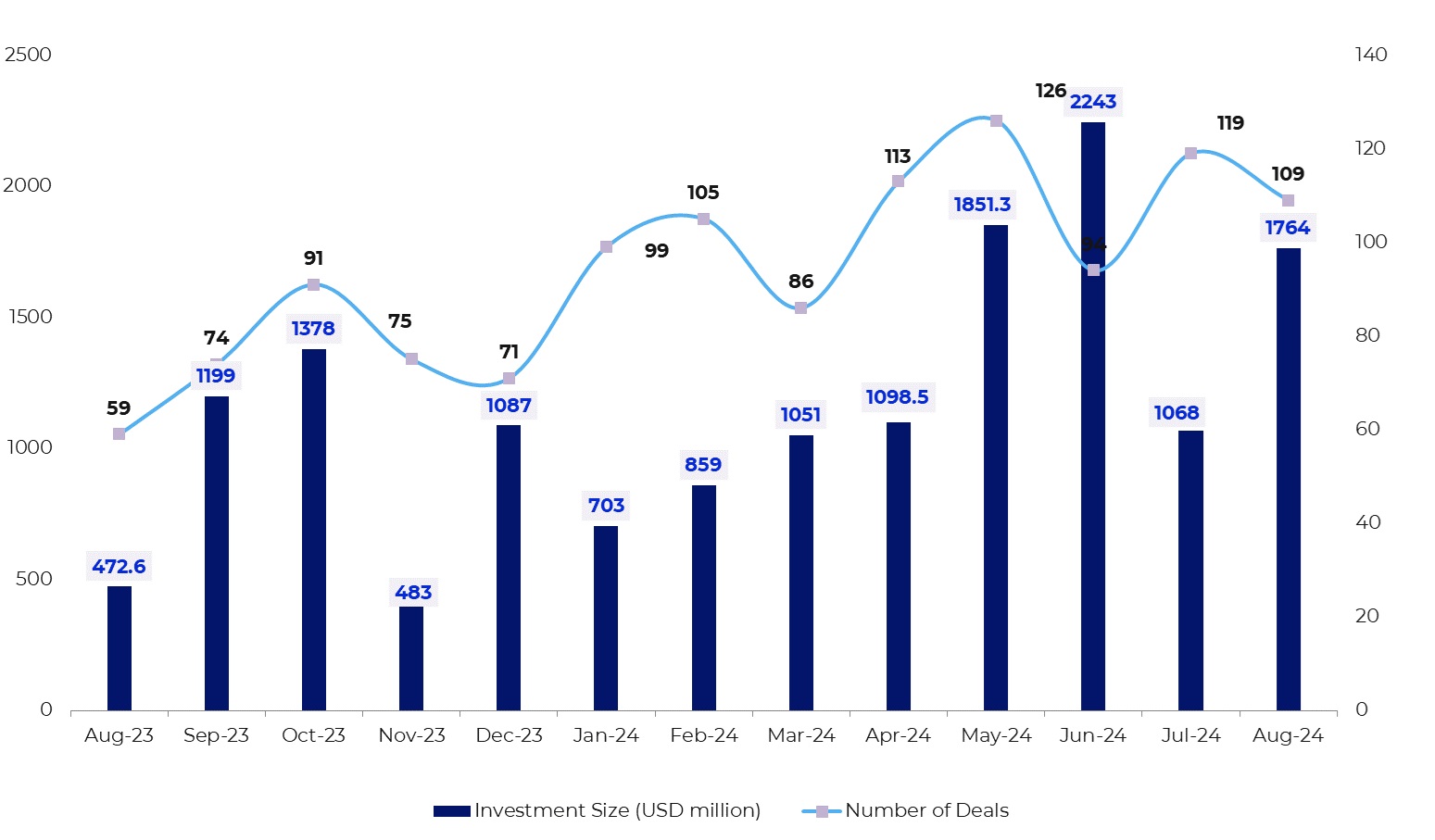

Private equity and venture capital funding for Indian startups jumped to $1.76 billion in August owing to an uptick in big-ticket transactions, according to proprietary data compiled by DealStreetAsia. The investment marked an increase of 76% in value from July when startups collectively garnered $1 billion across 119 deals.

The dealmaking plummeted in July after hitting the $2-billion mark for the first time in two years in June this year. However, startup fundraising has been on an upward trend hitting the $1-billion mark since March this year, touching its peak in June.

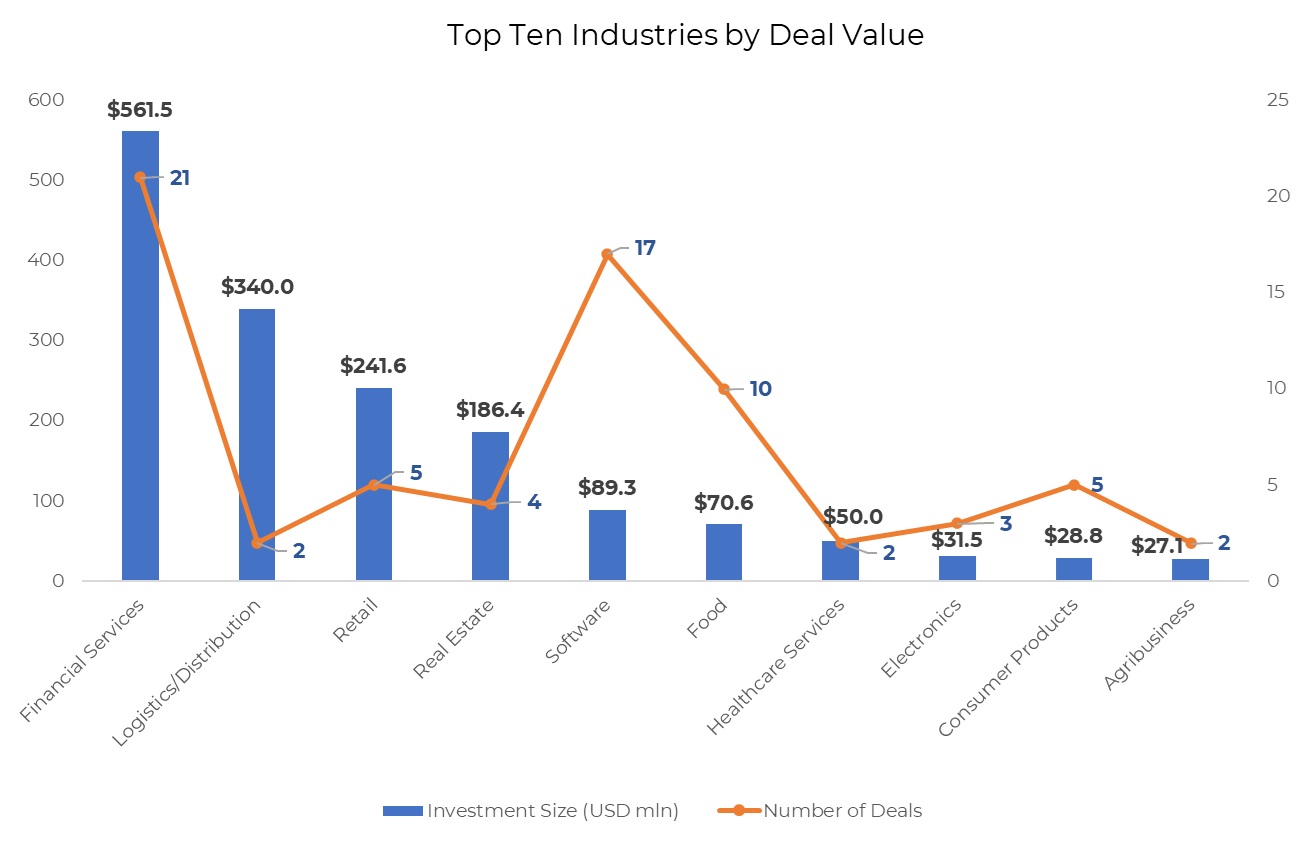

Led by financial services, software, and food industries, a total of 109 transactions were closed in August as against 119 in July, recording a drop of 8% month-on-month, the data showed.

Overall, the funding continues to improve for Indian startups after facing turbulent times in 2023. On a year-on-year basis, the funding value more than trebled from $473 million in August 2023. Deal volume was also up 85% from the comparable period last year.

However, due to a prolonged funding winter and market uncertainties witnessed in the whole of 2023, venture capitalists have become selective in their approach and are focusing on fewer, larger deals with solid business ideas, a proven track record, and strong fundamentals.

The month also saw a return of big-ticket transactions. Four megadeals (classified as those over $100 million in size) were recorded in August with quick e-commerce major Zepto, non-banking financial company DMI Finance, baby products retailer FirstCry, and budget hotel chain OYO raising funding.

Top ten funding deals in August 2024

At $340 million, Zepto raised the highest sum in a fresh round led by General Catalyst at a valuation of $5 billion, just two months after its last funding. The company was valued at $3.6 billion in its last fundraise of $665 million in June this year.

In comparison, two megadeals were sealed in July, four in June, and six in May.

Financial services continues to shine

Financial services emerged as the most funded industry in August with total proceeds worth $561 million from 21 deals. This is more than double the investment raked in by the industry in July.

Digital lending company DMI Finance raised the largest round of $334 million from Japanese banking giant Mitsubishi UFG Financial Group (MUFG). DMI Finance is a digital-first NBFC that offers consumption, personal and MSME loans. Wealth and asset management startup Neo Group followed with $48 million funding led by MUFG Bank along with New York-based Euclidean Capital.

Other notable deals within financial services include digital lending platform Yubi ($30 million), digital investment platform Syfe ($27 million), microlending platform Aye Finance ($25.3 million), trade financing startup Vayana ($20.5 million), digital lender Axio ($20 million), wealth tech platform InvestorAi ($9.5 million), and MSME-focused fintech lending platform FlexiLoans ($9 million).

Zepto’s $340-million funding round pushed the logistics and distribution industry to second place. Food-delivery platform Swiggy, too, raised funding in the month from actor Amitabh Bachchan’s family office but the amount remained undisclosed. In comparison, the industry witnessed four deals worth $8.3 million in the previous month.

Retail slipped to the third spot from second in July with total proceeds worth $241.6 million from five deals. In July, however, retail startups collectively raised $190.6 million through 11 deals.

Within retail, FirstCry led the pack with $227 million in funding from 71 anchor investors ahead of its initial public offering (IPO). The IPO of FirstCry, which competes with online kids’ store Hopscotch, Shoppers Stop and Flipkart-owned Myntra, was oversubscribed 12 times last month.

Other deals within the industry include luggage brand Uppercase ($9 million), ethnic wear brand Fashor ($5 million), luxury men’s brand Halden ($595,238), and D2C men’s lifestyle brand Metaman.

Together the top three industries — financial services, logistics and distribution, and retail — scooped up a total of $1.14 billion or 65% of the total deal value.

Growth-stage deals drive funding

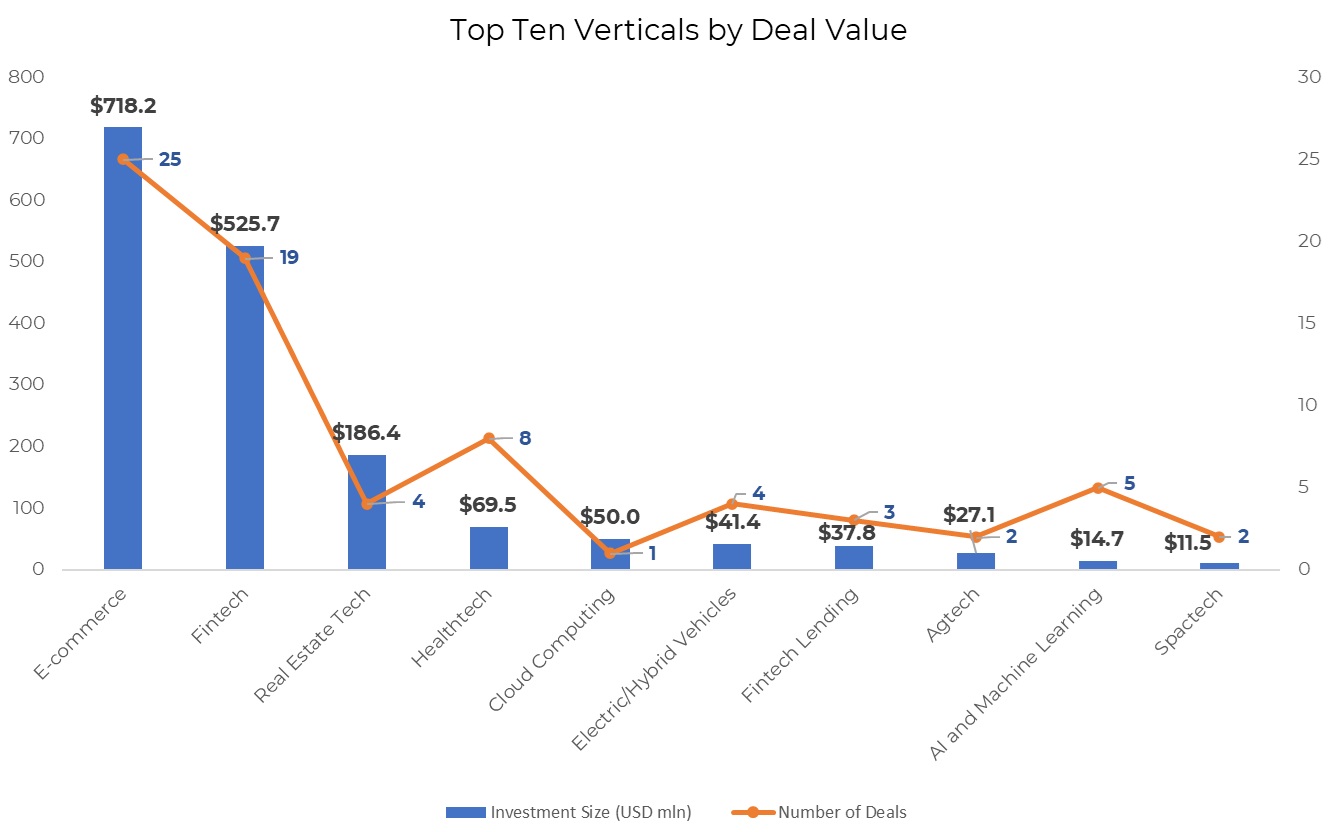

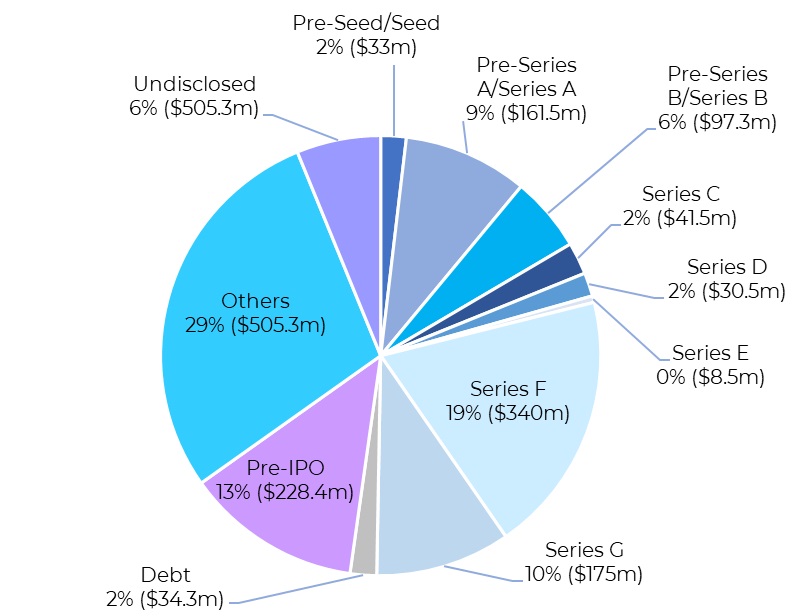

In terms of value, growth-stage startups led fundraising in August. Companies in the Series B or post-Series B rounds (including private equity and pre-IPO rounds) collected an aggregate of $1.27 billion — about 72% of the total deal value — through 18 investments. In comparison, growth-stage deals collectively garnered a mere $480 million in July.

Zepto ($340 million), DMI Finance ($334 million), FirstCry ($227 million), Oyo ($175 million), Neo Group ($48 million), Blue Tokai Coffee Roasters ($35 million), Hangyo ($25 million), Vayana ($20.5 million), AGRIM ($17.3 million), Servify ($10 million), Agrizy ($9.8 million), and InvestorAi ($9.5 million) were among the startups that raised growth rounds in August.

While the value of pre-seed and seed stage deals increased to $33 million in August from $27.1 million in July, their volume dropped to 24 from 37 in the previous month. The largest seed deal in the month was closed by stock-broking platform Punch, which raised $7 million from Stellaris Venture Partners, Susquehanna Asia VC, Prime Venture Partners, and Innoven Capital.

Seed rounds during the month were also raised by EtherealX ($5 million), Truva ($3 million), Plutos ONE ($2 million), and Hyperbots ($2 million), among others.

Startups in the pre-Series A and Series A stages raised a total of $161.5 million across 32 deals in August, which is marginally lower than the $167.9 million raised through 27 deals in July.

In the largest Series A round, electric vehicle manufacturer Kinetic Green secured a $25 million investment from Greater Pacific Capital (GPC), a global private equity firm. Other notable Series A deals include Fresh Bus ($10.5 million), Agrizy ($9.8 million), Scimplify ($9.5 million), InvestorAi ($9.5 million), Kindlife ($8 million), HouseEazy ($7 million), GalaxEye Space ($6.5 million), Metadome.ai ($6.5 million), and Convin ($6.5 million), among others.

Meanwhile, there were only two debt deals worth $34.3 million in August as against 11 debt deals worth $137.9 million in July.

Top investors

Early-stage investor Inflection Point Ventures and Venture Catalysts, along with its accelerator fund 9Unicorns (now 100Unicorns), emerged as the top investors in August with a total of five investments each.

Inflection Point’s investments include talent marketplace FlexiBees, mortgage lender LoanKuber, AI-driven quantum software startup Bloq Quantum, user data storage startup Medront, and manufacturing-tech startup Fabrication Bazar. Meanwhile, CricHeroes, NxtQube, Sunfox Technologies, and LLUMO AI secured funding from Venture Catalysts and 9Unicorns.

Alternative financing firm Anicut Capital and Chiratae Ventures Fund occupied the second spot with four investments each. Anicut’s investments include engineering and technology services company BlueBinaries, space technology GalaxEye Space, AI-driven B2B sales enablement platform MiCLIENT, and specialty coffee roaster and café chain Blue Tokai Coffee Roasters.

In July, Anicut Capital closed its maiden late-stage equity continuum fund of Rs 300 crore ($36 million), to invest in companies preparing for an IPO within the next 2-4 years.

Meanwhile, Chiratae invested in online marketplace for pre-owned homes HouseEazy, extended reality (XR) startup Metadome.ai, Blitzscale Technology, the parent company of WMall and ShopDeck, and trade financing startup Vayana.

Other investors Omnivore, Antler, Elevation Capital, India Quotient, Kalaari Capital and Alteria Capital made three investments each during the month.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

Greater China Deals Barometer Report: Megadeals propel startup funding to $6.8b in August

August witnessed an upswing in investment activity in Greater China as startup fundraising doubled from the previous month and also grew a third from year-ago levels.

Venture Capital

SE Asia Deals Barometer Report:Startup funding hits four-month low in August as megadeals play truant

Southeast Asian startup fundraising dropped to a four-month low in August, according to proprietary data compiled by DealStreetAsia, highlighting a continued slowdown in the region since the post-pandemic recovery phase.