Greater China Deals Barometer Report: Megadeals propel startup funding to $6.8b in August

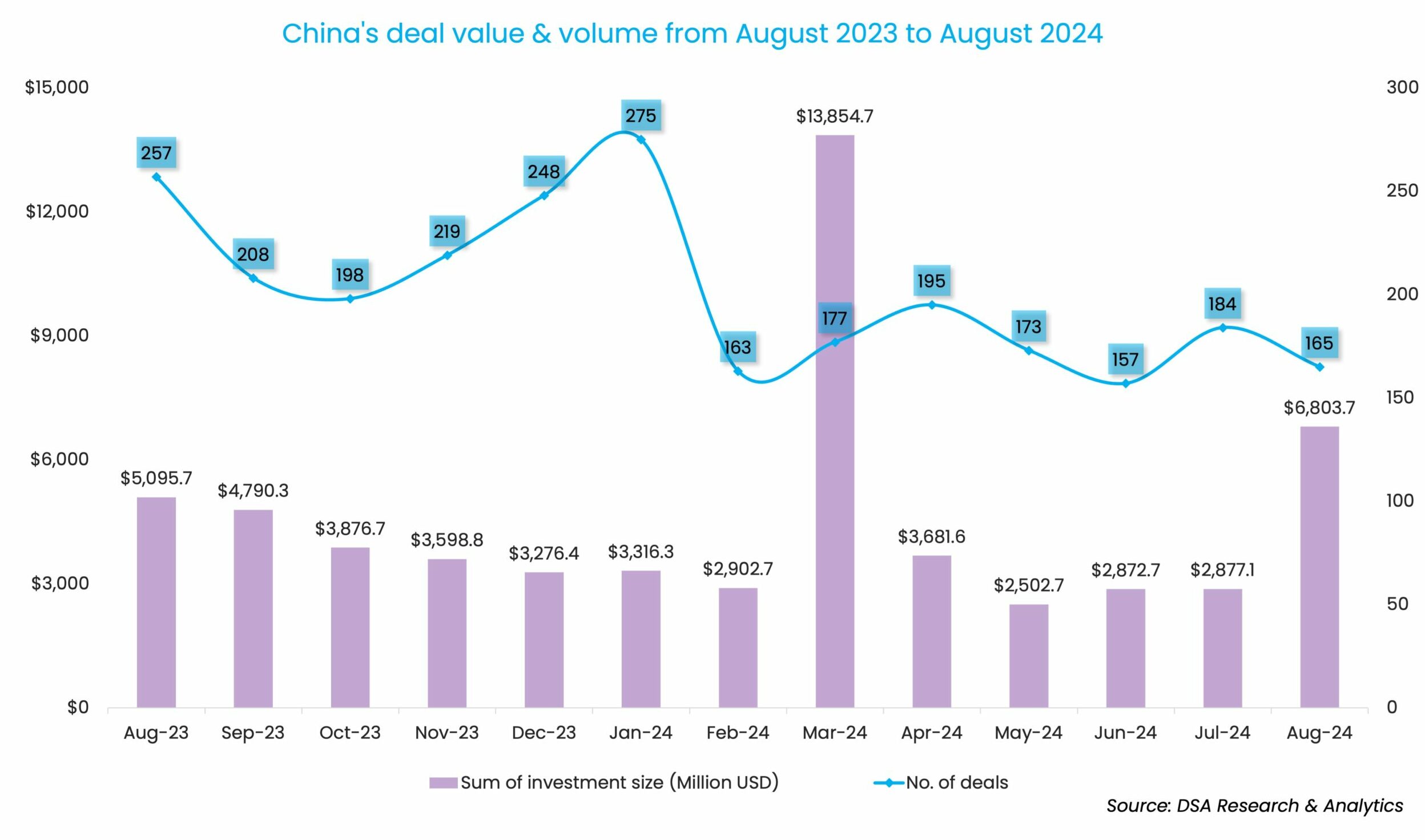

August witnessed an upswing in investment activity in Greater China as startup fundraising doubled from the previous month and also grew a third from year-ago levels.

Investors pumped $6.8 billion into privately-owned firms in mainland China, Hong Kong, Macau, and Taiwan last month, compared with $2.9 billion in July, show proprietary data compiled by DealStreetAsia. The capital commitments last month were also 34% higher than the $5.1 billion recorded in August 2023.

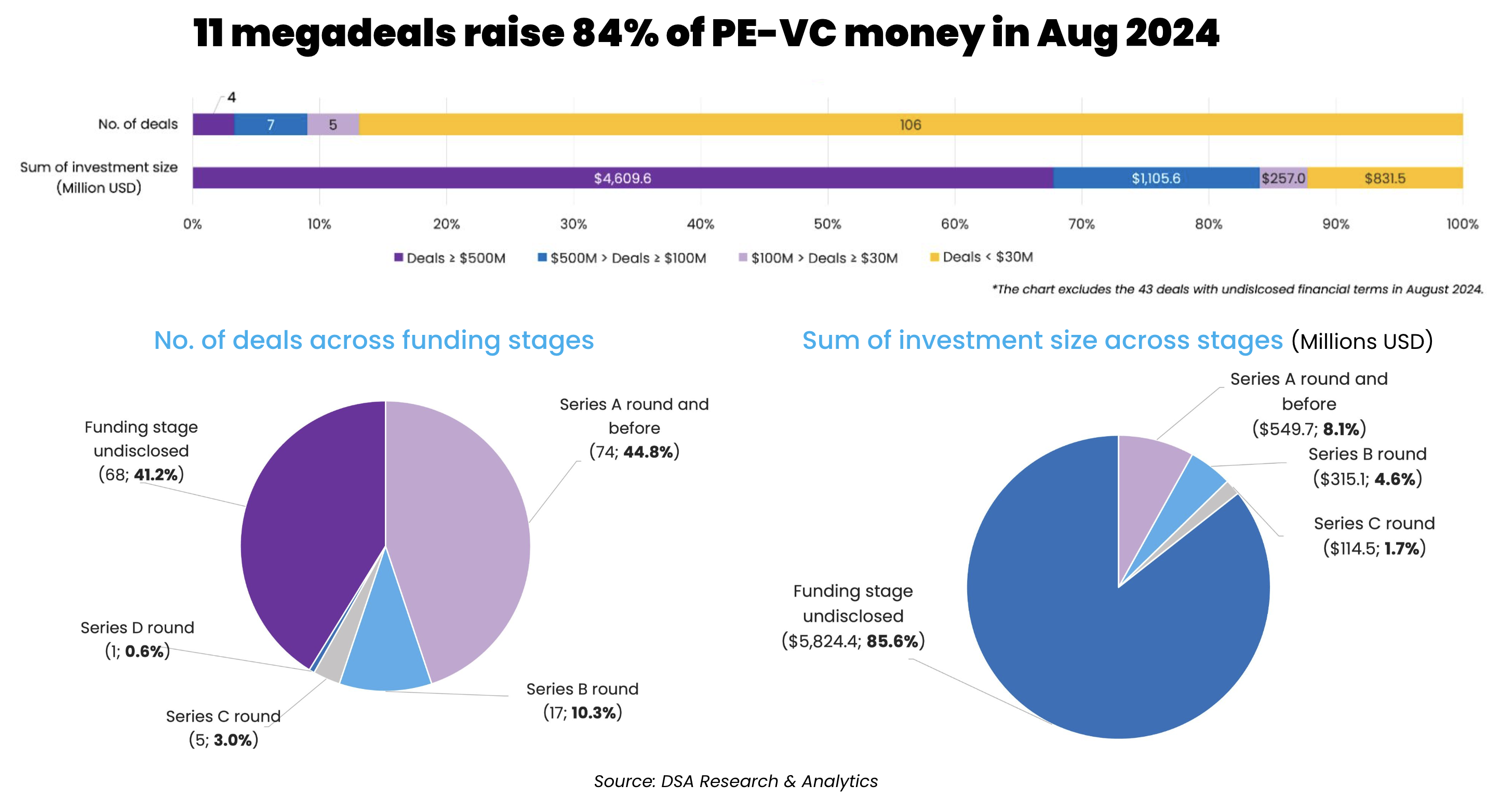

The surge in monthly fundraising was on account of 11 megadeals, or investments worth at least $100 million, which garnered 84% of the total capital raised in August. In comparison, there were six megadeals in July that accounted for 51% of the capital raised that month.

While it is not unusual for megadeals to dominate the funding scene, August was interesting as early-stage investments slid sharply. This resulted in overall monthly deal volume sliding to 165, which is 10.3% less than the previous month and 35.8% less than August 2023 (see chart).

Overall, the first eight months of 2024 saw startups in Greater China secure $38.8 billion—up 11% from the same period last year, while the deal count of 1,489 is down 13.2%.

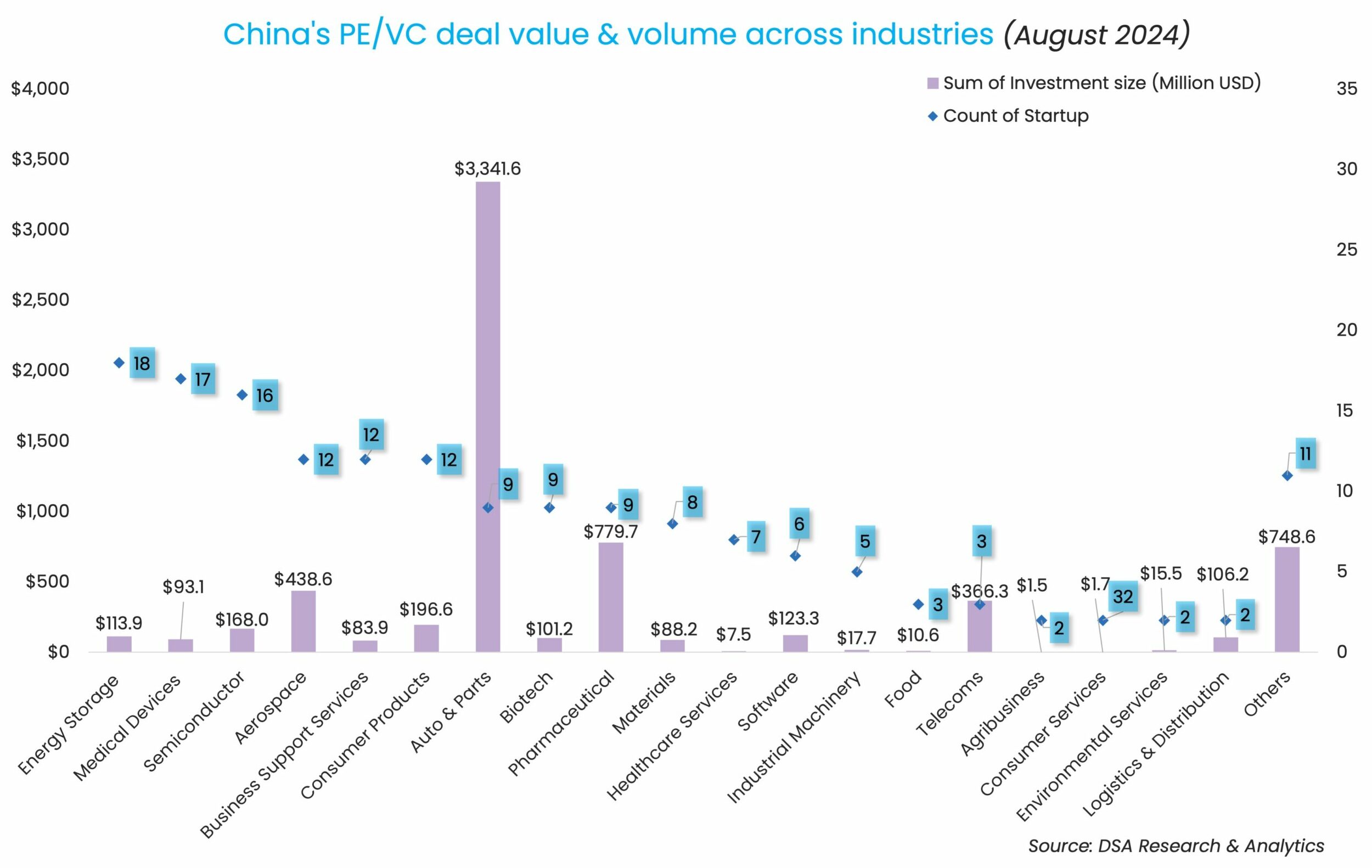

Auto & Parts ride high

The surging demand for intelligent components used in smart vehicles made the automotive sector stand out in August amid overall market uncertainty.

Shenzhen Yinwang Smart Technologies, was the biggest fundraiser of August, riding high on the EV boom. Yinwang snapped up a combined 23 billion yuan ($3.2 billion) from two megadeals after Chinese EV firm AVATR Technology and Shanghai-listed automobile maker Seres Group separately announced that they would buy a 10% stake each in the Huawei-owned smart auto parts firm.

Yinwang’s two fundraisings were part of August’s 11 megadeals—the highest megadeal volume recorded so far this year.

Solar company Tongwei’s plan to acquire a controlling stake in its competitor Runergy for about 5 billion yuan ($697.8 million) was the third largest deal of the month followed by the $680 million acquisition of UCB Pharma’s neurology and allergy business in China by Mubadala and CBC group.

The rest of the megadeals were scattered across telecom, aerospace, consumer products, and logistics.

Early-stage investments take a hit

Early-stage investments took a hit in August.

Although companies in their Series A and earlier stages sealed 74 deals, or 44.8% of the month’s deal count, the early-stage firms raised only $549.7 million, or 8.1% of the total investments in the month—the lowest share of capital commitment so far this year in these stages.

The share of early-stage deal value in August was far below the monthly average of 23.7% in Jan-August 2024.

List of megadeals (August 2024)

Startup Headquarters Investment size (Million USD) Unspecified size Investment stage Lead investor(s) Other investor(s) Industry/Sector Vertical

Yinwang Smart Technologies Shenzhen 1615.9 Equity Financing AVATR Technology Automobiles & Parts Electric/Hybrid Vehicles

Yinwang Smart Technologies Shenzhen 1615.9 Equity Financing Seres Group Automobiles & Parts Electric/Hybrid Vehicles

Runergy New Energy Technology Yancheng 697.8 M&A Tongwei Co Ltd Renewable Energy CleanTech

UCB’s mature business (neurology and allergy) in China Zhuhai 680 M&A Mubadala Investment Company, CBC Group Pharmaceutical Biotech

Hengtong Submarine Power Cable Changshu 364.8 Guokai Manufacturing Transformation and Upgrading Fund CCB Investment, BOC Financial Asset Investment, State Grid Yingda Industry Investment Funds Management, Baowu Green Carbon Private Investment Fund Telecoms N/A

XPeng AeroHT Guangzhou 150 B1 Aerospace AI and Machine Learning

Xinwanxing Composite Materials Leshan 140.6 Equity Financing Eastern Bell Capital, Goldstone Investment Aerospace N/A

Seek Pet Food Linyi 140.6 Strategic Investment Advent International, Boyu Capital Consumer Products Pet Technology

AutoAi Nanjing 108.3 Strategic Investment DiDi Smart Transportation Technology (affiliated with DiDi Global), NavInfo Automobiles & Parts Electric/Hybrid Vehicles

Ganghong Wharf Zhuhai 101.3 China Energy Investment Corp Logistics & Distribution N/A

Autoflight Shanghai 100 Yes Strategic Investment Contemporary Amperex Technology Co Limited (CATL) Aerospace N/A

Chinese flying cars take flight

China is furthering its support to the so-called ‘low-altitude economy’, providing tailwinds to aerospace companies like flying car makers.

Xpeng Aeroht, a subsidiary of EV maker Xpeng secured $150 million in a Series B1 funding round as the firm looks to kickstart pre-orders for its modular flying car in Q4 this year and start deliveries to consumers in Q4 2025.

Chinese electric vehicle battery maker CATL also pumped in “several hundreds of millions” of US dollars into electrical aerial vehicle maker AutoFlight, as the duo eyes to dedicate resources for the R&D of batteries used in electric aviation.

The investments come four months after Chinese drone maker EHang Holdings received the first-ever Production Certificate (PC) from the Civil Aviation Administration of Central and Southern China (CAAC) in April. The PC enables eVTOL companies to commence mass production and commercial operations of their eVTOL aircraft.

Apart from the flying car ambition, investors continued to dabble in energy storage, medical devices, and the semiconductor sectors to spawn the country’s deep tech ambitions.

Jinding Capital tops investor list

Local investment firm Jinding Capital and its affiliates clocked five deals to top the investor list in August. The five investees raised $32.5 million.

With offices across Beijing, Shanghai, Hangzhou, Shenzhen, and Xiamen, Jinding Capital sets itself apart by serving listed companies and their corporate venture arms. It invests on behalf of the listed firms and their CVC arms.

So far, the firm has served over 50 listed firms in the areas of strategic investment as well as M&As, according to its website.

Most active investors in China (August 2024)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Jinding Capital & affiliates | 5 | 32.5 | 4 | 1 |

| Qiming Venture Partners | 4 | 117 | 2 | 2 |

| Suzhou Capital Group | 4 | 1.5 | 2 | 2 |

| TopoScend Capital | 4 | 37.9 | 1 | 3 |

| Suzhou International Development Venture Capital (SIDVC) | 3 | 3 | 1 | 2 |

| Legend Holdings & affiliates | 3 | 29.5 | 0 | 3 |

| Fortune Capital | 3 | 41.9 | 1 | 2 |

| Oriza Holdings & affiliates | 3 | 14 | 1 | 2 |

| CICC Capital & affiliates | 3 | 105.1 | 2 | 1 |

Note: In our monthly analysis for August 2024, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Startup funding hits four-month low in August as megadeals play truant

Southeast Asian startup fundraising dropped to a four-month low in August, according to proprietary data compiled by DealStreetAsia, highlighting a continued slowdown in the region since the post-pandemic recovery phase.

Venture Capital

India Deals Barometer Report: Startup funding tanks 52% to $1b in July

Private equity and venture capital funding for Indian startups jumped to $1.76 billion in August owing to an uptick in big-ticket transactions, according to proprietary data compiled by DealStreetAsia. The investment marked an increase of 76% in value from July when startups collectively garnered $1 billion across 119 deals.