India Deals Barometer Report: Startup funding in June crosses $2b for first time in two years

The funding winter that beset India’s startup landscape is showing signs of thawing. The month of June saw private funding for local startups cross the $2-billion mark for the first time in two years, finds data compiled by DealStreetAsia.

Buoyed by grocery delivery startup Zepto’s $665-million funding round, June’s proceeds of $2.2 billion marked a nearly 18% growth over May when Indian startups had garnered $1.9 billion. However, at 94, deal volume was down 27% from 129 in May.

On a year-on-year basis, the funding grew more than threefold from $648 million in June 2023. The deal value was also up 5.6% from the comparable period last year.

The local startup ecosystem has been under pressure due to a prolonged challenging fundraising environment that began in the latter half of 2022 as a result of global economic uncertainties, market volatility, and a tightened monetary environment. As wary investors slowed their pace and prioritised profitability among portfolio companies, many Indian startups were forced to carry out significant cost-cutting measures, including mass layoffs.

While the June numbers look promising, it might be too early to say the ecosystem is out of the woods. Big-ticket deals, for one, remain scarce. There were only four mega deals worth at least $100 million in June. In comparison, the month of May had recorded six megadeals.

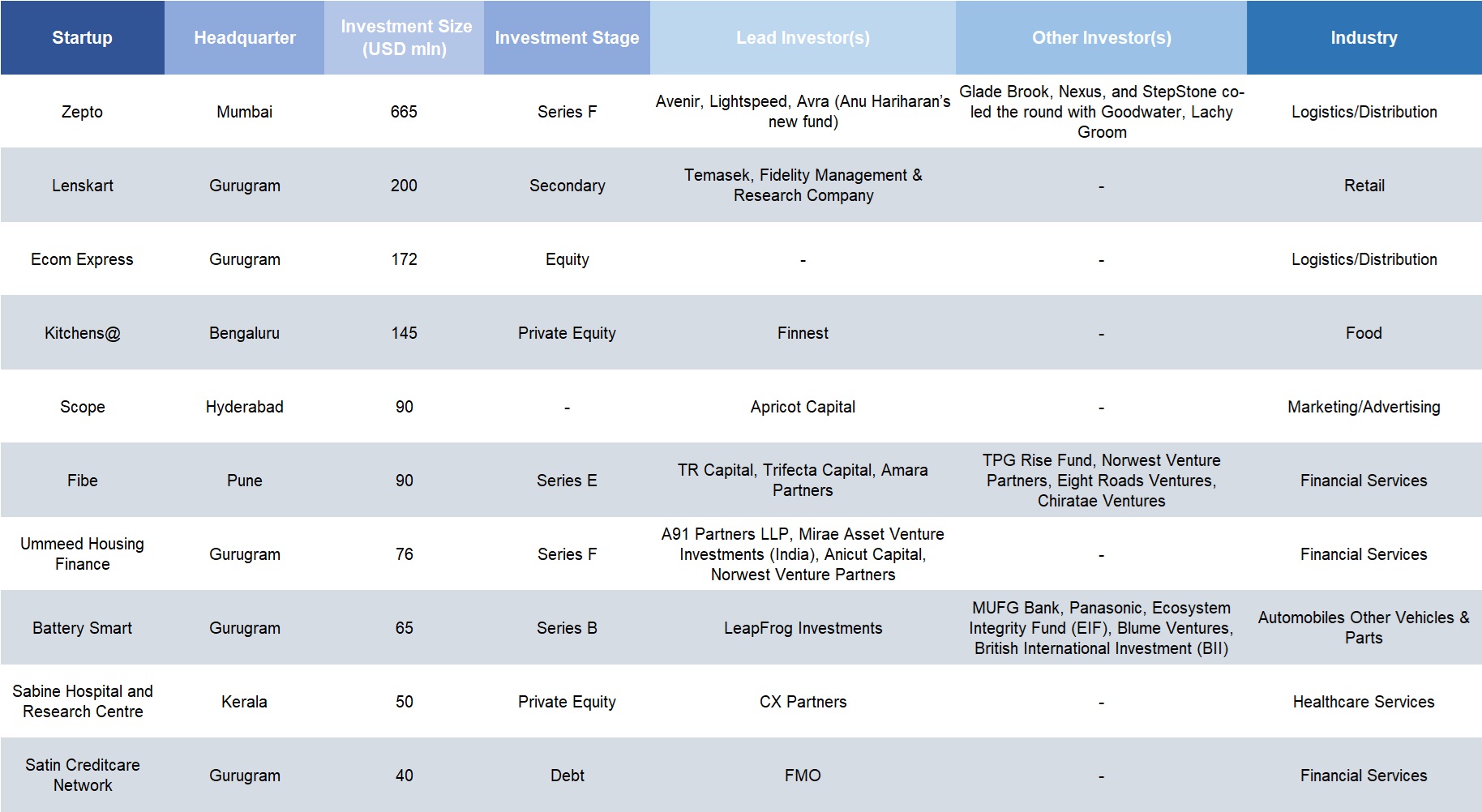

Top ten funding deals in June 2024

Zepto’s $665-million round in June, which also marked the biggest financing of the year to date, was co-led by existing investors Glade Brook, Nexus, and StepStone, with Goodwater and Lachy Groom doubling down as well. Avenir, Lightspeed, and Avra (Anu Hariharan’s new fund) joined Zepto’s cap table as new investors.

Eyewear retailer Lenskart followed with a $200 million secondary investment from Temasek and Fidelity Management & Research Company. The transaction reportedly valued Lenskart at $5 billion. Other megadeals comprised logistics platform Ecom Express ($172 million) and cloud kitchen startup Kitchens@ ($145 million).

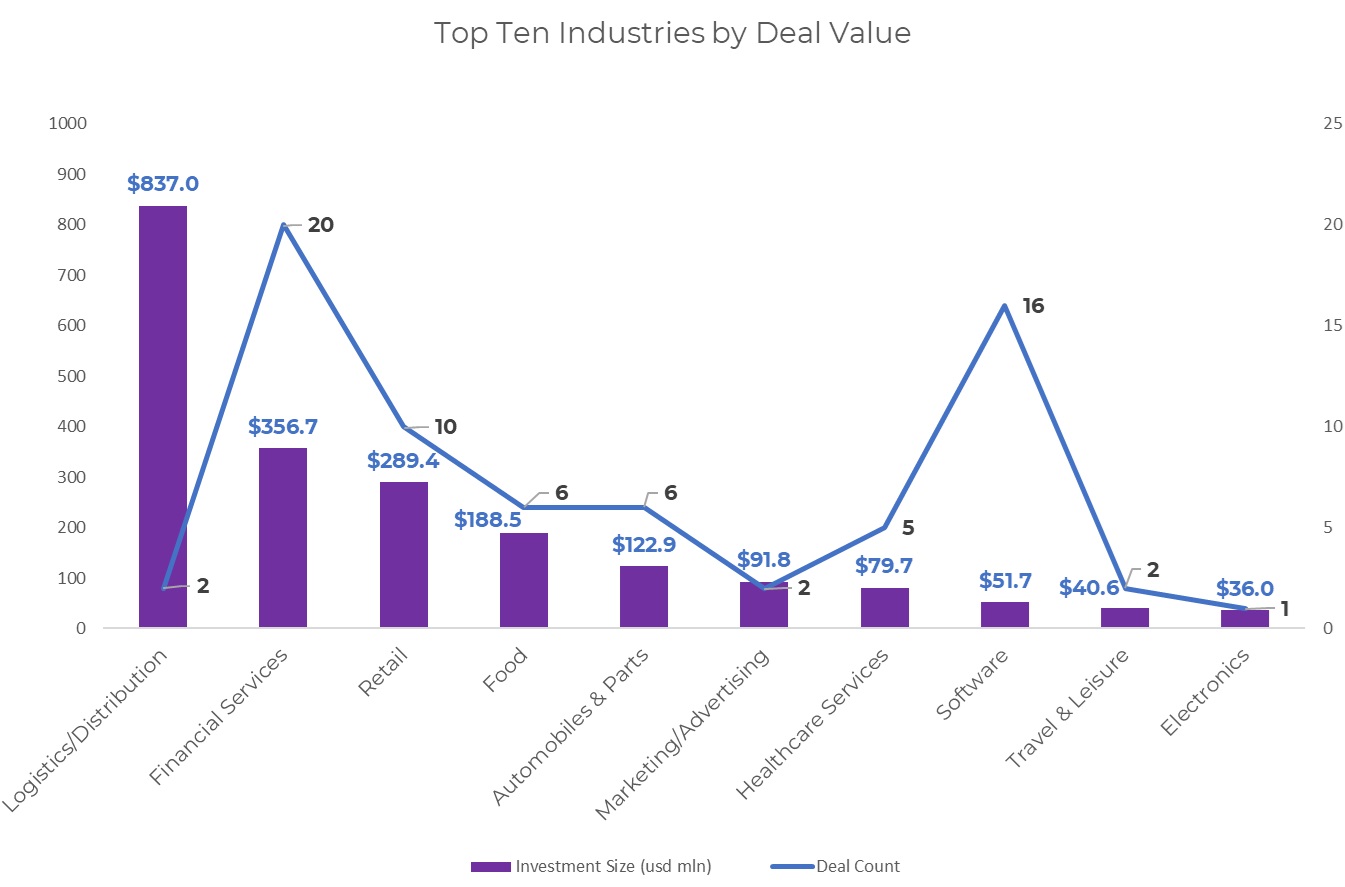

Logistics/distribution industry shine

Logistics/distribution emerged as the top fundraiser in June, with total proceeds of $837 million from the Zepto and Ecom Express deals. The industry raised a mere $13 million in May from six deals.

The rapid growth of e-commerce, particularly after COVID-19, created a surge in demand for efficient logistics and distribution services. The need for reliable last-mile delivery solutions became critical, driving innovation in logistics. Flush with funds, quick commerce companies that started with the delivery of groceries and perishables slowly expanded their offerings to include books, plants, phone chargers, board games, and bouquets – all delivered within minutes. Last month, Zomato said it would invest an additional Rs 300 crore in Blinkit, a competitor of Zepto.

The financial services industry, which has been an investor favourite, occupied the second spot with a total of $357 million in funding from 20 transactions. Digital lending startup Fibe, formerly known as EarlySalary, was the industry’s largest fundraiser in June, with a $90 million Series E funding round led by TR Capital, Trifecta Capital, and Amara Partners.

Ummeed Housing Finance, a Gurugram-based digital affordable housing finance company, took second place with its $76 million round, which was backed by A91 Partners, Mirae Asset Venture Investments (India), Anicut Capital, and Norwest Venture Partners.

Other prominent deals within the financial services industry include non-bank finance company Satin Creditcare Network ($40 million), microlending platform Aye Finance ($30 million), consumer payments and lending company Slice ($20 million), agri-finance company Samunnati ($16 million) and online gold loan platform Rupeek ($15 million).

The retail industry slipped to third place with a total of $289 million in funding from 10 transactions, against $678 million from 16 transactions in May. Lenskart led the tally, followed by B2B fashion marketplace ZYOD ($18 million), fashion brand Rare Rabbit ($18 million), men’s apparel brand Wrogn ($15 million), beauty brand RENÉE Cosmetics ($12 million), and jewellery retailer Bluestone ($12 million).

The top three industries – logistics/distribution, financial services, and retail – raked in a total of about $1.5 billion, or 66% of the total proceeds, in June.

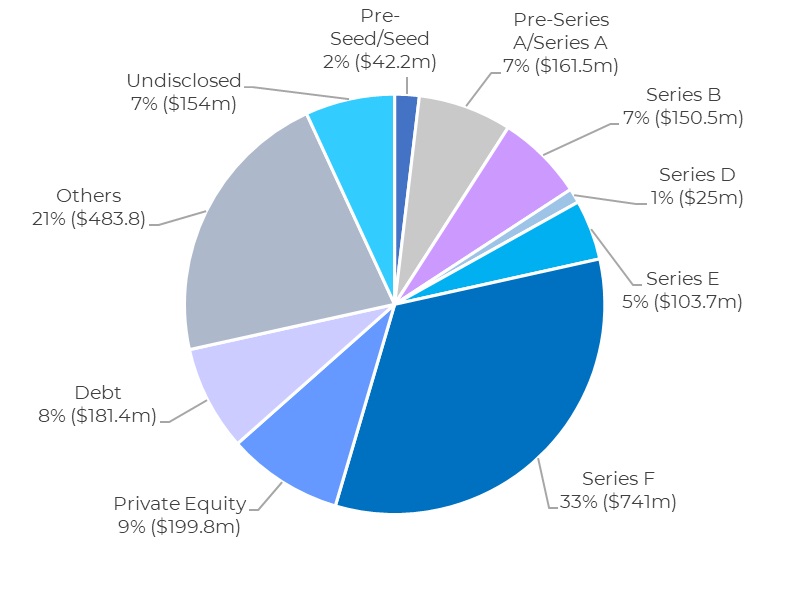

Investors favour growth-stage startups

Growth-stage startups accounted for the majority of private capital secured in June. Companies at Series B and later stages (including pre-IPO companies) collected an aggregate of $1.26 billion from 16 deals, against $1.02 billion from 14 transactions in May.

During the month, prominent growth-stage deals were inked by Zepto, Ummeed Housing Finance, Fibe, Innoviti Technologies and Bira 91, among others.

Share of capital raised in June by company stage

Pre-Series A and Series A deals raised $161.5 million in June, registering an increase of about 71% over May. However, the volume of such deals remained unaltered at 26 in the month. In the month’s largest Series A deal, Bengaluru-based consumer electronics startup Indkal Technologies raised $36 million in funding led by Mauritius-based Aries Opportunities Fund.

Other prominent Series A deals in June include ZYOD, Astrotalk ($14 million), Ethereal Machines ($13 million), Cloudphysician ($10.5 million), Matter ($10 million), Sid’s Farm ($10 million), and Two Brothers Organic Farms ($7 million).

Funding for pre-seed and seed deals dropped marginally to $42.2 million in June from $49.6 million in May. B2B cross-border home decor brand Trampoline raised $5 million in one of the largest seed funding rounds in the month.

Most active investors

Matrix Partners emerged as the top investor in June, with at least five investments. These include B2B home décor brand Trampoline, non-banking financial company Amica Finance (Jupiter), workflow automation platform Rocketlane, speech analytics platform GreyLabs AI, and direct-to-consumer (D2C) skincare firm Foxtale.

With four investments each, Inflection Point Ventures (IPV) and Peak XV Partners (formerly Sequoia Capital India & SEA) followed in second place. IPV’s June investments included healthtech startup Docplix, AI and machine learning platform Metis Intellisystems, sports and fitness tech startup Machaxi, and D2C consumer goods company Palette Brands. Meanwhile, Peak XV Partners backed Ethereal Machines, OrbitShift, Amica Finance (Jupiter), and Cloudphysician.

Lightspeed, Capital 2B, and India Quotient shared the third spot with three investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

Greater China Deals Barometer Report: Startup funding declines 41% YoY in June as investor caution continues

Startup financing in Greater China logged a 41% year-on-year (YoY) decline in June as macro uncertainties, geopolitical tensions, and a tepid exit landscape continue to dampen investor interest.

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising falls 11% in June as investors sign smaller cheques

Startup funding in Southeast Asia dipped in June, after hitting a five-month high in May, in another reminder of the stubborn challenges that persist in private capital fundraising in the region.