India Deals Barometer Report: Startup fundraising crosses $1b on a trot in April

Amid mass layoffs and shutdowns due to a prolonged funding winter, April brought some cheer as startups raised $1.1 billion across 115 private equity and venture capital transactions, the highest monthly deal value since October 2023.

Moreover, the deal volume at 115 during the month was also the highest since September 2022, according to proprietary data compiled by DealStreetAsia.

The numbers also marked a marginal jump over March when startups collectively garnered $1.06 billion across 87 transactions. Owing to the funding slowdown, private equity and venture capital investments in Indian startups stood at a mere $2.61 billion in the Jan-March quarter, registering a drop of 11% from $2.94 billion in the previous quarter.

On a year-on-year basis, the deal value in April was up 10% sequentially, while deal volume rose almost 60%, the data revealed.

The Indian startup ecosystem faced numerous challenges in 2023, with more than 35,000 ventures shutting down as the funding winter intensified, according to a report by Bain & Company in collaboration with the Indian Venture and Alternate Capital Association (IVCA) released in March.

A convergence of domestic and global factors including stubborn inflation, increased investor expectations, and persistently high interest rates prolonged the funding winter, the report said.

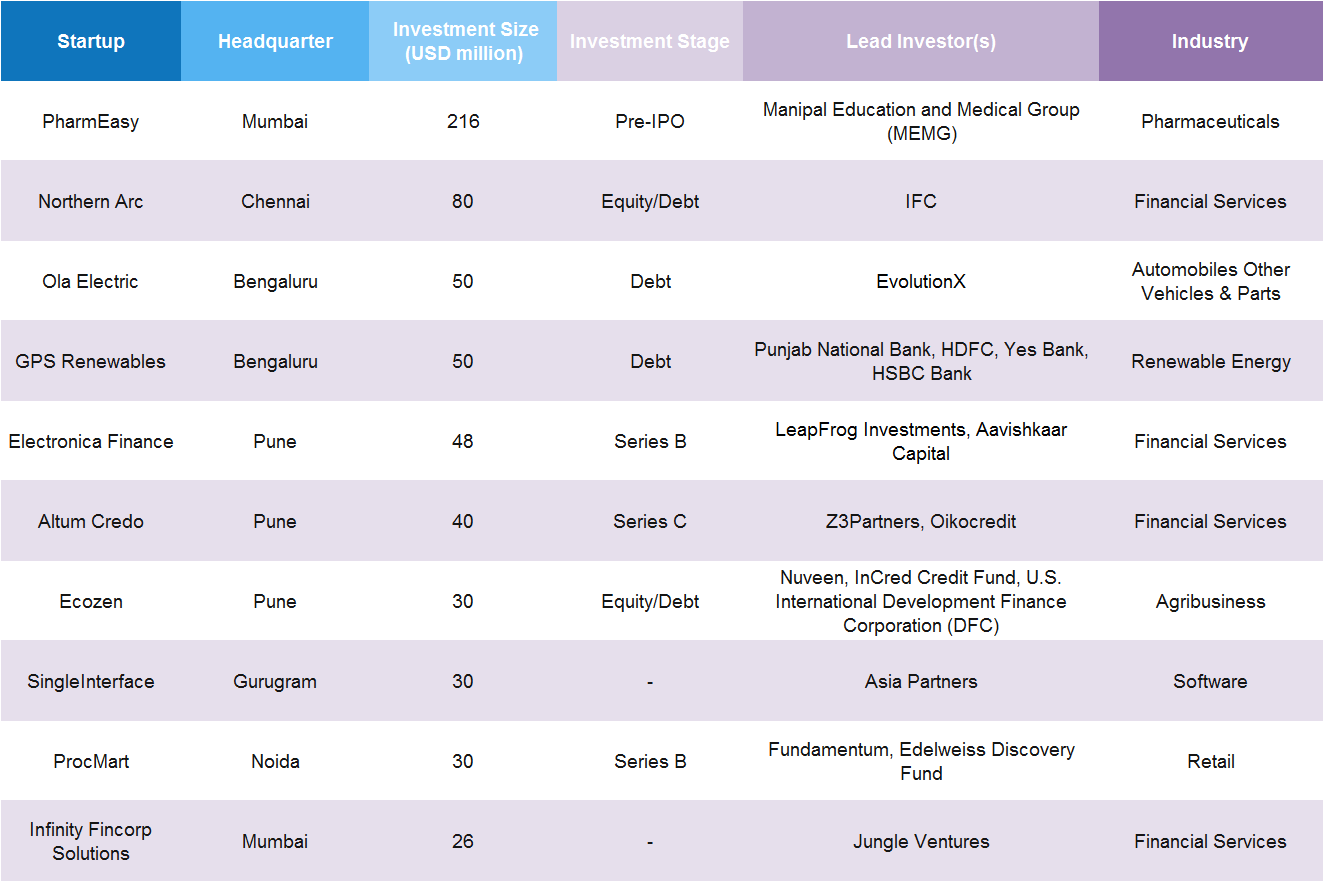

Top 10 deals in April 2024

Online pharmacy platform PharmEasy reportedly snapped up $216 million in a down round, making it the top deal of April 2024. The rights issue was executed at a 90% valuation cut compared with its peak valuation of $5.6 billion in October 2021, per an Entrackr report.

The funding was led by Ranjan Pai’s Manipal Education and Medical Group (MEMG) and participated by Prosus, Temasek, 360 One Portfolios, CDPQ Private Equity, WSSS Investments, Goldman Sachs, and Evolution Debt Capital.

PharmEasy was also the only mega-deal (or deal worth at least $100 million) of the month. Among other prominent deals were Northern Arc’s $80-million round; Ola Electric and GPS Renewables’s $50-million rounds; and Electronica Finance’s $48-million financing round. In comparison, two mega-deals — Avanse Financial Services and Pocket FM — were announced in March.

No startup made it to the unicorn club in April. Unicorn is a moniker used to describe privately-held companies valued at $1 billion or more. Krutrim AI and fintech SaaS Perfios are the only two startups to have made it to the unicorn club so far this year.

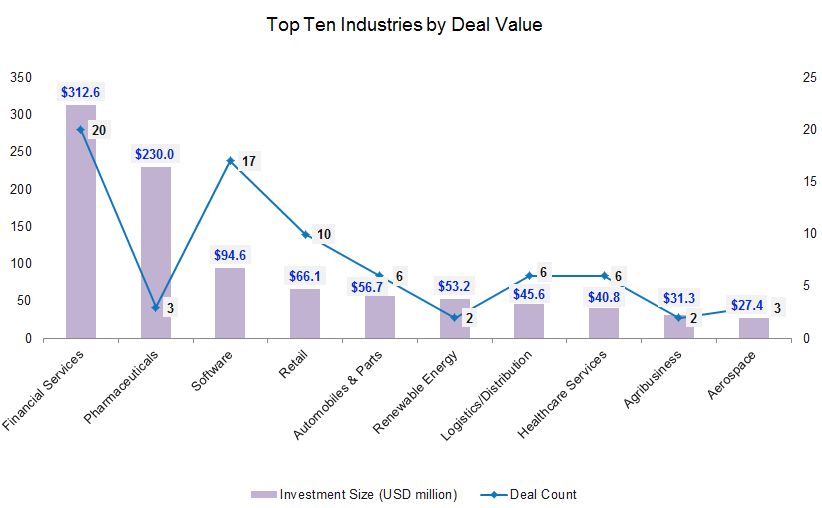

Financial services retains top spot

The financial services industry, which comprises banking, mortgages, credit cards, and digital payment startups, continued to lead PE-VC funding in April with total investments worth $312.6 million, or 28% of the total funding value in the month. This is down from $353.2 million scored collectively by 17 financial service startups last month.

Non-banking lender Northern Arc led the industry with an $80-million funding from the International Finance Corporation (IFC), a member of the World Bank Group. The investment comprised an equal split of equity and debt, each contributing $40 million. Other prominent deals within financial services included Electronica Finance ($48 million), Altum Credo ($40 million), Infinity Fincorp Solutions ($26 million), Namdev Finvest ($19 million), and RING ($12 million).

Buoyed by PharmEasy, pharmaceuticals made it to the second spot in April with a total $230-million funding across three deals. PharmEasy has been trying to raise around Rs 3,500 crore since August last year to repay debt to Goldman Sachs. The firm defaulted on its loan terms with Goldman Sachs last June. The other two deals within the industry included Biodeal Pharmaceuticals and healthcare startup PlatinumRx.

Funding secured by software startups almost halved in value to $94.6 million across 17 transactions in April from $182 million across 14 transactions in March.

SingleInterface, a marketing software startup, led the pack with $30 million in its first external funding from investors led by Asia Partners. Neysa, a Mumbai-based artificial intelligence (AI) cloud and platform-as-a-service startup, followed with a $20-million funding led by Matrix Partners India, Nexus Venture Partners and NTTVC.

Other software startups that raised funding in April included Recykal ($13 million), GTM Buddy ($8 million), SiftHub (5.5 million), Assert AI ($4 million), Plane ($4 million), Clientell ($2.5 million), and PineGap.ai ($2.5 million).

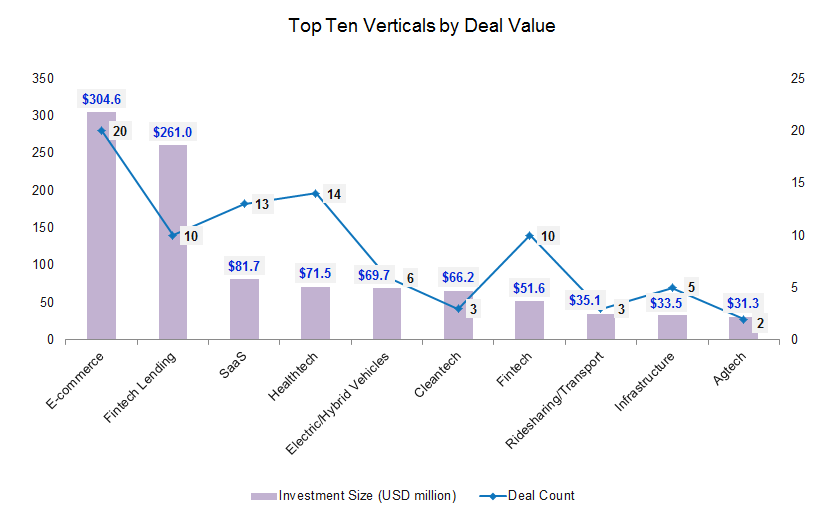

Early-stage deals get a boost

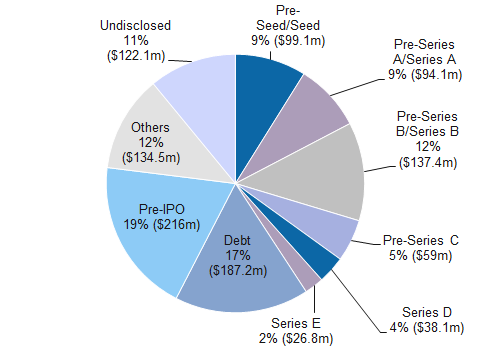

Early-stage deals, comprising companies in their pre-seed to Series A stages, were back in focus in April with a share of 17% of the total deal volume as against 9% in March. There were a total of 54 such deals worth $193 million in the month as against 43 deals worth $96 million in March.

Breaking it up further, pre-seed and seed rounds scooped up $99 million, while pre-Series A and Series A round collectively raked in $94 million in April.

Omnichannel fashion startup Lyskraft ($26 million), AI cloud and platform-as-a-service startup Neysa ($20 million), grey-collar training and recruitment platform Beyond Odds Technologies ($11 million), gaming startup LightFury Games ($8.5 million), AI platform for sales SiftHub ($5.5 million), and B2C credit management platform CheQ ($4.2 million) were among the startups that raised seed rounds during the month.

Meanwhile, the largest Series A round was raised by spacetech startup Dhruva Space ($15 million) from IAN Alpha Fund and other investors. Other Series A deals included Traya ($9 million), GTM Buddy ($8 million), BeepKart ($6.5 million), ClickPost ($6 million), and ClaimBuddy ($5 million).

Companies in Series B or post-Series B rounds (including pre-IPO deals) collected an aggregate of $464 million across 15 transactions in April as against $502 million through 19 investments in March. The growth transactions during the month were closed by startups including LetsTransport, Innoviti, Portea Medical, BankBazaar, Wow! Momo Foods, Rentomojo, Electronica Finance, ProcMart, Sprinto, RED.Health, Uniqus Consultech, Altum Credo, and 1K Kirana.

The only pre-IPO deal was clinched by PharmEasy. There were 13 debt deals worth $187 million in April as against six deals worth $150 million in March.

Top investors

Venture capital firm Blume Ventures, along with its founders fund, emerged as the top investor in April with a total of seven investments including AI-powered SaaS startup Clientell, gaming startup LightFury Games, spacetech startup Dhruva Space, construction and home improvement platform Wify, AI SaaS startup SiftHub, travel and lifestyle startup Assembly, and compliance automation startup Sprinto. The venture capital firm had closed six deals in March.

Venture investing platform Venture Catalysts, along with its accelerator fund 9Unicorns, occupied the second spot with a total of six deals, including Butterfly Learnings, MatchLog Solutions, Cloudworx Technologies, Plotch.ai, and BluWheelz.

Venture capital firm including Incred Capital, Alteria Capital, Chiratae Ventures, and Matrix Partners India recorded at least three deals each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: At 195, deal volume hits three-month high in April

Investors stepped on the gas in April as the Greater China market wrapped up 195 deals, up 10.2% from March. The deal count, which hit a three-month high, signifies a rebound in dealmaking activity.

Venture Capital

SE Asia Deals Barometer Report: Startup funding nosedives to record low of $227m in April

Southeast Asian startups continued to see a subdued funding environment in April, as the total private capital raised during the month plunged to $227 million, the lowest this year and down 54% month on month, according to proprietary data collated by DealStreetAsia.