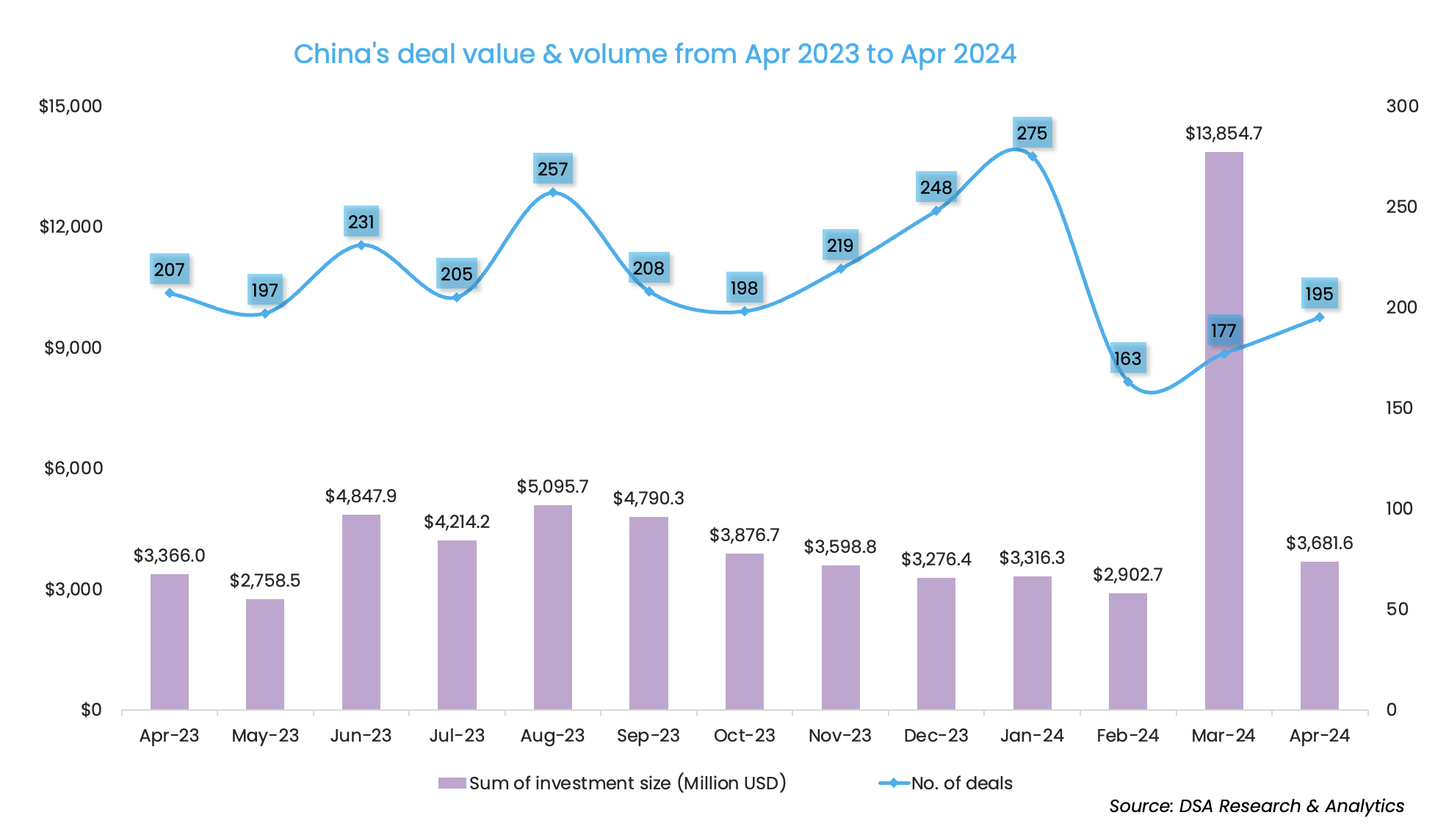

China Deals Barometer Report: At 195, deal volume hits three-month high in April

Investors stepped on the gas in April as the Greater China market wrapped up 195 deals, up 10.2% from March. The deal count, which hit a three-month high, signifies a rebound in dealmaking activity.

At around $3.7 billion, however, the monthly deal value was far from the whopping $13.9 billion secured in March, resulting in a 73.4% month-over-month (MoM) fall, according to proprietary data compiled by DealStreetAsia.

In terms of a year-on-year (YoY) comparison, the deal amount in April 2024 registered a 9.4% jump from the same month last year, while the deal count saw a drop of 5.8%.

Startup fundraising had a strong start in Q1 thanks to the three billion-dollar deals in March. However, it remains to be seen if the dealmaking momentum will sustain in Q2 as macro uncertainties and exit challenges linger.

In April, China’s State Council also put forward the once-in-a-decade capital market reform guidelines, known as the Nine-Point Guideline, which could take a further toll on IPO exits in the near term.

In the first four months of this year, startups in Greater China collectively garnered $23.8 billion across 810 venture deals. The deal value grew 31.6% over the same period of 2023, while deal volume fell 54.8%.

EV investments in top gear

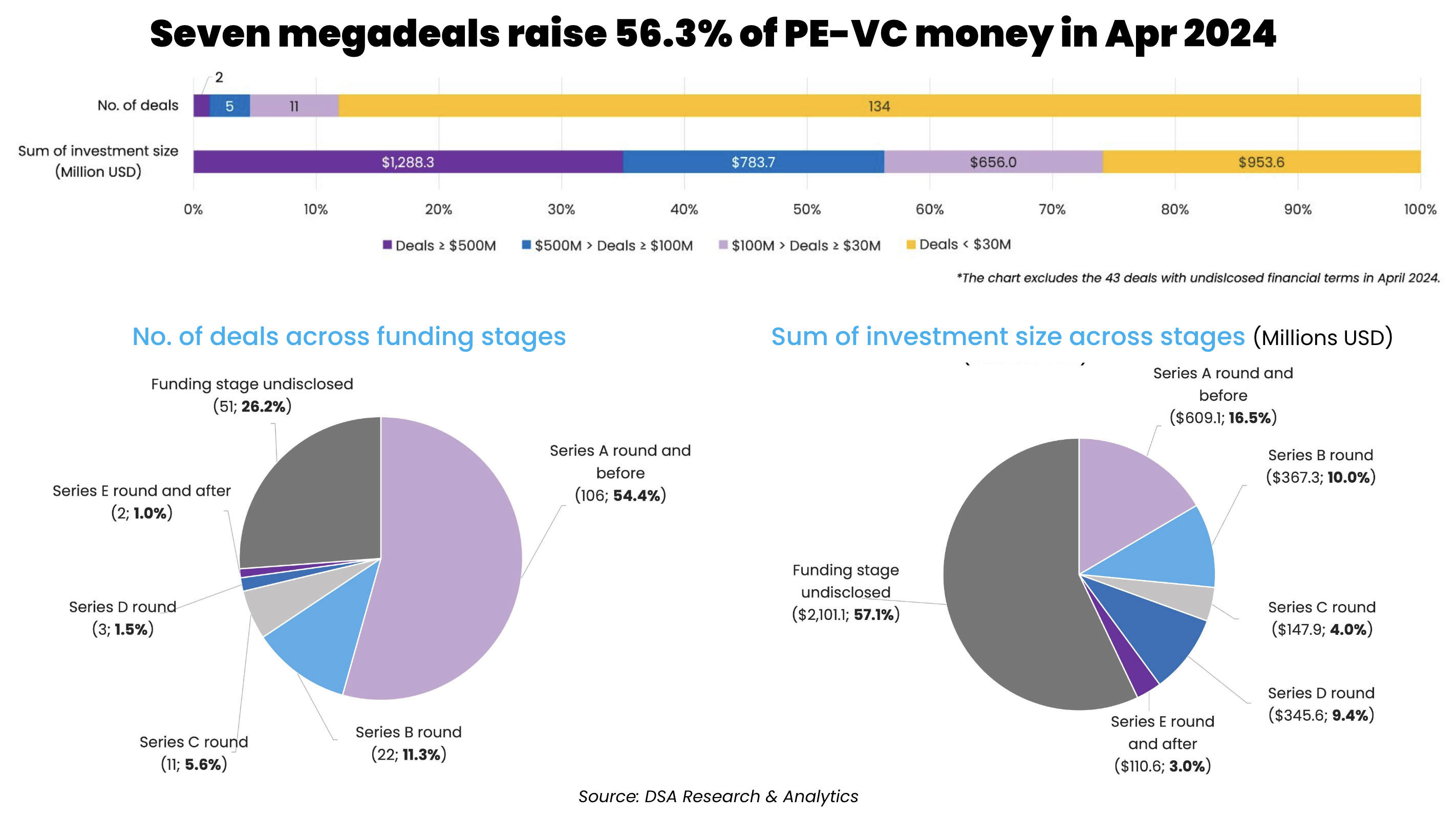

Billion-dollar deals were scarce in April, but the month saw the completion of two deals worth over $500 million and another five mega-deals in the range of $100-500 million.

Chinese electric vehicle (EV) maker Hozon New Energy Automobile, which sells EVs across China and overseas markets such as Thailand, Indonesia, and Malaysia, was the top raiser of the month.

The firm signed agreements in mid-April to raise at least 5 billion yuan ($690.96 million) from three regional government-backed investment firms. The fundraising came over eight months after the firm appointed China International Capital Corporation (CICC) and Morgan Stanley to help with its public listing in Hong Kong that could raise up to $1 billion, Reuters reported in September 2023.

Chinese electric heavy-duty truck developer Windrose Technology was another EV firm that pocketed a big-ticket in April. The firm completed the second phase of its Series B round to bring its overall fundraising to $110 million.

Windrose roped in several investors including HSBC and Boston-based HITE Hedge Asset Management, Australian industrial real estate and digital infrastructure specialist Goodman Group, as well as executives from global brands and logistics companies.

Part of the Series B financing also came in the form of bank debt, led by HSBC through its HSBC New Economy Fund, a $3-billion specialist lending scheme to startups and technology-led businesses.

The remaining mega-deals were scattered across the sectors of semiconductor, power & utilities, financial services, and cybersecurity, among others.

Early-stage investments at Series A and before accounted for over half (54.4%) of the transactions in April at 106 deals. This stood in contrast with investments close to the public listing stage, with only two deals completed at the Series E stage or beyond amid a bleak exit landscape.

As a proof, initial public offerings (IPOs) by Greater China firms hit a five-year low in terms of the number and proceeds in Q1, according to DealStreetAsia’s recent report titled Greater China Deal Review: Q1 2024.

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| Hozon New Energy Automobile | Shanghai | 690.96 | Tongxiang State-Owned Capital Investment and Operation, Yichun City Jinhe Equity Investment, Nanning Minsheng New Energy Industry Investment | Automobiles & Parts | Electric/Hybrid Vehicles | |||

| CRRC Times Semiconductor | Zhuzhou | 597.3 | Zhuzhou City Guochuang Tianxin Venture Investment Fund, Yixing Kechan Dongneng Shidao Equity Investment, China Southern Power Grid, SAIC Motor, Ningbo Jinfeng Aoying Equity Investment, and others | Semiconductor | N/A | |||

| Terminus Group | Beijing | 276.4 | D | AL Capital (affiliated with Aqualand Group), Yangming Equity Investment Fund | National Development and Reform Commission’s investment platform, Futian Capital, Investment platform backed by Nanchang municipal government, Gemdale Corporation, China Everbright Limited, and others | Business Support Services | Internet of Things | |

| Hengtong Submarine Power Cable | Suzhou | 183 | CCB Financial Asset Investment, BOC Asset Management, Hainan Zhongying, Changshu Guofa Venture Capital | Power & Utilities | N/A | |||

| TDHX Industrial Network Security | Beijing | 110.6 | E | Svolt Capital (affiliated with Great Wall Holdings), Beijing Jingguorui Equity Investment Fund Management (affiliated with Beijing State-Owned Capital Operation and Management Center), China Unicom-CICC Capital | Beijing Information Industry Development Investment Fund, CNNC Industry Fund Management Corporation, Green Pine Capital Partners, Zhongguancun Science City, Wangsu Science & Technology | Cybersecurity | N/A | |

| Windrose Technology | Hefei | 110 | B2 | HSBC, HITE Hedge Asset Management, Goodman Group | Automobiles & Parts | Electric/Hybrid Vehicles | ||

| Union Mobile Pay E-Commerce | Qingdao | 103.7 | Tianjin Tongrong E-Commerce (affiliated with ByteDance’s Douyin) | Financial Services | Fintech |

State-owned capital powers chipmakers

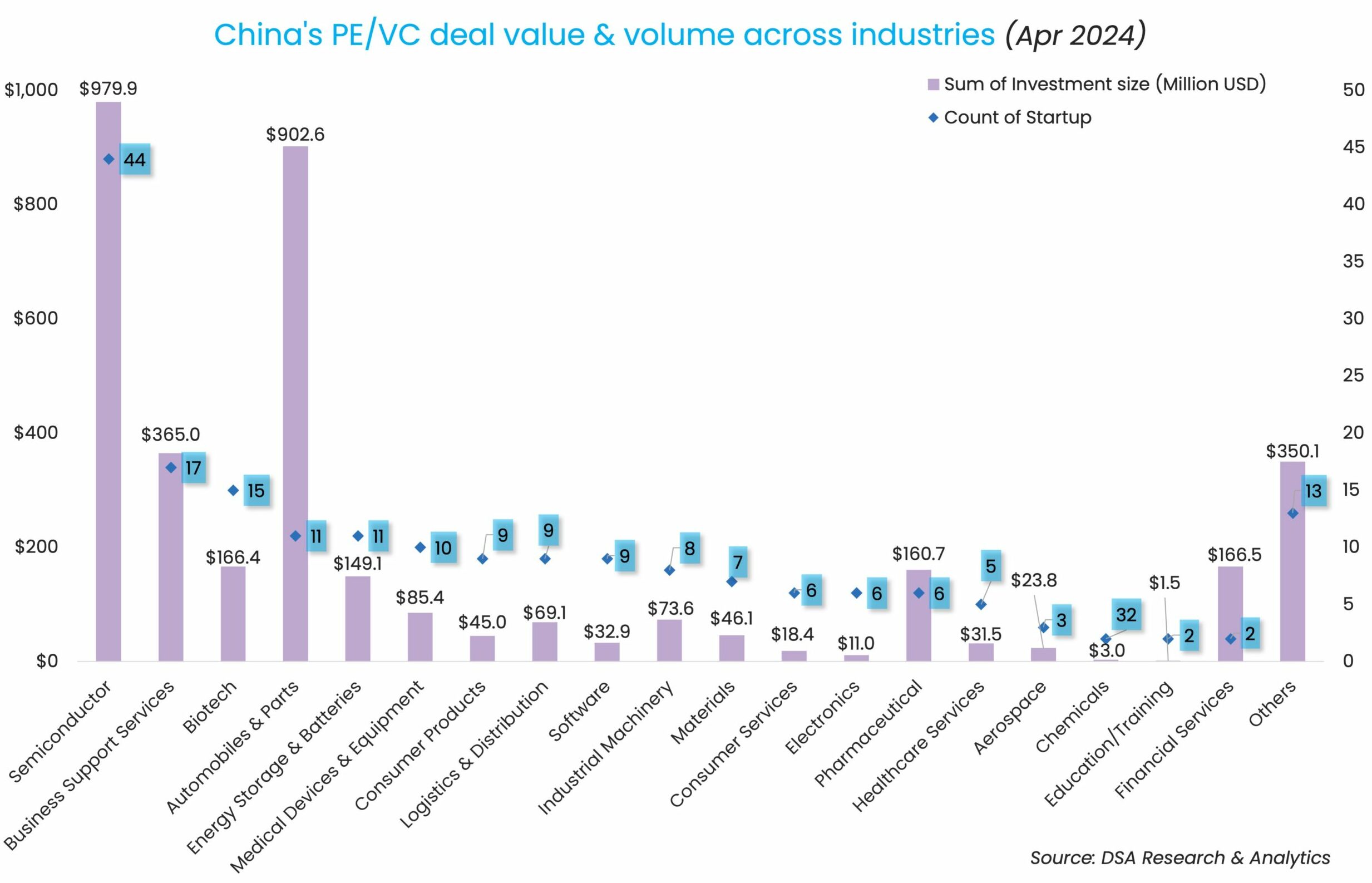

When it comes to investments, Chinese chipmakers look unstoppable. The most sought-after sector for investors in China saw the completion of 44 deals in April, raising a total of $979.9 million.

Semiconductor is one of the strategic sectors where state-backed investors are almost omnipresent. Zhuzhou CRRC Times Semiconductor, the controlling subsidiary of trains and electric vehicle systems manufacturer Zhuzhou CRRC Times Electric, the second top raiser of the month with around 4.3 billion yuan ($597.3 million) in equity financing, is one example.

The round was joined by investment platforms under the municipal governments of Zhuzhou and Yixing; state-owned power generator China Southern Power Grid, which operates power grids in the southern provinces of Guangdong; and state-owned automobile manufacturer SAIC Motor, among others.

Meanwhile, biotech firms also made a comeback in April. Although no mega-deals was recorded in the sector, it completed a total of 15 deals — a threefold increase from only four in March, despite raising an aggregate of $166.4 million.

Biotech startup Arnatar Therapeutics was the top raiser within the sector, securing $50 million in a Series A funding round to speed up the development of its drug pipeline, accelerate clinical trials, and build a presence in China.

The round was jointly led by Chinese healthcare-focused investment firm 3E Bioventures and Eight Roads, a global venture platform that invests across Asia, Europe, Israel, and the US, per the announcement.

Legend Holdings tops investor list

Chinese conglomerate Legend Holdings was the most active investor of the month in terms of deal count. The group pumped in at least $79.5 million across four startups through its subsidiaries.

CICC Capital, the flagship private equity unit of Chinese investment bank China International Capital Corp Ltd, ranked first in terms of deal value. The firm injected $124.6 million across three deals through its subsidiaries.

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Legend Holdings & affiliates | 4 | 79.5 | 2 | 2 |

| SJ Jiacheng Investment Management (affiliated with Shengjing Technology)/Peakview Capital | 3 | 42 | 1 | 2 |

| Wuxi Venture Capital Group | 2 | 14 | 2 | 0 |

| Shenzhen Capital Group | 3 | 69.4 | 1 | 2 |

| CDH Investments | 3 | 70.6 | 2 | 1 |

| CAS Star | 3 | 1.5 | 2 | 1 |

| CICC Capital & affiliates | 3 | 124.6 | 2 | 1 |

| Oriza Holdings & affiliates | 3 | 29.5 | 2 | 1 |

Note: In our monthly analysis for April 2024, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Startup funding nosedives to record low of $227m in April

Southeast Asian startups continued to see a subdued funding environment in April, as the total private capital raised during the month plunged to $227 million, the lowest this year and down 54% month on month, according to proprietary data collated by DealStreetAsia.

Venture Capital

India Deals Barometer Report: Startup fundraising crosses $1b on a trot in April

Amid mass layoffs and shutdowns due to a prolonged funding winter, April brought some cheer as startups raised $1.1 billion across 115 private equity and venture capital transactions, the highest monthly deal value since October 2023.