China Deals Barometer Report: Startup funding deals hit a three-month high of 219 in Nov

Venture investors flocked to seal deals in the Greater China region in November ahead of the year-end holiday season.

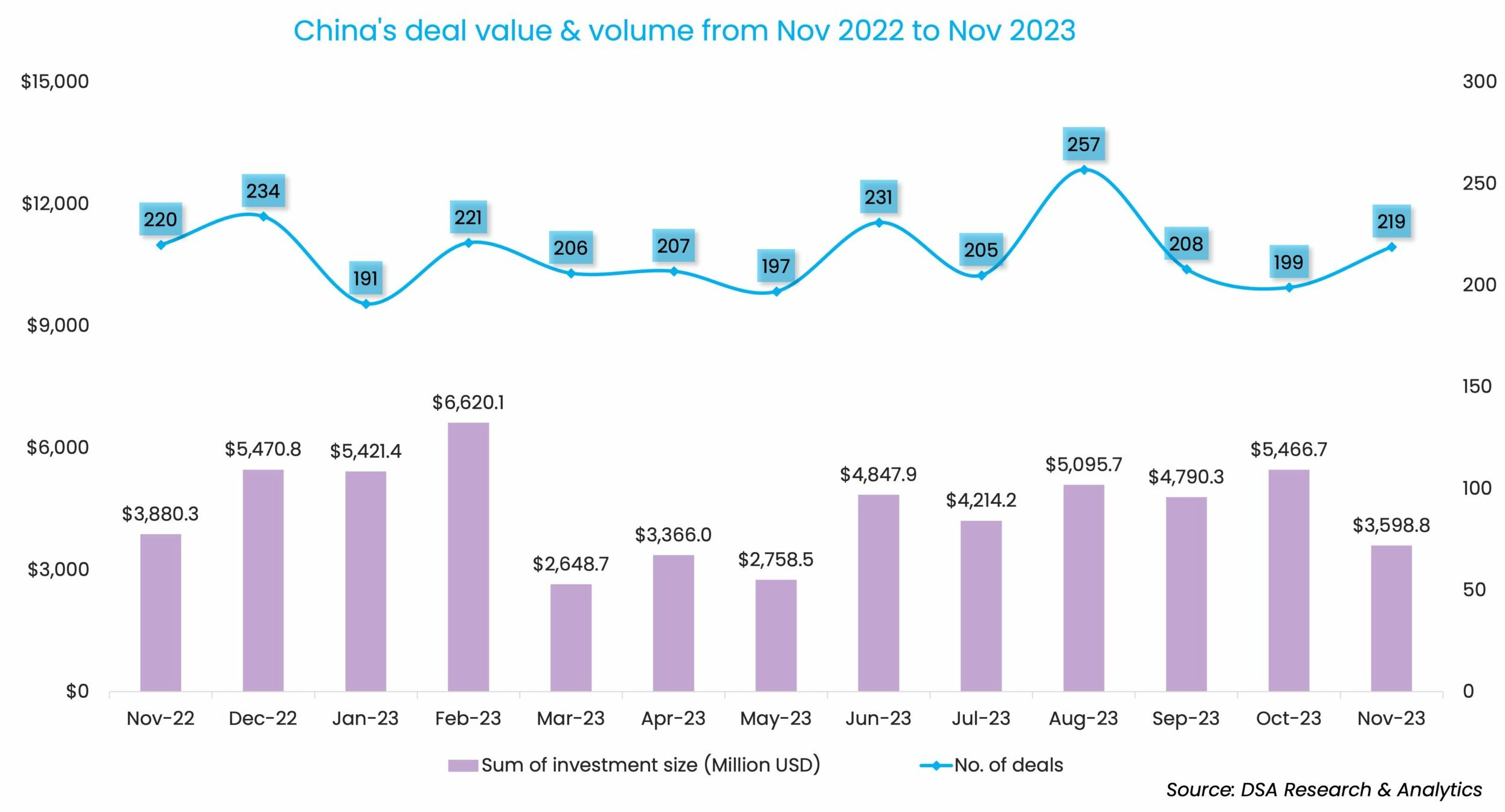

Startups headquartered in mainland China, Hong Kong, and Taiwan sealed 219 deals in the month, up 10.1% from October, show proprietary data compiled by DealStreetAsia.

Despite a more active dealmaking scene, investors are still hesitant to make big bets. This manifested as a 34.2% month-on-month fall in deal value to almost $3.6 billion in November. On a year-on-year basis, deal value was down 7.3%.

A total of $48.8 billion was invested across 2,341 deals in the first eleven months of 2023. Despite a negligible growth of 2.4% in deal value, the total number of deals was 13.9% higher than in Jan-Nov 2022, according to the data.

EV firms ride on funding tailwind

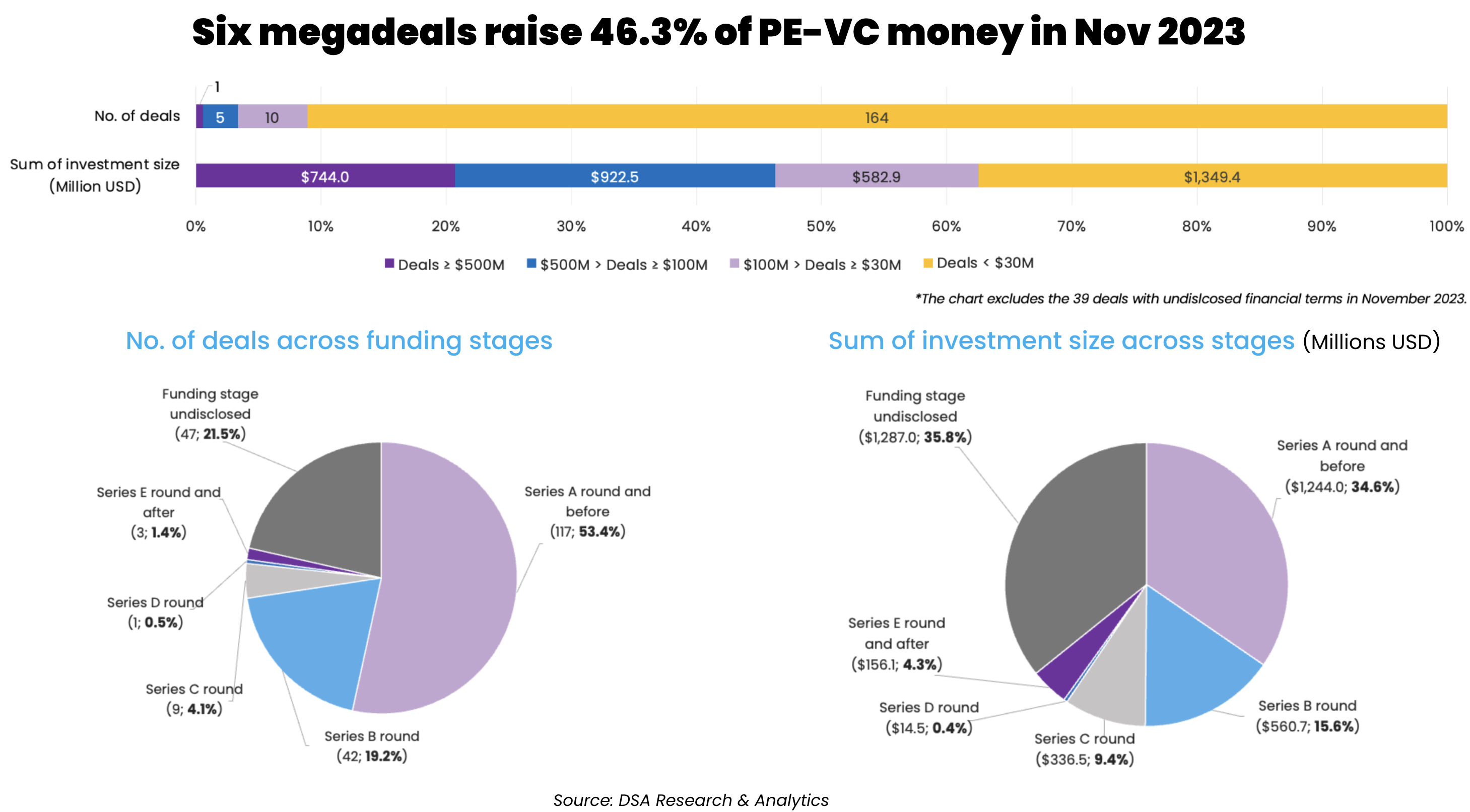

November saw the completion of six megadeals—or transactions worth at least $100 million—that cumulatively raised nearly $1.7 billion, or 46.3% of the month’s total financing.

Half of the megadeals came from the EV sector.

Chinese electric vehicle manufacturer Xpeng’s acquisition of ride-hailing firm Didi’s smart auto development business was the top deal of the month. The acquisition could cost Xpeng as much as $744 million, according to an exchange filing.

In another EV megadeal, smartphone maker Xingji Meizu Group, a subsidiary of Chinese automaker Zhejiang Geely Holding, raised 2 billion yuan ($276.1 million) in an extended angel and Series A round. Xingji Meizu Group, which has now evolved into a cross-sector platform that taps into the intersection of consumer electronics and smart electric vehicles, also formed a joint venture with Polestar to deepen the Swedish automotive brand’s presence in China’s EV market.

Among other mega deals, EV battery maker Aerospace Powercell (ASPC) sealed its 1-billion-yuan ($140.8 million) Series A round.

The rest of the three megadeals were from the renewable energy, financial services, and healthcare sectors.

Series A and earlier funding stages continued to dominate the deal count—a total of 117 early-stage deals were sealed accounting for 53.4% of the month’s total deal volume.

With an aggregate deal value of $1.2 billion, the average deal size in the early stages was $10.6 million. Excluding the two megadeals (Xingji Meizu Group and ASPC) the average deal size was $7.1 million.

The average investment size signified signs of recovery in early-stage investments compared to October, when early-stage firms clocked an average deal value of $7.6 million. Excluding megadeal Baichuan Intelligent Technology’s $300 million Series A1 funding round, the average deal size was $4.4 million.

The late-stage investment scene, however, was more sluggish—with only three firms completing Series E round and later transactions.

Bang-Er Orthopaedic, which invests in and operates an orthopaedic hospital chain, was the only megadeal that took place at the pre-IPO stage. The Qiming-backed firm snapped over 800 million yuan ($109.8 million) in a round led by state-affiliated Xiamen C&D Emerging Industry Equity Investment.

The six megadeals of November 2023

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| DiDi’s smart auto development business | Beijing | 744 | Xpeng | Automobiles & Parts | Electric/Hybrid Vehicles | |||

| Huasun Energy | Xuancheng | 276.3 | C | China Green Development Investment Group | China Post Life Insurance (affiliated with China Post Group), Bank of China Financial Asset Management (affiliated with Bank of China), Guolian Jintou Zhiyuan, China Xinxing Asset Management | Renewable Energy | CleanTech | |

| Xingji Meizu Group | Wuhan | 276.1 | Angel+, A | A: Asia Investment Capital (Shanghai) Management, Harvest Global Investments | Angel+: Winreal Investment, Xingyuan Fund, Wuhan Economic Development Zone, A: QC Capital, Wuhan Economic Development Zone | Consumer Products | Electric/Hybrid Vehicles | |

| Aerospace Powercell | Yangzhou | 140.8 | A | Anshui Capital | Hailan Capital, Origin Fund | Energy Storage & Batteries | Electric/Hybrid Vehicles | |

| Ping An OneConnect Bank | Hong Kong | 119.5 | Lufax Holding | Financial Services | Fintech | |||

| Bang-Er Orthopaedics | Hangzhou | 109.8 | Pre-IPO | Xiamen C&D Emerging Industry Equity Investment | Lake Bleu Capital, October Capital, GY Capital, Sunshine Insurance Group, China Pacific Insurance Company | Healthcare Specialist | N/A |

Splurging into ‘China chip’

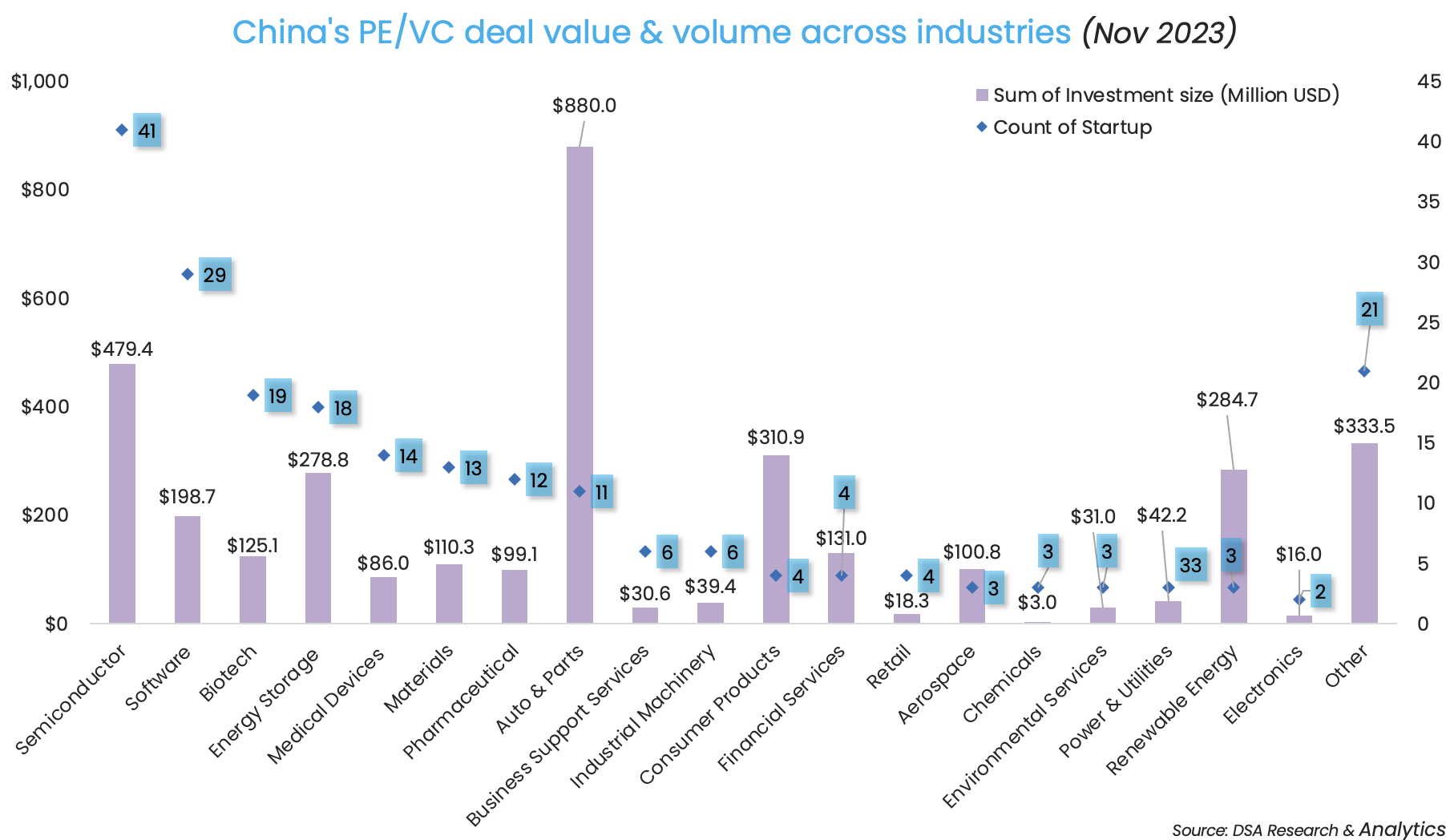

Semiconductors was the most-invested sector by deal count, having completed 41 deals despite raising only $479.4 million. Three chipmaking firms including DIS Microelectronics, Inuchip, and Betone Technology sealed some of the notable deals in the sector.

The pullback of US investors amid the ongoing geopolitical tension between China and the US could lead to RMB-denominated funds taking a more major role in sensitive sectors including semiconductor and artificial intelligence, PitchBook analysts shared in a research note.

Automobiles & parts came as the most-invested industry by deal value. Despite wrapping up only 11 deals, the sector drew in $880 million worth of investment, mostly contributed by Xpeng’s acquisition of Didi’s smart auto business.

Addor Capital, CICC Capital top investor list

Early-stage venture capital firm Addor Capital, backed by state-affiliated Jiangsu High-tech Investment Group, which participated in six deals, topped the investor list. The six startups raised a total of $17.5 million.

CICC Capital, the flagship private equity unit of Chinese investment bank China International Capital Corp Ltd, and its affiliates, too, ranked first in terms of deal count. The state-affiliated investors pumped around $173.5 million into six privately owned Chinese firms.

Top investors in Greater China in Nov 2023

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Addor Capital | 6 | 17.5 | 1 | 5 |

| CICC Capital | 6 | 173.5 | 2 | 4 |

| Winreal Investment | 5 | 321.1 | 2 | 3 |

| Oriza Holdings and affiliates | 5 | 46.5 | 2 | 3 |

| SDIC Venture Capital and its affiliates | 4 | 43.5 | 4 | 0 |

| Shenzhen Leaguer & its affiliates | 4 | 155.1 | 1 | 3 |

| Lanchi Ventures | 3 | 44.2 | 1 | 2 |

| SAIC Motor & its affiliates | 3 | 16 | 1 | 2 |

| Sichuan Venture Capital | 3 | 16 | 1 | 2 |

| Cowin Capital | 3 | 43.5 | 2 | 1 |

| Panlin Capital | 3 | 17.5 | 2 | 1 |

| Linear Capital | 3 | 17.5 | 2 | 1 |

| Hongtai Aplus | 3 | 70.9 | 2 | 1 |

| Chongqing Mingyuehu Seed Fund | 3 | 14.5 | 0 | 3 |

| Pegasus Capital | 3 | 43.5 | 0 | 3 |

| CITIC Group & its affiliates | 3 | 130 | 2 | 1 |

| Lenovo Capital and Incubator Group (affiliated with Legend Holdings) | 2 | 29 | 0 | 2 |

Note: In our monthly analysis for November 2023, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: At $382m, startup fundraising plunges to lowest this year in Nov

November was another reminder of the challenges that persist in startup fundraising in Southeast Asia.

Venture Capital

India Deals Barometer Report: After two-month relief, PE-VC investments plunge 65% in Nov

After showing signs of recovery in September and October, private equity and venture capital investments into Indian startups once again plunged to hit $483.6 million in November—a drop of 65% over October when startups had collectively raked in $1.38 billion.