SE Asia Deals Barometer Report: At $5.3b, funding hits year's highest in Aug on the back of megadeals

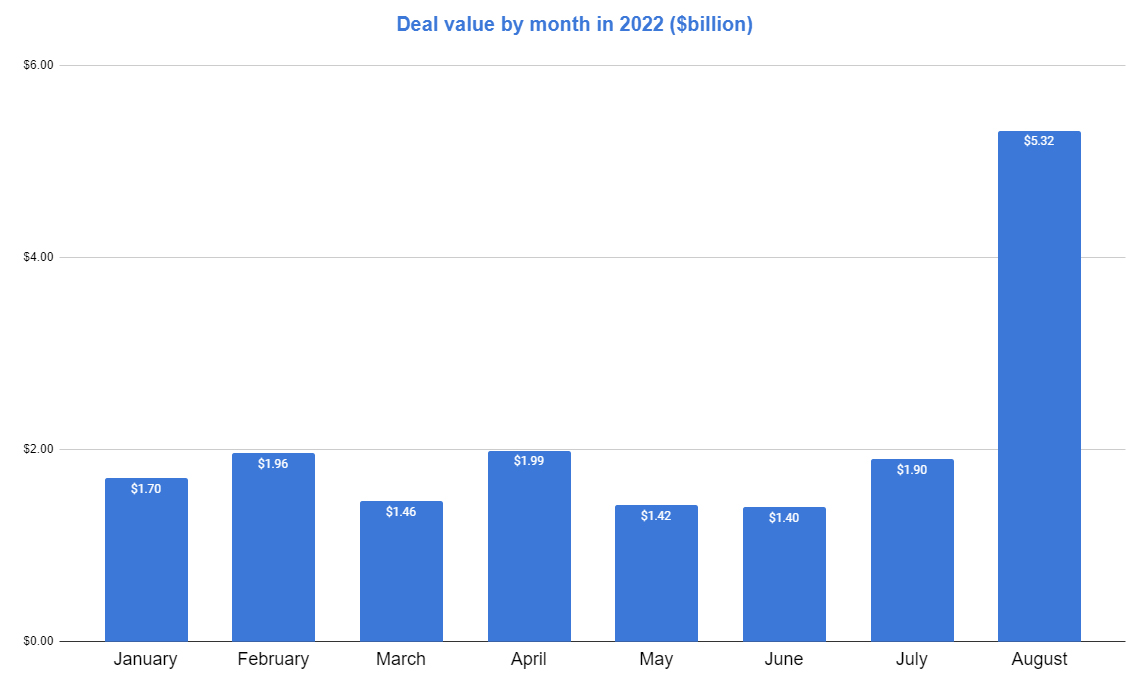

Startups in Southeast Asia raised at least $5.3 billion in August, the highest so far in 2022, on the back of nine megadeals that collectively accounted for $4.4 billion of the total. (Megadeals are those valued at at least $100 million.)

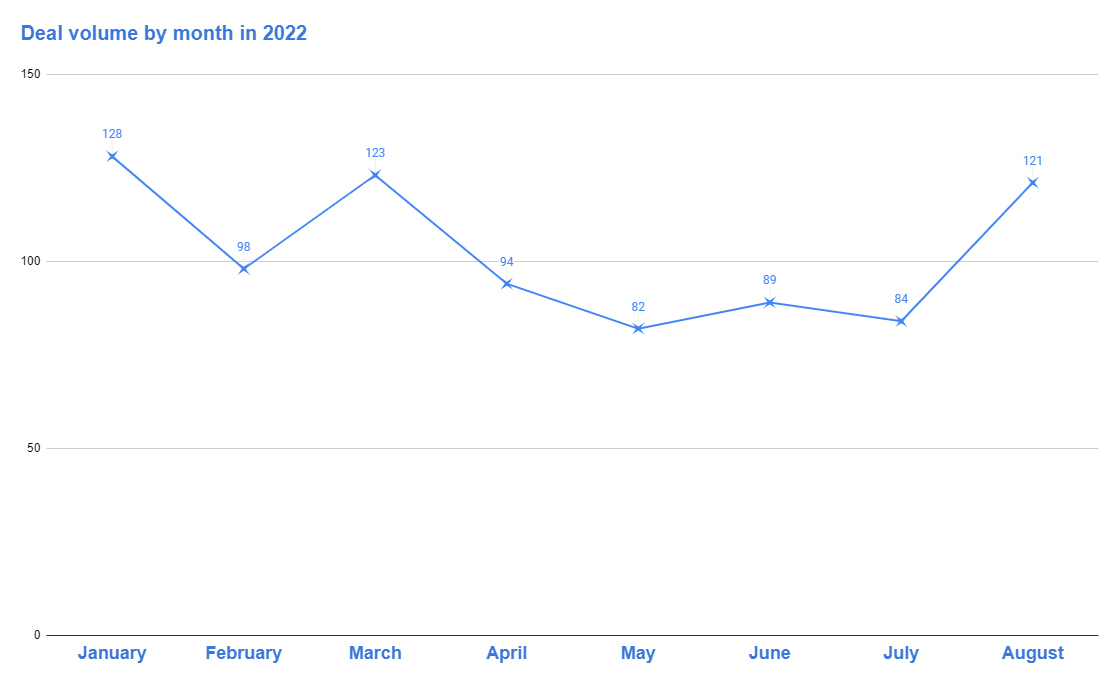

While the number of deals in August was only the year’s third highest at 121, the megadeals ensured fundraising rose by 178% from July’s $1.9 billion, proprietary data compiled by DealStreetAsia showed. Monthly dealmaking value has never surpassed $2 billion since the start of this year.

Startups in Southeast Asia have collectively completed 819 transactions that secured at least $17.15 billion in the first eight months of 2022.

Last month’s deals include venture capital, private equity, corporate round, debt, and crowdfunding.

Megadeals scale new 2022 peak

The biggest among the deals in August was the nearly $2 billion debt financing in Olam Food Ingredients (OFI), a wholly-owned subsidiary of Singapore-listed commodity trader Olam Group.

Among the other megadeals was the $912.5 million that the Lazada Group raised from Chinese internet giant Alibaba, which is also its parent company.

In Indonesia, conglomerate Sinar Mas Group and Lazada invested $554 million in local digital wallet company Espay Debit Indonesia Koe, popularly known as DANA.

Singapore-based environment services company 800 Super’s acquisition by a consortium comprising Keppel Asia Infrastructure Fund and Keppel Infrastructure for about $218 million also helped boost August’s deals figure.

The other top grossers of the month included greentech firm Maxeon Solar, which raised $200 million in a post-IPO debt round from TCL Zhonghuan. Singapore-based Fullerton Health also scored $181.7 million while fintech firm Funding Societies raised $160.2 million, both in debt financing deals.

Vietnam also saw a megadeal in August when Japan’s biggest power generator JERA paid $112 million to acquire a 35.1% stake in Vietnamese renewable energy company Gai Lai Electricity JSC (GEC).

Completing the megadeals table last month was Atome Financial’s $100 million debt facility from HSBC Singapore. Atome provides flexible payment options to consumers.

The nine megadeals of August 2022

| Company | Headquarters | Amount Raised | Funding Type | Lead Investor/s | Vertical |

|---|---|---|---|---|---|

| Olam Food Ingredients | Singapore | $1,975,000,000 | Debt Financing | Food | |

| Lazada Group | Singapore | $912,500,000 | Corporate Round | Alibaba Group | E-commerce |

| DANA Wallet Indonesia | Indonesia | $554,500,000 | Secondary Market | Lazada Group, Sinar Mas Group | Fintech |

| 800 Super Holdings | Singapore | $218,122,069 | Private Equity | Keppel Asia Infrastructure Fund | Environmental services |

| Maxeon Solar Technologies | Singapore | $200,000,000 | Post-IPO Debt | TCL Zhonghuan | Greentech |

| Fullerton Healthcare Corporation | Singapore | $181,763,322 | Debt Financing | Healthcare | |

| Funding Societies | Singapore | $160,263,090 | Debt Financing | HSBC Bank Singapore | Fintech |

| Gia Lai Electricity | Vietnam | $111,701,973 | Private Equity | JERA | Renewable energy |

| Atome | Singapore | $100,000,000 | Debt Financing | HSBC Bank Singapore | Fintech |

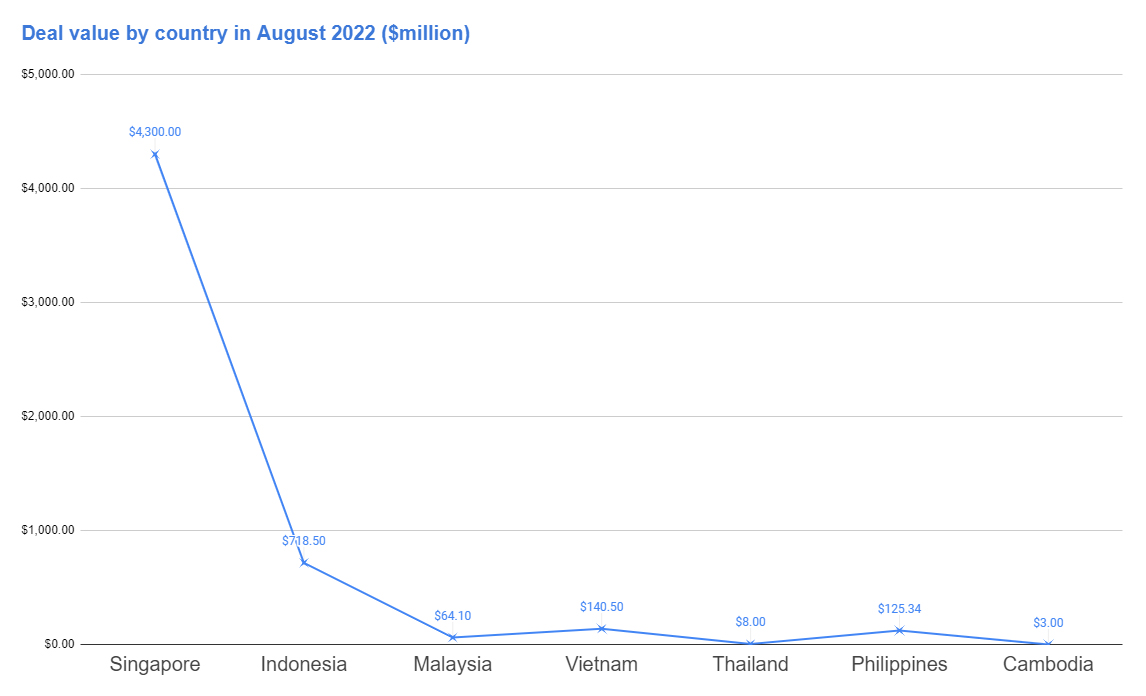

Singapore tops in deal volume and value

Investors continued to favour private companies in Singapore, a trend seen since the start of this year, according to DealStreetAsia’s data. In August, startups in the city-state were involved in 68 transactions worth over $4.4 billion, accounting for nearly 80% of the total deal value in the month.

Singapore also accounted for seven of the nine megadeals of August. In July, 39 startups based in the city-state amassed about $1.1 billion in total, accounting for about 58% of the region’s combined investments.

Though far behind Singapore, Indonesia came in second with 21 deals that raised $718.5 million. The largest deal in the archipelago last month was DANA’s $554 million funding from Sinar Mas and Lazada.

Vietnamese startups raised $140.5 million in August from at least 10 transactions, while the Philippines saw 11 deals that secured $125.3 million.

Malaysia’s six transactions secured $64 million in funding while Thailand and Cambodia saw a combined five deals that raised at least $8.3 million in total.

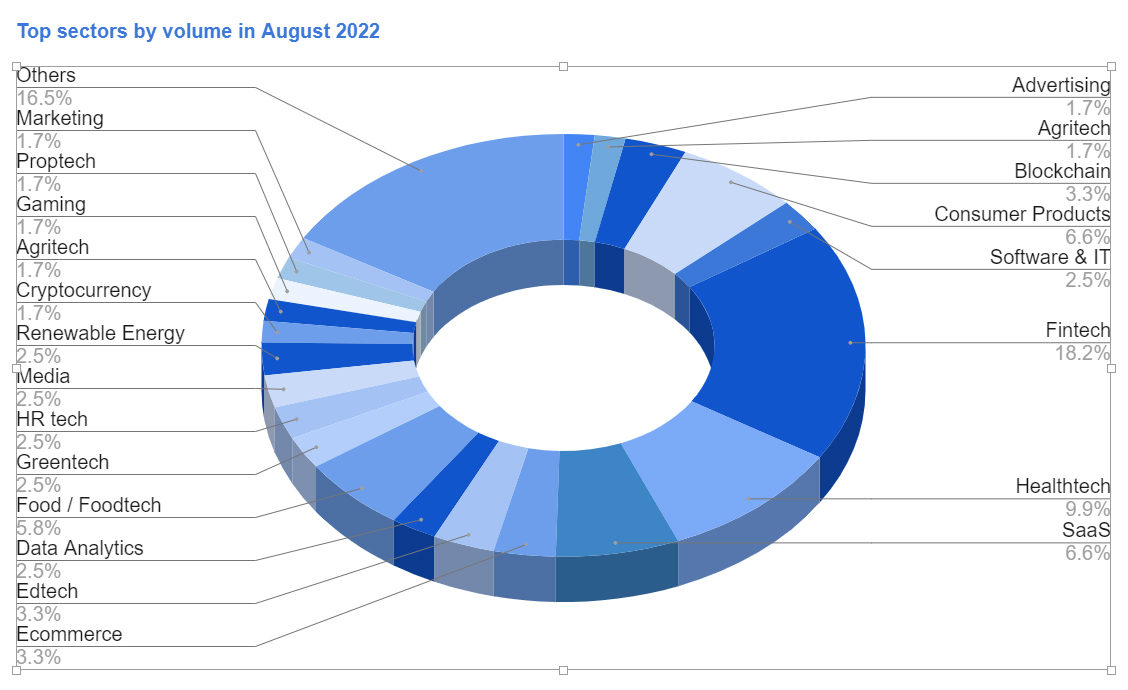

Fintech tops in deal count

Fintech once again led in terms of deal count with the completion of 22 deals that secured over $1 billion in investments. Healthtech startups completed 12 deals, SaaS startups and consumer products firms sealed eight deals each, while food tech saw seven transactions last month.

The majority of investments in August went to sectors including renewable energy, blockchain, edtech, sofware and IT, Saas, agritech, advertising, and more.

Ecommerce, which joined fintech in topping the leaderboard during the onset of the pandemic, only saw four deals that raised a combined $940,000 million in August.

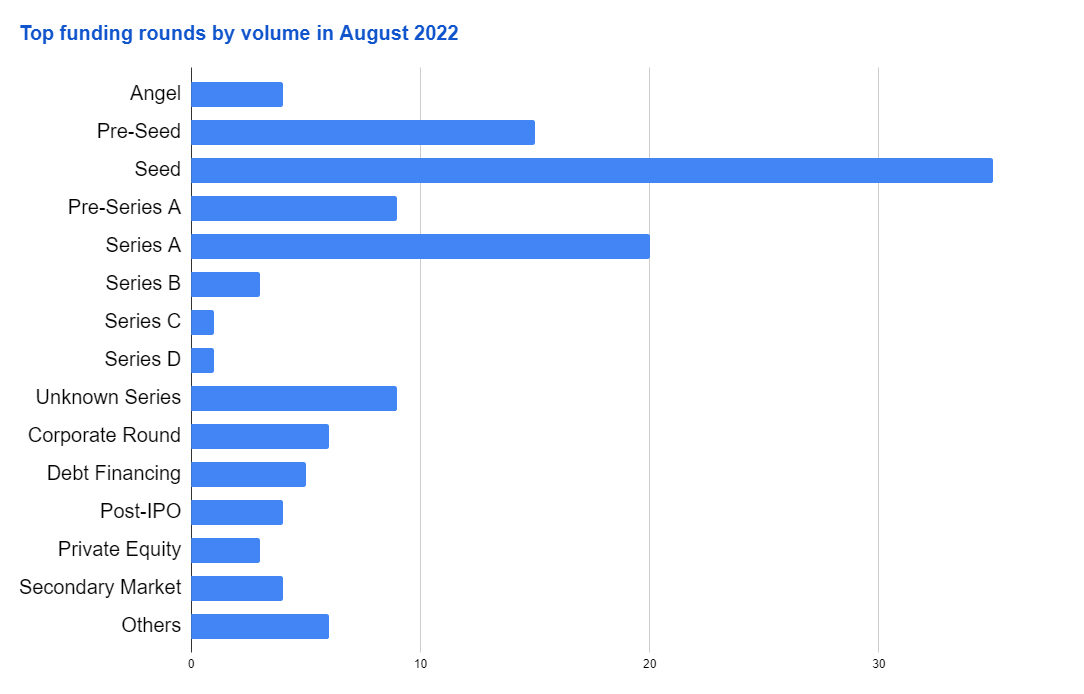

Investors favour seed, Series A stages

DealStreetAsia’s compilation showed that early-stage fundings continued to dominate the region’s dealmaking activities in August in terms of deal volume, with seed taking the lead at 35 deals, up from July’s 26 seed rounds.

The largest seed funding deal was Singapore-based MBD Financials’ $10-million funding from global investment group LDA Capital to build accessible and equity financial services in the Metaverse.

Series A rounds also soared in August, with 20 deals — up from the previous month’s 13 transactions.

Singapore e-commerce group Graas raised over $40 million in August to lead the Series A rounds. The company is looking to launch a growth-as-a-service solution involving predictive AI to detect trends and offer recommendations for brands.

During the month, there were also 15 pre-seed rounds, 9 pre-Series A, 3 Series B, 1 each for Series C and D, 9 unknown series, 3 private equities, 6 corporate rounds, 5 debt financing, and 4 post-IPO deals, among others.

Related Stories

Venture Capital

Deals Barometer Report: At $6.8b in Aug, PE-VC dealmaking scales new 2022 peak

August was a month of record dealmaking in the Greater China market, as startups raised $6.8 billion...

Venture Capital

Despite economic headwinds, fundraising by Indian startups recovers to touch $1.2b in Aug

After hitting a 21-month low in July, fundraising by Indian startups bounced back in August as venture capital...