India Deals Barometer Report: Despite economic headwinds, fundraising by Indian startups recovers to touch $1.2b in Aug

After hitting a 21-month low in July, fundraising by Indian startups bounced back in August as venture capital and private equity investors put a total of $1.2 billion to work across 113 transactions, according to proprietary data compiled by DealStreetAsia.

This was 36% higher than in July, when startups had raised $885 million across 119 transactions. However, the aggregate deal value in August was almost one-third of the capital raised in the corresponding period last year.

The lower net inflow compared with last year is a reflection of subdued investor sentiment amid an ongoing global economic slowdown. However, funding activity is expected to rebound by the last quarter of this year or early next year once the economic situation returns to normalcy, according to analysts.

Of the total transactions in August, the value of as many as 16 deals was undisclosed, the data showed.

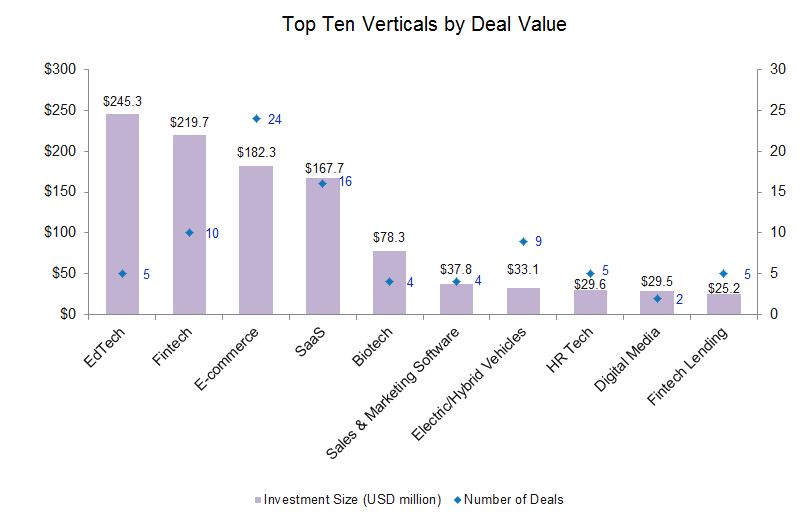

With investors turning slightly cautious, August saw just three mega-deals — where the funding size is more than $100 million. These include Ronnie Screwvala-led edtech unicorn upGrad; consumer lending fintech startup EarlySalary; and customer engagement and user retention software platform CleverTap. In comparison, there were only two mega-deals in July.

Top 10 funding deals in August

| Startup | Headquarter | Investment Size (USD) | Investment Stage | Lead Investor(s) | Industry | Verticals |

|---|---|---|---|---|---|---|

| upGrad | Mumbai | 210,000,000 | Undisclosed | Undisclosed | Education/Training | EdTech |

| EarlySalary | Pune | 110,000,000 | Series D | TPG’s The Rise Fund, Norwest Venture Partners | Financial Services | Fintech |

| CleverTap | Mumbai | 105,000,000 | Series D | CDPQ | Software | SaaS |

| Servify | Mumbai | 65,000,000 | Series D | Singularity Growth Opportunity Fund | Consumer Services | N/A |

| MedGenome | Bengaluru | 50,000,000 | Undisclosed | Novo Holdings | Biotechnology | Biotech |

| Hector Beverages (Paper Boat) | Gurugram | 50,000,000 | Series D | Lathe Investment Pte (GIC) | Food | E-commerce |

| Sunstone Eduversity | Gurugram | 35,000,000 | Series C | Westbridge Capital | Education/Training | Edtech |

| Shiprocket | Delhi | 33,500,000 | Series E | Temasek, Lightrock India | Logistics/Distribution | E-commerce |

| Bizongo | Mumbai | 25,000,000 | Series D | Mars Growth Capital | Packaging | E-commerce |

| HyperTrack | Delhi | 25,000,000 | Series A | WestBridge Capital, Nexus Venture Partners | Logistics/Distribution | SaaS |

upGrad raised the largest round of $210 million during the month from marquee investors and family offices, including ETS Global; Bodhi Tree; Singapore’s Kaizen Management Advisors Pvt Ltd; the family office of Bharti Airtel; Narotam Sekhsaria Family Office (Ambuja Cements and ACC); Artian Investments (Family Office of Lakshmi Mittal – ArcelorMittal); and existing investors Temasek, IFC and IIFL.

Zomato-backed SaaS-based logistics platform Shiprocket was the only startup to join the country’s unicorn club in August after securing $33.5 million in its Series E2 funding round led by Lightrock India. Unicorn is a moniker used to describe privately-held companies valued at $1 billion and above.

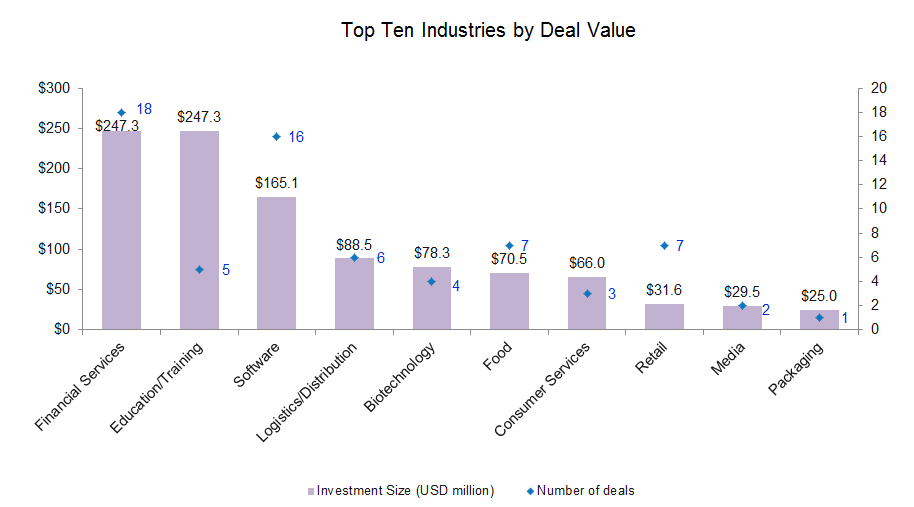

Financial services, education lead the pack

The financial services and education/training industries attracted the majority of the funding during the month. Edtech startups raked in a total of $247 million across just five deals while financial services raised the same amount across 18 transactions.

upGrad’s $210-million funding round helped push education/training startups to the top spot, which are otherwise struggling to survive with the reopening of schools across the country.

Within financial services, EarlySalary raised the largest round of $110 million in a Series D round of funding co-led by TPG’s The Rise Fund and Norwest Venture Partners, with participation from Piramal Capital. EarlySalary, which offers a mobile app that allows salaried persons to avail of instant loans, is also planning to go public in the next four to five years.

Other financial services startups that raised funding in August include investment tech platform Jar, wealth management startup Dezerv, neobanking startup Fi Money, education payment-focused fintech platform Jodo, rewards and loyalty startup Twid and SME-focused fintech lender NeoGrowth.

Software was the second most-funded industry with a total of $165 million in its kitty across 16 transactions. Within software, the largest round of $105 million was raised by CleverTap, led by global investment group CDPQ. The Mumbai-headquartered company was valued at about $775 million in the round.

The logistics and distribution industry followed with a total of $88.5 million in funding across six deals. Together, the top four industries garnered a total of $748 million, accounting for about 63% of the total deal value in August.

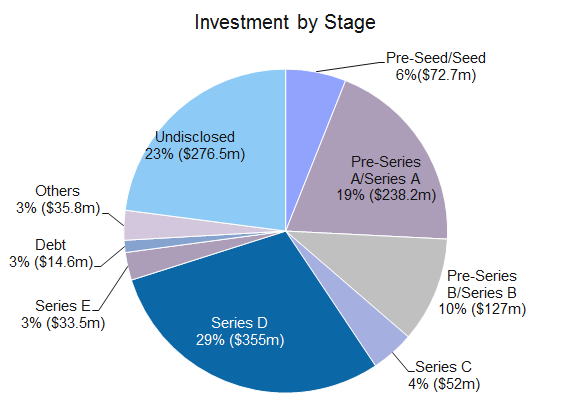

Early-stage deals dominate numbers

Pre-seed and seed-stage deals led the volumes in August by accounting for about 40% of the deal volume at 45. These startups together scooped up about $72.7 million, which is marginally higher than the $71.4-million funding secured in July. Kula, Credit Fair, Metalbook, RevSure, Loopworm, Ottonomy, MetaMorphoSys, Produze and Bluecopa were among those who raised big seed rounds in August.

Startups in the pre-series A and Series A stages raked in about $238 million across 29 transactions, which is an increase of about 63% from July. Last-mile logistics and transportation software HypertRack’s $25-million round marked the largest Series A round in August, followed by Dezerv ($20.7 million), Mojocare ($20.6 million), Phyllo ($15.1 million), Jodo ($15 million) and Privado ($14 million).

The share of growth-stage deals in the total funding dropped to 47% in August from 68% in July. Companies in the Series B or post-Series B rounds collected an aggregate of $561 million through 16 investments in August compared with $598 million across just 13 transactions in the previous month.

Growth rounds were raised by EarlySalary ($110 million), CleverTap ($105 million), Servify ($65 million), Hector Beverages ($50 million), Sunstone Eduversity ($35 million), Shiprocket ($33.5 million) and Bizongo ($25 million), among others.

Most active investors

Sequoia Capital India, along with its startup accelerator Surge, and Singapore-based venture capital firm BEENEXT emerged as the most active investors in August with six investments each.

BEENEXT’s investments in the month include Lysto, Zeda.io, Winuall, Servify, Deconstruct and Twid. The fund invests in startups across India, Southeast Asia, Japan and the US. Its investors include major institutional investors in the US, along with Japanese corporations, global family offices and entrepreneurs.

Meanwhile, Sequoia led or co-led funding for startups including Mojocare, Privado, Kula, Twid, CleverTap and Powerplay. Sequoia recently launched $2-billion early-stage venture and growth funds (SC India Venture VIII and SC India Growth IV) for India as it looks to increase exposure in the country.

SC India VIII comes about two years after Sequoia raised $525 million for its predecessor fund, SC India VII. In August 2018, the firm raised $695 million for SC India VI.

Meanwhile, Blume Ventures and Indian Angel Network (IAN) made five investments each in the month.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

Deals Barometer Report: At $6.8b in Aug, PE-VC dealmaking scales new 2022 peak

August was a month of record dealmaking in the Greater China market, as startups raised $6.8 billion...

Venture Capital

SE Asia Deals Barometer Report: Startup funding up 36% sequentially in July as megadeals recover

Startups in Southeast Asia raised at least $5.3 billion in August, the highest so far in 2022...