SE Asia Deals Barometer Report: PE-VC funding dips 25% to $1.46b in March

Venture capital (VC) and private equity (PE) funding in Southeast Asia slowed by 25% in March as startups in the region raised a mere $1.46 billion during the month after amassing $1.96 billion in February, proprietary data compiled by DealStreetAsia showed.

In January, startups in the region raised $1.7 billion from 128 transactions.

In terms of volume, however, there was a 25% jump month-on-month as the number of deals in March stood at 123 as against 98 in February.

The decline in value in March can be attributed to the scarcity of megadeals – those that were worth $100 million or above. As many as 29 deals did not disclose the funding amounts.

After seven mega deals in February, only four over $100-million deals were registered in March in Southeast Asia that also included a $350-million debt financing.

The deals in March also involved non-equity assistance, corporate rounds, convertible notes, and initial coin offering, the data showed.

The March deals bring the total startup funding in Southeast Asia to $5.12 billion so far this year from at least 349 transactions.

Deals worth over $100 million in March 2022

| Startup Name | Headquarters | Funding Round | Amount Raised | Lead Investor | Sector / Vertical |

|---|---|---|---|---|---|

| Emeritus | Singapore | Debt Financing | $350,000,000 | CPP Investments | Edtech |

| DANA Wallet Indonesia | Indonesia | Venture – Series Unknown | $200,000,000 | Sinar Mas Group | Fintech |

| Sun Cable | Singapore | Series B | $151,173,973 | Grok Ventures, Squadron Energy | Energy |

| Sayurbox | Indonesia | Series C | $120,000,000 | Alpha JWC Ventures, Northstar Group | E-commerce |

Showing 1 to 4 of 4 entries

Big-ticket transactions

Emeritus, a Singapore-registered edtech startup, that is part of Indian unicorn Eruditus, raised $350 million in debt financing from Canada Pension Plan Investment Board (CPP Investments), marking the largest funding among private companies in March.

Meanwhile, Indonesian digital wallet DANA raised at least $200 million from affiliates of diversified conglomerate Sinar Mas Group. Founded in 2017 by Vincent Iswara, DANA offers a digital solution to replace conventional wallets.

The other two megadeals during the month were recorded by Singapore solar energy firm Sun Cable, which secured $151 million in Series B funding; and Indonesian agritech startup Sayurbox, which raised more than $120 million in an oversubscribed Series C funding co-anchored by Alpha JWC Ventures and Northstar.

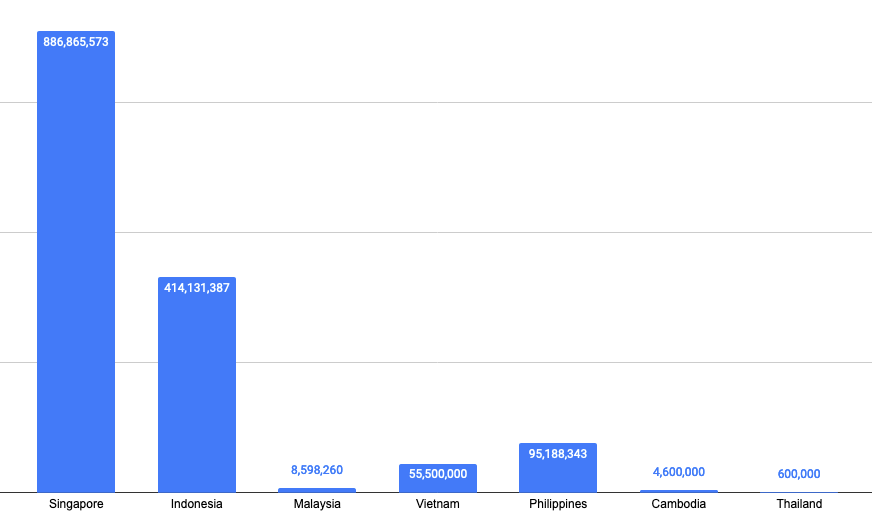

Singapore tops funding volume, value

Private companies in Singapore continued to dominate Southeast Asia’s funding scene in March, with 64 startups amassing $886.9 million, accounting for 61% of the total capital raised during the entire month.

This took the total corpus raised by startups in the city-state to around $3.13 billion in the first quarter of this year.

Indonesia came in second in terms of deal volume and value. This is even as the amount raised by 27 startups in the country in March stood at $414 million – less than half of Singapore’s tally. About 11 Indonesian deals, however, did not disclose the amount they raised.

Fundraising by country in March (US $)

What is noteworthy is that the Philippines continued to occupy the third spot on the leaderboard for the second straight month, with as many as nine startups raising a total of $95 million in the country.

Interestingly, Philippine-based B2B e-commerce platform GrowSari’s $77.5 million Series C funding was the fifth biggest funding in the entire region during the month. The round was led by KKR, backed by the International Finance Corporation and Pavilion Capital of Singapore’s Temasek Group.

Vietnam, on the other hand, saw five deals that raised $55.5 million, while Malaysia scored $8.6 million from 16 deals. Cambodia recorded one deal that raised $4.6 million, while Thailand’s lone funding transaction secured $600,0000.

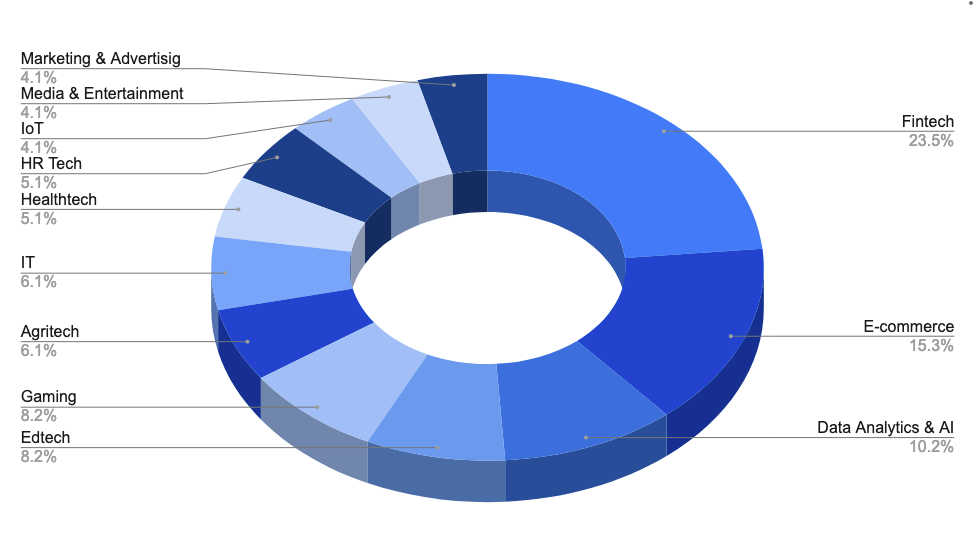

Fintech, e-commerce top deal volume

Startups in the financial technology (fintech) and e-commerce spaces cornered the most number of funding deals in March with the numbers standing at 23 and 15, respectively. Data analytics and AI, meanwhile, saw 10 transactions that raised $89.5 million.

In terms of value, fintech startups raised $294.3 million in the region. E-commerce firms, on the other hand, secured $232.7 million. DANA Wallet’s $200-million venture funding led the fintech transactions, while Sayurbox’s $120-million Series C round was the biggest among e-commerce deals. Both the startups are headquartered in Indonesia.

The edtech sector, too, continued to witness robust action even as physical schools opened up across the region. Startups operating in the sector raked in $370.2 million – the highest during the month – from just eight deals, thanks to the $350-million debt financing of Singapore-based startup Emeritus.

HR Tech saw five transactions that raised $80.3 million, led by the $60-million Series B funding in Singapore-based employment platform Multiplier. the round was backed by Tiger Global Management and Sequoia Capital India.

Top sectors in March

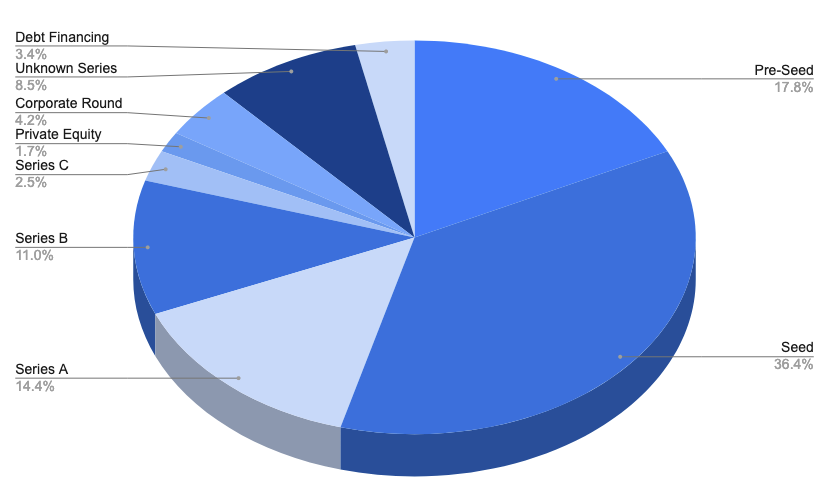

Early-stage rounds continue to dominate

Based on DealStreetAsia’s compilation, early-stage fundings continued to dominate in March in terms of volume. There were 43 seed rounds that raised $135.7 million and 21 pre-seed rounds that secured $9.5 million.

Meanwhile, debt financing totalled $362 million from four transactions, while two private equity deals raised $36 million.

The month also saw 17 Series A deals that raised $94.8 million while 13 Series B funding rounds secured $373 million. There were also three Series C rounds that raised $211.5 million.

Top deal stages in March

According to a recent Asia Partners report, there is a $1.1 billion funding gap in Series C and Series D stages in Southeast Asia when compared to China. This shortfall of growth equity series capital in the region has widened from 2019 when it was about $930 million.

Funding between $20 million and $100 million typically falls within Series C and D rounds. Also called growth capital, it is crucial for companies looking to scale and reach the next level of their business.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: PE-VC fundraising remains muted in Q1 despite uptick in March

Startup financing in Greater China showed some signs of recovery in March...

Venture Capital

India Deals Barometer Report: Startups raise $4b in March, record 10% jump from Feb

Indian startups raised about $4 billion in funding across 163 private equity (PE) and venture capital (VC) ...